Could dLocal be the next Mercado Libre success story?

dLocal: specialized in cross-border payment processing for emerging markets.

Dear growth investors,

Founded in 2016, dLocal (Ticker: DLO) is a global fintech company headquartered in Montevideo, Uruguay. It specializes in cross-border payment processing for emerging markets.

Emerging Markets as High-Growth Regions

CEO Pedro Arnt emphasizes the strong demographic and economic trends shaping emerging markets:

„These regions are expected to account for about 65% of global economic growth by 2035.“

Emerging markets are extremely attractive because of their economic growth, digitalization, and rapidly growing and underserved populations in the banking sector. While emerging markets offer enormous potential, they also face significant challenges: regulations, frequent policy changes, currency volatility, limited access to banks, high fraud risk, and economic instability. These challenges complicate payment processing and management, causing significant problems even for the largest companies. dLocal recognized this problem early on and supports companies with their transactions.

United Nations - World Population Prospects 2022 & S&P Global Market Intelligence Study

The world's population is projected to reach nearly 10 billion by 2050. Therefore, the opportunities in emerging markets are more promising than ever. Over 50% of transactions in emerging markets are cash-based, and 80% are processed using payment methods other than credit cards. Despite technological advances, hundreds of millions of people in emerging markets are still digitally underserved when it comes to banking. dLocal can benefit from the growth of emerging markets in the future. Nearly 90% of the world's population under the age of 20 will live in emerging markets by 2050. These regions are expected to account for approximately 65% of global economic growth by 2035. This young population is driving the rapid adoption of digital solutions, particularly in areas such as mobile payments, digital wallets, and other financial services. This demographic dynamic provides dLocal with a huge addressable market, high revenue growth, attractive margins, and strong cash generation.

Total Addressable Market (TAM)

