High-tech from the depths: Kraken Robotics

Kraken develops and sells sonar devices, underwater robots and special batteries for maritime applications and has already acquired well-known customers.

Dear growth investors,

The oceans, which represent our largest and least explored ecosystem at 71% of the Earth's surface, offers enormous growth potential from an economic perspective. This is where Kraken Robotics (Ticker: KRKNF) comes in. The company develops and sells sonar devices, underwater robots, and specialized batteries for maritime applications and has already won over well-known customers such as the US Department of Defense and Anduril.

Table of Contents

Overview

Business areas

Management

TAM

Sales distribution and current financial report

Customers

Outlook

Opportunities and risks

Valuation

Conclusion

Overview

Before I begin my company presentation, I would first like to explain three terms that are important for the analysis:

AUVs (Autonomous Underwater Vehicles) are autonomous underwater vehicles that operate without direct control from a ship or land. They are pre-programmed and can independently cover large areas and collect data, for example, for seabed mapping, mine hunting, or scientific research missions. Thanks to sensors and sophisticated navigation systems (often without GPS), they are particularly suitable for deep or hard-to-reach areas.

ROVs (Remotely Operated Vehicles) are remotely operated underwater vehicles. They are connected to the "mother ship" via a cable and controlled in real time by a crew on board. ROVs are often used for inspections, repairs, or salvage work, for example, on oil and gas platforms or underwater cables.

UUVs (Unmanned Underwater Vehicles) is a broader term that encompasses both AUVs and ROVs. It basically refers to all unmanned and underwater vehicles.

In summary: AUV = autonomous, ROV = remotely operated, UUV = umbrella term for both. I hope this brief introduction has been helpful in understanding the technology. Now let's move on to Kraken Robotics.

Kraken is a Canadian company specializing in marine technologies. It develops advanced imaging sensors, sonar equipment, specialized subsea batteries for maritime applications, and unmanned underwater drones (UUVs) for both military and commercial use.

Kraken also offers Robotics-as-a-Service (RaaS) and conducts seafloor and subsurface surveys for customers. These services were expanded through the acquisition of 3D at Depth (a specialist in underwater LiDAR).

The company was founded in 2012 and initially offered a low-cost, high-resolution sensor for seafloor mapping (Synthetic Aperture Sonar, SAS). Later, products such as the underwater vehicle KATFISH, autonomous launch and recovery systems, and pressure-resistant deep-sea batteries (SeaPower) were added.

Kraken is headquartered in Canada and operates offices in the USA, UK, Germany, Denmark, and Brazil. Kraken supports the defense industry, offshore energy projects, and underwater scientific research worldwide.

Business areas

Kraken's business model is divided into two areas: PRODUCTS and SERVICES.

Kraken offers its customers a comprehensive service portfolio in the PRODUCTS area, based on state-of-the-art underwater technology. With Synthetic Aperture Sonar (SAS), Kraken enables simultaneous high-resolution imaging and precise mapping, providing detailed insights into the seafloor. The KATFISH system operates at speeds of up to 10 knots, efficiently covering large areas. In addition, Kraken offers the highest energy density on the market with its SeaPower underwater batteries, supporting longer and more powerful underwater operations.

In the SERVICES division, Kraken offers various specialized services for the underwater industry. These include LiDAR solutions that enable highly precise measurements with millimeter accuracy, thus facilitating informed decisions regarding underwater facilities and infrastructure. With the Sub-Bottom Imager, Kraken creates 3D data that provides a clear image of the seafloor. The Acoustic Corer creates a 3D acoustic "core" up to 14 meters in diameter and more than 50 meters deep to precisely analyze bottom structure. In addition, the KATFISH systems perform high-resolution sonar surveys that are faster and more detailed than conventional sonar systems. This helps Kraken help its customers accurately capture, analyze, and monitor underwater environments.

Let's take a closer look at the product and service portfolio.

