Grab: The SuperApp from Southeast Asia

With its SuperApp, the company has gradually expanded its range of services in the SEA region over the past few years.

Dear growth investors,

When I embarked on my very first trip to Thailand at the end of 2022, one very special company repeatedly caught my eye from the moment I landed until my departure: Grab (Ticker: GRAB) was and remains omnipresent throughout Southeast Asia. With its SuperApp, the company has gradually expanded its range of services in the SEA region over the past few years, offering everything from food deliveries and mobility services to financial services, business solutions, and much more. All of this is handled seamlessly via a user-friendly app. Through a potential acquisition, Grab is now striving for a monopoly position. Is the company a buy?

Table of Contents

Founding and IPO

Market opportunity

Business model

Financial indicators

Speculation: Goto takeover

Risks

Opportunities

Valuation

Conclusion

Founding and IPO

Anthony Tan, co-founder and CEO of Grab, grew up as the youngest of three sons in one of Malaysia's wealthiest families and shouldn't have needed to start his own business to become wealthy. His father, Tan Heng Chew, is president of Tan Chong Motor, a multinational automobile dealership founded by Tan's grandfather in the 1950s and now listed on the Kuala Lumpur Stock Exchange.

In 2009, Tan began studying at Harvard Business School, where he met his co-founder, Hooi Ling Tan.

During a discussion in 2011 about the inadequate and often unsafe taxi infrastructure in their hometown, the idea of offering a safe, reliable ride service was born. With this guiding principle in mind, they outlined a business plan that won second place in the university's startup competition and earned a prize of $25,000, the seed capital for their company, which initially operated under the name MyTeksi.

Even in the early stages, Tan's ambition in pursuing his dream became apparent. Tan used all of his student savings and the initial funds from his mother, the first private investor, and launched the company in June 2012. The modest startup headquarters consisted of a small, poorly ventilated room in Kuala Lumpur without Wi-Fi or air conditioning. To attract drivers to their platform, Tan traveled tirelessly throughout Southeast Asia: In Ho Chi Minh City, he handed out free coffee to taxi drivers at 4 a.m., in Manila, he negotiated with fleet operators over cheap beer, and even experienced weeks of 15 to 20 hours of work per day, Monday to Sunday.

Despite all these adversities, the company grew rapidly: In 2018, after lengthy negotiations, Grab acquired Uber's Southeast Asia business, thereby consolidating its dominant market position. In return, Uber received a 27.5 percent stake and appointed its CEO, Dara Khosrowshahi, to Grab's supervisory board. Supported by investors such as SoftBank, Grab reached a market capitalization of just under $40 billion. With its IPO in the US in December 2021, the company reached the next milestone; by 2023, Grab had already generated revenue of over $2 billion.

Today, Grab is far more than a ride-hailing platform: Users can use its "SuperApp" to book rides, have food and groceries delivered, and conduct banking transactions such as payments, lending, and digital banking.

Grab now operates in Singapore, Indonesia, Vietnam, Cambodia, the Philippines, Myanmar, Malaysia, Thailand, and Japan.

And Grab's rapid growth plans are far from over: At Grab, the future is guided by the motto "AI-First with Heart," meaning consistently placing artificial intelligence at the forefront of the company while simultaneously placing people at the center of everything it does. The company unveiled its next milestones in April 2025 at GrabX, its first pure product event.

First, Grab plans to train all employees in the use of generative AI and create space for innovation. The goal is clear: instead of simply making business models scalable, Grab is now asking about its users' most pressing problems and how they can be solved x times better with AI-supported solutions.

A key future product for this is the AI Merchant Assistant: a virtual assistant that acts as a coach for retailers around the clock. It analyzes sales data, provides recommendations for product range optimization, plans marketing measures, and answers inquiries in seconds. This will enable small businesses in Southeast Asia to work more efficiently, increase their sales, and professionalize their business operations.

Grab is also driving innovation in the area of safety: With the help of large-scale speech and audio models, real-time analyses of sounds and moods in vehicles will be possible in the future. Alarm signals such as loud arguments, hidden cries for help, or unusual driving noises will be automatically detected and trigger immediate intervention, for example, by establishing a direct connection to the emergency team. Security is no longer guaranteed solely through subsequent evaluation, but through immediate response.

In terms of technology, Grab relies on world-leading AI partners: In addition to deepening its alliance with OpenAI, Grab is bringing on board another strategic partner, Anthropic. Both AI research institutions provide the basic models that Grab fine-tunes using its unique data from millions of trips and deliveries. This co-development is intended to ensure that the AI applications are perfectly tailored to the cultural and infrastructural characteristics of Southeast Asia.

Another innovation focus is the integration of agentic AI, i.e., autonomously acting systems that can plan and execute complex tasks. For drivers, this means, for example, that routes are optimized and sales targets are forecast without them having to prepare data themselves. Retailers, in turn, receive automated inventory management and reordering functions.

Beyond all these technological projects, the core promise remains: "Solving real problems for real people." As a super app, Grab aims to continue offering not only mobility and delivery services, but also to further strengthen the economic participation and security of millions of people in Southeast Asia with the help of AI-supported financial solutions, microcredit, and digital tools. Emerging technologies may open new avenues, but the guiding principle remains unchanged: innovations that have a practical social impact.

