Effectiveness of personalized GLP-1 offers

The first results of a 12-month cohort study on the effectiveness of personalized GLP-1 offerings are available.

Dear growth investors,

There is exciting news from Hims & Hers (Ticker: HIMS): The first results of a 12-month cohort study on the effectiveness of personalized GLP-1 offerings have just been published.

What are the concrete results?

Overall, the personalized GLP-1 offering leads to a more pleasant, effective, and sustainable therapy, perfectly tailored to each individual

Andrew Dudum (Founder and CEO) adds that the results from the 12-month cohorts demonstrate the long-term effectiveness of personalized GLP-1 programs and allow for continuous optimization of the program.

Thanks to regular telemedicine support, approximately 60% of participants remain in therapy after three months, a rate significantly higher than the average for conventional programs. After just two months, an average weight loss of approximately 5% is evident, proving that the tailored treatment is working. At the same time, 96% of participants report further health improvements, for example in blood sugar levels and blood pressure.

Why are such good results achieved?

At Hims & Hers, each patient receives an individually tailored GLP-1 dose, rather than a fixed standard amount for everyone. This personalized dosage ensures that potential side effects are reduced.

Why is Hims & Hers publishing its results on the effectiveness of personalized GLP-1 offerings now?

Eli Lilly & Co. recently clarified that it will only cooperate with telehealth providers that refrain from selling copycats of their weight-loss products. Therefore, a collaboration with Hims & Hers seems rather unlikely. Hims & Hers still offers “Compounded-Semaglutide”. It has expressly prohibited the sale of copied versions of Lilly's Zepbound and Novo Nordisk's Wegovy with providers such as Ro and LifeMD. Lucas Montarce, Lilly's Chief Financial Officer, also emphasized at a conference that it will only enter into partnerships with telehealth companies that completely forgo copycats.

Why doesn't Hims & Hers need Eli Lilly & Co. as a partner?

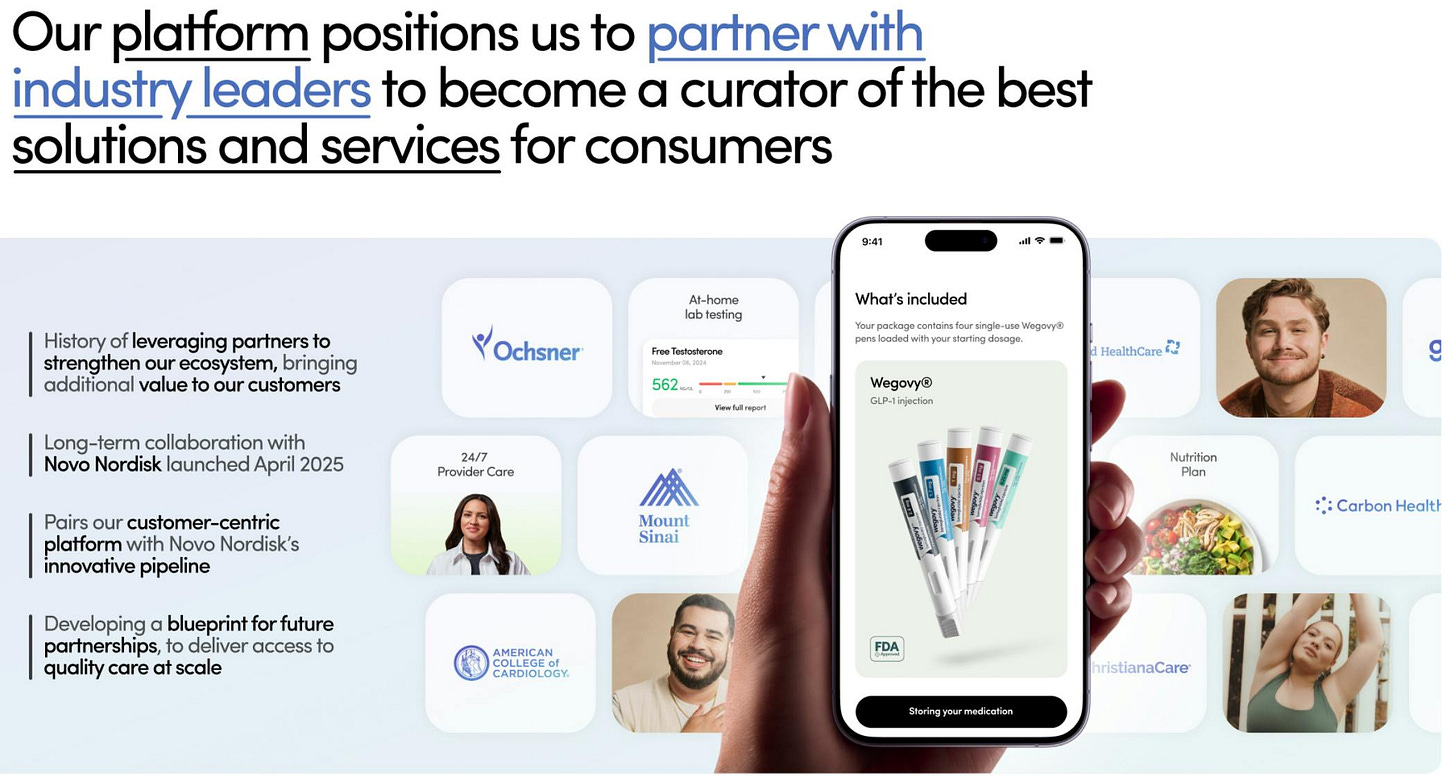

On April 29, Hims & Hers announced a news that silenced many critics: Hims & Hers will be collaborating with Novo Nordisk.