Product Portfolio

Synthetic Aperture Sonar

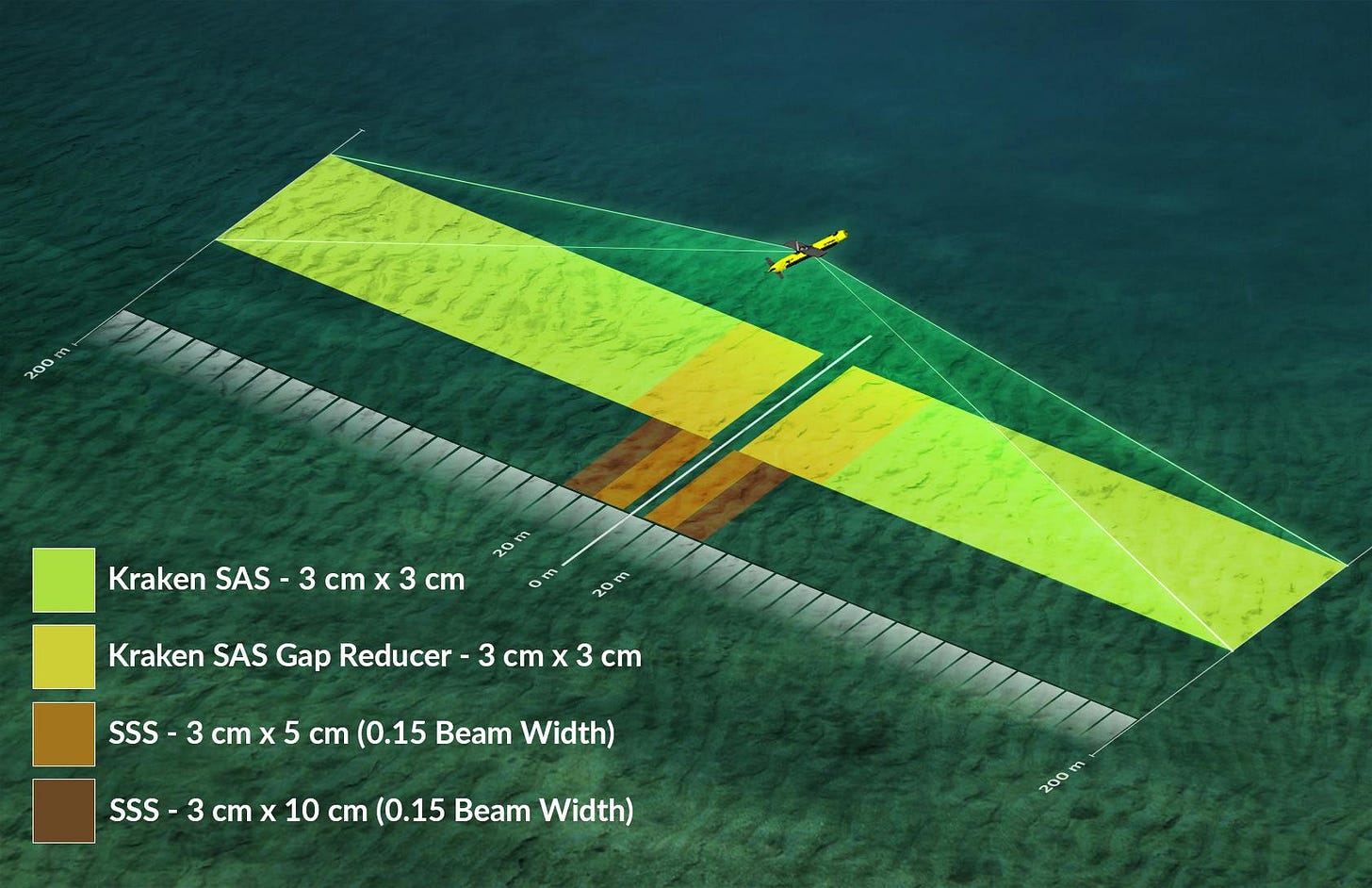

With its Synthetic Aperture Sonar (SAS), Kraken offers state-of-the-art sonar technology designed for ultra-high-resolution images and precise mapping. The Kraken SAS combines the advantages of a synthetic aperture method with the ability to cover large areas of the seafloor quickly and efficiently. The system delivers a resolution of up to 1 x 1 cm at a range of 600 meters on each side, enabling significantly greater detail than conventional side-scan sonars.

The technology is ideal for a wide range of applications, including munitions and mine detection, underwater infrastructure inspection, scientific mapping projects, and defense and security applications. The Kraken SAS can be deployed on various platforms, such as autonomous or remotely operated underwater vehicles (AUVs/ROVs).

Overall, the system offers a powerful combination of image resolution and range that redefines the standard in underwater imaging.

Towed Synthetic Aperture Sonar

KATFISH is a state-of-the-art sonar system from Kraken, specifically designed for high-resolution seafloor mapping. The system utilizes Synthetic Aperture Sonar (SAS) technology to deliver exceptionally high image quality with large area coverage. KATFISH can operate at speeds of up to 10 knots, enabling significantly faster data acquisition compared to traditional systems.

KATFISH produces crisp, detailed images with a resolution of up to 3 cm across its entire coverage. This makes it ideal for applications such as mine countermeasures, search and rescue, underwater infrastructure inspection, scientific mapping, and offshore applications.