Market Opportunity

The global population is projected to reach nearly 10 billion by 2050. Therefore, the opportunities in emerging markets are more promising than ever. Over 50% of transactions in emerging markets are cash-based, and 80% are processed using payment methods other than credit cards. Despite technological advances, hundreds of millions of people in emerging markets remain digitally underserved when it comes to banking. Nearly 90% of the world's population under the age of 20 will live in emerging markets by 2050. These regions are expected to account for approximately 65% of global economic growth by 2035. This young population is driving the rapid adoption of digital solutions, particularly in areas such as mobile payments, digital wallets, and other financial services. This demographic dynamic creates a huge addressable market for Grab, with high revenue growth, attractive margins, and strong cash generation. The total market for Grab's services is estimated at $375 billion, although the company currently serves only about 6% of that market.

Business Model

Grab pursues a super-app business model centered on the platform, seamlessly connecting various mobility, delivery, and financial services. This enables Grab to build strong customer loyalty and increase the lifetime value of each user through cross-selling. The four core segments at a glance:

Mobility Services (Ride-Hailing)

Active in eight Southeast Asian countries.

In 2023, 215.7 million rides were completed, with 32.4 million monthly active users.

Food and Grocery Delivery

The platform processed 324.1 million orders in 2023 with a gross merchandise value (GMV) of $4.2 billion.

Over 250,000 restaurant partners are connected.

The delivery network uses the same driver infrastructure as ride-hailing, optimizing fixed costs and achieving economies of scale.

Financial Services (GrabFin)

Includes digital payments, lending, and banking services.

In Q3 2024, revenue in this segment increased by 34% year-on-year to $64 million, driven by higher loan volumes and initial revenue from the digital bank.

The outstanding loan portfolio reached $498 million, an increase of 81% compared to Q3 2023.

Financial services increase the transaction frequency on the platform and open up high-margin revenue sources beyond commissions.

Logistics and Parcel Delivery (Grab Logistics)

In 2023, 168.3 million parcels were delivered, generating revenue of $763 million.

Cross-selling and user engagement

CFO Peter Oey sums up the super app principle:

“About two-thirds of our user base uses two or three products […] And over time, we want to see more and more users use all parts of our various products and services.”

This multifactorial model maximizes customer lifetime value, reduces dependence on individual segments, and simultaneously increases barriers to switching for customers. For Grab, this not only means revenue diversification, but also a deeper integration into the everyday lives of customers in Southeast Asia, whether it's their daily commute, getting lunch, or paying for small purchases.

And Grab is constantly evolving: With GrabCabs, the company impressively demonstrates what a consistently consumer-oriented strategy looks like in practice: On July 2, 2025, Grab officially launched its first fleet of "GrabCabs" in Singapore, ushering in a new era in the city's taxi service. The modern, environmentally friendly vehicles complement the existing private-hire vehicle (PHV) network and are primarily intended to improve ride availability and the user experience for all segments of the population. While ride-hailing services are now an integral part of the transportation system, seniors, tourists, and people without smartphones or mobile data are particularly dependent on traditional taxis. With GrabCab, Grab closes this gap: The new taxis are available nationwide, offer convenient booking options, and ensure that no passenger is left behind.

Financial Key Figures

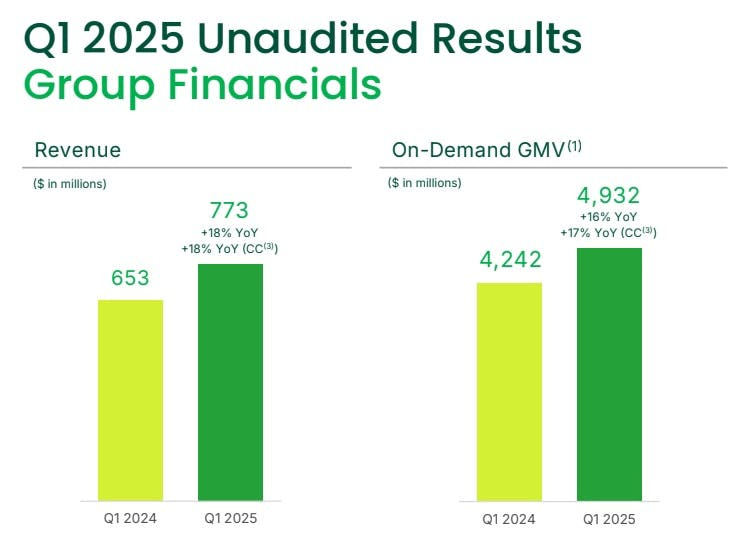

Grab reported record profit and record user growth in the first quarter of 2025. Revenue increased 18% year-on-year to $773 million, and profit reached $10 million.