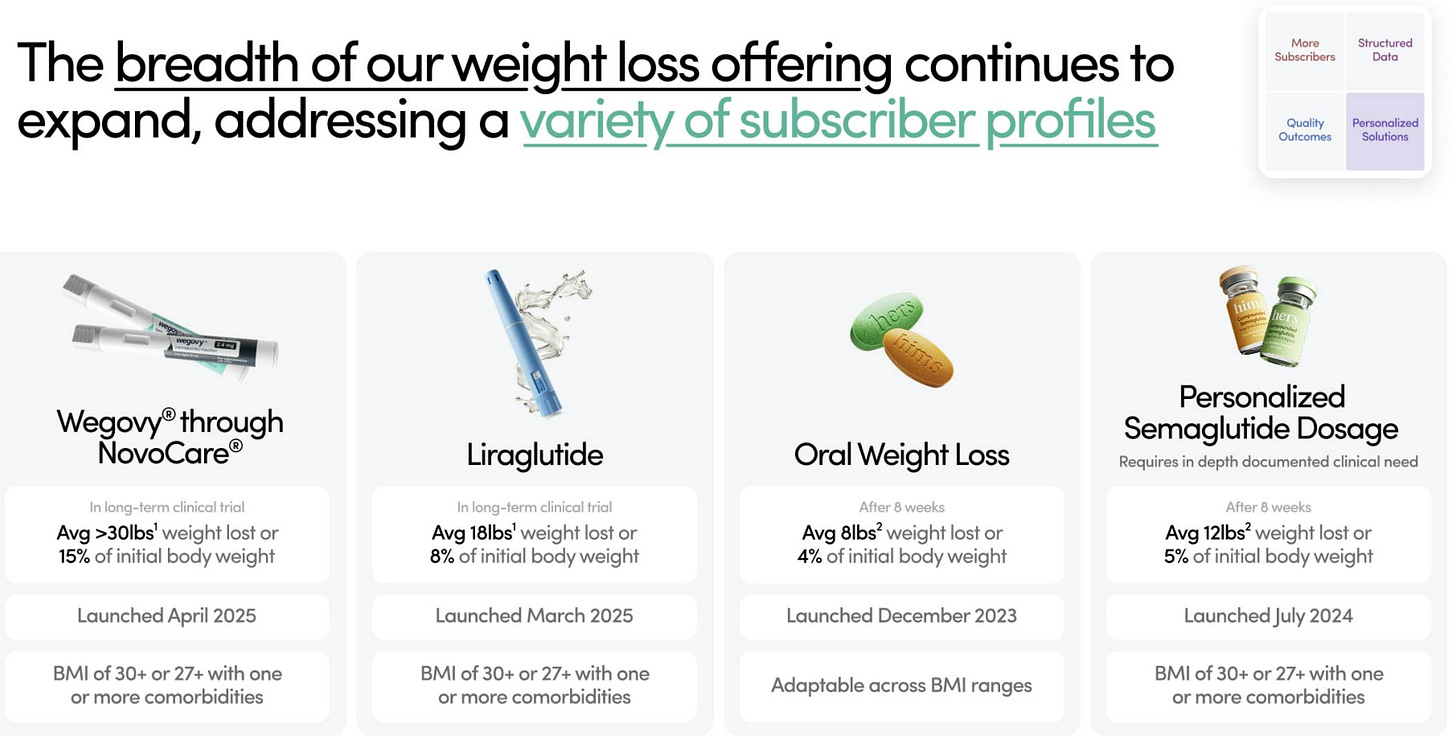

Customers can now access NovoCare® Pharmacy directly through the Hims & Hers platform. The offering includes a full range of Wegovy® dosages and a Hims & Hers membership. This includes around-the-clock care, ongoing clinical support, and nutritional counseling, all in one place. For a single price starting at $599 per month, individuals receive a prescription of Wegovy® along with Hims & Hers' world-class, holistic care approach powered by cutting-edge technology.

Conclusion

While a partnership with Eli Lilly & Co. would undoubtedly be attractive, Hims & Hers can operate largely independently thanks to its already forged alliance with Novo Nordisk. Hims & Hers distributes its GLP-1 drug Wegovy at attractive terms. Pharmacies are permitted to manufacture customized dosages for specific patient groups in accordance with FDA regulations. Hims & Hers leverages this opportunity to respond flexibly to specific medical needs without relying on exclusive supply agreements.

In addition, Hims & Hers has an established telemedicine platform, a loyal subscriber and customer portfolio, and proven direct sales processes that enable the company to launch and scale new products independently. Through this combination of external collaborations, internal compounding, and a strong digital business model, Hims & Hers minimizes supplier and price fluctuation risks, eliminating the need for an exclusive deal with Lilly to continue growing in the dynamic weight-loss market.

Eli Lilly & Co.'s strict contractual clauses against "copycat" versions give rise to a certain concern: the fear that Hims & Hers, thanks to direct online access and customized formulations, will achieve a dominant market position in the long term. To prevent this, Eli Lilly & Co. requires its cooperation partners to no longer distribute independent copycat products. This is intended to ensure that Zepbound is not under pressure from low-cost compounds and that Lilly retains its market share. In my opinion, Eli Lilly & Co. is trying to demonstrate strength with this, but in the long run, it is shooting itself in the foot.

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.