With KATFISH, customers receive a reliable solution for fast, large-scale, and high-quality underwater surveys.

Battery Systems

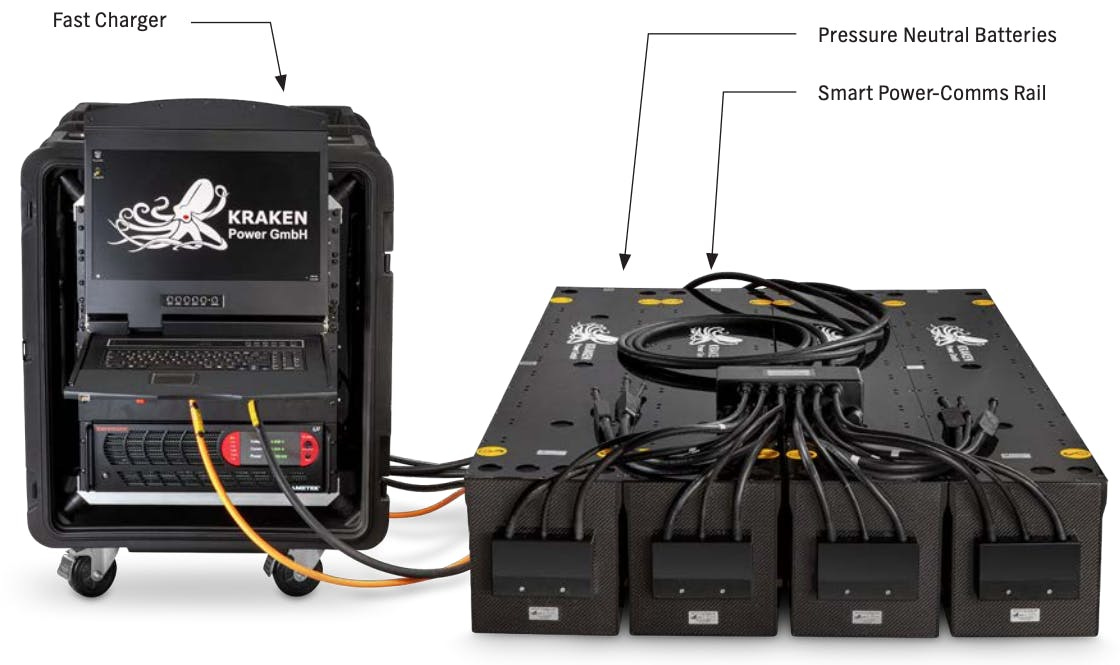

With SeaPower, Kraken has developed an innovative underwater battery solution that revolutionizes the operation of autonomous and unmanned underwater vehicles (AUVs, UUVs). These battery modules feature exceptionally high energy densities, currently among the highest on the market. This enables longer operating times and significantly extends the range of autonomous and remotely operated underwater vehicles (AUVs and ROVs).

SeaPower batteries are pressure-tolerant and designed to operate reliably even at great depths. Their robust design and advanced safety architecture ensure high operational reliability even under extreme conditions.

They consist of lithium-ion pouch cells embedded in a silicone polymer and operate reliably at depths of up to 6,000 meters. This design enables an impressive energy density of up to 260 Wh per liter and 145 Wh per kilogram, while simultaneously weighing 46% less per kWh in water compared to conventional systems.

The SeaPower modules are available in various sizes and voltages and can be flexibly adapted to any mission, with capacities of up to 23 kWh per module and voltages between 45 V and 355 V. Furthermore, multiple modules can be connected in series or parallel to create large energy banks of up to 1 MWh. Each module is equipped with an integrated battery management system (BMS) that monitors, balances, protects, and controls the charging and discharging processes.

To extend operational life and reduce charging time, Kraken also offers a specially designed 15 kW fast charger that can charge up to nine batteries simultaneously. A 23 kWh battery can be fully charged in just four hours. The chargers feature an intuitive user interface as well as data logging and visualization functions to make the charging process safe and efficient.

SeaPower batteries are manufactured to the highest quality standards, including ISO 9001-certified processes and rigorous pressure tests up to over 600 bar. They also meet UN 38.3 standards for safe transport by air, sea, and land.

Service Portfolio

LiDAR Solutions - “3D at Depth”

On April 1, 2025, 3D at Depth was acquired by Kraken. 3D at Depth specializes in high-precision, laser-based underwater surveying technologies. The company develops and operates LiDAR (Light Detection and Ranging) systems capable of capturing detailed 3D data of underwater environments. This technology enables the creation of high-resolution, three-dimensional models of underwater structures, buildings, and geological formations, which plays a critical role in inspections, construction projects, scientific studies, and offshore asset monitoring. 3D at Depth's patented LiDAR technology delivers measurements with millimeter accuracy, allowing for a complete digital mapping of underwater infrastructure without the need for direct divers. The collected data improves project planning and execution and reduces costs by allowing more precise preparation for maintenance and inspection work.