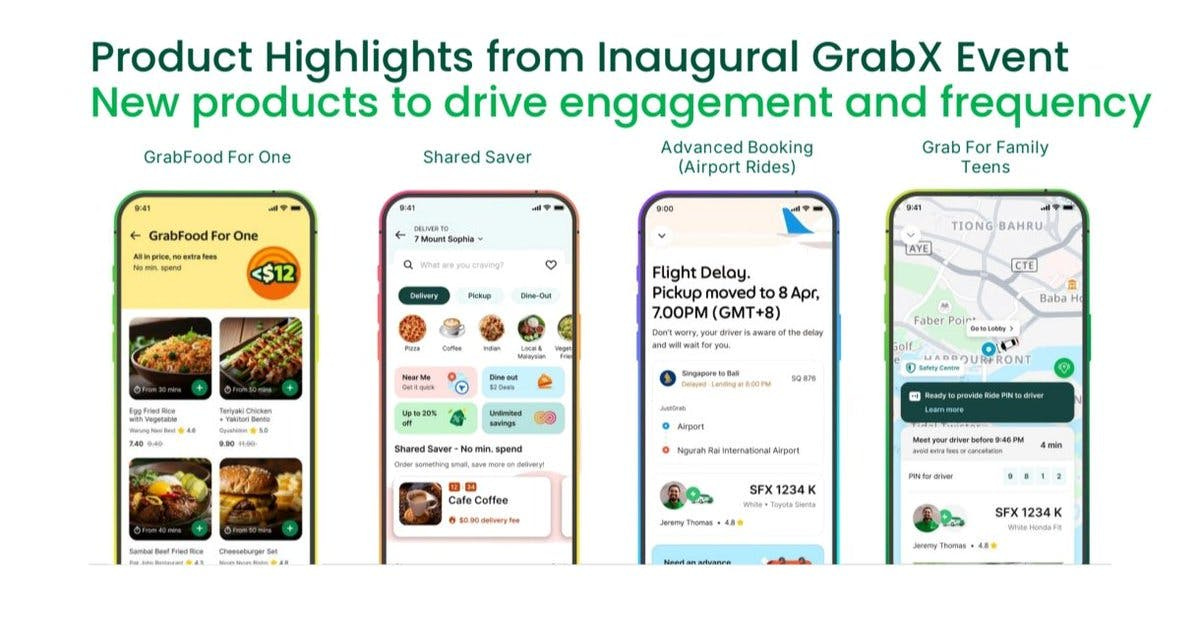

In the earnings call, Grab began with a summary of its first Grab X event on April 8, 2025, where a variety of new product lines were introduced.

1. Grab For Family | Teens: Grab for Family & Teens offers young people a safe and reliable way to travel independently, while providing parents and caregivers with information about the whereabouts of their children and teens thanks to additional security features.

2. LLM Improvements: Grab has improved its Large Language Model (LLM) to determine whether a shipment is too bulky or heavy for a single delivery driver.

3. GrabFood for One: "GrabFood for One" makes food deliveries more accessible and easier by offering affordable meals with no minimum order value and a fixed, low delivery fee.

4. Shared Saver: Shared Saver is designed for users who, for example, want a cup of bubble tea or a midday snack, but consider ordering a small portion wasteful and don't have anyone to share the order with. Shared Saver allows users to discover and participate in live orders in their area. Grab's AI detects when there are multiple orders from the same merchant nearby and can decide to start a Shared Saver order.

5. Advance Booking (Airport Pickup): Grab has introduced advance booking (airport pickup). This offers a reliable and predictable service that dynamically adapts to users' flight status.

6. Dine Out Discovery (Powered by GrabMaps): Grab has also introduced Dine Out Discovery (based on GrabMaps). With Dine Out Discovery, users can easily and intuitively discover nearby restaurants and offers.

7. Grab Travel Pass: Grab has introduced a new Travel Pass that can be purchased via the app before departure. The Travel Pass includes various vouchers for airport rides, public transport, food deliveries, and restaurant visits.

8. AI Solutions for Merchant and Driver Partners: As mentioned previously, Grab also presented agent-based AI solutions for merchant and driver partners at the event. These were developed in collaboration with OpenAI and Anthropic.

A look at the current metrics shows how Grab's super app has significantly expanded its user engagement over the past two years. In Q1 2023, Grab recorded 6 million daily transaction users, 33 million monthly transaction users, and a total of 88 million annual transaction users. Two years later, in Q1 2025, these figures have increased to 7 million daily, 45 million monthly, and 119 million annual.

In particular, the number of Daily Transacting Users (DTU) is growing dynamically, now accounting for 16% of the total Monthly Transacting User (MTU) base. Grab attributes this to the introduction of new products and features aimed at strengthening user loyalty and increasing transaction frequency. Through targeted engagement measures and continuous expansion of its offerings, Grab aims to further increase the DTU ratio and thus unlock the full potential of its super app.

