Abel vs. Elon - AST SpaceMobile challenges Starlink!

AST SpaceMobile is poised to become the indispensable backbone of global mobile communications.

Dear growth investors,

AST SpaceMobile (Ticker: ASTS) is poised to become the indispensable backbone of global mobile communications. Through strategic partnerships with industry heavyweights such as AT&T, Vodafone, Rakuten, and Verizon, the company gains potential access to a massive user base of over 3 billion mobile customers worldwide, using standard smartphones without any additional hardware modifications.

EBITDA margins of over 90% and rapidly growing future cash flow are piqued investors' interest and raising expectations for one of the most profitable business models in the entire telecommunications sector.

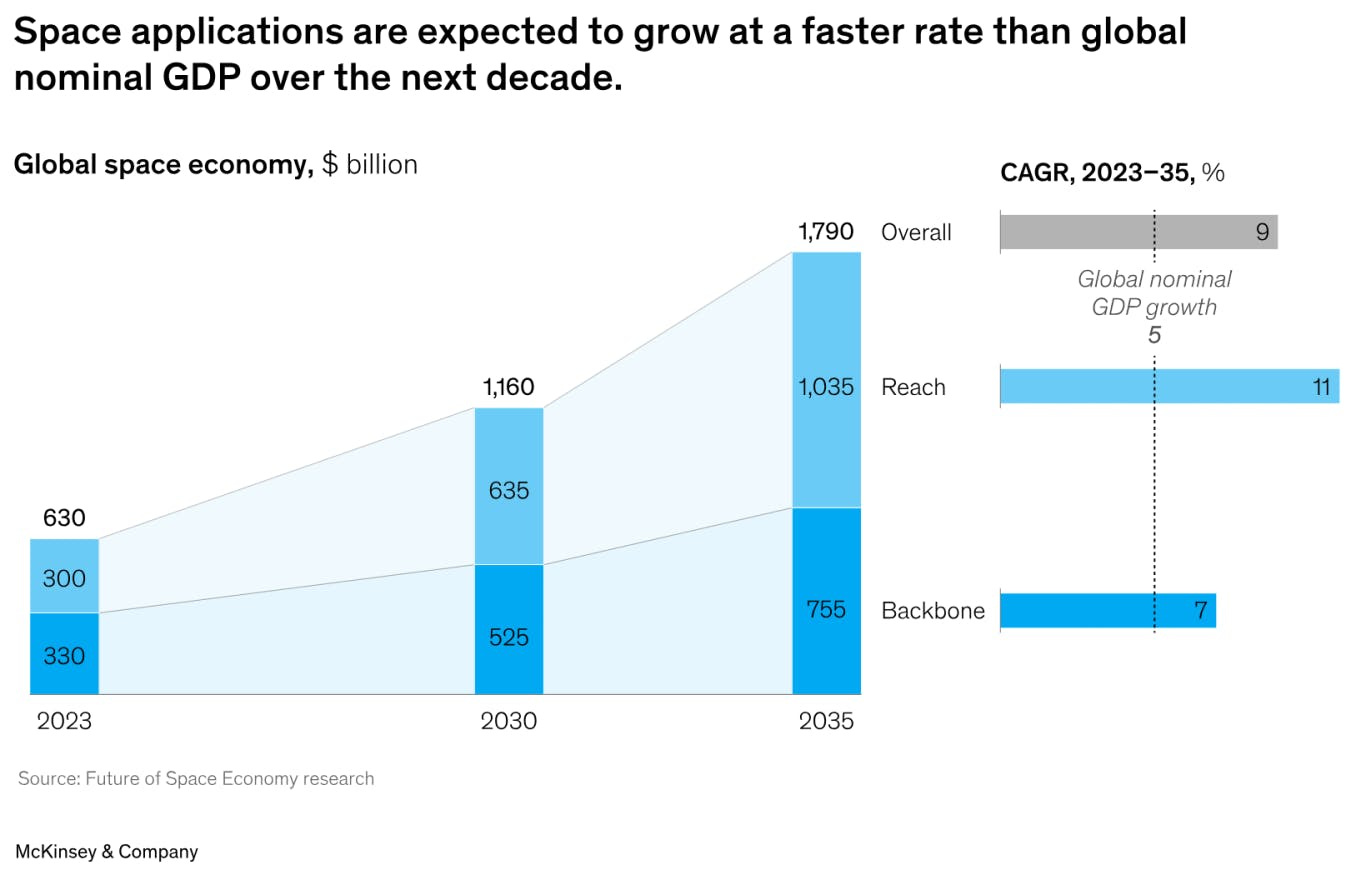

Space Market Opportunity: McKinsey Space Report

The report “Space: The $1.8 Trillion Opportunity for Global Economic Growth” by McKinsey and the World Economic Forum highlights the massive growth potential of the space economy. Forecasts suggest the market could reach a volume of $1.8 trillion by 2035 a significant leap from $630 billion in 2023.

The space economy can be divided into two main segments:

“Backbone” technologies – These include satellites, launch vehicles, and the underlying infrastructure that makes space access and operations possible.

“Reach” applications – These leverage space technology to deliver services in sectors such as transportation, agriculture, digital communication, and more.

Key growth areas in the space sector include: Satellite connectivity, Navigation services, Data solutions, which support industries like logistics, disaster response, and climate monitoring.

Mobile Services Market Opportunity

The world's population currently comprises approximately 7.9 billion people. Of these, approximately 5.3 billion have access to mobile services, known as "unique cellular subscribers." However, many of these users regularly move in and out of network coverage, for example, when traveling, working, or living in regions with unreliable infrastructure.

Of these 5.3 billion mobile users, 4.2 billion people use mobile services with broadband connections. Another 1.1 billion access mobile services but without broadband access.

At the same time, a significant gap emerges: A total of 3.7 billion people worldwide are not connected to mobile broadband. Of these, approximately 0.5 billion live in areas with no network coverage at all. The remaining 3.2 billion are in the so-called "usage gap," meaning they theoretically have access but do not use mobile broadband for other reasons, such as costs, a lack of devices, or a lack of digital infrastructure.

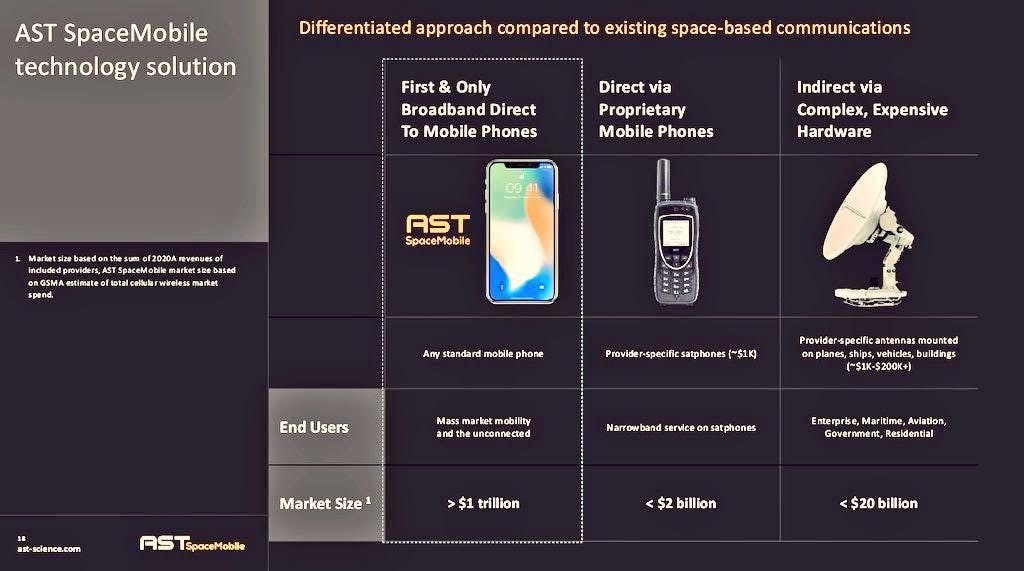

In summary, although the global wireless communications market generates over $1.1 trillion annually, one key problem remains: billions of people are still offline. This is where AST SpaceMobile comes in: The company aims to build a space-based mobile broadband network.