In addition to hardware solutions, the company also offers comprehensive services, from data acquisition and processing to the creation of detailed 3D visualizations and digital twins. These digital twins help operators continuously monitor the condition of their assets and make informed decisions.

Sub-Bottom Imaging

With its sub-bottom imaging, Kraken offers an innovative service that enables the creation of precise 3D images of the structures beneath the seabed. This technology goes beyond conventional seismic methods, providing not just two-dimensional profiles but complete three-dimensional images. This enables operators to identify the subsurface's layered structure in detail and precisely locate objects such as pipeline routes, buried cables, geological formations, or potential hazards. Customers also benefit from faster data acquisition and more efficient analysis, reducing overall costs and deployment time.

Acoustic Coring

With Acoustic Coring, Kraken offers an innovative method for detailed seafloor investigation. This technology creates a so-called "acoustic core," a three-dimensional representation of the sedimentary structure and subsurface structures, without the need for physical drilling or sampling. The Acoustic Corer delivers high-resolution data with a diameter of up to 14 meters and a penetration depth of more than 50 meters. These 3D models provide precise information about geological layers, embedded objects, or potential obstructions. This makes the technology ideal for offshore construction projects, pipeline and cable laying, site investigations for renewable energy, as well as geotechnical and archaeological studies. Compared to traditional core sampling, this method offers significant advantages: it is faster, more cost-effective, and does not cause direct disturbance to the seabed, thus reducing environmental impact.

Towed SAS Survey

As previously mentioned, Kraken's SAS Survey (Synthetic Aperture Sonar) services provide a state-of-the-art solution for precise and efficient seafloor surveying. The use of Synthetic Aperture Sonar (SAS) produces high-resolution images that simultaneously provide wide area coverage and the finest details. Compared to conventional sonars, SAS delivers significantly higher image quality and enables the identification of small objects and fine structures. These services are ideal for applications such as mine clearance, asset identification, cable and pipeline inspections, environmental studies, and geological and archaeological investigations. Kraken uses the aforementioned KATFISH system for these operations.

Management

Greg Reid has been Kraken's new Chief Financial Officer (CFO) since June 1, 2015. Greg has more than 25 years of experience in finance and business development, particularly in the technology and cleantech sectors. Prior to his current position, he served as CFO and COO at Kraken, where he spent nine years with the company.

After watching some of Greg's lectures and interviews, I'm impressed by his personality. Reid was a co-founder and partner at Wellington West Capital Markets, where he led technology and cleantech research and investment banking. He used this foundation at Kraken as CFO and now as CEO. With his expertise, he has transformed Kraken into a leading marine technology company. Under his leadership, Kraken has made significant acquisitions, including the company 3D at Depth (underwater LiDAR), as well as expanded into the US and strengthened its product range. In 2025, he increased annual revenue to around USD 45 million through SeaPower battery orders alone, a clear success in business development.

TAM

Kraken serves a $5 billion maritime robotics market by supplying underwater sensors, batteries, and robots to military and commercial customers.

At first glance, the $5 billion market opportunity seems rather small, especially compared to other high-tech or defense markets. However, Kraken serves a specialized niche market with high barriers to entry, which it has successfully overcome. Although the market is small, it is highly technology-driven, with high margins and few providers worldwide. Growth potential exists through the development of new offshore wind farms, renewable energies, and critical infrastructure (e.g., pipelines and cables). Worldwide, there are over 7,000 offshore oil and gas platforms, more than 200,000 kilometers of underwater pipelines, over 4,000 offshore wind turbines, and around 1.2 million kilometers of fiber optic cables on the seabed. Offshore wind power is a central component of the energy transition: from 35 GW of installed capacity in 2020, it is expected to grow to 250 GW by 2030, and in the USA from 0 to 30 GW. The best sites for offshore wind farms in shallow, near-shore waters are becoming increasingly scarce, necessitating expansion in deeper waters with more challenging bottom conditions. This creates strong demand for new technologies and tools, which Kraken offers with its solutions.