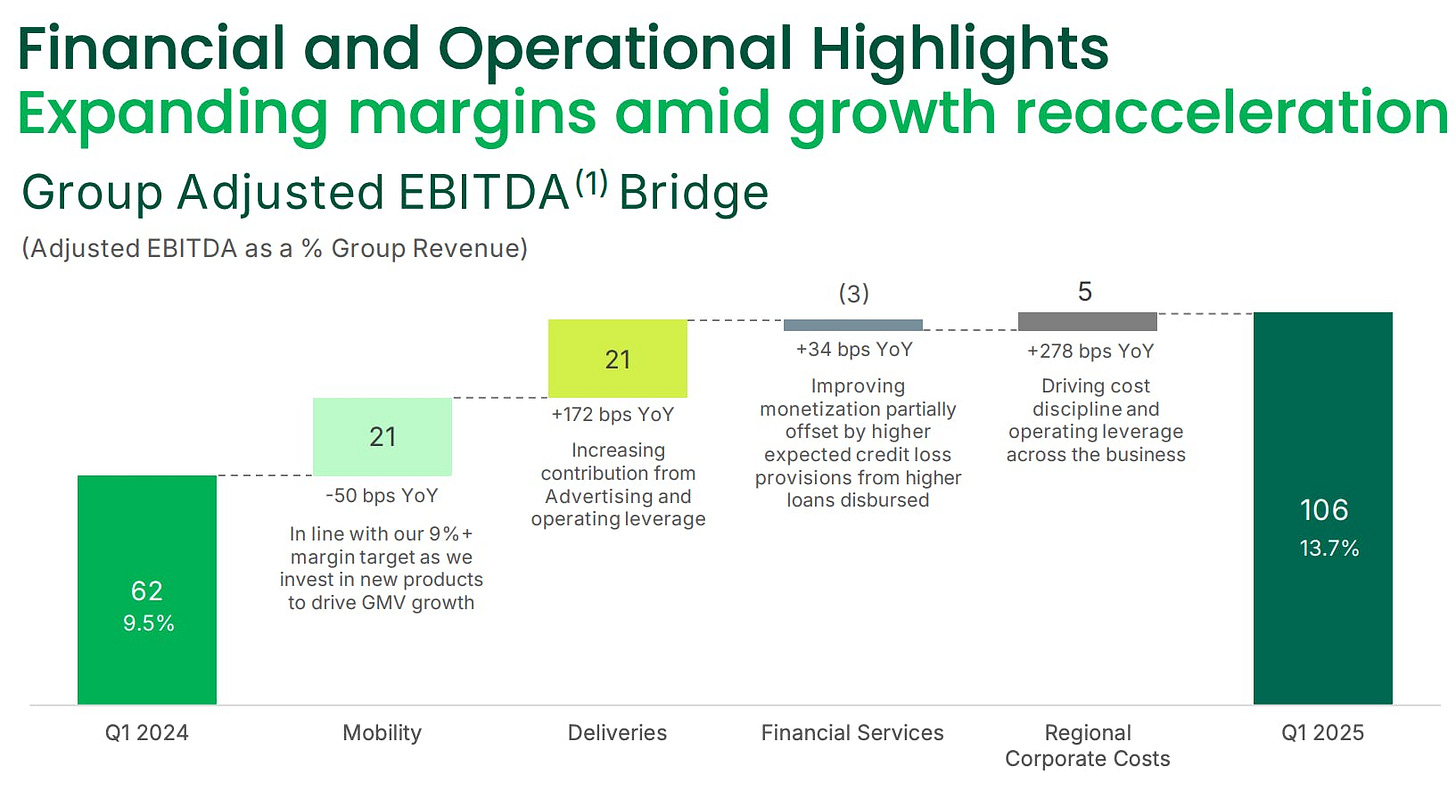

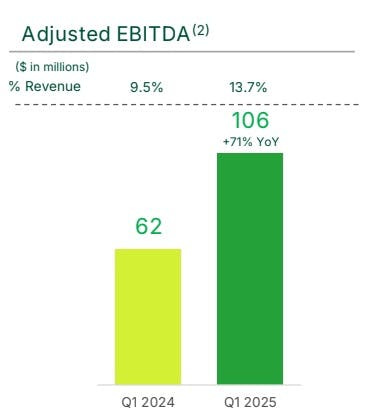

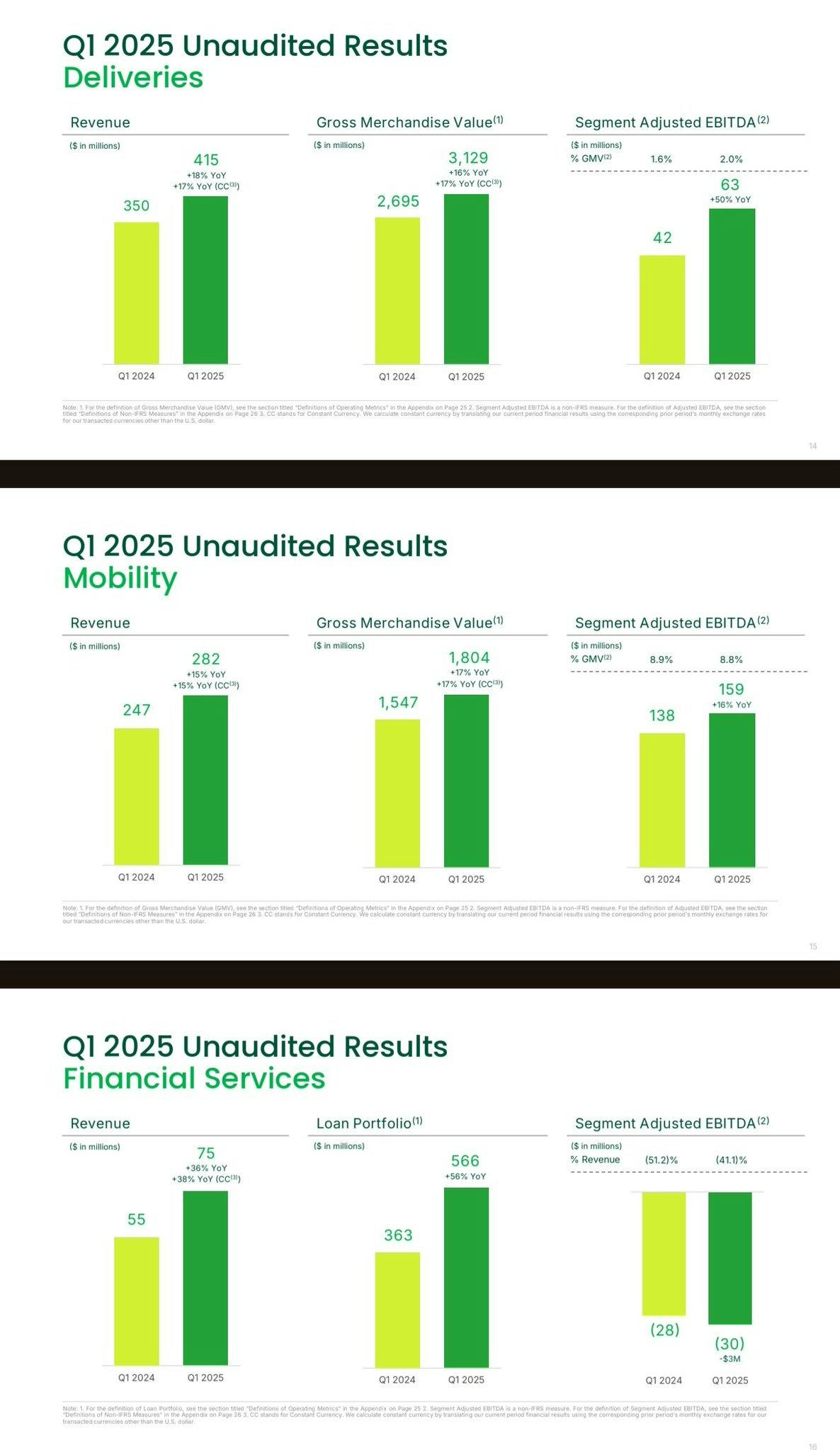

Between the first quarter of 2024 and the first quarter of 2025, Grab significantly increased its Adjusted EBITDA margin from 9.5% to 13.7%. This increase of approximately 420 basis points can be broken down into four key contributions.

Mobility Business

While the EBITDA margin declined by 50 basis points, this is within the company's self-imposed target of margins above 9%, a conscious decision to invest in new product features and further boost transaction volumes.

Food and Goods Delivery

The Delivery segment benefited significantly from additional advertising revenue and operational synergies. As a result, the margin improved by 172 basis points year-on-year, thus contributing significantly to the overall increase.

Financial Services

Here, too, there was a positive margin development of 34 basis points, due to better monetization of payment services. However, this was offset by increased provisions for expected loan losses, which slightly dampened growth.