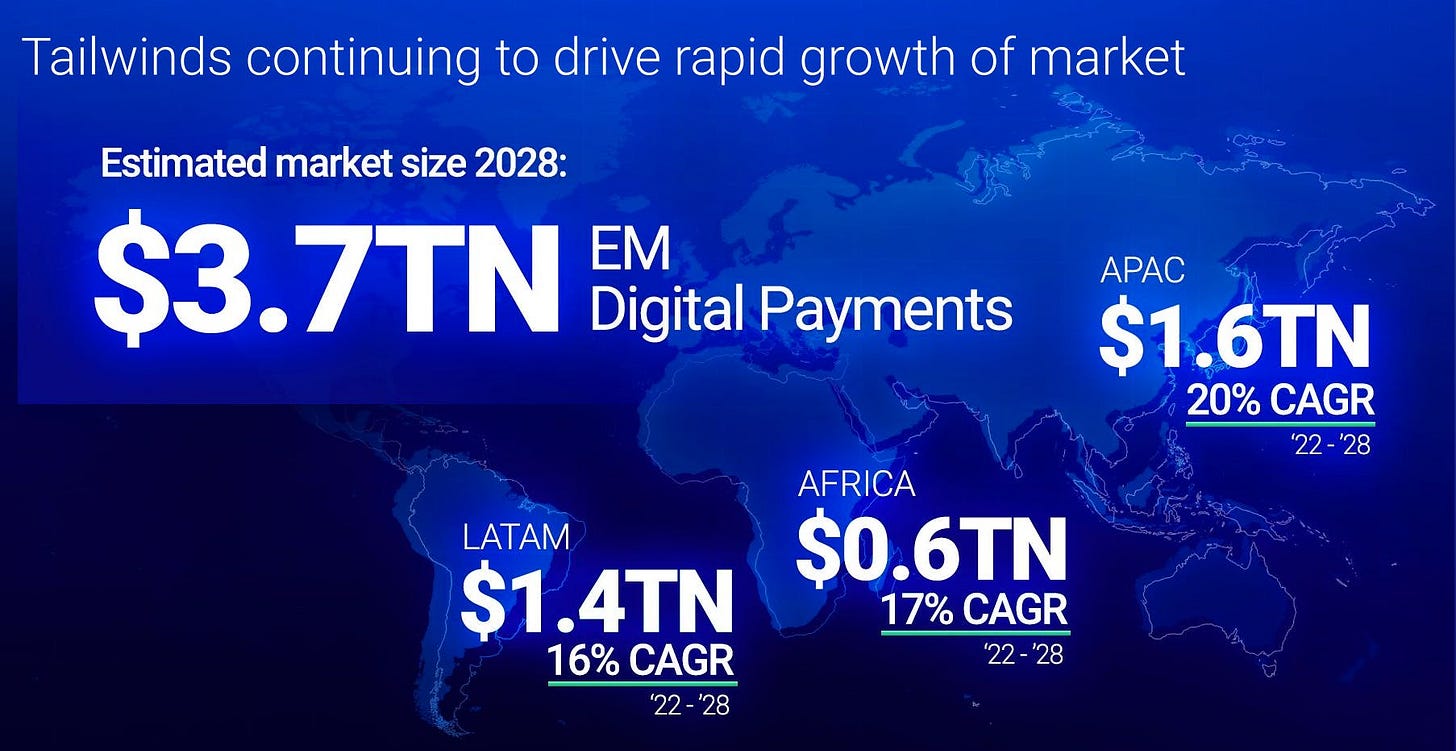

With an expected total volume of $3.7 trillion, the digital payments market in emerging markets represents a huge expansion opportunity for companies like dLocal. Asia, Africa, Latin America, and the Middle East, in particular, offer high growth potential through technological penetration, new customer needs, and structural transformations.