Geopolitical developments and the defense sector are also significantly increasing demand. The overall market for maritime security and defense technology is much larger (tens of billions) than Kraken's original market, and Kranken is making strong inroads into this. Geopolitical tensions, such as those between Russia and Ukraine or in the South China Sea, are driving up global naval defense spending. Underwater mines are an increasingly significant threat. Many navies are therefore modernizing and increasingly relying on unmanned and autonomous systems instead of manned minehunters. Over 300 mine countermeasures are in operation in Europe, the Asia-Pacific, the Middle East, and North Africa, more than 70% of which are over 20 years old. Autonomous systems can detect and neutralize mines from great distances, greatly increasing the safety of ships and crews. Therefore, underwater drones will play a central role in underwater warfare in the future, particularly in mine clearance, reconnaissance, anti-submarine warfare, perimeter reconnaissance, and route surveying. Against this backdrop, Kraken and its technology offer enormous growth prospects.

Sales distribution and current financial report

Kraken's revenue is primarily generated from 80% defense and 20% commercial applications. In the commercial segment, services are offered in contract sizes ranging from $1 million to $5 million. In the defense segment, revenue comes from single sales to multi-year contracts valued at up to $50 million. Typically, over 75% of revenue is realized in the first two years, with the remainder distributed across multi-year support and maintenance agreements.

One example of the products is the KATFISH system, which costs between $4 million and $8 million per unmanned underwater vehicle (UUV) and can also be offered as a service. Sonar systems range from $300,000 to $700,000 per UUV, while batteries can cost between $1 million and $10 million per UUV.

Looking at Kraken's company growth, it can be seen that Kraken has continuously expanded its business areas since 2012, from sensors and components to platforms and "Robotics as a Service" (RaaS). In terms of revenue, the company has grown from $4 million in 2018 to $12 million in 2020, $41 million in 2022, and $70 million in 2023.

Financial Key Figures for the First Quarter of 2025

Revenue

In the first quarter of 2025, Kraken generated revenue of CAD 16.1 million, down from CAD 20.9 million in the prior-year quarter. Services revenue increased by 38% to CAD 7.0 million, while product revenue decreased by 42% to CAD 9.2 million. The decrease in product revenue was primarily due to lower sales of the RMDS program and the KATFISH system, while the battery business continued to perform robustly.

Gross Profit

The company generated gross profit of CAD 10.1 million in Q1 2025, with a significantly improved gross margin of 63% (Q1 2024: 45%). This improvement was driven by higher-margin projects, although a CAD 1.5 million write-off of a receivable following a customer insolvency impacted earnings.

Adjusted EBITDA

Adjusted EBITDA decreased by 32% to CAD 2.8 million (Q1 2024: CAD 4.1 million), with an EBITDA margin of 17% (Q1 2024: 20%). Net income decreased significantly to CAD 215,000 (Q1 2024: CAD 2.2 million), corresponding to earnings per share of CAD 0.00.

Expenses and Expenses

Administrative expenses increased to CAD 6.4 million (Q1 2024: CAD 4.5 million), due in part to higher personnel costs due to the increased headcount (297 employees compared to 250 in the previous year) and increased software spending. Research and development amounted to CAD 1.5 million, an increase of 62% over the previous year.

Liquidity Position

At the end of the quarter, Kraken had a solid liquidity position with CAD 59.3 million in cash and cash equivalents and working capital of CAD 94.6 million. This strong financial position is partly the result of two equity financings in 2024 with total gross proceeds of CAD 71.9 million.

My assessment of Kraken's Q1 2025 figures:

The figures for the first quarter of 2025 paint a mixed picture for Kraken. While total revenue declined from CAD 20.9 million to CAD 16.1 million compared to the same quarter last year, the company still achieved an exceptionally high gross margin of 63%, driven by higher-margin projects and a growing service business. The performance of the service business, which increased by 38% to CAD 7 million, is particularly positive. This confirms Kraken's strategy of increasing its focus on recurring revenue and "Robotics as a Service".

In contrast, the product business saw a significant decline of 42%, primarily due to lower sales of the RMDS program and the KATFISH system. This weakness in the core product area is a warning sign and must be closely monitored in the coming quarters, even though the battery business continues to experience solid growth.

Adjusted EBITDA declined by 32% to CAD 2.8 million, with the EBITDA margin at 17% (previous year: 20%). Net income also fell significantly to CAD 215,000, reflecting the impact of lower product sales and rising administrative expenses. These higher costs resulted, among other things, from the increase in personnel, and research and development expenses also rose significantly, which should strengthen innovation in the long term.

Financially, Kraken remains very solid: At the end of the quarter, the company had strong liquidity of CAD 59 million and working capital of approximately CAD 95 million. These funds provide Kraken with the necessary flexibility to continue investing in growth and new technologies, even in the face of fluctuating product demand.

Overall, Kraken is in a phase of transformation. The company is working to become less dependent on the cyclical product business and to focus more on recurring service revenue. In the long term, this strategy can improve stability and profitability, but in the short term, the development of the product segment is an important risk factor that must be kept in mind.

