Highway revolution: Kodiak and Aurora ignite the turbo for autonomous trucks!

Who will win the race for next-generation autonomous trucks?

Dear growth investors,

With their vision of driverless freight transport, Kodiak Robotics (Ticker: KDK) and Aurora Innovation (Ticker: AUR) are positioning themselves as pioneers of a multi-billion dollar future market. Who will win the race for the next generation of autonomous trucks?

Table of Contents

Market Overview

Kodiak Robotics (Ticker: KDK)

Aurora Innovation (Ticker: AUR)

Opportunities

Risks

Conclusion

Market Overview

Which players are currently active in the market?

A crucial factor for the scalability of autonomous truck technology is, first and foremost, the collection of test mileage. The Chinese company Inceptio Technology leads the field with an impressive 125 million miles driven. Following significantly behind are the US companies Kodiak with 3.5 million miles, Aurora with 2.2 million miles, and Gatik with 1.52 million miles. Pony.ai, also a Chinese company, is in between with 3.1 million miles.

While autonomous trucks in the US currently still require a safety driver, China already allows more comprehensive testing under real-world conditions. Forecasts suggest that US companies could catch up significantly once driverless testing is approved, likely starting in 2025. Until then, China will remain the leader in collecting real-world driving data.

What are the benefits of autonomous trucks?

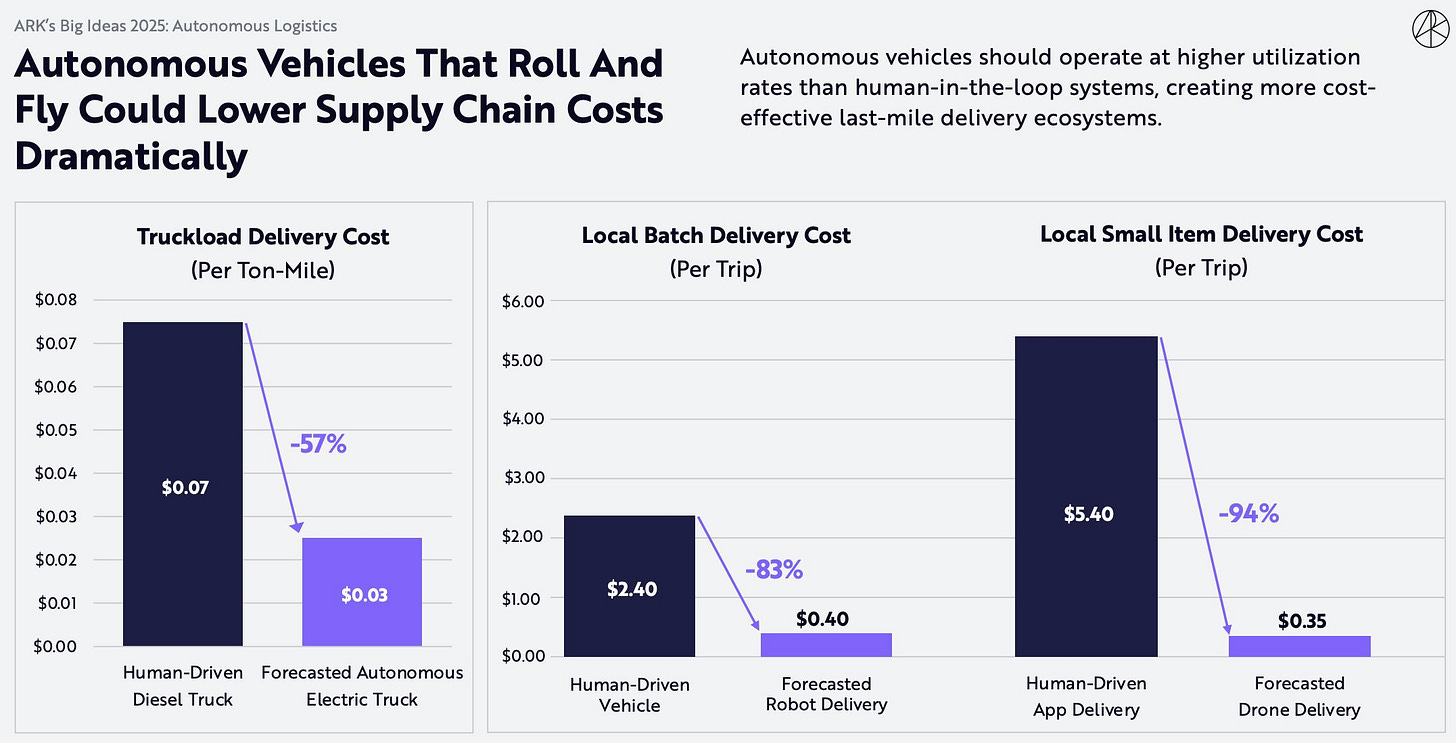

Autonomous vehicles can enable significant cost savings in the supply chain in the future. In truck delivery, a human-driven diesel truck costs an average of $0.07 per ton-mile, while autonomous electric trucks are expected to cost only $0.03, a 57% reduction.

What are the specific long-term revenue opportunities?

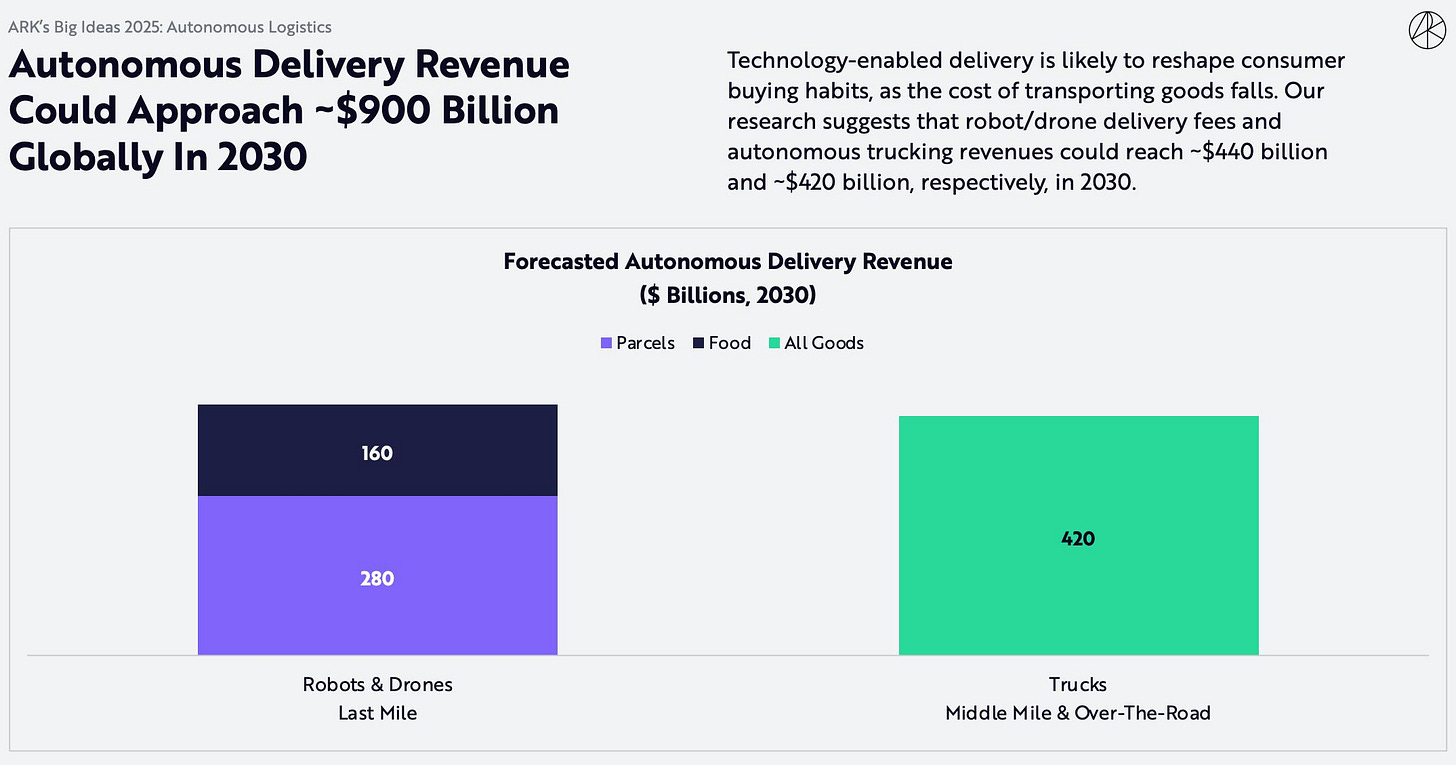

According to forecasts by ARK Invest, global revenue from autonomous delivery services could reach around $900 billion by 2030. This development is being driven by falling transportation costs, which in turn is likely to influence consumer behavior. In the area of so-called "last-mile" delivery, i.e., deliveries directly to end customers, robots and drones could generate total revenue of $440 billion. Of this, $280 billion will be attributable to parcel shipping and $160 billion to food deliveries. At the same time, autonomous medium- and long-distance trucking is expected to generate revenue of approximately $420 billion. Overall, the chart shows that there is significant market potential for autonomous delivery technologies in both local and long-distance transport.