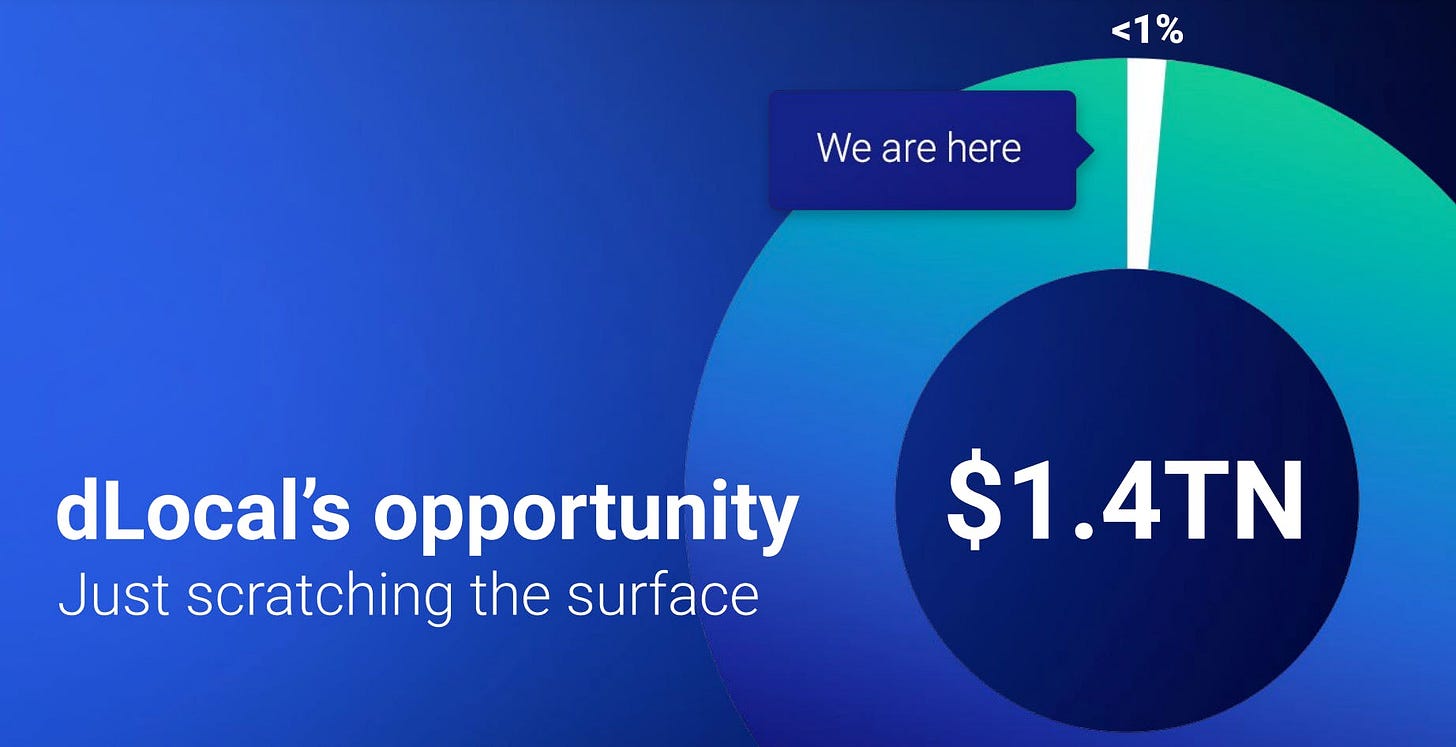

dLocal is at an early stage within this vast, largely untapped market. The company believes it is well positioned to scale massively in the long term, both through organic growth and by expanding into new geographies and payment solutions. dLocal's addressable market is approximately $1.4 trillion, a massive volume. dLocal has so far tapped less than 1% of this potential. Therefore, there is enormous growth potential.

Business Model

dLocal focuses on a three-pronged strategy: product, merchants, and regions. The company relies on a robust and balanced growth model. The combination of a strong product, a growing and diversified merchant base, and geographic expansion enables sustainable business scaling in the world's most dynamic markets.