Customers

Kraken works with more than 50 customers worldwide in over 30 countries, providing a broad presence in both the defense and commercial sectors. In the defense and government segment, customers include renowned partners such as Lockheed Martin, Boeing, Northrop Grumman, Saab, the Royal Navy, and various NATO organizations. On the commercial side, which primarily focuses on offshore wind and oil and gas projects, Kraken works with Shell, Equinor, Ørsted, EDF, Fugro, and ConocoPhillips, among others.

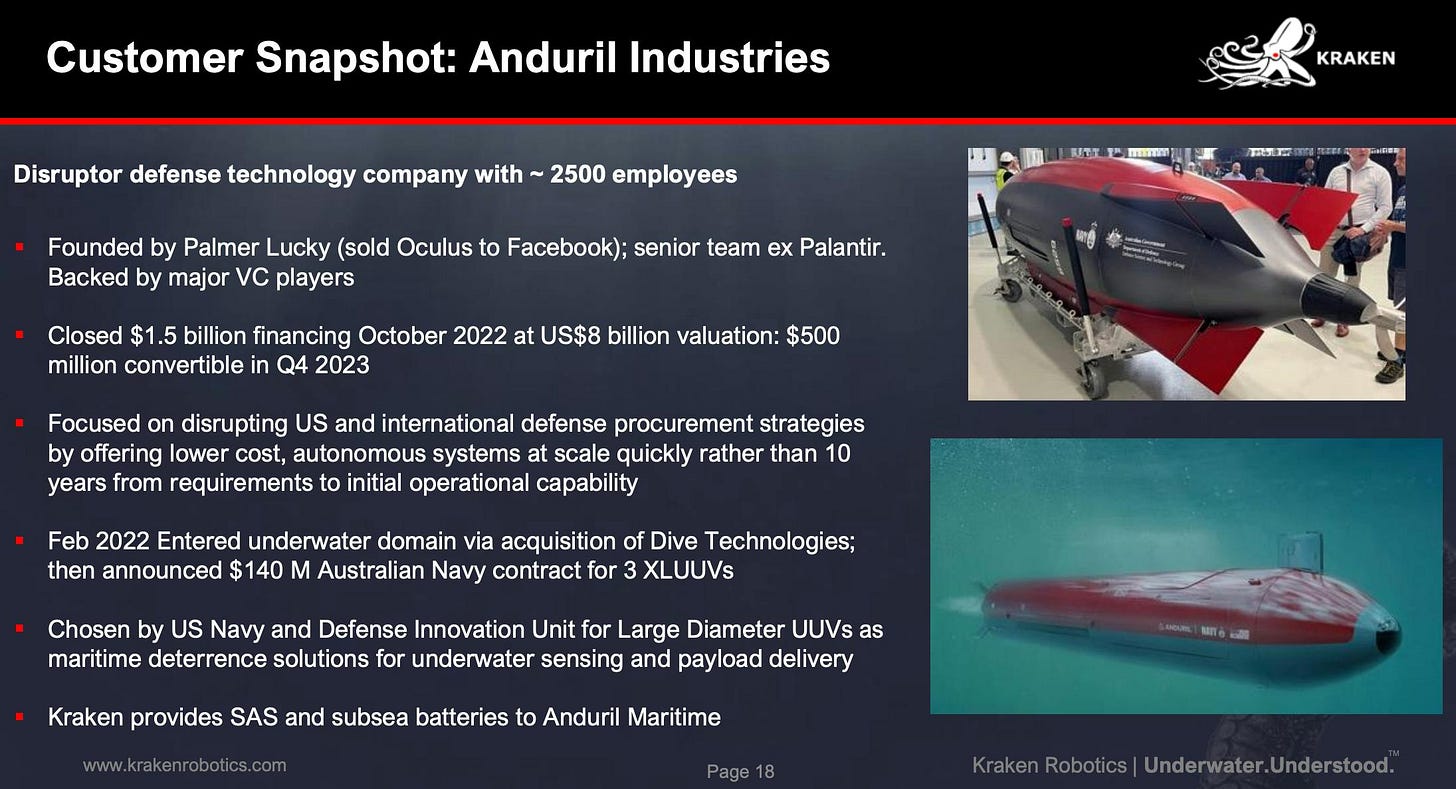

For example, Anduril is a key Kraken customer, particularly for autonomous underwater vehicles (AUVs). Anduril uses Kraken products such as batteries, sensors, and software in its AUVs.