Founding and IPO

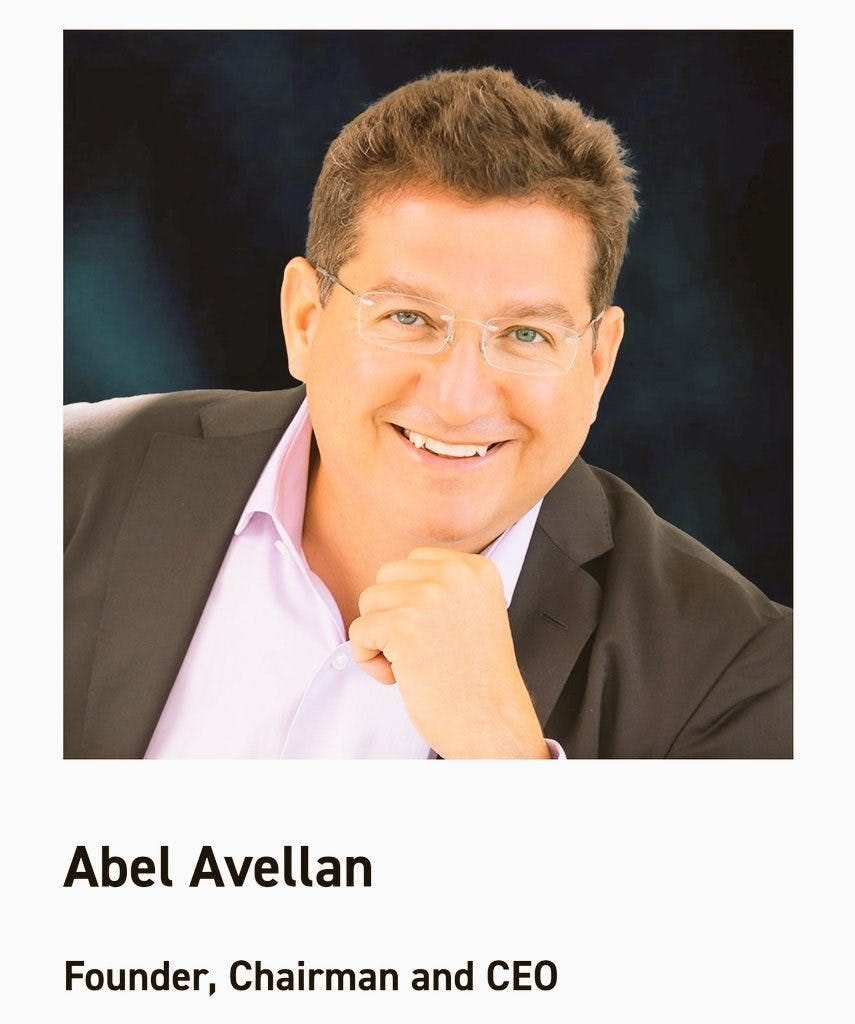

The company was founded in 2017 by Abel Avellan, who had previously founded and sold Emerging Markets Communications, a provider of satellite communications services.

Abel Avellan is the largest single shareholder with 78 million Class C shares. There are three types of AST SpaceMobile shares:

A: Traded on the NASDAQ

B: Early Investors

C: Abel Avellan

Voting Rights:

A & B: 1 vote per share

C: 10 votes per share

Abel Avellan thus controls 79% of the company, even though he only owns 27% of the shares. He also has long-standing industry relationships. AST SpaceMobile's investors include Vodafone, Verizon, AT&T, American Tower, and the Rakuten Group. Google is also on board with its expertise.

The IPO took place in 2021. AST SpaceMobile went public through a SPAC merger with New Providence Acquisition. SPAC stands for Special Purpose Acquisition Company. It is a publicly traded shell company, i.e., a company without its own operating business, founded solely for the purpose of taking a company with an operating business public. This move initially raised $462 million for AST SpaceMobile to realize its vision of a space-based mobile broadband network.