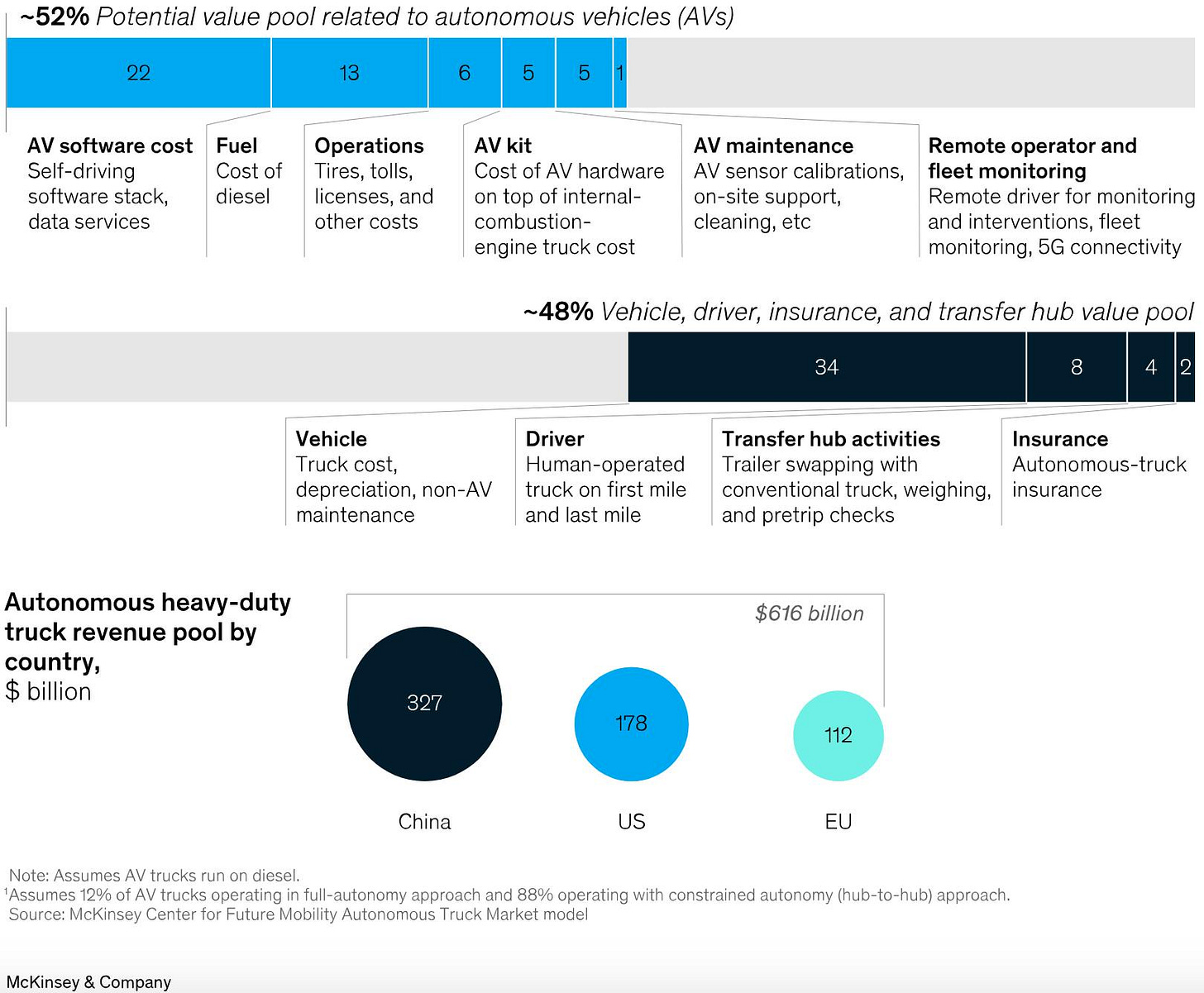

According to McKinsey forecasts, the market for autonomous truck transport could reach a total volume of around 616 billion US dollars in 2035. China would have the largest share with around 327 billion US dollars, followed by the USA with around 178 billion US dollars and Europe with around 112 billion US dollars.

Around 52% of this revenue potential is directly related to autonomous technologies. The largest item is AV software costs such as self-driving software and data services (22%). This is followed by fuel costs (13%), operating costs such as tires and tolls (6%), the AV retrofit kit (5%), maintenance of the AV systems (5%), and remote monitoring and fleet management (1%).

The remaining 48% is attributable to traditional cost areas: vehicle value including depreciation and maintenance (34%), the driver share on handover and delivery routes (8%), transfer hub activities (4%), and insurance costs for autonomous trucks (2%).

This breakdown shows that autonomous technologies will represent not only technological but also economically significant components of the global logistics infrastructure in the future.

Why do we need autonomous trucks?

A 2024 report by McKinsey & Company shows that there is currently a shortage of over 80,000 truck drivers in the US, and this number could double by 2030. The average age of a US trucker is 46. In Europe, the situation is even more critical: around 7% of trucking positions, or over 200,000 jobs, are vacant. By 2028, this number could rise to 745,000. The age distribution is particularly striking: only 5% of truck drivers in Europe are younger than 25, while a third are older than 55. Demographic change is making the use of autonomous trucks increasingly necessary. Autonomous trucking offers a strategic response to this development. It can close the looming supply gaps in freight transport, reduce dependence on hard-to-recruit personnel, and make transport more efficient, especially in an aging society with a shrinking workforce.

How could the development toward autonomous trucking proceed?

The McKinsey graphic shows the expected transition from semi-autonomous to fully autonomous truck transport between 2027 and 2040+. During the limited autonomy phase (2027–2040), driverless operation will only take place on highways between so-called transfer hubs. The first and last sections of the route, e.g., between the distribution center and the hub, will continue to be driven by humans.

From 2040 and beyond, the goal is full autonomy: trucks will then drive completely autonomously from one distribution center (DC) to the next, without intermediate stops or transfers to hubs. This development will mean a gradual reduction in the number of required transfer points, with the goal of completing the entire freight transport process seamlessly and driverlessly.

Kodiak Robotics

Foundation & SPAC IPO

Kodiak is headquartered in Mountain View, California, USA, and was founded in 2018. The company focuses on autonomous long-distance trucking, with plans to expand into the public sector in the long term. To this end, Kodiak is developing autonomous systems specifically designed for highway traffic, a key use case for the logistics and supply chain industry. Furthermore, the company's systems can be used in the defense and heavy industry sectors.

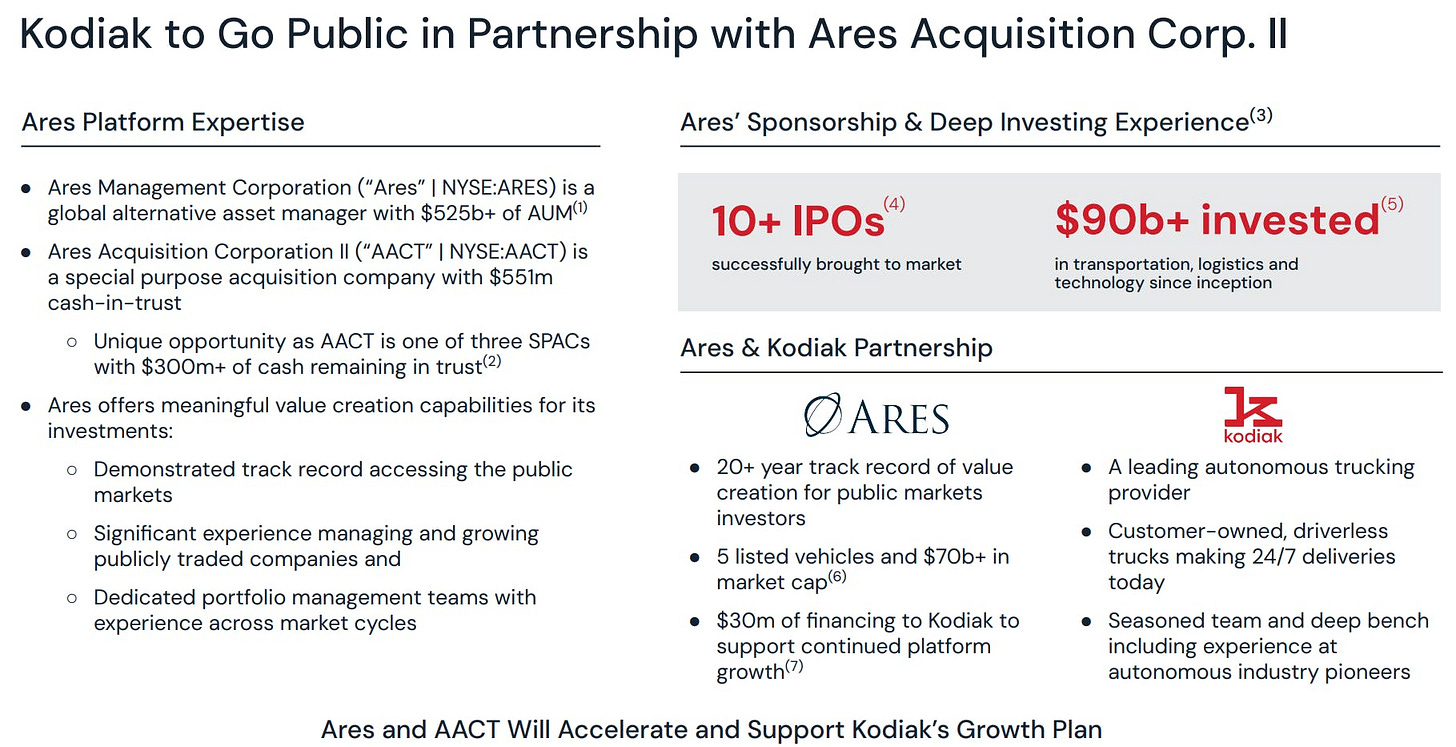

In June 2024, Kodiak announced a planned initial public offering (IPO) through a SPAC merger with Ares Acquisition Corporation II. This transaction is intended to drive growth. The parent company, Ares Management Corporation, is a global asset manager with over $525 billion in assets under management and a proven track record of investing in public markets, particularly in transportation, logistics, and technology. Ares has already facilitated over 10 successful IPOs and invested more than $90 billion in relevant industries.

The partnership between Kodiak and Ares Acquisition Corporation II offers significant potential for value creation. The total addressable market (TAM) for Kodiak's target applications, including commercial freight transportation and public projects, exceeds $4 trillion.