Over the past eight quarters, Kraken has won contracts totaling over $150 million. This includes a significant $50 million contract from the Canadian Navy for the SAS/UUV program. Additionally, there were several contracts for the KATFISH systems, including a $9 million follow-on contract and another $4 million contract from NATO, a $10 million contract from a navy in the Asia-Pacific region, and another $3 million follow-on contract.

Kraken also enjoyed success in the underwater battery sector, receiving orders for $5 million, $14 million, $3 million, $16 million, and $6 million.

In the service area, the company secured several larger projects: two contracts for the Acoustic Corer, each worth $5 million, another Acoustic Corer contract worth $7 million, and several smaller contracts for the Sub-Bottom Imager (SBI), each worth millions of dollars.

Outlook

Kraken has ambitious long-term financial targets, supported by strong demand. It plans to achieve annual revenue growth (CAGR) of 40% and EBITDA margins of 20% to 25%.

Kraken has a very strong sales pipeline with a total volume of over $900 million. The largest share of this is attributable to naval sonar programs, driven by geopolitical tensions and a global modernization cycle. This segment has an estimated potential of over $600 million.

In the "Sonar on AUVs" segment, Kraken has already sold more than 55 SAS systems, over half of them in the last two years. The company maintains close partnerships with leading manufacturers of autonomous underwater vehicles such as HII, Teledyne, and Anduril. The "Subsea Power" segment encompasses energy supply. Over ten new platforms are expected to come to market in the next few years, with an average battery volume per platform of $5 million to $10 million. The pipeline potential here exceeds $250 million. Kraken also has a strong presence in the seabed and subsurface surveying sector. This business area currently generates approximately $15 million per year with the existing fleet. KATFISH-based surveys, in particular, have average contract sizes of over $3 million. The total pipeline potential in this segment exceeds $80 million.

Overall, Kraken offers strong and broadly diversified growth potential across all core areas: defense, subsea energy, and offshore infrastructure inspection. This pipeline reflects both its technological strength and the growing market demand for highly specialized subsea solutions.

Opportunities and risks

Kraken operates in a dynamic yet challenging market environment with significant opportunities, but also significant risks. Key opportunities include the growing global demand for maritime defense solutions. Due to increasing geopolitical tensions, for example in Eastern Europe or the South China Sea, many states are investing heavily in modernizing their naval fleets, particularly in mine-hunting and surveillance technologies. Kraken excels here with its state-of-the-art sonar and autonomous underwater vehicle systems. At the same time, the demand for critical underwater infrastructure such as offshore wind farms and submarine cables is growing rapidly, further fueled by the global trend toward energy transition. These facilities require regular inspection and monitoring, for which Kraken offers high-resolution imaging solutions and robotics.

Another key potential lies in the trend toward automation and the growing market for unmanned underwater vehicles and service-based business models ("Robotics as a Service"). This development enables Kraken to generate increasing recurring revenue and become less dependent on individual contracts. In addition, the company has a strong technological base with unique solutions, such as synthetic aperture sonar and subsea batteries, which provide competitive advantages and enable high margins.

Nevertheless, Kraken is also exposed to significant risks. A large portion of its revenue depends on defense contracts, which are highly politically influenced. Reductions or delays in such contracts can have an immediate impact on revenue and liquidity. The offshore sector also has a certain dependence on global investment cycles and energy prices, making the business volatile.

Furthermore, Kraken must consistently invest heavily in research and development to remain technologically competitive. Failure to keep pace with the industry's rapid innovation dynamics could result in a loss of market share. Furthermore, the production of underwater technology is capital-intensive and requires reliable supply chains. Shortages or price surges for components could lead to delays and pressure on margins. Finally, geopolitical developments and exchange rate fluctuations pose additional uncertainties, as Kraken operates globally and relies on international customers and suppliers.

In summary, Kraken offers enormous growth potential in a highly specialized market, but at the same time is highly dependent on stable order intake, political support, and technological innovation. In the long term, the strategic expansion of services and the focus on autonomous systems could help reduce dependence on individual projects and increase revenue stability.

After intensively examining direct competitors in the sonar and underwater robotics sector, the following companies caught my attention:

Teledyne Technologies

Teledyne is one of the largest players in the field of maritime sensors and underwater vehicles (AUVs, ROVs). The company is particularly strong in sonar and camera systems as well as autonomous platforms (e.g., Teledyne Gavia).

Kongsberg Maritime

Kongsberg offers a broad portfolio of maritime technology, including AUVs, ROVs, surveillance systems, and advanced sonar technology. The Norwegian company has a strong presence among defense and offshore customers.

SAAB (Seaeye)

SAAB Seaeye is a leader in remotely operated underwater vehicles (ROVs) and also offers sonar systems and military applications. It is a strong competitor, especially in Europe and among defense customers.