Regional Corporate Costs

Through consistent cost discipline and economies of scale at headquarters, Grab was able to improve its overhead ratio by 278 basis points, a key lever for strengthening profitability while driving growth.

Overall, the combination of investments in growth areas (Mobility), operational leverage (Deliveries), and efficiency improvements (Corporate Costs), as well as the solid performance of the Finance division, led to strong margin expansion. This result underscores Grab's ability to become more profitable while expanding market share through targeted product and cost strategies.

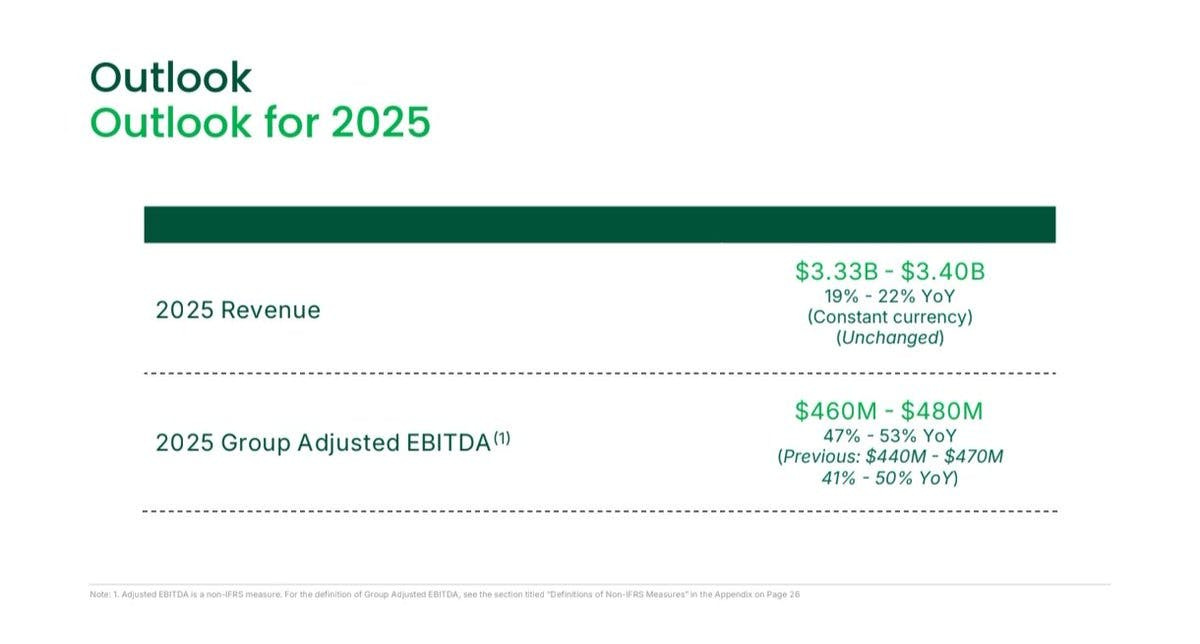

Revenue increased by 18% year-on-year and at constant currency, with growth accelerating quarter-on-quarter. Revenue reached $773 million in the first quarter of 2025. This was driven by growth across all segments, with on-demand GMV increasing by 16% year-on-year and 17% at constant currency to $4.9 billion.