The SPAC IPO is expected in the second half of 2025. Kodiak will then operate under the ticker KDK. Currently, the only SPAC available for acquisition is the AACT-listed company that is taking Kodiak public.

What market environment does Kodiak Robotics see for autonomous trucks?

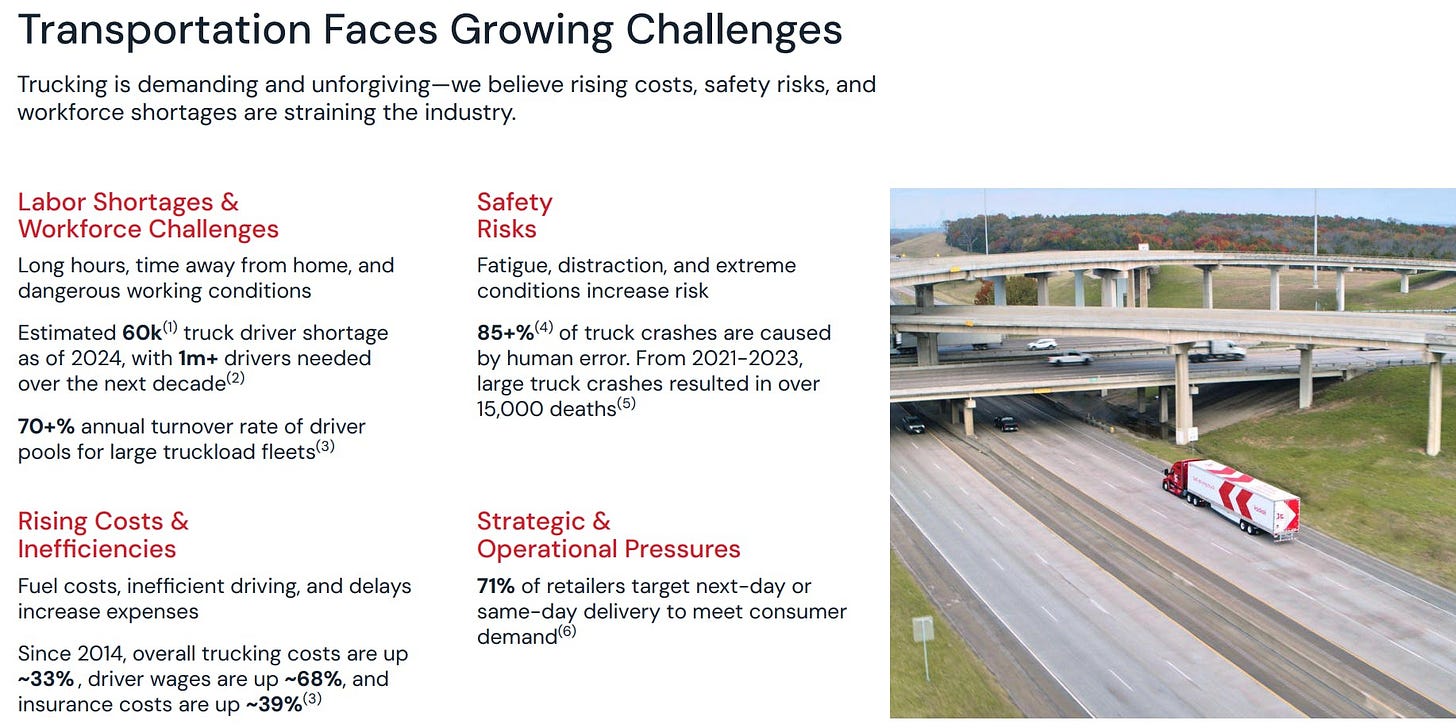

Kodiak claims that the transportation industry is facing growing challenges, including labor shortages, safety risks, rising costs, and increasing delivery pressure. According to the company, the truck driver shortage reached approximately 60,000 by 2024 alone, and over a million additional drivers will be needed by the next decade. At the same time, the annual turnover rate for large fleets exceeds 70%. The safety situation is also critical: Over 85% of all truck accidents are due to human error, resulting in more than 15,000 fatalities between 2021 and 2023. Costs are also continuously rising; since 2014, total freight transport costs have increased by approximately 33%, driver wages by 68%, and insurance costs by 39%. Operational pressures are also mounting: 71% of retailers rely on same-day or next-day deliveries to meet consumer expectations.

Overall, the overview highlights the urgent need for structural and technological solutions in the transportation sector, particularly through automation.

Kodiak estimates the global market for commercial freight transport to be worth over $4 trillion, of which approximately $1 trillion is attributable to the United States alone.

In this vast market, Kodiak offers autonomous solutions for a variety of applications. The company is not only active in traditional commercial long-distance transport, but also aims to make its technology available to the public sector, for example, for military or security-related transport.

The company aims to close the aforementioned gaps and bottlenecks in the industry. With its AI-controlled "Kodiak Driver," Kodiak demonstrates that autonomous truck technology is already being successfully deployed. Kodiak's business model is already generating revenue through driverless trucks, which operate in the Permian Basin, among other areas, in partnership with Atlas Energy Solutions. Deliveries are made on four active freight routes with leading carriers and transportation service providers.

Kodiak demonstrates its leadership in autonomous trucking with clearly measurable success in practice:

Over 7,000 deliveries have already been completed autonomously.

The autonomous system has traveled more than 2.6 million miles.

The route network currently covered comprises approximately 20,000 miles.

In addition, 750+ hours of fully driverless deployments have been completed under real-world, paid conditions.

These figures underscore Kodiak's market-ready technology and its active role in transforming freight transport through autonomous trucks.

Technology

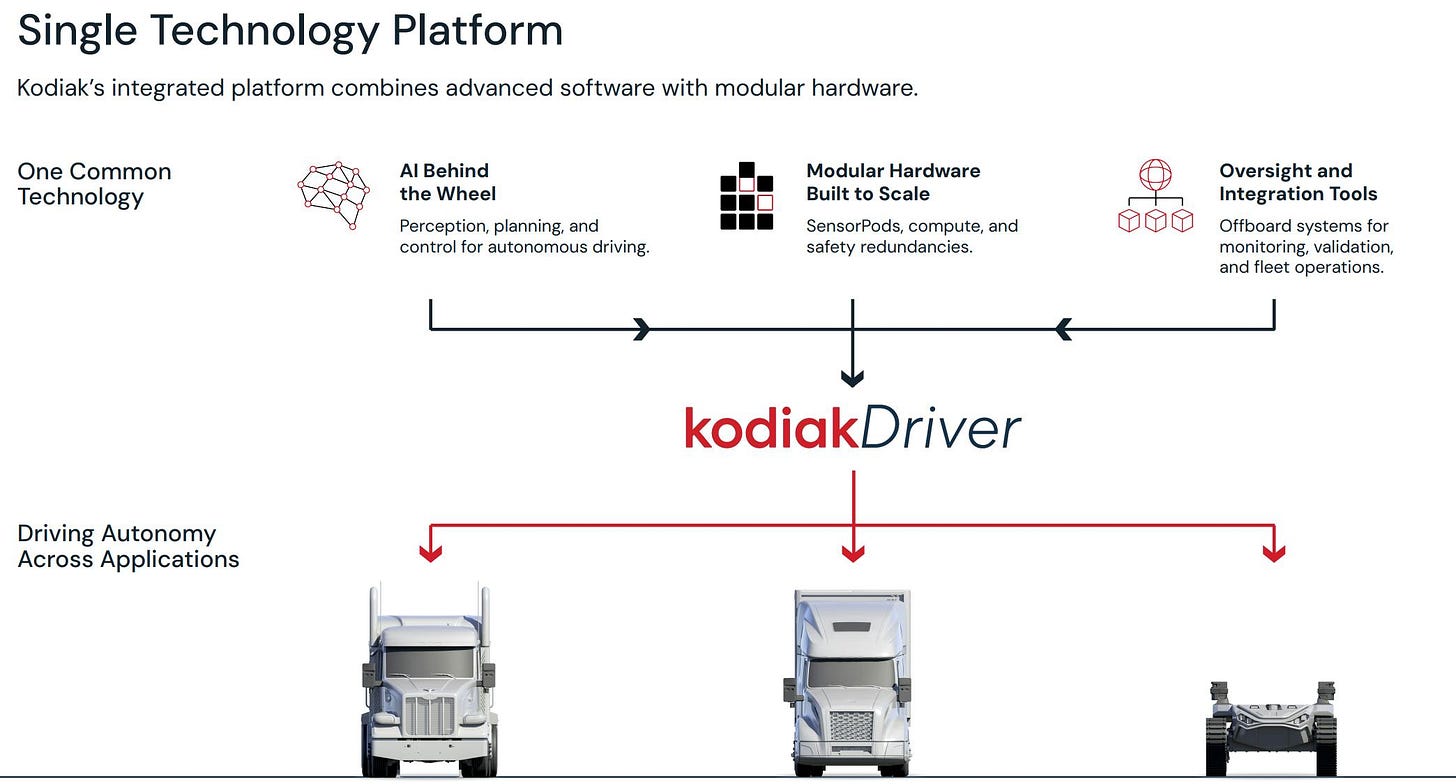

Kodiak's technology is based on the so-called Kodiak Driver, a sensor that combines radar, lidar, and cameras.

The system is based on a virtual driver that continuously learns through deep learning networks and can safely navigate a wide variety of environments, such as highways, city streets, gravel, and off-road routes. Unlike many other systems, Kodiak's solution operates independently of high-resolution maps (HD Maps). It detects and interprets the environment in real time and flexibly adapts to construction sites, obstacles, and lane changes. The technological platform is vehicle-independent and, thanks to redundant safety-critical functions, offers broad application on various vehicle types. In addition, Kodiak relies on modular hardware that is particularly easy to maintain: It can be quickly replaced without specialized knowledge, even faster than a tire, thus maximizing the system's operational availability.