Technology

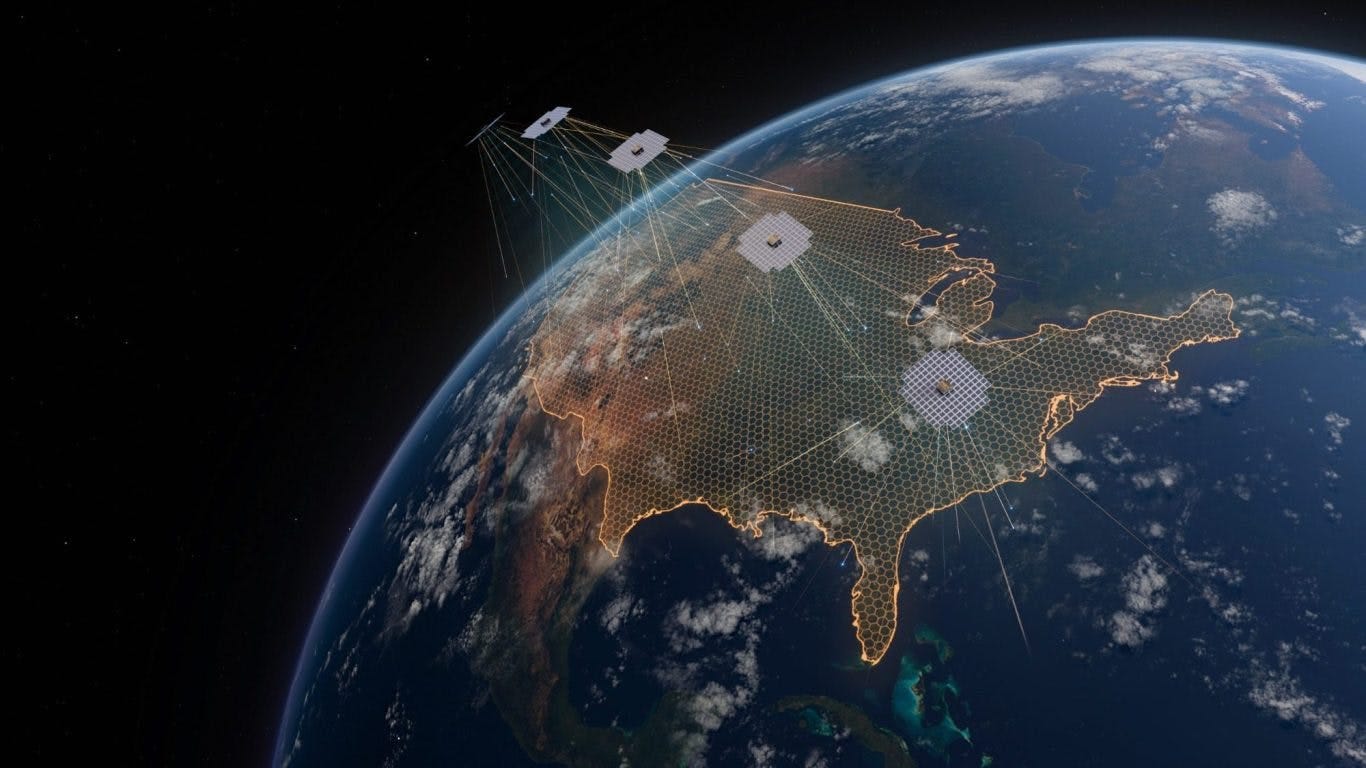

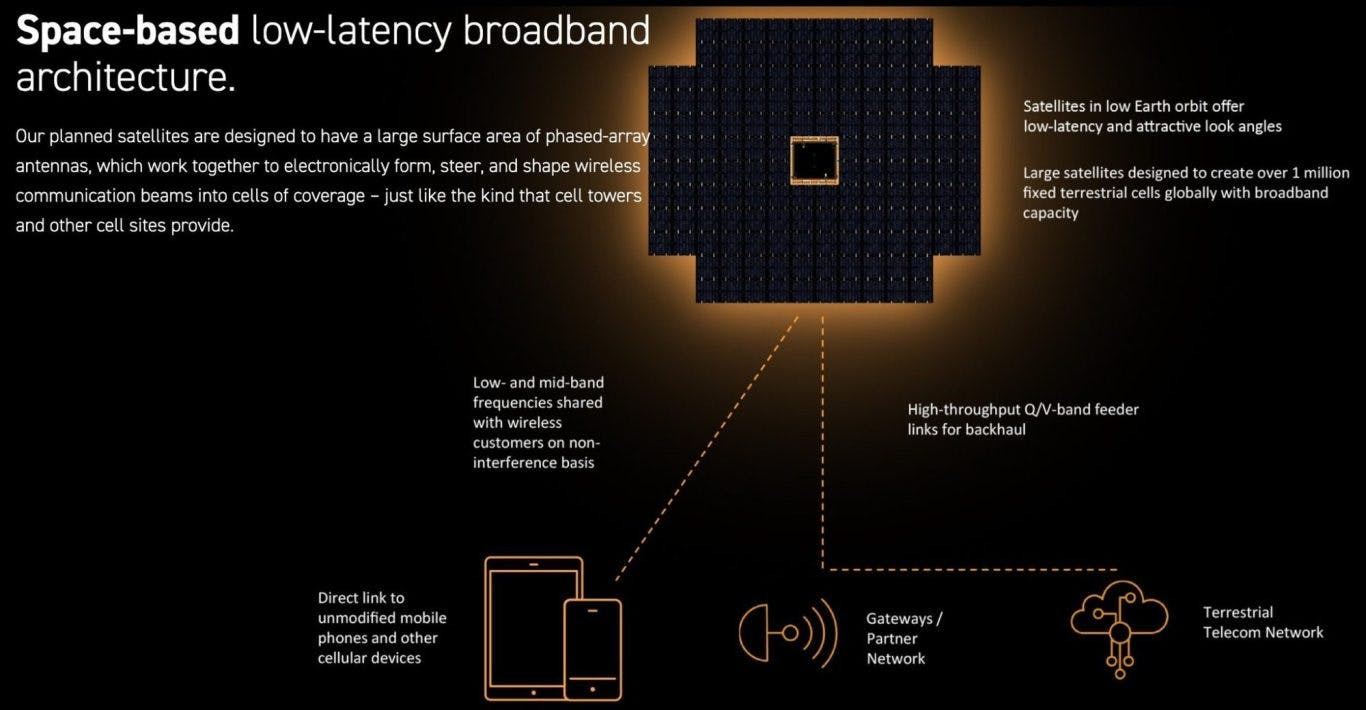

This space-based mobile broadband network, also known as "satellite-to-cell technology," operates via the so-called BlueBird satellites. These are cell towers in orbit and are therefore the largest of their kind. They were built to process massive amounts of data. The large-area satellites are placed in low Earth orbit and are designed to communicate directly with standard mobile phones.

The 2nd generation satellites span an area of 2,400 square feet, three times larger than the 1st generation. AST SpaceMobile's technology is based on phased array antennas that can electronically steer and shape wireless communication beams. Phased array antenna technology works by using numerous small antenna elements that work together to electronically shape, direct, and steer radio beams into specific coverage cells, similar to cell phone towers on the ground. Signals from users' smartphones are sent via the BlueBird satellites to gateways on Earth, from where they are relayed to terrestrial cellular networks. Because the satellites orbit in low Earth orbit, latency (the delay in signal transmission) is significantly lower than with geostationary satellites, enabling smoother communications and data transmission.

The technology enables smartphones to connect directly to satellites. This means that space-based mobile broadband networks can be accessed directly via smartphones, making physical terminals like those used in Starlink or Iridium obsolete.

A key component for the performance of the BlueBird satellites are specially developed ASIC chips, known as AST5000 ASICs. They form the heart of the satellites.

These chips were developed in collaboration with Cadence Design Systems and tested with TSMC. These are not standard chips, but are specifically optimized for the requirements of satellite-based mobile communications.

The chips are optimized for low power consumption and high performance, essential for operation in space, where energy and weight are critical factors. They also include high-speed capabilities for efficient data transmission within the satellite. The AST5000 ASIC is designed to increase the processing bandwidth per satellite by up to tenfold. The integration of these ASICs will enable the BlueBird satellites to support a processing bandwidth of up to 10,000 MHz per satellite in the future.

AST SpaceMobile states that its BlueBird satellites will be capable of peak data speeds of up to 120 megabits per second (Mbps). These speeds are critical to enabling a true broadband experience for standard smartphones that goes beyond simple text messaging. They are designed to support voice calls, full data transmission, and video applications. Although initial tests have already achieved download speeds of over 20 Mbps on a 5 MHz channel, 120 Mbps represents a target for the full constellation of the more powerful Block 2 BlueBird satellites.

AST SpaceMobile also uses various frequency bands to enable direct communication with mobile phones:

The company has partnerships with wireless operators such as AT&T and Verizon to share their low-band spectrum (e.g., in the 850 MHz range). This spectrum is particularly valuable because it offers excellent building penetration and wide-area coverage, ideal for space-to-Earth communications. Therefore AST SpaceMobile partnered with FirstNet (which is operated by AT&T). The goal is to provide a seamless satellite-to-cell service that behaves like a standard mobile connection, without requiring specialized equipment or terminals for first responders. Listen to Celeste, my personal assistant. She will give you a breakdown of the key purposes and benefits:

AST SpaceMobile has also secured access to additional spectrum, particularly up to 45 MHz in the lower mid-band in the US (including through an agreement with Ligado Networks). This wider spectrum is crucial to achieving the targeted high data speeds of 120 Mbps. Wider channels enable higher data rates.

With Ligado, AST SpaceMobile is securing exclusive rights to use 45MHz of lower mid-band spectrum across the U.S. and Canada for the next 80 years. This is huge for AST SpaceMobile. Here's what it means for their future:

1. Massive Spectrum Advantage: Securing 45MHz of lower mid-band spectrum gives AST SpaceMobile prime real estate for delivering satellite-to-smartphone broadband. This frequency range strikes a great balance between coverage and data capacity - perfect for mobile connectivity.