Adjusted EBITDA improved by $44 million year-on-year to another record $106 million.

Delivery revenue increased by 18% in the first quarter of 2025. Mobility revenue increased by 15% in the first quarter of 2025. Financial services revenue increased by 36%.

With operating cash flow of $936 million and adjusted free cash flow of $157 million on a trailing 12-month basis, cash liquidity totaled $6.2 billion at the end of the first quarter.

Grab also raised its EBITDA guidance from $440-470 million to $460-480 million.

Speculation: GoTo Acquisition

On June 10, 2025, Grab announced the successful placement of a convertible bond issue due 2030 totaling $1.5 billion (previously $1.25 billion). The net proceeds from the issue will be used for general corporate purposes and further strengthen Grab's strategic flexibility, for example, for potential acquisitions. This gives Grab a total cash position of $7.7 billion.

Why does Grab need so much money? Although Grab officially denies it, the company is in serious negotiations to acquire one of its largest competitors in Indonesia: GoTo. One of the reasons for Grab's low margins is competition. Furthermore, GoTo is dependent on a sale of its business. GoTo cannot afford to continue burning cash to compete with Grab. The company is not profitable, and its stock has fallen 80% since its IPO.

Grab, on the other hand, is profitable and, while it doesn't have the best stock performance, has a very low risk of insolvency due to its liquidity. The company just easily raised $1.5 billion from investors through convertible bonds. GoTo, on the other hand, will not be able to raise money so easily if it doesn't find a path to profitability.

Risks

Grab's biggest problem is its poor margins. The reason is simple: The company is investing to establish its market dominance and then further monetize it.

Another key risk for Grab lies in a potential takeover of GoTo: Antitrust authorities in Indonesia, Singapore, and other Southeast Asian countries could prohibit the merger as a market-dominant alliance or impose strict conditions. Combining Grab's mobility, delivery, and FinTech offerings with Gojek/Tokopedia's e-commerce and logistics volumes would lead to a quasi-monopolistic position in many segments.

Furthermore, the Southeast Asia region is highly competitive: In addition to GoTo, local players and global giants (e.g., Amazon, Sea Group) are vying for market share in mobility, delivery, and e-commerce. Price and investment wars can put pressure on margins and require constant additional spending on marketing and subsidies.

Market saturation and maturity: Ride-hailing and delivery are already well established in some major cities. Organic growth is increasingly shifting to less densely populated regions with lower solvency, which can reduce profitability.

Financing and interest rate risk: While Grab has a strong cash position, future expansions or acquisitions could require further capital measures (bonds, dilution through shares). An unfavorable interest rate environment makes debt more expensive and can burden the balance sheet.

Opportunities

Future growth drivers are advertising and financial services:

Advertising: Thanks to the vast amount of transaction data and the daily interaction of millions of users, Grab can offer its advertising partners exceptionally precise and contextual campaigns. This not only increases advertising revenue but also increases user engagement: The more relevant the offers are displayed, the more likely customers are to engage with the app. Advertising already contributed to a margin improvement of 172 basis points in the Deliveries business in Q1 2025, a clear indication of how cross- and upsellable touchpoints can boost profitability.

Financial Services (GrabFin): The latest Q1 figures underscore the momentum: Revenue climbed 36% year-on-year to $75 million, and the loan portfolio grew 56% to $566 million. At the same time, the loss ratio (adjusted EBITDA) decreased from -51.2% to -41.1% of segment revenue. This progress demonstrates that economies of scale and optimized risk provisioning are already paying off. As the segment continues to invest in technology, data analytics, and market expansion, the path to profitability is clearly visible. Financial services is currently growing at around 40% per year, making it the fastest-growing business segment. Grab expects this sector to reach breakeven by the end of 2026.