The platform consists of three central components:

AI "at the wheel," responsible for perception, planning, and control of autonomous driving,

scalable, modular hardware (e.g., sensor pods and redundant safety systems)

as well as monitoring and integration tools that enable fleet operations, validation, and monitoring.

This holistic architecture allows the technology to be used in a variety of areas, from traditional long-distance haulage to urban delivery traffic and even military vehicle platforms. The solution is flexible, scalable, and transferable to a variety of applications.

Kodiak's autonomous truck technology is based on a robust, modular hardware architecture specifically designed for reliable driverless operation.

Key components include:

SensorPods with LiDAR, radar, and cameras for environmental awareness, which can be quickly replaced without specialized training.

A redundant architecture for computing power, power supply, sensors, and propulsion to mitigate failures.

The Actuation Control Engine (ACE), a safety-critical controller that enables precise, real-time vehicle control.

A powerful AI compute stack that combines communications, cooling, and data processing.

A partner network that integrates leading component suppliers to increase efficiency and scalability.

The underlying AI platform was developed for a wide range of operating environments, from highways to off-road scenarios, and does not require constant retraining when hardware or sensor changes occur.

Particularly noteworthy are:

Multi-sensor perception: LiDAR, radar, and cameras are treated equally to ensure the best possible data utilization.

Scalability: The modular design allows for easy upgrades and adaptations.

Iterative development: Continuous improvements based on real-world tests, simulations, and feedback ensure constant progress of the software.

From the Pre-Commercial Deployment Phase to Market Entry

Kodiak is still in the pre-commercial deployment phase. Raising capital through its IPO with Ares Acquisition Corporation II is intended to put the company in a financial position to systematically implement its market entry starting in 2025.

The Commercial and Product Roadmap outlines the planned expansion of autonomous truck operations beyond 2027.

Commercial:

Commercial launch begins in 2024.

Transition to profitability and delivery of the first trucks follows in 2025.

2026-2027: Scaling with hundreds to thousands of vehicles delivered and transition to self-financing.

Product:

Validated Lanes: Starting with a few off-highway routes, expanding to many on-highway lanes by 2027+.

Trailer Configurations: Starting with standard trailers, later expanding to double/triple combinations (e.g., Triple Pup).

Delivery Model: From a few endpoints to comprehensive end-to-end delivery.

Fleet Ownership: Initially Kodiak-owned fleet, later increasingly operated by customers.

Daily operating hours: Increase from 16+ hours in 2024 to over 22+ hours daily by 2027.

Technology & Services:

Truck Platform: From Sleeper Cab to Day Cab and multiple OEMs.

Hardware Production: Transition from internal AV integration to Tier 1 components as a service.

Integration: Scaling from individual conversions to OEM series integration.

Services: From a few remote assistance systems to AI-supported assistance with minimal on-site support.

Overall, the roadmap demonstrates a clear strategy for scaling, increasing efficiency, and integrating into the mass market. I'm already excited to see these milestones achieved.

Founder & CEO

Don Burnette is the founder and CEO of Kodiak and has an impressive resume with more than ten years of experience in developing autonomous driving software. He began his career as the software technology lead for Google's self-driving car project, the predecessor of Waymo. After more than five years at Google, Don left the company to co-found Otto, a self-driving truck startup that was ultimately acquired by Uber. After nearly two years as Uber's software technology lead, Don left the company to finally found Kodiak. In a meeting with ARK Invest, Don explained that self-driving trucks are significantly more efficient than manual trucks. His main point is:

Manual trucks can only be driven about 11 hours per day (regulated by law).

In reality, however, they only drive about 7 hours per day on average, which means they are underutilized.

Autonomous trucks, on the other hand, can operate almost 24/7.

This would mean that the same vehicles could almost triple capacity utilization and thus potentially triple the revenues of transport companies.

Business model

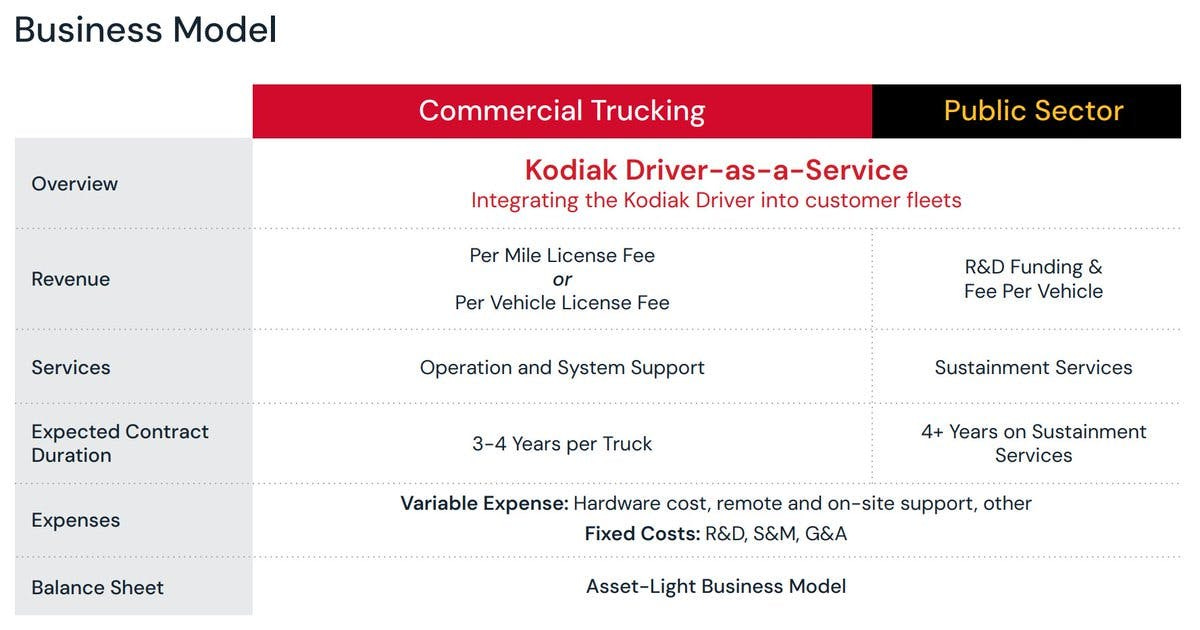

Kodiak targets commercial trucking and the public sector. Kodiak Robotics offers Driver-as-a-Service for both and integrates the Kodiak Driver into customer fleets.

Revenue for commercial trucking is generated through per-mile or per-vehicle license fees, with an expected contract term of 3-4 years per truck. Revenue for the public sector is generated through R&D funding and per-vehicle fees, with an expected contract term of more than 4 years for maintenance services.

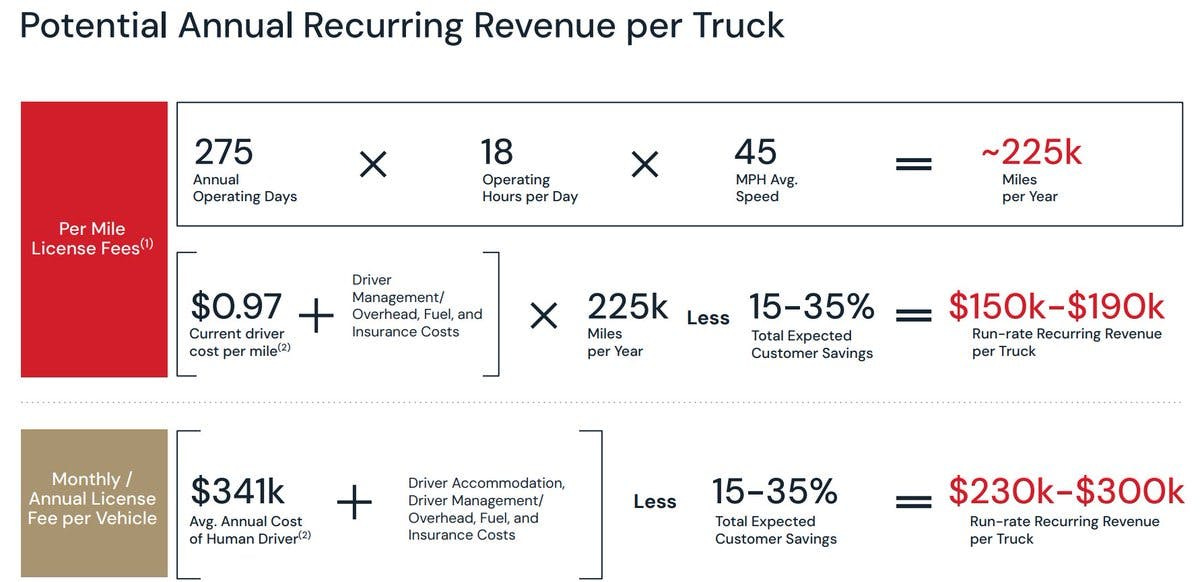

The potential annual recurring revenue per truck is highlighted:

The potential annual mileage per truck is calculated as follows:

275 operating days per year

18 operating hours per day

72 km/h (average speed)

This corresponds to an annual mileage of approximately 360,000 km.

To calculate revenue:

The current driver cost per mile is $0.97 plus additional costs for driver management, operating costs, fuel, and insurance.

Multiplying the total cost per mile by 225,000 miles yields the baseline.

After applying an expected customer savings range of 15-35%, the estimated recurring revenue per truck is between $150,000 and $190,000.

Alternatively, the monthly or annual license fee per vehicle is calculated based on the following factors:

Average annual cost for a human driver of $341,000, including driver housing, management, operating costs, fuel, and insurance.

After subtracting the expected customer savings of 15-35%, the estimated recurring revenue per truck is between $230,000 and $300,000.

Other Applications

Kodiak is also working with Textron Systems on the U.S. Army's Robotic Combat Vehicle (RCV) program. The goal is to develop autonomous ground systems for military operations, specifically with integration into unmanned vehicles such as the RIPSAW® M3, which lacks a driver. The solution is based on flexible, AI-assisted autonomy and is designed to enable deployment in a variety of combat environments.