2. Long-Term Security: An 80-year deal is virtually unheard of. It gives AST SpaceMobile long-term operational certainty, making it easier to plan, invest, and scale without worrying about spectrum access expiring or becoming contested.

3. North American Market Lock-In: With exclusive rights across the U.S. and Canada, AST SpaceMobile now has a solid foundation to dominate satellite mobile service in two of the most valuable telecom markets globally.

4. Boosts Investor Confidence: This kind of long-term asset improves their strategic positioning and could attract more partnerships, government support, or capital from investors who see this as reducing risk and increasing future revenue potential.

5. Head Start on Competitors: The spectrum war is real and AST SpaceMobile just grabbed a powerful weapon that could put it far ahead of rivals in the space-based cellular game.

Bottom line: this deal is a game-changer. If AST SpaceMobile executes well, it could be one of the defining moves that propels it into a leadership role in global satellite mobile connectivity.

Let’s get back to the frequency bands:

In addition AST SpaceMobile secured long-term usage rights for up to 40 MHz in the L-band MSS (Mobile Satellite Service) in the USA and Canada and an additional 5 MHz in the 1670-1675 MHz band were secured.

In summary, the core of the technology lies in the ability to communicate directly with commercially available 4G and 5G smartphones without requiring any modifications to the devices. This is made possible by the combination of satellite antennas, advanced phased array technology, and powerful ASICs, which allow the satellite to behave like a "cell tower in the sky." The ability to deliver high data rates (up to 120 Mbps) across various frequency bands (from low-band to lower mid-band) is a key factor for the desired broadband connectivity.

A major technical advantage is that the part that communicates directly with the phone is located on Earth. Why is this important? When cellular technology transitions from 4G to 5G or, in the future, to 6G, AST SpaceMobile won't need to launch new satellites. They will simply upgrade the system on Earth.

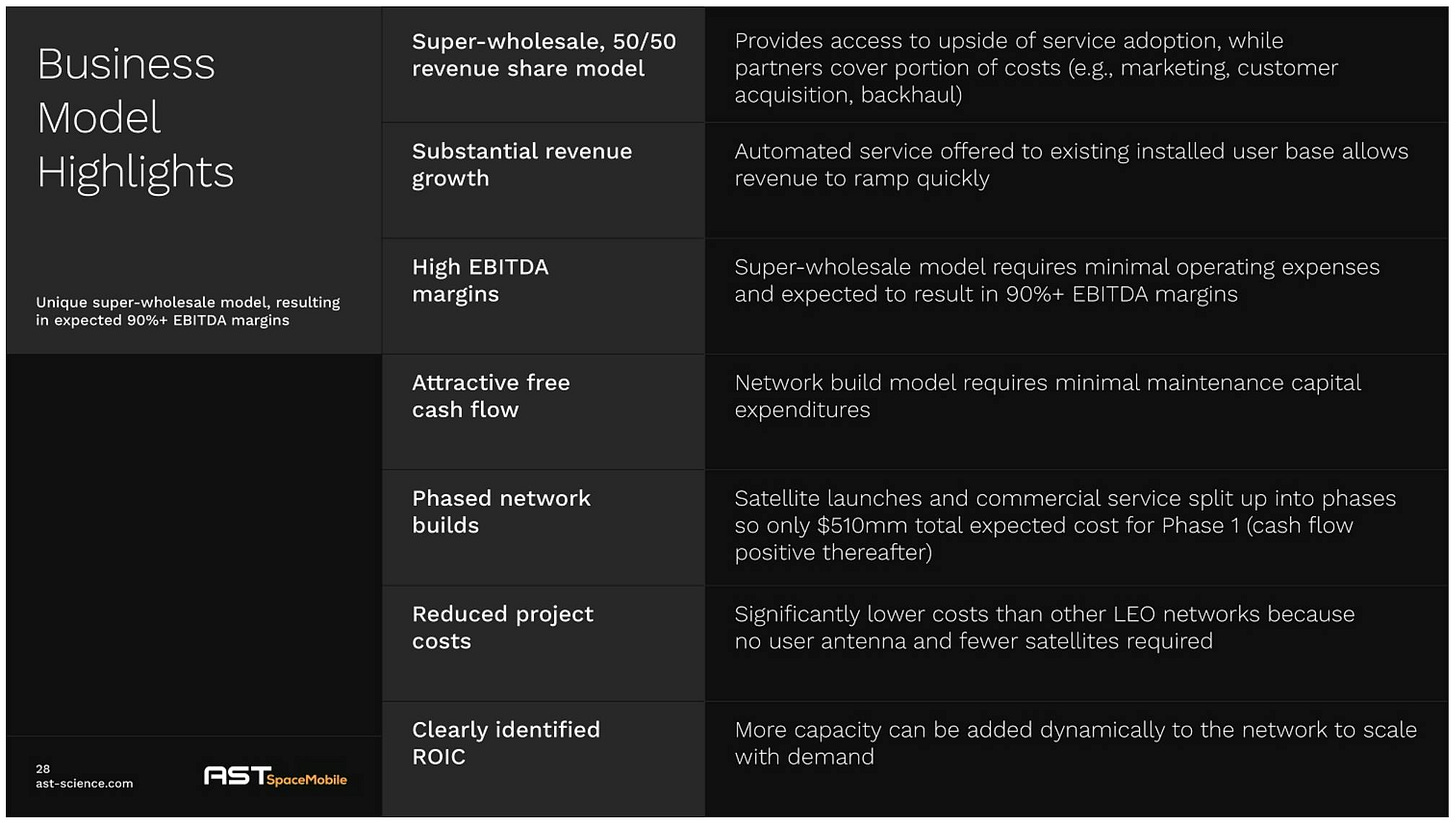

Business Model

AST SpaceMobile aims to make its broadband satellite constellation available to network operators worldwide. These operators, in turn, are responsible for marketing the service to their end customers. To this end, AST SpaceMobile has created a B2B infrastructure: The company has signed contracts with nearly 50 MNOs (mobile network operators), representing nearly 3 billion potential customers.

And AST SpaceMobile continues to expand its partner network

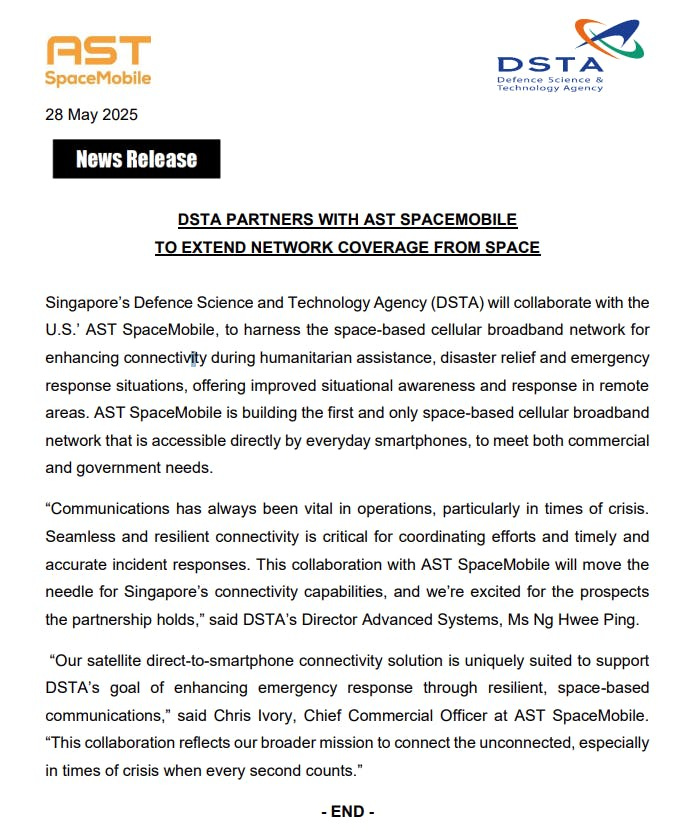

For example Singapore's Defence Science and Technology Agency (DSTA) announced its collaboration with AST SpaceMobile on May 28 to benefit from AST's satellite-based mobile network, which can communicate directly with commercially available smartphones.