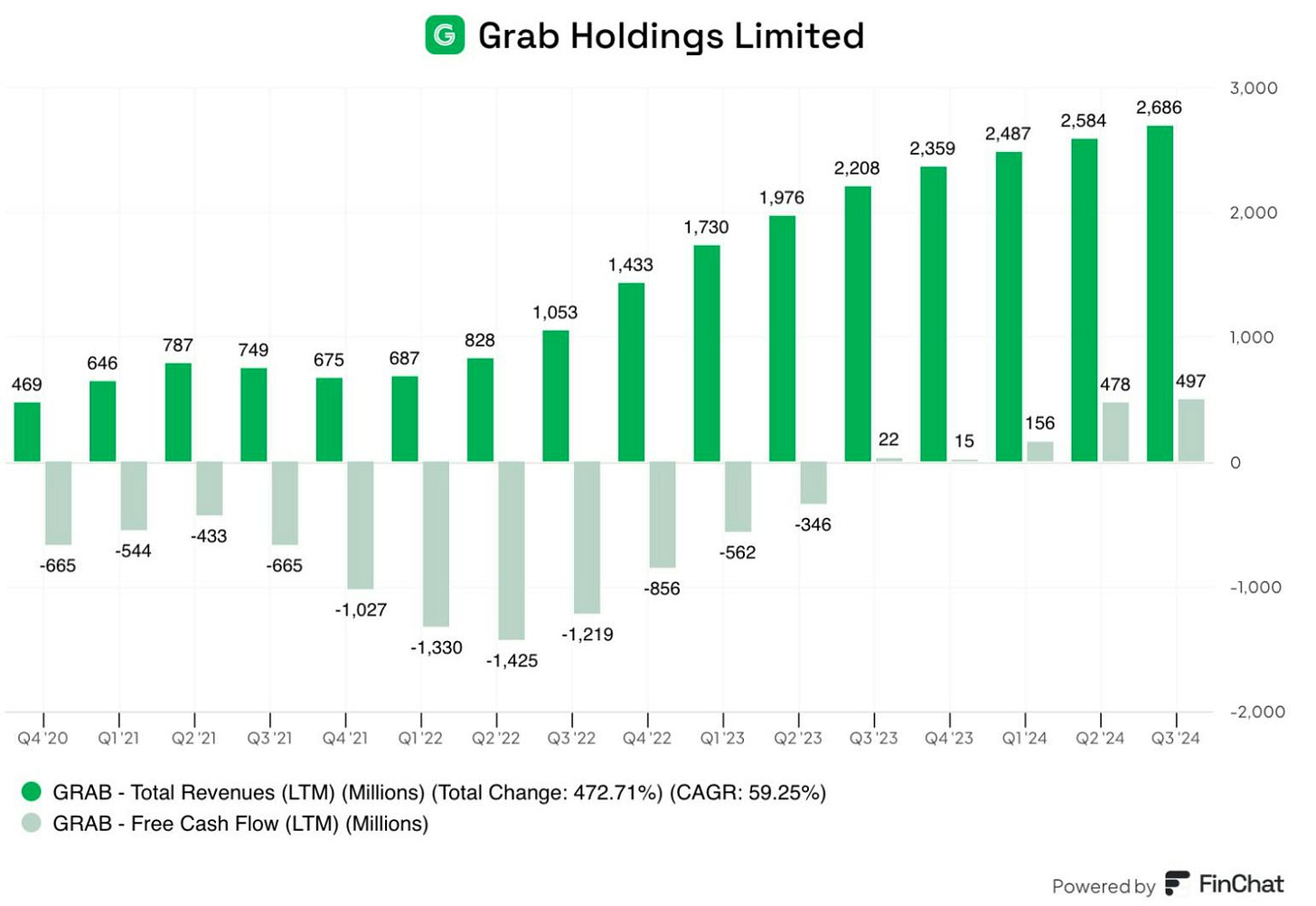

The following chart vividly illustrates Grab's impressive revenue expansion over the past four years, from LTM revenue of $469 million at the end of 2020 to $2.686 million at the end of Q3 2024, corresponding to a compound annual growth rate (CAGR) of approximately 59%. Particularly striking is the steady increase from Q1 2022, when the $1 billion mark was exceeded for the first time, to nearly $2.7 billion in Q3 2024.

At the same time, a clear trend of operational consolidation is emerging: From the first quarters of 2021 to mid-2023, Grab repeatedly recorded negative free cash flows between $-433 million and $-1.425 million. However, starting in Q3 2023, the numbers turned around, and the company achieved positive free cash flow for the first time (+$22 million). This trend continued: In Q2 2024, free cash flow rose to $478 million and even to $497 million in Q3 2024.

Key takeaways:

Massive revenue growth: An almost fivefold increase in LTM revenue in less than four years underscores the scaling power of Grab's super-app model.

Improved profitability: The subsequent turnaround in free cash flow signals that investments in mobility, delivery, and fintech are now translating into sustainable cash generation.

Maturity phase reached: Exceeding the break-even point in operating cash flow indicates that Grab is moving from pure growth mode to a more balanced mix of expansion and profitability.

Overall, the chart confirms that Grab has not only massively expanded its market presence, but is now also translating this success into solid cash flows, a crucial step toward long-term profitability.