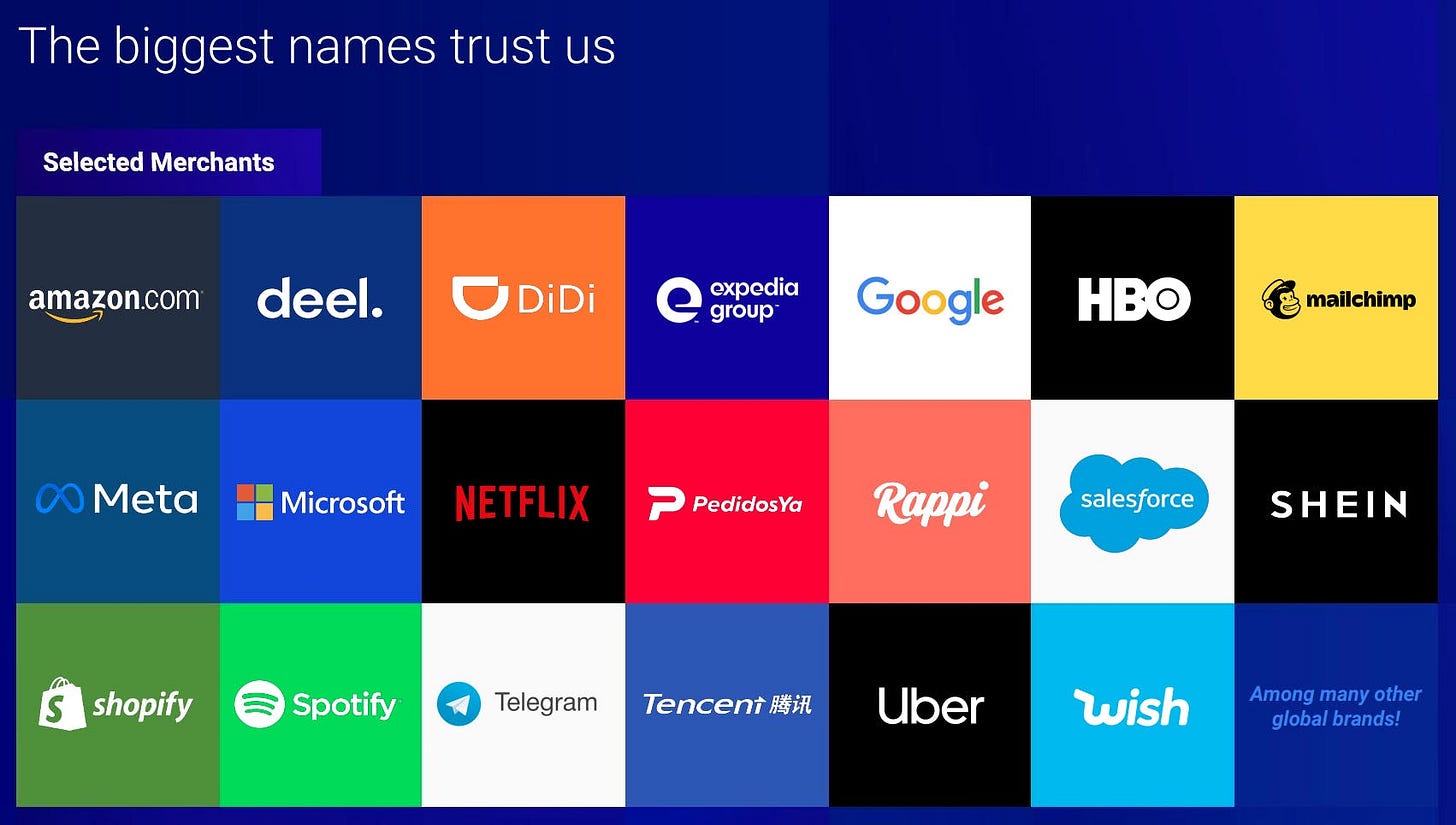

dLocal primarily helps large international companies such as Uber, Temu, Spotify, Netflix, Meta, Microsoft, Amazon, Shein and also Starlink to process local payments in over 40 emerging markets across Latin America, Africa, Asia and the Middle East.

For this purpose, dLocal has developed the platform called "One dLocal." It offers over 900 payment methods in over 40 countries. "One dLocal" supports local payment methods, including bank transfers, credit cards, e-wallets, and market-specific payment options.

Partnerships

In its Q1 2025 highlights, dLocal highlights four key partnerships:

The collaboration with Temu was further announced. The goal is to enable seamless transactions for Temu customers in more than 15 emerging markets in Africa, Asia, and Latin America.

Zepz is experiencing significant growth in key markets, particularly in Latin America and several African and Asian countries. dLocal is actively supporting Zepz in its global expansion.

Rappi is showing strong growth in Colombia and Argentina. This growth is supported, among other things, by new, jointly developed features that have been successfully implemented.

Hotmart is also growing strongly in Latin America, particularly in Brazil and Mexico. The partnership was further expanded with the expansion to Ecuador. The goal is to increase its business share in other Latin American markets as well.

One of its newest customers is Starlink, SpaceX's satellite internet service. The collaboration will enable Starlink to more easily offer its services in emerging markets where local payment methods are more widely used.

An expanded collaboration with PayPal has also been concluded: With PayPal, dLocal offers access to payment processing and local payment methods in over 40 new, untapped emerging markets. The dLocal platform handles both B2B and B2C payment flows for PayPal, making it easier for the company to connect with local customers and suppliers.

Pedro Arnt, CEO

With Pedro Arnt, dLocal has gained a CEO who is deeply familiar with the culture and processes of emerging markets and brings extensive experience in scaling companies within the industry. Before joining dLocal, Arnt served as Chief Financial Officer (CFO) and Executive Vice President at Mercado Libre for more than twelve years.

Q1'25 Highlights

Overall, dLocal is showing strong growth across multiple performance metrics, with new record highs achieved in several categories:

Total payment volume reached a record high of $8.1 billion in Q1 2025. This represents an increase of 53% year-on-year (YoY), 5% quarter-on-quarter (QoQ), and even 72% YoY at constant exchange rates. Revenue also reached a new high of $217 million. This represents growth of 18% YoY, 6% QoQ, and 36% YoY in constant currency. Gross profit rose to $85 million, also a record. This represents an increase of 35% year-on-year, 1% quarter-on-quarter, and 59% YoY at constant currency. Adjusted EBITDA (adjusted earnings before interest, taxes, depreciation, and amortization) also reached a record high of $58 million. This represents growth of 57% YoY, with a slight increase of 2% QoQ. Operating profit was $46 million in Q1 2025, an increase of 70% year-on-year and 8% quarter-on-quarter.

dLocal is showing strong and accelerating growth across all key metrics, with record levels of revenue, payment volume, gross profit, EBITDA, and operating profit. Particularly noteworthy is the strong growth at constant exchange rates.