The goal of this partnership is to improve connectivity for humanitarian aid, disaster relief, and emergency operations, especially in remote areas where traditional networks are unavailable.

According to DSTA, reliable communications in crisis situations are crucial for efficient coordination and rapid response. The collaboration is seen as a significant step in strengthening Singapore's connectivity capabilities.

Chris Ivory, CCO of AST SpaceMobile, emphasized that the company's proprietary technology is particularly well-suited to helping DSTA improve emergency communications.

From my perspective, the collaboration between Singapore's Defence Science and Technology Agency (DSTA) and AST SpaceMobile has several positive impacts:

1. Improved network coverage in crisis situations

Using a satellite-based mobile network that is directly compatible with standard smartphones, even remote or infrastructure-poor regions can be reached. This is particularly useful in:

Natural disasters

Humanitarian aid

Emergency operations

2. Direct satellite connection with smartphones

AST SpaceMobile offers the world's first and only solution that allows regular smartphones to connect directly to satellites without the need for additional hardware. This means:

No ground stations required

Speed and efficiency in communications

3. Strengthening national security and emergency preparedness

Through this partnership, DSTA can improve its response capabilities in crisis situations, for example, through:

Better awareness of crisis situations

Faster coordination during incidents

Reduced communication downtime

4. International technological cooperation

The partnership demonstrates how international cooperation can help promote technological innovation in public safety and communications. For Singapore, this means:

Access to advanced US technology

Strengthening its own technological ecosystem

In my opinion, this cooperation offers strategic benefits for both sides. It improves crisis communications, promotes global connectivity, and ensures reliable communications even in the most critical moments.

Customer Base

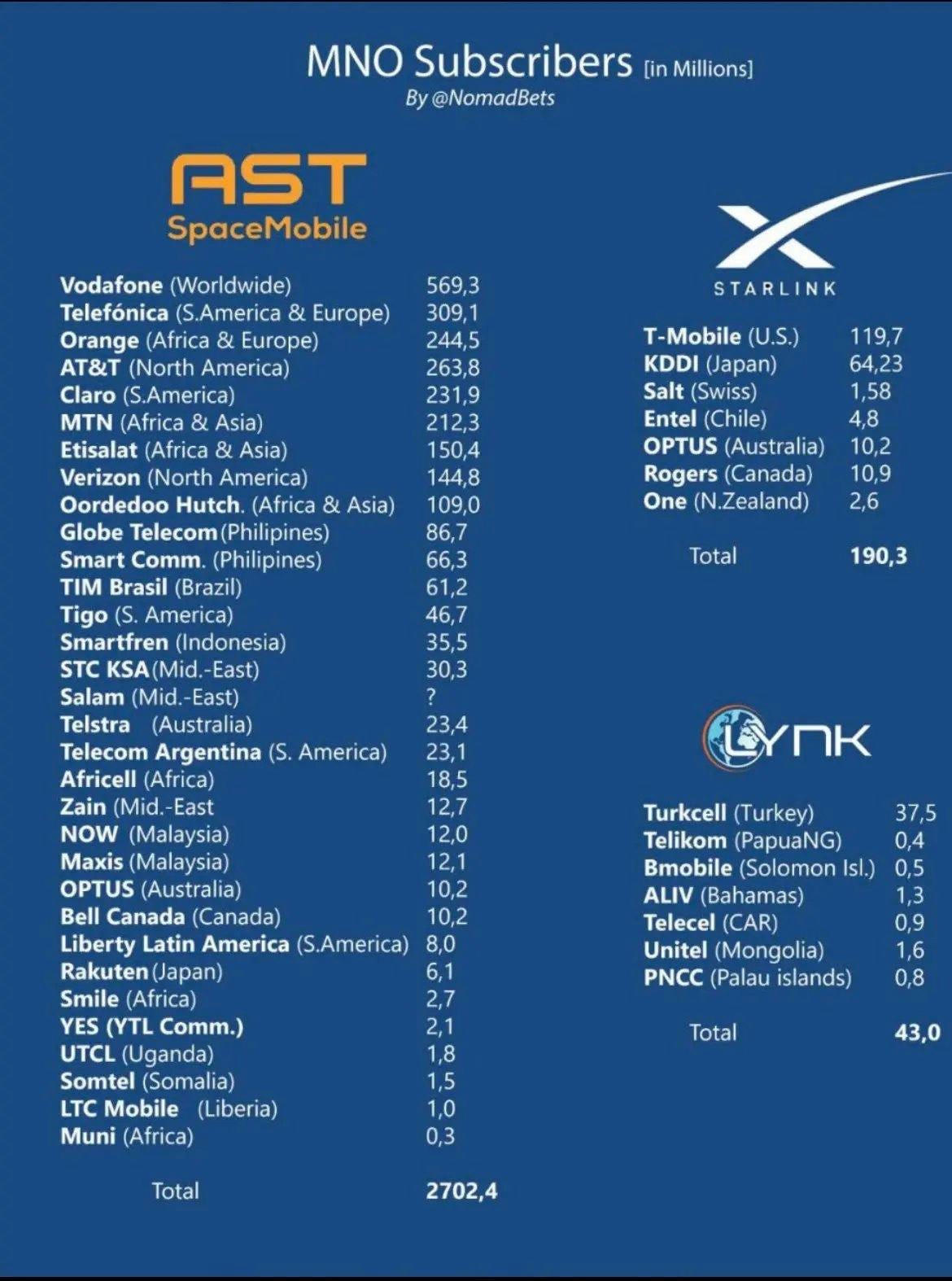

Once the constellation is operational, the SpaceMobile service will be available to MNO customers. These are a growing list (see below) of leading companies with nearly 3 billion existing subscribers.

These MNO customers ensure integration into existing mobile networks and provide seamless Space Based Cellular Broadband service worldwide. Starlink has a potential customer base of only 190 million through its MNO partners, and LYNK only 43 million.

Through its partnership with AT&T and Verizon, AST SpaceMobile can provide nearly 100% nationwide broadband coverage to 70% of the US population via their smartphones.

According to Abel Avellan, founder and CEO of AST SpaceMobile, the commercial launch of the service in the US is expected in early 2026. This service will then provide text messaging, internet, and data services directly via the BlueBird satellites.

Abel Avellan also announced that a total of 60 satellites will be launched over the next two years. The launches will be spaced one to two months apart, allowing for rapid scaling.

How does AST SpaceMobile make money?