In October 2022, Kodiak was officially selected and awarded a three-year, $30 million contract. The project has already conducted extensive field tests in military-relevant terrain, including mountainous regions in California, the Texas desert, and snowy terrain in Michigan.

The collaboration is considered groundbreaking for the future of unmanned ground units in US defense and brings cutting-edge autonomous technology into operational military vehicles.

This suggests that Kodiak is active in three sectors of its industry: trucking, public service, and defense.

Valuation

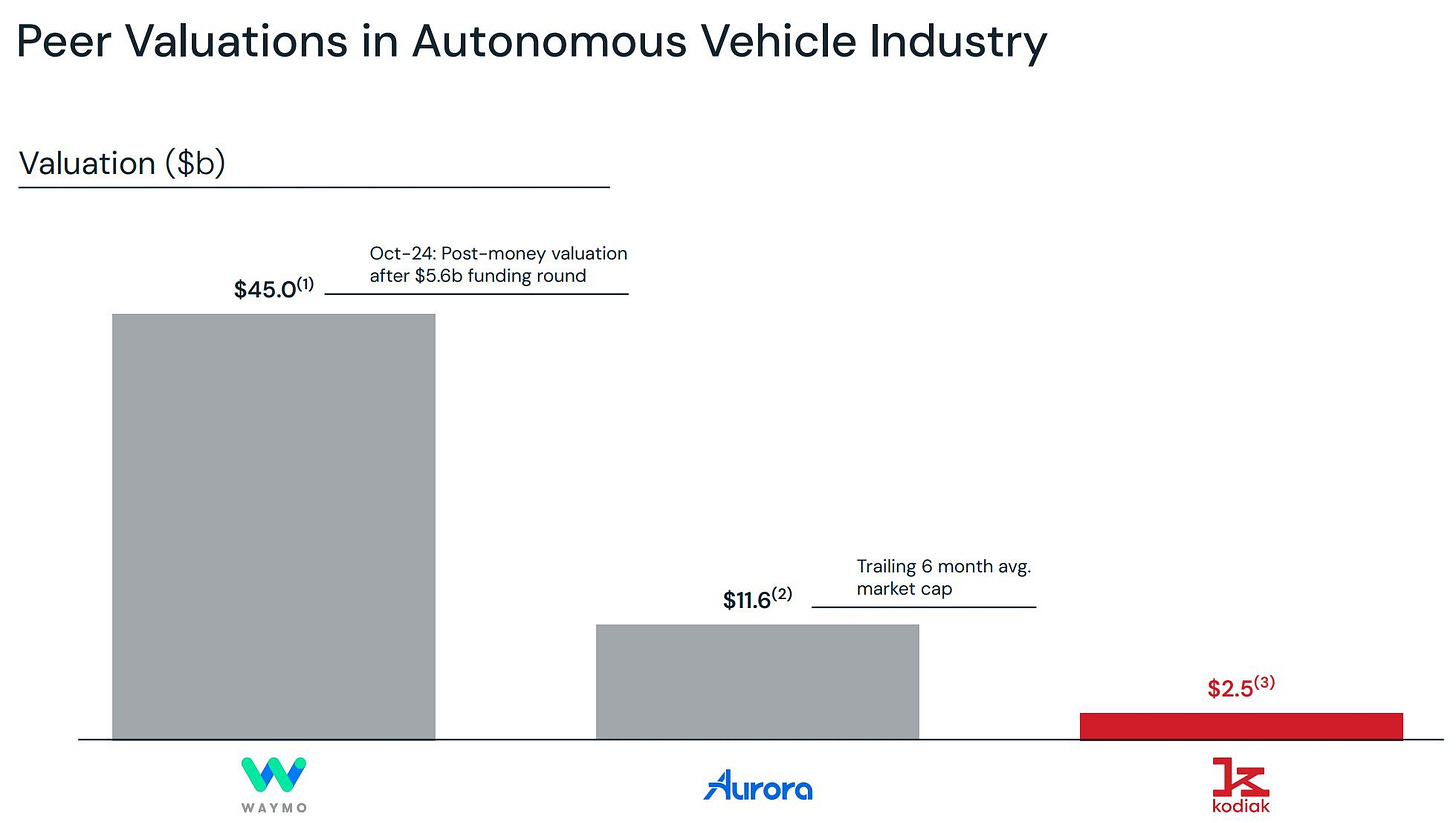

The chart compares the company valuations of leading players in the autonomous vehicle industry.

Waymo (a Google subsidiary) is valued at $45 billion (following a financing round in October 2024).

Aurora currently has a market capitalization of $9.8 billion.

Kodiak's market capitalization is significantly lower at $2.5 billion, despite its technological maturity and real-world deployments.

This discrepancy highlights a potentially underestimated market potential for Kodiak compared to larger competitors.

Conclusion on Kodiak

Kodiak positions itself as a technologically mature and practice-oriented provider in the field of autonomous commercial vehicles. The company has an experienced and dynamic management team that is delivering convincing work both strategically and operationally. The clear focus on scalability, modular technology, and real-world deployments is particularly noteworthy. At the same time, it will be important to monitor the coming months closely: Whether Kodiak achieves its self-imposed milestones and financial targets will be crucial for market confidence. If it succeeds, it will be significantly undervalued compared to competitors such as Waymo or Aurora, potentially offering attractive potential for investors. Kodiak shows great potential, but the company remains subject to high regulatory, technological, competitive, and adoption risks, typical of young companies in the field of autonomous driving.

Aurora Innovation

Foundation & SPAC IPO

Aurora Innovation is headquartered in Pittsburgh, Pennsylvania, USA, and was founded in 2017. The company focuses on autonomous driving technology in the trucking and passenger transport sectors.

The company went public in 2021 through a SPAC merger with Reinvent Technology Partners Y. Aurora Innovation is currently focused on autonomous freight transport (trucks), but plans to expand into the ride-hailing sector in the long term.

What market environment does Aurora Innovation see for autonomous trucks?

Like Kodiak, Aurora estimates the global truck market at around $4 trillion globally and $1 trillion in the US alone.

In this environment, Aurora clearly sees itself as a leader in autonomous trucking. The company emphasizes that it is currently the only provider operating commercial, driverless truck operations on public roads. With strong strategic partnerships and solid financing until at least the end of 2026, Aurora says it is well positioned to commercialize the technology at scale.

Aurora is developing its autonomous truck technology specifically to solve key challenges in the transportation industry:

Driver shortage and high turnover: With over 1.2 million drivers needed over the next ten years and a turnover rate of over 90%, Aurora promises scalability and stable driver availability through autonomous systems.

Limited driving hours: Conventional trucks are only allowed to drive a maximum of 11 hours per day. Aurora aims to achieve higher utilization and faster delivery times through autonomous systems.

High fuel costs: With diesel averaging $4 per gallon, Aurora offers the potential to reduce fuel consumption and emissions by up to 32%.

High insurance costs: With approximately 4,800 fatalities due to truck accidents in 2023 and rising premiums, Aurora offers safer processes and better data for error analysis.

From September 23, 2021, to May 7, 2025, the company has completed over 11,000 autonomous commercial delivery trips, both driverless and supervised by safety drivers. These trips spanned more than 3 million miles, demonstrating the growing capabilities and reliability of autonomous technology.

Particularly noteworthy: The on-time performance rate was nearly 100%, measured against Aurora-controlled deliveries. This result underscores the system's maturity and suitability for commercial use in freight transport.

Technology

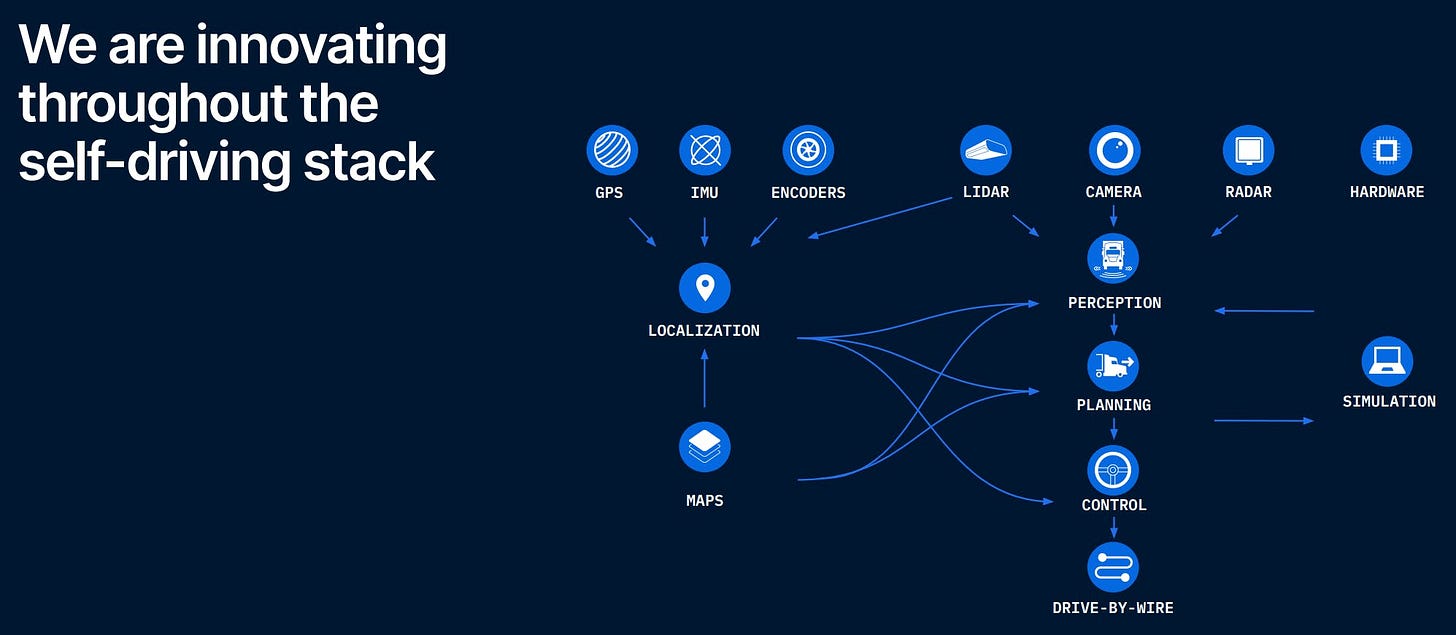

The Aurora Driver is a flexible software/hardware system that can be integrated into various vehicle types and is heavily AI-driven.