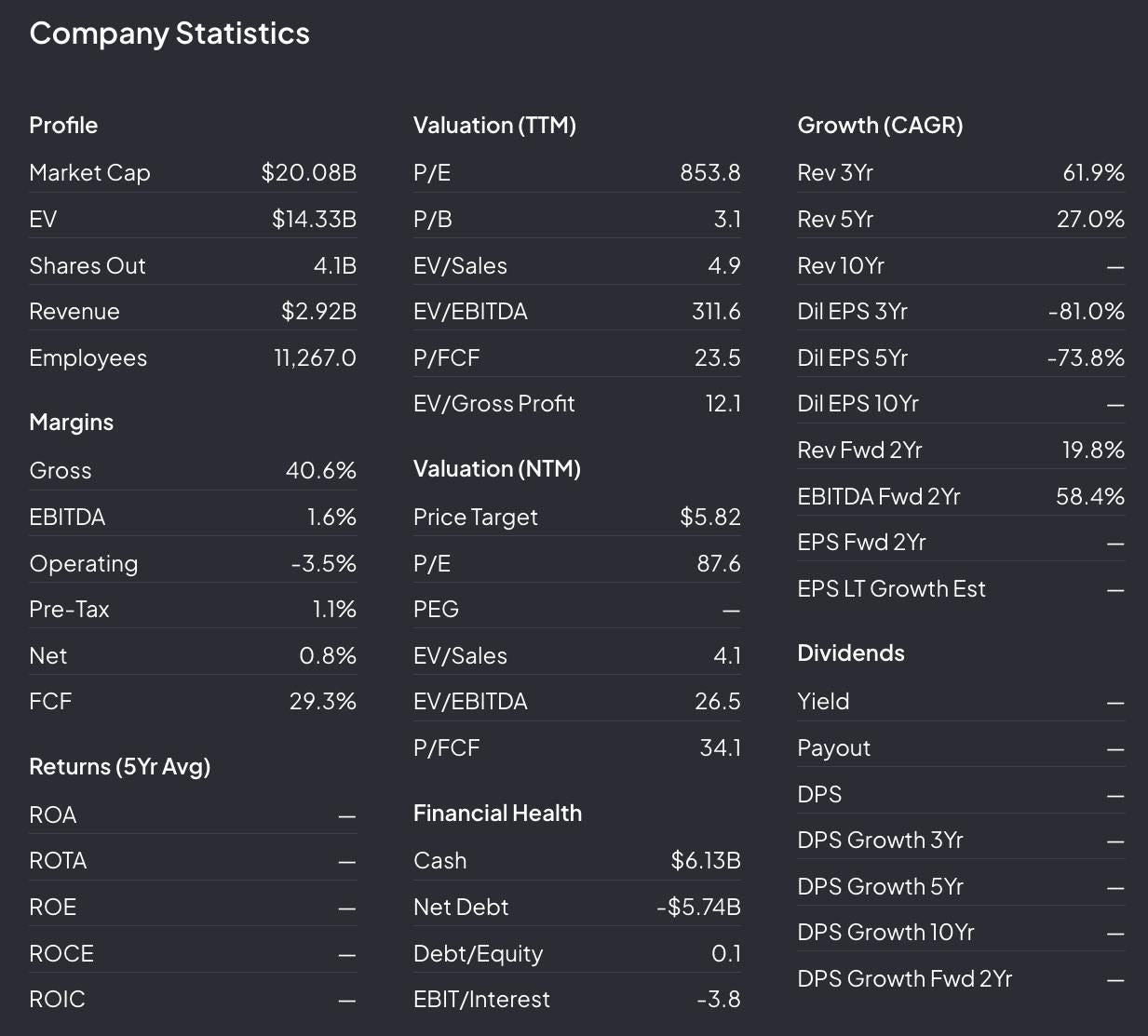

Valuation

Grab is currently valued at a market capitalization of approximately $20 billion. Cash on hand of approximately $6.1 billion and manageable debt result in a net cash position of just under $5.7 billion. On this basis, the enterprise value (EV) is approximately $14.3 billion. In the trailing twelve-month period (TTM), Grab generated revenue of $2.92 billion and posted a respectable gross margin of around 41%. The EBITDA margin is still low at 1.6%, while the operating result, at -3.5%, and the net result, at 0.8%, are only just beginning to develop in the profit zone. What is strikingly positive, however, is the free cash flow ratio of almost 30%, which underlines the high efficiency of the business model.

A closer look at the valuation metrics reveals the very high TTM multiples: The price-earnings ratio is 853x, and the EV/EBITDA multiple is as high as 312x. These values reflect the company's status as a high-growth, but still relatively unprofitable platform. However, looking at the expected key figures for the next twelve months (NTM), the P/E multiple drops to 87x and the EV/EBITDA to 27x, a significant decline that anticipates the potential for sustained earnings growth. With an EV/Sales of 4.9x (TTM) and 4.1x (NTM), as well as a P/FCF of 23.5x (TTM) and 34.1x (NTM), respectively, Grab remains at a challenging but not unusual valuation compared to global tech stocks.

The overall growth profile is impressive: Revenues have increased by an average of 61.9% per annum over the past three years and by 27% over five years. Analyst estimates forecast further revenue growth of almost 20% over the next two years and EBITDA growth of almost 60%. This momentum, coupled with solid cash generation, provides a strong foundation for the targeted profitability.

Investors today generally pay a premium for the expected break-even point and expansion in the FinTech business. The currently low operating margin and high multiples carry risk, but are offset by the company's strong net cash position, impressive revenue and free cash flow growth, and the prospect of sustainable margin expansion.

An acquisition of GoTo could unlock additional leverage in this regard to further improve Grab's margins. A strategic acquisition of GoTo would give Grab access to a vast consumer and merchant network, thus boosting cross-selling in the high-margin advertising and financial segment. GoTo combines e-commerce (Tokopedia) and mobility/delivery services (Gojek) under one roof. The integration would expand advertising and financial services to an even broader user base. In particular, the financial division (payments, lending, digital banking) benefits from more transactions and higher loan volumes, which leads to better monetization in the medium term and increases the EBITDA margin.

Conclusion

In conclusion, Grab has an impressive success story with its super-app approach: The consistent expansion of mobility, delivery, advertising, and financial services is not only driving growth, but is also ensuring an ever-deeper integration into the everyday lives of millions of people in Southeast Asia. In particular, strong cash generation and rapid FinTech growth support the prospect of sustainable profitability and justify the currently high valuation expectations.

For long-term investors, Grab nevertheless offers a unique combination of scaling potential and cash flow strength in one of the world's most dynamic markets. Those willing to accept the uncertainties associated with ambitious growth will find an investment story in which the super-app not only simplifies everyday life but also offers return opportunities, provided management stays on track with innovation, efficiency, and regulatory compliance.

Have you heard of Grab before? What's your opinion of the company?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.