Revenue is generated through a revenue-sharing model, specifically through profit-sharing agreements. MNOs leverage their subscriber base to acquire customers. AST SpaceMobile receives a 50% share of the revenue from the SpaceMobile service. This is a huge advantage: MNOs have a large user base to which they can sell new services. This means AST SpaceMobile doesn't have to build its own infrastructure. This saves immense costs.

It's important to note that the SpaceMobile service is offered not only to MNOs, but also to private companies and government agencies. In addition to providing broadband connectivity for smartphones, the technology also opens up possibilities for IoT and critical communication services in emergencies or natural disasters when terrestrial networks fail. "IoT" stands for "Internet of Things." Devices are connected to each other via the internet and can exchange information or be remotely controlled. These devices collect data, communicate with each other, and in some cases even make autonomous decisions. One example are transport systems, such as networked vehicles.

Regarding IoT, Mikitani, CEO of the Rakuten Group, asked Abel Avellan in a conversation at MWC Barcelona (the annual trade fair for mobile communications) on March 6, 2025, whether cellular connectivity was AST SpaceMobile's only solution. Abel Avellan answered with a resounding NO and highlighted his company's future fields: drones, cars, robotics, and all kinds of wearables should be able to communicate with each other: MWC Barcelona

Vertically Integrated

95% of the business is vertically integrated, encompassing manufacturing, assembly, and testing. Global production takes place at approximately 18,000 m² in Midland, Texas, approximately 5,500 m² in Barcelona, Spain, and soon approximately 7,900 m² in Homestead, Florida.

Attack on the market leader Starlink

Similar to AST SpaceMobile, Starlink will use the spectrum of its partner (T-Mobile), allowing existing smartphones to use the service. Starlink already has a large constellation in orbit and has already brought services online.

Let's first look at Starlink's existing offering, and in the next section, the mobile service in partnership with T-Mobile.

Starlink offers end customers two subscription models: HOME and TRAVEL. The current end customer price for HOME is €50 per month. The "Light" version is €29 per month. Please note that the equipment is already included in the price and that the subscription is for a 12-month commitment. Without a commitment, the standard Starlink kit costs €349 and the mini Starlink kit costs €299. Payments are made recurring monthly.

The current retail price for TRAVEL is €40 per month for TRAVEL 50 GB, plus the €299 Mini Starlink kit. Unlimited Travel costs €72 per month, plus the €349 Standard Starlink kit. Payments are recurring monthly. TRAVEL is ideal for RVs, frequent travelers, campers, and those working on the go. Users receive nationwide coverage, can use the service while moving and traveling internationally, have coastal coverage, and can pause the service individually.

Starlink Mini has a built-in Wi-Fi router.

The Starlink standard hardware consists of a satellite dish, including the GEN3 router.

Customers must install the satellite dish themselves and position it so they have a clear view of the satellites in Earth's orbit.

In comparison, the SpaceMobile service receives free subscriptions from its mobile network partners, and end users can connect without any upfront costs. No additional hardware, external terminals, or satellite dishes are required. A regular cell phone, which everyone carries in their pocket, is sufficient to connect via the SpaceMobile service. This is the key difference.

What advantage does Starlink offer customers over a mobile solution?

Starlink's targeted internet speeds are 1-10 Gbps, with an average latency of 34 ms:

Conventional smartphones with their small antennas can barely achieve these speeds. However, AST SpaceMobile focuses on a different market, namely mobile communications, so a direct comparison with Starlink's broadband service is far-fetched.

In developed countries, consumers have sufficient disposable income to afford the SpaceMobile service in addition to their potential Starlink service, thus enjoying the convenience of two services: having phone and internet access everywhere.

Emerging markets, on the other hand, represent the largest portion of the world's unconnected population. Since AST SpaceMobile can offer some of its services for as little as one dollar per month, while Starlink currently costs $29 per month for its cheapest subscription plan, most people in emerging markets will likely choose the SpaceMobile service through its MNO partners as their primary internet service.

Starlink - Direct-To-Cell Technology

Starlink and T-Mobile announced that they intend to offer "low-data cellular satellite services" like AST SpaceMobile. Starlink's "Direct-To-Cell" technology can be considered equivalent to AST SpaceMobile's "Satellite-To-Cell" technology. The Starlink D2D service will initially transmit text, followed by data, IoT, and voice. However, Starlink is limited to a 5 MHz channel in the S-band, which limits speed and must overcome interference issues. AST SpaceMobile is designed from the ground up for direct-to-cell connectivity.

This allows AST SpaceMobile to offer voice, text, and data services, including high-speed data services. Compared to AST SpaceMobile's customized approach, Starlink will face performance and integration limitations, even with upgrades.

Let's compare the space-based broadband architecture of AST SpaceMobile and Starlink.

Most satellite networks move all their technology and computing power into space. AST SpaceMobile does things differently, as described above: An important part of the system remains on Earth. The part of the network that communicates directly with the mobile phone is called "Transparent eNodeB terrestrial" in AST SpaceMobile. What's special about it is that it's not located in the satellite, but on Earth, more precisely in a ground station. In contrast, Starlink relies on a different technology: There, the corresponding part is built into the satellite itself and is called "Regenerative gNodeB on satellite," but this makes maintenance significantly more complex.

In short: AST SpaceMobile relies on a "ground-based brain”, while Starlink relies on a "brain-active" satellite system. The major advantage of AST SpaceMobile: If technical problems arise or upgrades to 5G or 6G are necessary, there's no need to send a new satellite into space; an update is sufficient.

Q1’25 Highlights

AST SpaceMobile Inc. released its financial results for the first quarter of 2025 on May 12, 2025.

Key Figures

Loss per share (EPS): The company reported a loss per share of $-0.20. In the prior-year quarter, the loss was $-0.16 per share. This exceeded some analysts' estimates by $0.06, but missed others.

Revenue: Revenue amounted to $0.7 million. This represents an increase of 44.00 percent compared to the prior-year quarter ($0.5 million), but significantly missed the forecast of $10.94 million.

Cash reserves: The company's cash reserves increased to $874.5 million (from $567.5 million in the fourth quarter of 2024), strengthening its financial position.

Outlook: The company forecasts revenue of $50-75 million for the full year 2025. Commercial operations are expected to begin in early 2026.

Highlights

As can be seen from the investor presentation, AST SpaceMobile is pursuing an ambitious multi-provider launch strategy and has contracted five satellite launches over the next six to nine months to advance the expansion of its space network. Over 60 satellites have already been confirmed for launch, including larger Block 2 satellites with an area of 2,400 square feet and 100 times the capacity of the previous BW3 satellites. The Block 1 satellites with square feet already offer 10 times the capacity of the BW3.

The commercialization of the SpaceMobile network is progressing, with expected revenue potential of $50 million to $75 million in the second half of 2025. At the same time, a milestone was reached: the activation of two-way broadband video calls with partners such as AT&T, Rakuten Mobile, Verizon, and Vodafone using unmodified smartphones via a Block-1 BlueBird satellite. Such calls have been successfully completed in the US, Europe, and Japan.

Additional contracts with agencies such as the Defense Innovation Unit, the Space Development Agency (SDA), and FirstNet Authority for mission-critical capabilities strengthen the company's position in the security-related field. A coordination agreement has also been reached with the National Science Foundation (NSF).

At the same time, AST SpaceMobile is making significant progress in regulatory approvals, working closely with partners and key industry organizations.