At its core is a fully integrated technology stack based on state-of-the-art sensors and sophisticated software. Data comes from a variety of sources, including GPS, IMU, encoders, lidar, cameras, and radar, and is processed in real time for precise localization and decision-making. Localization is combined with high-resolution maps and feeds the downstream modules for perception, planning, control, and drive-by-wire. These processes are further supported by simulations to continuously improve safety and performance.

Particularly noteworthy is Aurora's sensor suite, which combines multiple sensor types and is enhanced by the company's proprietary FirstLight lidar. This FMCW lidar is specifically designed for high-speed highway driving and offers exceptionally long range, high accuracy, and robustness against interference from sunlight or other sensors. The combination of lidar, camera, and radar enables reliable object detection, even in complex driving situations. Each sensor type brings its own strengths: lidar for precise ranging, cameras for visual classification, and radar for three-dimensional speed information.

Through the interplay of these technologies, Aurora creates a robust foundation for safe, autonomous driving, especially in long-distance traffic. The targeted combination of different modalities dramatically increases system safety and sets Aurora apart from other providers.

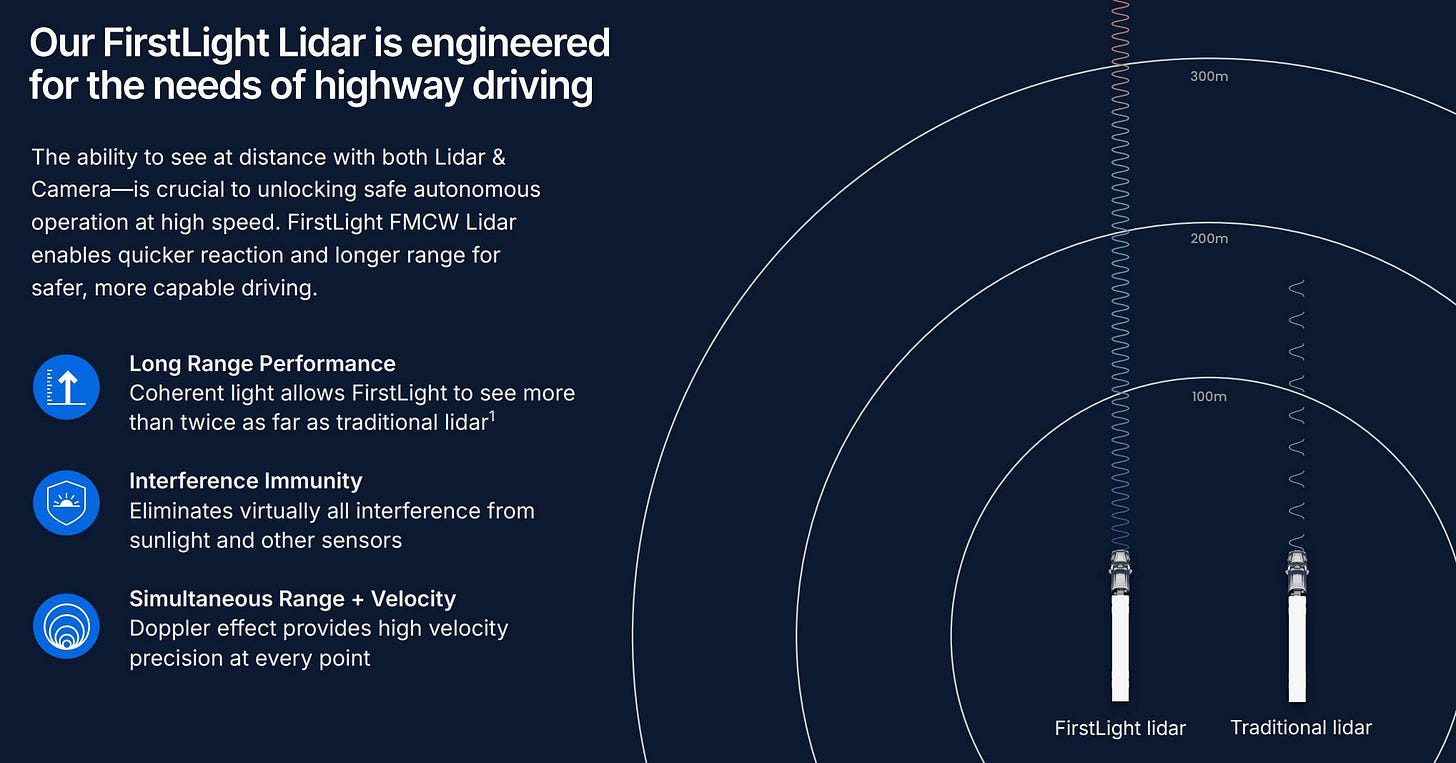

Aurora's FirstLight Lidar was specifically developed for the requirements of autonomous driving on highways. To operate safely and efficiently at high speeds, the ability to accurately detect long distances is critical. FirstLight is based on a frequency-modulated continuous wave (FMCW) method and combines the advantages of lidar and camera to enable early and reliable responses.

The system offers several technological advantages: Thanks to coherent light waves, FirstLight achieves more than twice the range of conventional lidar systems, a crucial safety factor in long-distance transport. Furthermore, the system is almost completely immune to interference from sunlight or other sensors, ensuring consistently high reliability even under difficult conditions. Another key feature is the simultaneous measurement of distance and speed using the Doppler effect, enabling extremely precise and dynamic object detection. Through this combination of range, interference immunity, and measurement accuracy, FirstLight creates the technical basis for a new generation of highly automated truck systems focused on speed, safety, and scalability in road traffic.

Overall, Aurora relies on an innovative combination of artificial intelligence and clearly defined traffic rules to safely handle complex and dynamic traffic situations. The system does not rely solely on machine learning but integrates concrete "guardrails," or hard-coded rules of conduct, to ensure reliable and legally compliant driving behavior.

One example of this is autonomous and natural lane changes on the highway. While there is no "one right solution" in such situations, Aurora's AI can use intelligent decision-making logic to choose the optimal behavior in dense or chaotic traffic, similar to an experienced driver. At the same time, a strict set of rules is applied for clear rules such as coming to a complete stop at a stop sign: Even if real-world data shows that only 11% of human drivers come to a complete stop, the Aurora Driver is consistently required to do so, increasing road safety and ensuring compliance with legal regulations.

From the Pre-Commercial Deployment Phase to Market Launch

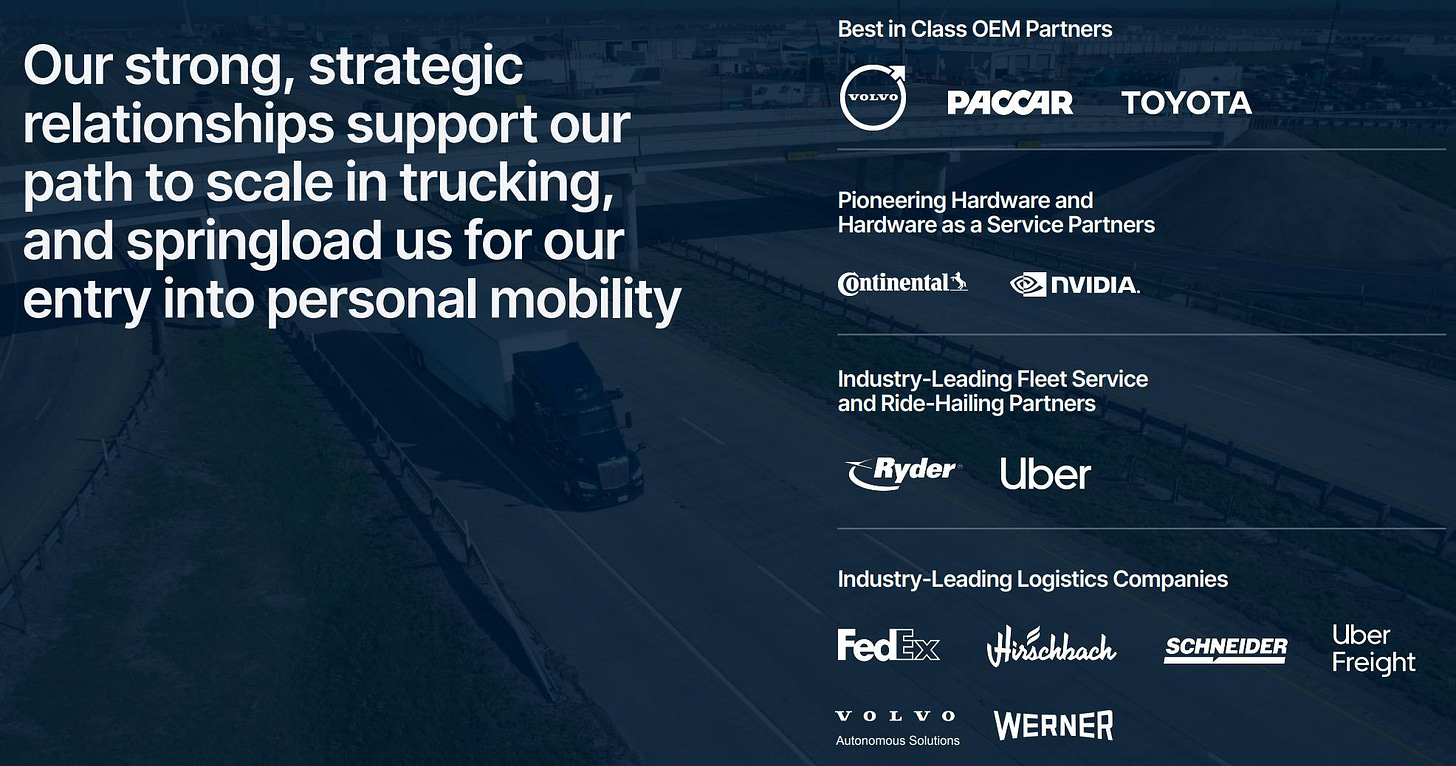

In 2024, Aurora launched pilot projects for commercial freight services with autonomous trucks on selected routes in Texas. The company is currently in the "Final Testing Phase”. Market launch is planned for 2025. Aurora is working with major freight forwarding and logistics partners, including FedEx, Werner, and Uber Freight, which are expected to be among the first customers of the Aurora Horizon product.