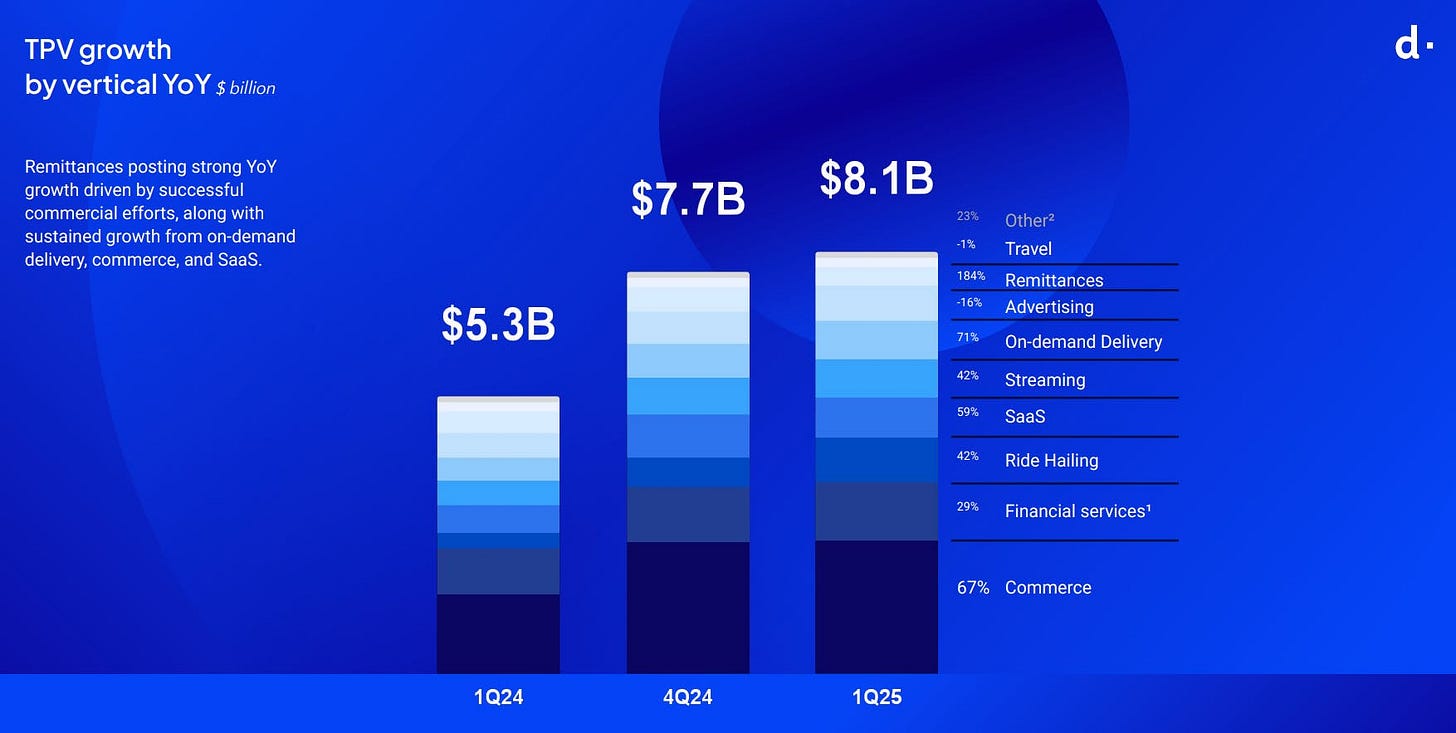

Total Payment Volume (TPV) Growth

In the first quarter of 2025, total payment volume rose to a new high of $8.1 billion, up from $7.7 billion in the previous quarter (Q4 2024) and $5.3 billion in the first quarter of the previous year (Q1 2024). This strong growth is being driven by several dynamic business areas. The largest contribution, 67%, comes from Commerce, which thus continues to form the backbone of payment volume.

Other key growth drivers include:

Remittances, with a remarkable 184% year-on-year growth.

On-Demand Delivery, which grew by 71%.

SaaS (Software-as-a-Service), with growth of 59% year-on-year.

Streaming and ride-hailing each grew by 42%, while advertising increased by 16%.

Travel saw a 19% decline, which could indicate lower demand or changing seasonal effects.

Financial Services also contributed a solid 29%.

The "Other" category accounted for 23%, although no further details were provided.

In the TPV segment, dLocal is demonstrating highly diversified growth, with digital services, cross-border remittances, and trading platforms in particular significantly increasing sales volume.