Orbital Launch Plan

AST SpaceMobile is also pursuing an ambitious orbital launch plan with multiple providers. A total of five rocket launches have been contracted over the next six to nine months to advance the construction of the largest commercial satellites in low Earth orbit (LEO).

Between 2025 and 2026, the company plans to launch a satellite every one to two months on average, ensuring continuous network expansion. Production is already underway: 40 Block 2 BlueBird satellites are in production, and components and materials have been procured to complete more than 50 fully assembled satellites, including micron and phased array technology.

A production rate of six satellites per month is targeted for 2025. The same rate is expected to be achieved for the assembly of phased array components by the third quarter of 2025 at the latest.

These production and launch cycles serve a clear goal: to ensure continuous mobile broadband coverage in strategically important markets such as the US, Europe, Japan, as well as for the US government and other key global regions starting in 2026.

Second Half 2025 Revenue Opportunity of $50–$75 Million

Andrew Johnson, CFO of AST SpaceMobile, explains that the company sees a revenue opportunity of $50–$75 million in the second half of 2025.

AST SpaceMobile plans to launch its first cellular-based broadband services in the US, Europe, and Japan starting in the second half of 2025. Together with partners such as AT&T, Rakuten, Verizon, and Vodafone, these services will be offered using premium frequencies in the lower band, which are particularly well-suited for nationwide coverage.

At the same time, the company is intensifying its activities under an existing $43 million contract with the U.S. Space Development Agency. Additionally, a new contract with the Defense Innovation Unit (DIU) has been signed, generating up to $20 million in revenue potential through a prime contractor. The agreement supports the implementation of SpaceMobile technologies for several U.S. government agencies for communications over land, sea, and air.

Another key revenue driver is the outfitting of ground infrastructure: In the first quarter of 2025, gateway equipment valued at $13.6 million was booked. For the remainder of the year, the company expects average bookings of around $10 million per quarter, preparing for the upcoming commercial launch of SpaceMobile services. The photo on the slide shows AST SpaceMobile's ground station (gateway), a key element in the global network infrastructure that enables the connection between satellites and terrestrial networks.

Two-Way Broadband Video Calls

AST SpaceMobile successfully conducted two-way broadband video calls using off-the-shelf, unmodified smartphones. These calls were enabled via a Block 1 BlueBird satellite and took place in the US, Europe, and Japan, marking a significant milestone for satellite-based mobile communications without specialized terminals.

The company is currently conducting tests in various countries, including voice services, SMS, mobile data usage, and video calls, functions typical of traditional mobile networks, but now delivered via satellite.

The slides shown show live demonstrations with major partners such as AT&T, Verizon, Vodafone, and Rakuten Mobile. These document successful tests, such as the first live video via satellite by Verizon and demonstrations in Japan by Rakuten Mobile.

These successful connections are tangible proof of AST SpaceMobile's ability to deliver true direct-to-device satellite communications.

Regulatory Approvals

AST SpaceMobile is making significant progress in regulatory approvals and spectrum security. The company has received a temporary special permit from the FCC to test the use of Band 14 spectrum as part of FirstNet, a mission-critical radio network for police, fire, and emergency responders.

Additionally, a cooperation agreement was signed with the U.S. National Science Foundation (NSF). AST SpaceMobile believes it is well positioned to receive full regulatory approvals for commercial operations in the U.S. and Europe. This is a key step toward the global rollout of its services. Another milestone is the signing of binding contracts for long-term access to up to 45 MHz of premium spectrum in the lower mid-band in the U.S., a particularly valuable frequency range for applications with direct satellite connections to standard terminals.

Operating and Capital Metrics

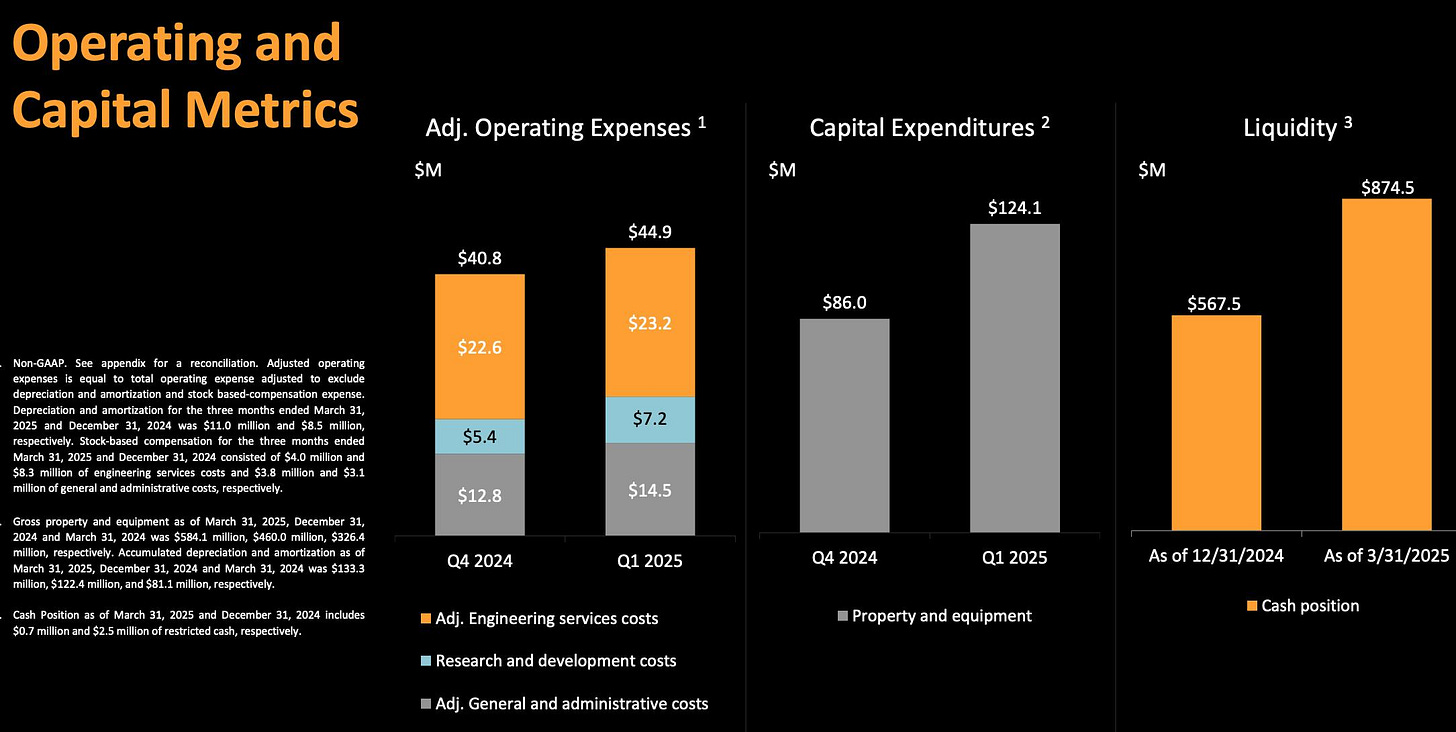

AST SpaceMobile presented solid operating and financial metrics for the first quarter of 2025. Adjusted operating expenses increased slightly quarter-on-quarter, from $40.8 million in Q4 2024 to $44.9 million in Q1 2025. These expenses consist of $14.5 million for general and administrative expenses, $7.2 million for research and development, and $23.2 million for engineering services.