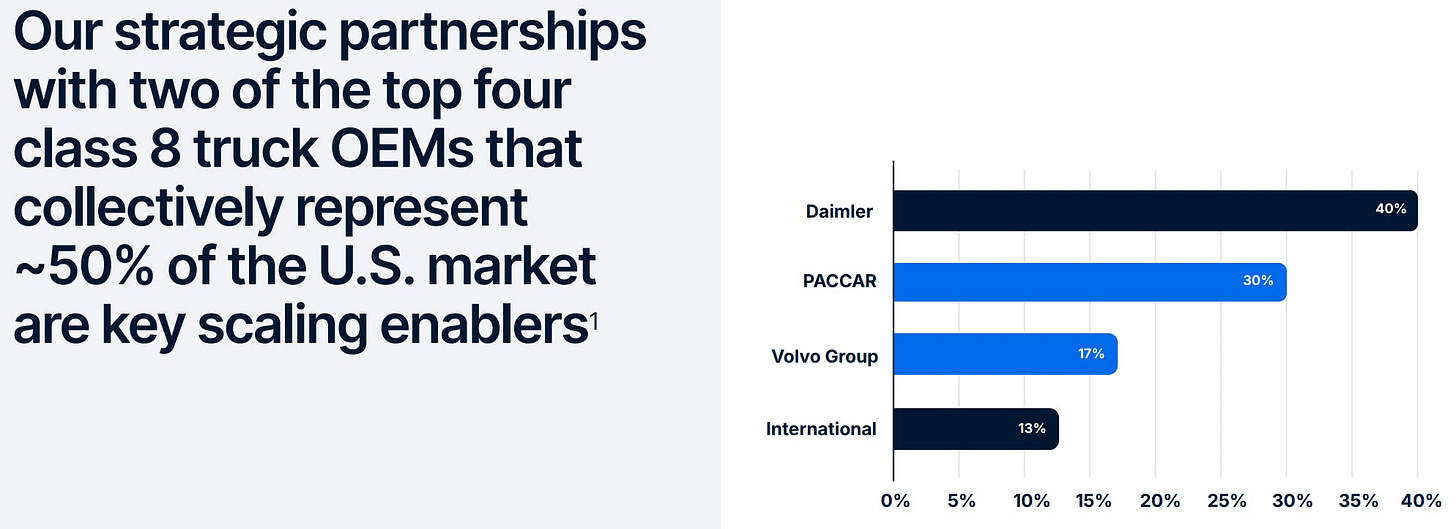

Aurora has also secured strong partnerships with two of the four largest Class 8 truck manufacturers in the US: Daimler (40% market share) and PACCAR (30% market share). These two OEMs together cover approximately 50% of the US market and are therefore crucial factors for the scaling and widespread adoption of the Aurora Driver System. The chart also shows other OEMs such as Volvo Group (17%) and International (13%), further highlighting the strategic relevance of the collaborations.

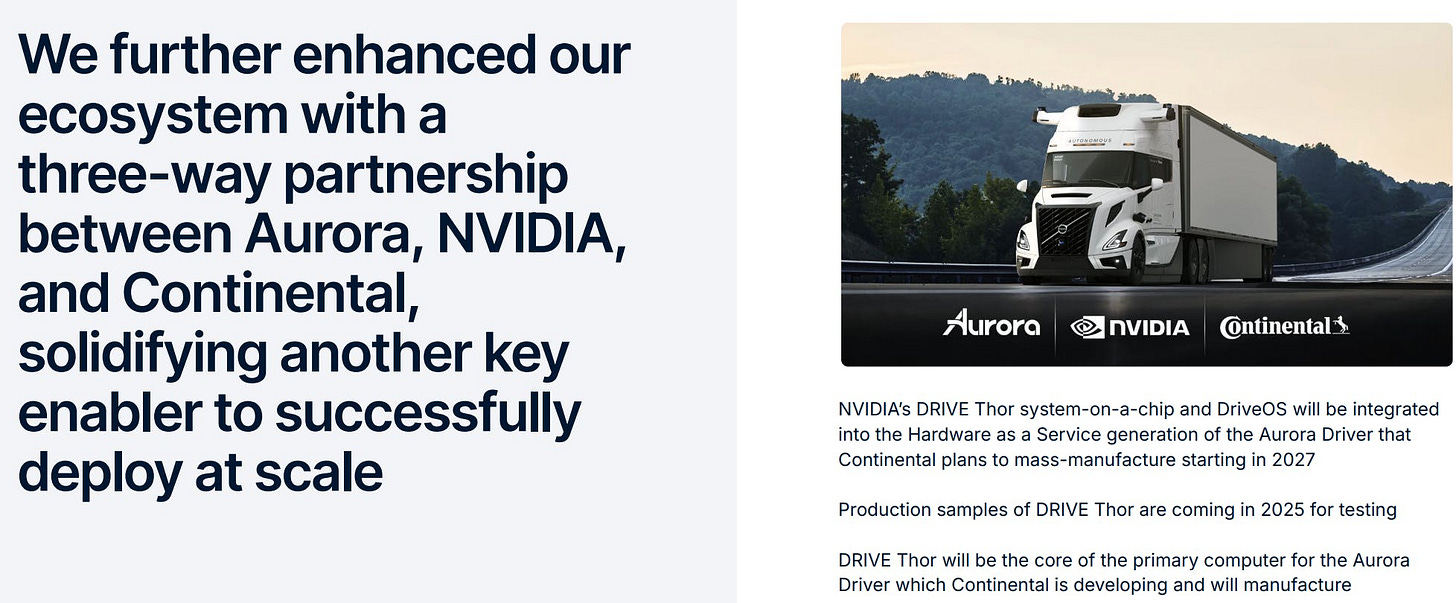

Aurora has also expanded its partner network through a strategic collaboration with Nvidia and Continental. The goal is to ensure the scalability of the Aurora Driver system through the use of state-of-the-art hardware and mass production.

Nvidia supplies the system-on-a-chip (DRIVE Thor) and DriveOS, which will be integrated into Aurora's next hardware generation.

Continental will take over series production of this hardware starting in 2027.

The first prototypes of the DRIVE Thor chip will be produced for testing purposes as early as 2025.

DRIVE Thor will form the heart of the Aurora computing unit, which Continental develops and manufactures.