Detailed breakdown of TPV

The data shows strong growth in cross-border payment volume, which reached $4.3 billion in Q1 2025. This represents an increase of 14% quarter-on-quarter (QoQ) and 76% year-on-year (YoY). The main drivers were remittances, commerce, financial services, and streaming, exceeding the $4 billion mark for the first time in this segment. Local-to-local volume was $3.8 billion during the same period, representing a slight decline of 3% QoQ but still 33% year-on-year growth. The quarter-on-quarter decline is explained partly by seasonal fluctuations in Mexican trade and the volume loss of a major partner.

Pay-ins volume increased to $5.4 billion in Q1 2025, representing an increase of 2% QoQ and 49% YoY. This growth was driven by strong performance in on-demand delivery, commerce, and streaming, although partially offset by advertising spending. Payout volume also grew significantly, reaching $2.7 billion, representing an increase of 12% QoQ and 61% year-on-year. Remittances and financial services were the main drivers.

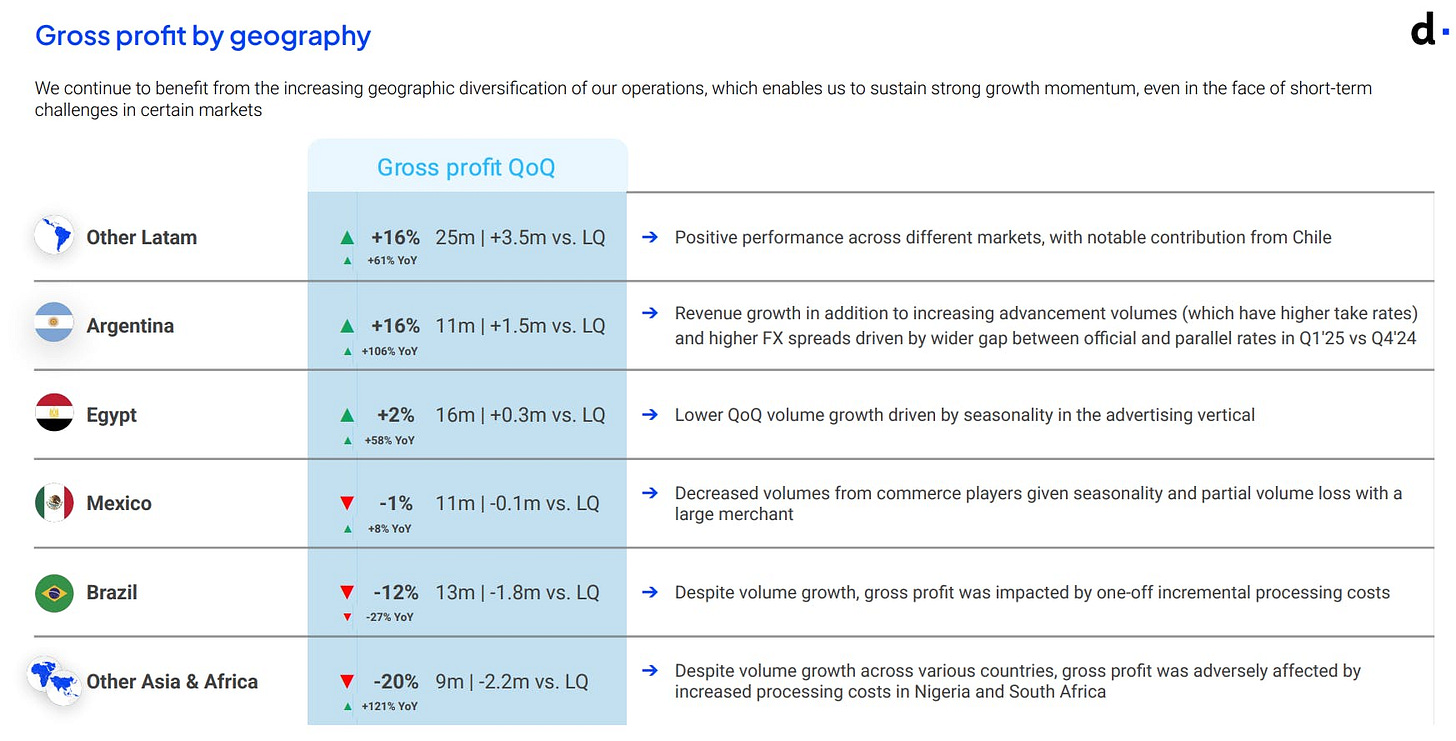

Breakdown of Gross Profit by Region

While Latin America achieved strong results overall, particularly in Chile and Argentina, parts of Africa and Asia are experiencing operational challenges, primarily due to rising costs.