Capital expenditures (CapEx) increased significantly, from USD 86.0 million in Q4 2024 to USD 124.1 million in Q1 2025. These expenditures will primarily be used to expand satellite production and infrastructure.

The improved liquidity position is particularly noteworthy: As of March 31, 2025, the company had USD 874.5 million in cash and cash equivalents, compared to USD 567.5 million at the end of 2024. This increase significantly strengthens the capital base and enables financing of the next phases of network expansion and planned satellite launches.

In summary: AST SpaceMobile is a pre-revenue company, meaning it is not yet generating revenue and has high expenses to complete its satellite fleet. With almost USD 900 million in cash, it is fully financed for the coming quarters. However, additional funding is needed. The company is trying to activate cash sources in this regard that do not dilute investors. This could be realized in the form of pre-payments or through payments from investors.

Growth Forecasts

Deutsche Bank and Scotiabank have issued forecasts for AST SpaceMobile's future development. The assessments of the two analyst firms differ significantly in some respects.

Deutsche Bank sets a price target for the stock at USD 64. For 2030, it expects revenue of USD 5.22 billion, EBITDA of USD 4.94 billion, and free cash flow of USD 3.48 billion.

Scotiabank, on the other hand, is somewhat more cautious with its price target, which it sets at USD 47.90. Interestingly, however, it expects significantly higher operating results by 2030: revenue is expected to increase to USD 17.58 billion, EBITDA to USD 15.11 billion, and free cash flow is estimated at USD 11.71 billion.

On the 4th of June Scotiabank reiterated sector outperform on AST SpaceMobile, maintains price target at $45.40, and speculates that Jeff Bezos could become soon an AST SpaceMobile investor.

The speculative rumors about a possible investment by Amazon or Blue Origin caused the AST SpaceMobile stock to rise by +40% in the last 5 days:

Golden Dome

What was really exciting in the earnings call: Founder and CEO Abel Avellan said: "We are well positioned for Golden Dome with our technology."

The Golden Dome Project is a $27 billion initiative of the U.S. Department of Defense. The goal of the Golden Dome Project is to create a shield over the United States to protect it from a range of missile threats, including ballistic, hypersonic, and advanced cruise missiles. Announced by presidential decree on January 27, 2025, the program is inspired by Israel's Iron Dome but aims to implement a far more comprehensive and technologically advanced system.

SpaceX is reportedly leading a bid to build a missile-detection satellite constellation, while Palantir and Anduril would contribute software and drone technologies. SpaceX has not officially bid for these government contracts. Elon Musk confirmed this on Platform X and said he hopes other US companies will also take on contracts.

AST SpaceMobile has declared its intention to make a significant contribution to this and could therefore receive significant contracts for the Golden Dome.

Why am I optimistic about this?

It's important to note that the $27 billion earmarked for the Golden Dome includes approximately $15 billion for satellites, sensors, launch infrastructure, and interceptor rockets. The $15 billion contract package for satellites, sensors, launch infrastructure, and interceptor rockets is enormous. Space companies such as Rocket Lab and AST SpaceMobile could land significant contracts.

AST SpaceMobile has also enjoyed significant government trust since April 2025. Senator Ted Cruz and FCC Chairman Brendan Carr visited AST SpaceMobile's headquarters on April 28.

US Senator Ted Cruz praised AST SpaceMobile’s technology highly:

“Great visit to Midland and Odessa, to visit AST SpaceMobile’s headquarters and employees. They’ve developed the first and only space-based broadband network for cell phones. I’m proud to see another Texas-based company leading in technology, space, and innovation.”

In addition, AST SpaceMobile was indirectly selected for the Golden Dome program by the U.S. Department of Defense's Defense Innovation Unit on May 12, 2025. The goal is to create an infrastructure that ensures the secure and uninterrupted delivery of satellite data to military users.

Also NASA and Pentagon seek alternatives to SpaceX as tensions rise between Trump and Musk.

What could further boost the share price is the inclusion in the Russell 1000 Index:

What does AST SpaceMobile’s inclusion in the Russell 1000 Index mean for the company?

1. Increased Visibility and Credibility: The Index tracks the largest 1,000 U.S. companies by market capitalization and reflects AST SpaceMobile’s advancing position as a leader in delivering space-based cellular broadband worldwide. Russell indexes are widely used by investment managers and institutional investors for index funds and as benchmarks for active investment strategies. The Inclusion signals that AST SpaceMobile is no longer a small-cap speculative play, it’s entered the radar of institutional investors, pension funds, and index-tracking funds.

2. Potential Inflows from Passive Funds: Funds and ETFs that track the Russell 1000 will automatically buy AST SpaceMobile shares, increasing liquidity and potentially supporting the stock price.

3. Institutional Confidence: Entry into this index suggests that AST SpaceMobile has achieved a certain level of stability, size, and governance that larger investors expect. Possible Golden Dome contract imminent?

4. Attracts Analyst and Media Attention: More analysts and media outlets will begin to cover AST SpaceMobile, which could lead to broader awareness and interest among retail and professional investors.

Management is very confident and affirms that inclusion opens new doors for AST SpaceMobile and that the company's goals are now even more achievable.

Membership for AST SpaceMobile in the Russell 1000 ® Index remains in place for one year.

Bottom Line: AST SpaceMobile entering the Russell 1000 opens the door to long-term capital and higher credibility. It’s a clear sign that AST SpaceMobile is now being recognized as a serious player in space.

Conclusion

AST SpaceMobile pursues a unique super-wholesale business model with a 50:50 revenue-sharing model. This allows the company to participate in the increasing use of its services, while partners bear a large portion of the costs, such as marketing, customer acquisition, and data backhaul. The automated provision of the service to existing user groups promises rapid revenue growth. With this model, AST SpaceMobile expects high EBITDA margins of over 90%, as operating expenses remain low. The network's service generates high free cash flows. Maintenance costs are also forecast to be minimal. The satellites have a service life of up to 10 years. Furthermore, the overall project costs are lower than for other LEO satellite networks, as no additional hardware is required and fewer satellites are required overall. At the same time, network capacity can be dynamically scaled to meet demand, enabling a clear return on investment.

AST SpaceMobile is positioning itself as a pioneer in satellite communications with a bold and groundbreaking mission: to bring broadband connections directly to standard mobile phones worldwide, without the use of satellite phones or ground-based transmission towers. AST SpaceMobile has the potential to revolutionize global connectivity.

What strengths does AST SpaceMobile bring, and what are the reasons for a potential investment?

📱 Compatible with standard smartphones

🛰️ Technological advantage: Direct connection from space, with 4G and 5G!

🤝 Collaboration with industry giants such as AT&T, Vodafone, Rakuten, and Verizon

📈 Huge market opportunity: 90%+ EBITDA margin through scalable super-wholesale model

💰 Revenue potential of up to USD 75 million in the second half of 2025

💵 Over USD 870 million in liquidity for global rollout

AST SpaceMobile is currently valued at just under $11.43 billion, while Starlink is valued at approximately $175 billion. That's a significant valuation difference! Two or three players will prevail in the direct-to-cellular market. I firmly believe AST SpaceMobile will be one of those three. AST SpaceMobile has the best technology and, through its 50 MNO partnerships, has secured a large portion of the global market. The defense and government business also offers AST SpaceMobile immense advantages.

What’s your opinion of AST SpaceMobile? Is the company becoming seriously dangerous for Starlink?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.

Very comprehensive analysis. What price would you currently put on the company knowing the risks and the potential?