L3Harris Technologies

L3Harris (with OceanServer) offers autonomous underwater vehicles, sensor systems, and solutions for military mine clearance. It is a relevant competitor, especially in the US market, and, of course, an industry heavyweight.

Valuation

Kraken is currently valued at a market capitalization of approximately CAD 768 million and an enterprise value (EV) of approximately CAD 739 million. This corresponds to a trailing-twelve-month (TTM) EV/Sales multiple of 8.5x and an EV/EBITDA multiple of 41.1x, which would be very high for traditional industrial or engineering companies. However, specialized technology or defense companies with strong growth often operate in similar valuation regions, as investors price in future potential.

The margins show a solid profile: a gross margin of 52.5%, an EBITDA margin of 20.7%, and an operating margin of 14.1%. This underscores Kraken's strong position in the high-tech segment in which it operates. However, free cash flow is currently still negative at -13.4%, due to high investments and start-up costs.

The growth metrics are impressive: The average revenue growth (CAGR) for the last three years was 46.5%, and over five years it was 33.8%. Expected growth for the next two years is over 35%. EBITDA is also expected to increase by around 41.5% per year over the next two years, supporting the growth story.

Valuation-wise, Kraken has a P/E ratio of 38.1x (TTM), which seems high but is not unusual for growth stocks in this niche. The P/E ratio for the next twelve months (NTM) remains similarly high at 38.4x, indicating that the market has already priced in further strong growth.

Financially, Kraken is in a solid position: The company has CAD 59 million in cash, no net debt, and a conservative debt/equity ratio of 0.3. The interest rate on debt is well hedged (EBIT/interest 4.4x), underscoring its financial flexibility.

The return on capital employed (ROIC) and ROCE (ROCE) metrics are 5.5% and 5.4%, respectively, which are acceptable for a young growth company, but should improve over the long term to justify sustainably higher valuations.

In summary, Kraken is not a value play, but rather a classic growth story. The current valuation reflects the company's technological potential, strong pipeline, and attractive margins. Investors today are paying a high price for future revenue and margin growth, which is typical for companies operating in a niche market with high barriers to entry. The high multiple is therefore not "cheap," but understandable in relation to the growth.

Conclusion

Kraken is a highly specialized provider of maritime robotics, sensors, and subsea batteries operating in a dynamic growth market. The company benefits from several strong trends: the growing importance of maritime defense, the global expansion of offshore wind power, and the increasing demand for autonomous underwater technology. Kraken boasts unique technological selling points, particularly in synthetic aperture sonar (SAS) and modular underwater batteries, and achieves high gross margins. These niches offer a technological advantage over the competition. Nevertheless, Kraken must compete with large, financially strong corporations that also have a broad product portfolio, existing customer relationships, and sometimes greater resources.

At the same time, Kraken faces challenges: Its heavy dependence on large defense-related contracts entails political risks. The product business is also susceptible to volatility, as demonstrated by the recent decline in sales. Furthermore, the technological lead requires significant investments in research and development, which can negatively impact profitability in the short term.

However, Kraken's solid balance sheet, high liquidity, and a strong pipeline of over USD 900 million give it the necessary financial and strategic flexibility to manage these risks. Its stock market valuation already reflects its growth potential and requires a certain degree of patience from investors, as much future success is already priced in.

Over the long term, Kraken has the opportunity to establish itself as a leading provider of highly specialized, autonomous underwater solutions and significantly stabilize its business model through recurring service revenues. For investors focused on technology, maritime, and defense, Kraken could therefore be an attractive, but risky, growth story.

How do I proceed?

After a thorough analysis, I consider Kraken to be a highly interesting company with a strong technological focus and excellent growth prospects, especially in the areas of defense, offshore wind power, and subsea infrastructure. I find its clear strategic direction and technological leadership in niche markets such as synthetic aperture sonar and subsea batteries particularly convincing.

A key success factor for me is also the management, especially Greg Reid as CEO. With his experience and clear vision, he has proven his ability to lead and develop Kraken very well. Under his leadership, the pipeline has been massively expanded, important major contracts have been won, and the technological position has been strengthened.

However, the valuation is currently too ambitious for me, as much future growth is already priced in. Therefore, I am putting Kraken on my watchlist for the time being to continue to closely monitor the company and market developments. I am considering a possible entry in the range between EUR 0.80 and EUR 1.00 per share, which would, in my view, represent a more attractive risk-reward ratio.

Have you heard of Kraken before? What's your opinion of the company?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.

Will they manage to grow at 40% each year? Sounds pretty optimistic. A bit expensive to my taste. Anyways, good article, thank you for showing us new companies.