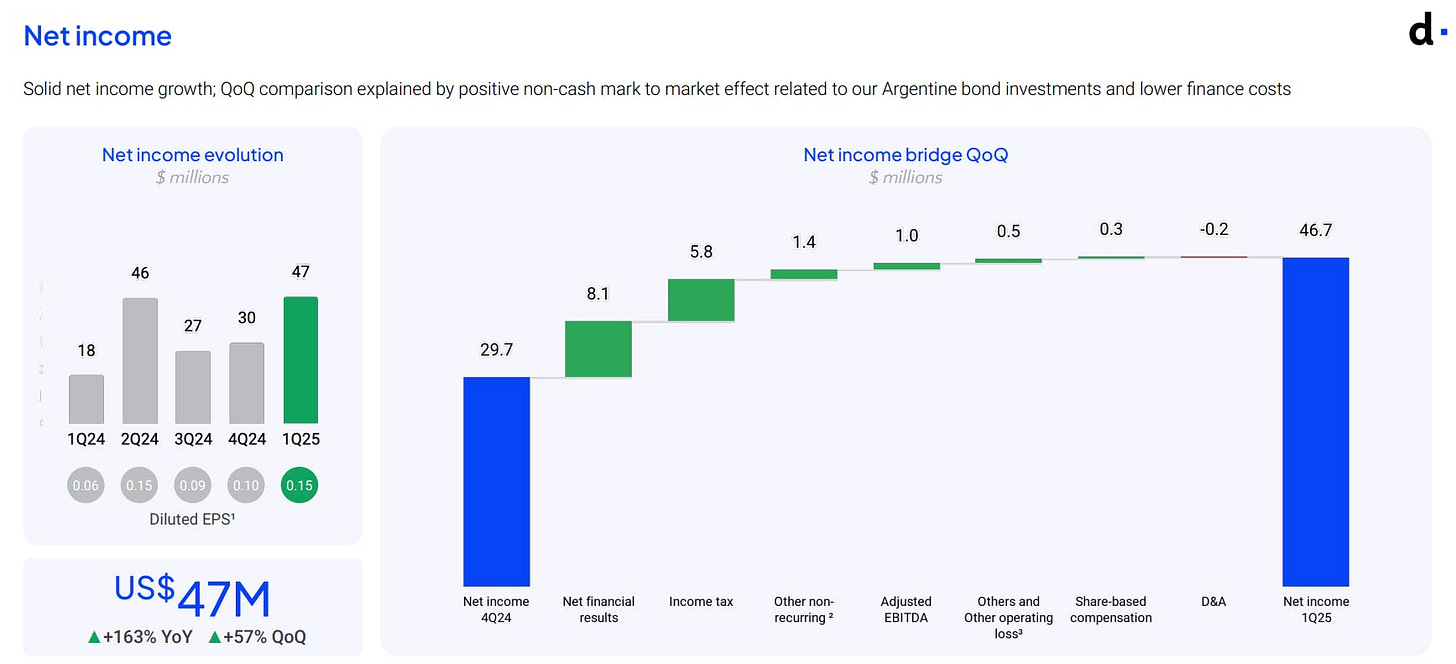

Net income

In Q1 2025, the company achieved net income of $47 million, representing a 57% increase quarter-on-quarter (Q4 2024: $30 million) and a 163% year-on-year increase. Diluted earnings per share (EPS) also increased to $0.15, up from $0.10 in the previous quarter. Overall, dLocal achieved strong net income growth, supported by a combination of positive financial income (particularly in Argentina), tax optimization, and operational efficiency. The increase in earnings per share reflects the company's sustained earnings strength and underscores its strategic and financial robustness.

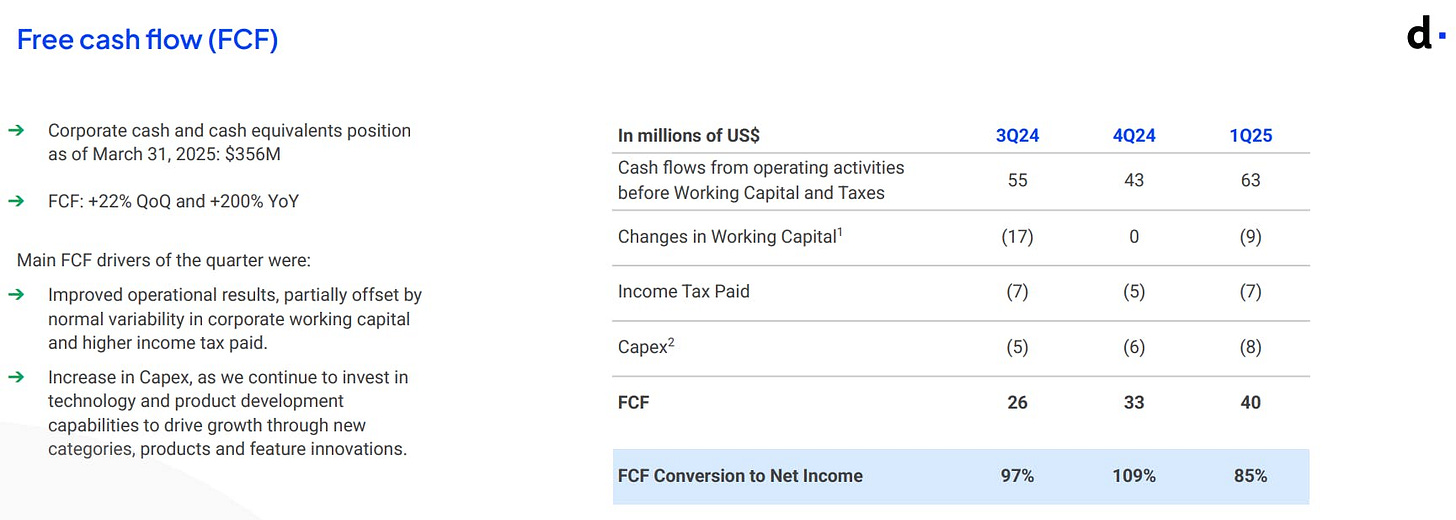

Free Cash Flow (FCF)

As of March 31, 2025, cash balance was $356 million. Free cash flow amounted to $40 million in Q1 2025, representing an increase of 22% quarter-on-quarter (QoQ) and 200% year-on-year (YoY). dLocal is increasingly generating free cash flow, supported by strong operating results and despite increased investments in growth and innovation. The high FCF conversion rate demonstrates a robust financial foundation and effective use of capital.

Dividend

"Our Board of Directors has approved both a dividend policy, as well as the payment of an extraordinary cash dividend of approximately $0.525 per common share, for a total cash outlay of $150 million", said Pedro Arnt

dLocal is very confident about its future free cash flow! Therefore, the company has implemented a new dividend policy: It includes a one-time extraordinary cash dividend of $0.525 per share, for a total of $150 million. This dividend will be paid on June 10 to shareholders of record as of May 27. Starting in 2026, dLocal plans to pay annual dividends equal to 30% of free cash flow.

My take on the dividend: dLocal operates in a world where achieving TPV scale is critical. This is the only way to build a profitable payments business over the long term. Growth is everything. Management should focus on finding future growth opportunities or preserving capital for stronger options. However, the dividend should increase in line with the company's growth over the next few years. Therefore, it can benefit from both.

dLocal acquires Aza Finance, a payments platform focused on the African market, for an estimated $150 million. The acquisition marks thee first acquisition outside Latin America. The company is thus further diversifying its business model.

“Our acquisition of AZA Finance will increase access for our global merchants to Africa’s dynamic, growing markets, while further strengthening our commitment to the region,” Carlos Menendez, COO

Conclusion

dLocal's mission is clear. To achieve this, the company sees a tremendous and growing opportunity in emerging markets, driven by demographic tailwinds and rapid digital adoption. By 2050, nearly 90% of the world's population under 20 will live in emerging markets, which are expected to generate around 65% of global economic growth by 2035. This backdrop supports the rising demand for seamless, localized payments infrastructure, precisely where dLocal operates. As global trade becomes increasingly multilateral and fragmented, the need for scalable, frictionless payment solutions in underserved markets is increasing. In my opinion, dLocal is the biggest beneficiary in the growing emerging markets.

What's your opinion on dLocal? Can the experienced CEO turn the company into a Mercado Libre 2.0?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.