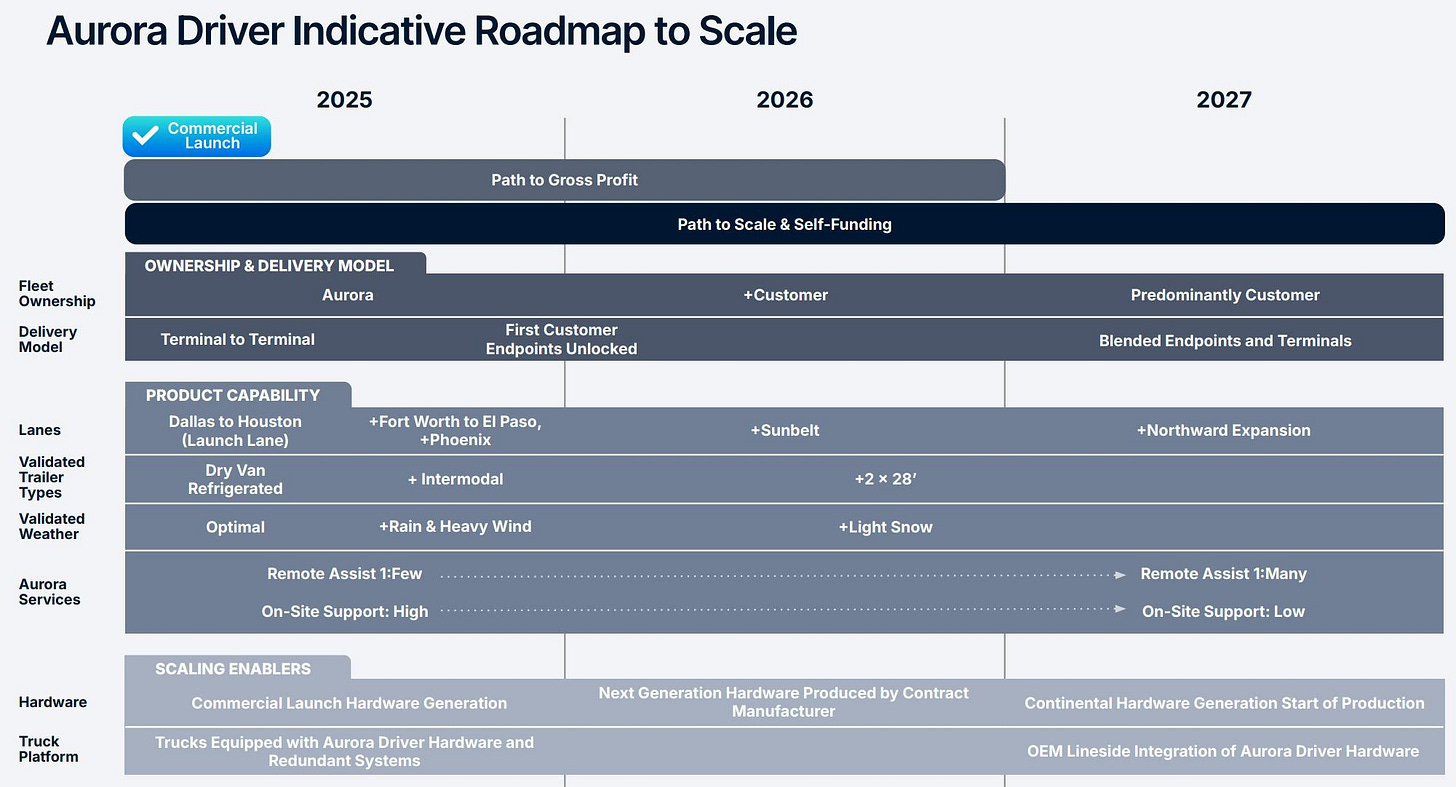

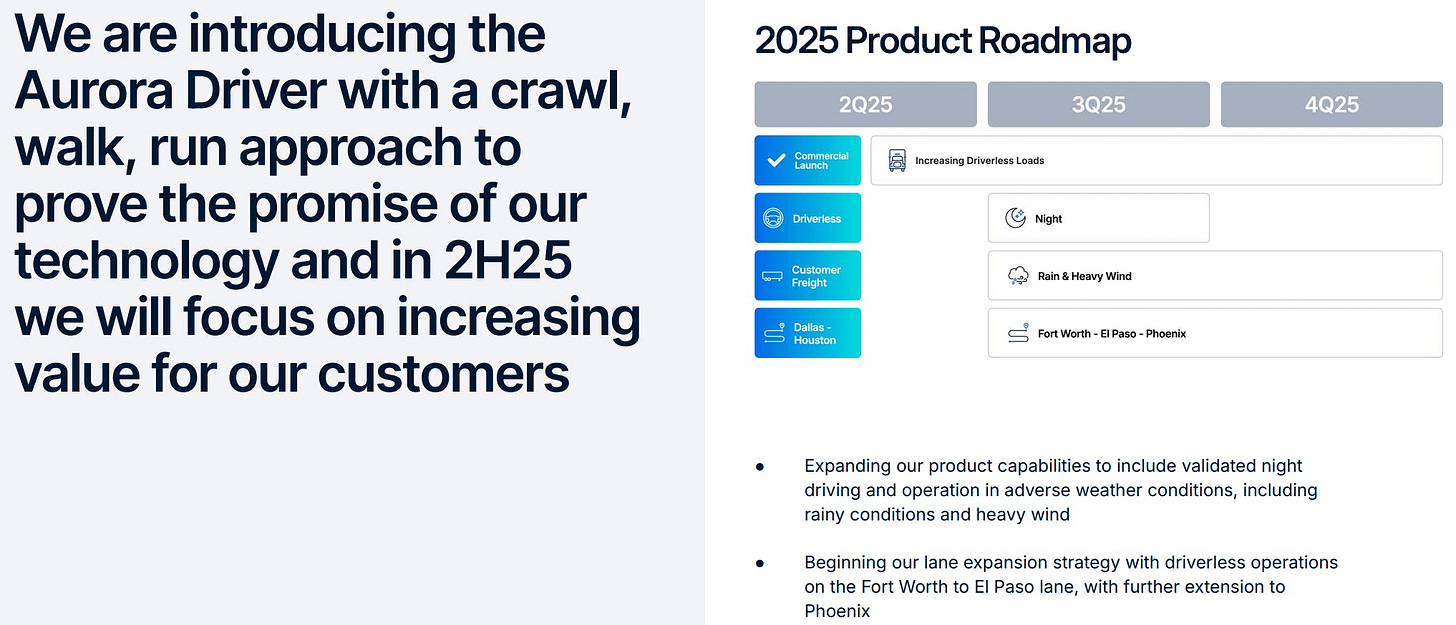

Like Kodiak, Aurora is pursuing an ambitious growth strategy with the goal of gradually commercializing its autonomous driving system and operating it self-financed. The roadmap shows how Aurora will expand both its product offering and operational infrastructure over three years starting in 2025.

Commercialization & Growth

2025: Commercial launch, first goal: profitability

2026–2027: Scaling & self-financing, growing customer share in fleet usage

2025: Terminal-to-terminal between Dallas and Houston

From 2026: Expansion to end-customer destinations and mixed networks (terminals + endpoints)

Technical & operational expansions

Routes/Lanes:

Starting with Dallas - Houston

2026: Fort Worth - El Paso - Phoenix, Sunbelt

2027: Northbound expansion

Trailer types:

2025: Dry freight & refrigerated trailers

From 2026: Intermodal + double trailers (2x28')

Weather conditions:

2025: Optimal conditions

2026: Rain, strong winds

2027: Snowy conditions

Service & Operations:

From high on-site support and 1:1 remote assistance

To minimal support and 1:1 remote assistance starting in 2027

Hardware & Platform

2025: Launch hardware + redundant systems

2026: Transition to the next hardware generation via contract manufacturing

2027: Series production by Continental and integration with OEMs

Aurora plans a systematic expansion of its autonomous driving service over three years, both geographically and technically, with clearly defined milestones for increasing revenue, cost efficiency, and scaling. Here, too, I'm curious to see whether the company can keep its promises.

This year, 2025, Aurora is committed to a structured rollout of its autonomous driving system, the "Aurora Driver”, based on the "crawl, walk, run" principle. The focus is on first proving the technology's capabilities and then systematically increasing customer benefits.

Key Milestones for 2025

Q2 2025:

Commercial launch (driverless launch) on the Dallas - Houston route

Launch of autonomous freight transport with first driverless freight trips

Q3 2025:

Expansion to nighttime operations

Operations validated in heavy rain and wind (difficult weather conditions)

Q4 2025:

Route expansion to Fort Worth - El Paso - Phoenix

Founder & CEO

Chris Urmson is the company's co-founder and CEO. He also serves on the board of directors. He is a pioneer in the field of autonomous driving. Before founding Aurora, he served as technical lead for Google's Self-Driving Car Project (now Waymo), among other roles, and has over a decade of experience in developing autonomous systems.

Business Model

Aurora relies on a scalable business model called "Driver as a Service" (DaaS), which is designed to enable efficient use of capital and sustainable value creation.

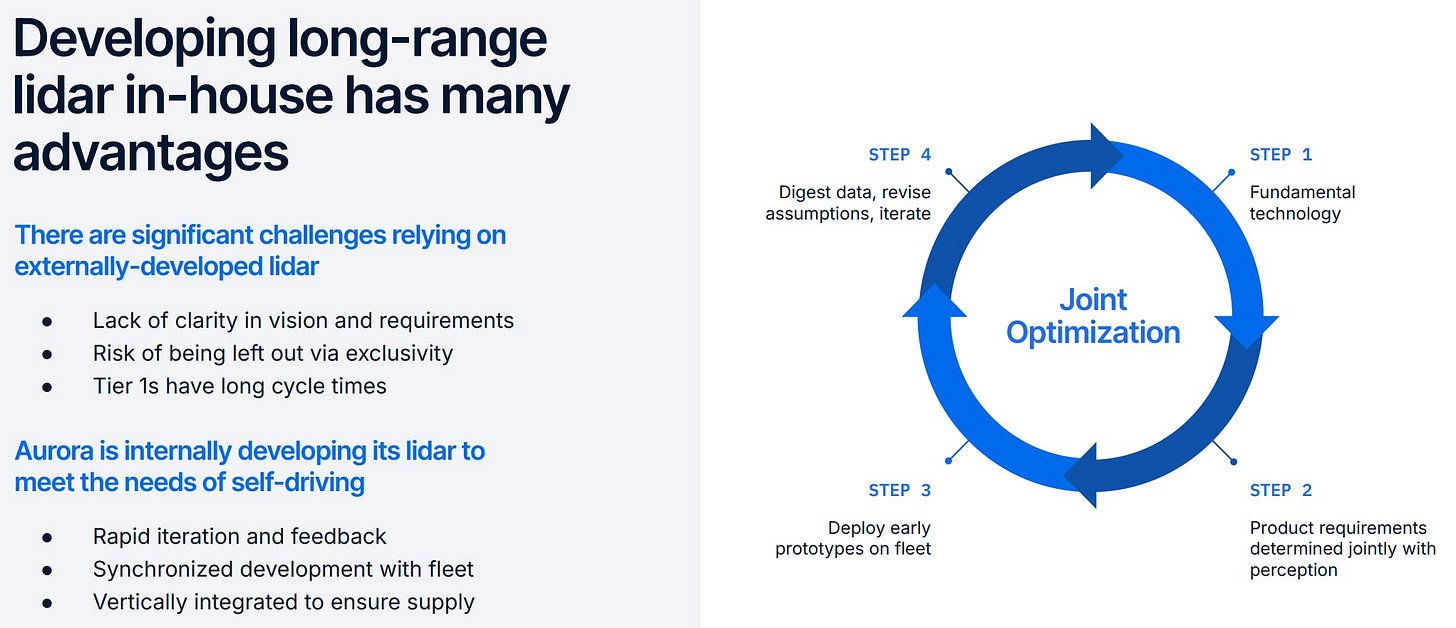

The company sees itself at a significant advantage over other competitors because it develops its long-range lidar in-house to optimally meet the specific requirements of autonomous vehicles. The company benefits from numerous advantages over traditionally purchased technology. External lidar solutions often involve ambiguities regarding requirements and technical maturity and are difficult to access due to exclusive contracts. In contrast, in-house development allows for close vertical integration, improving both security of supply and adaptability.

Financial Key Figures and Valuation

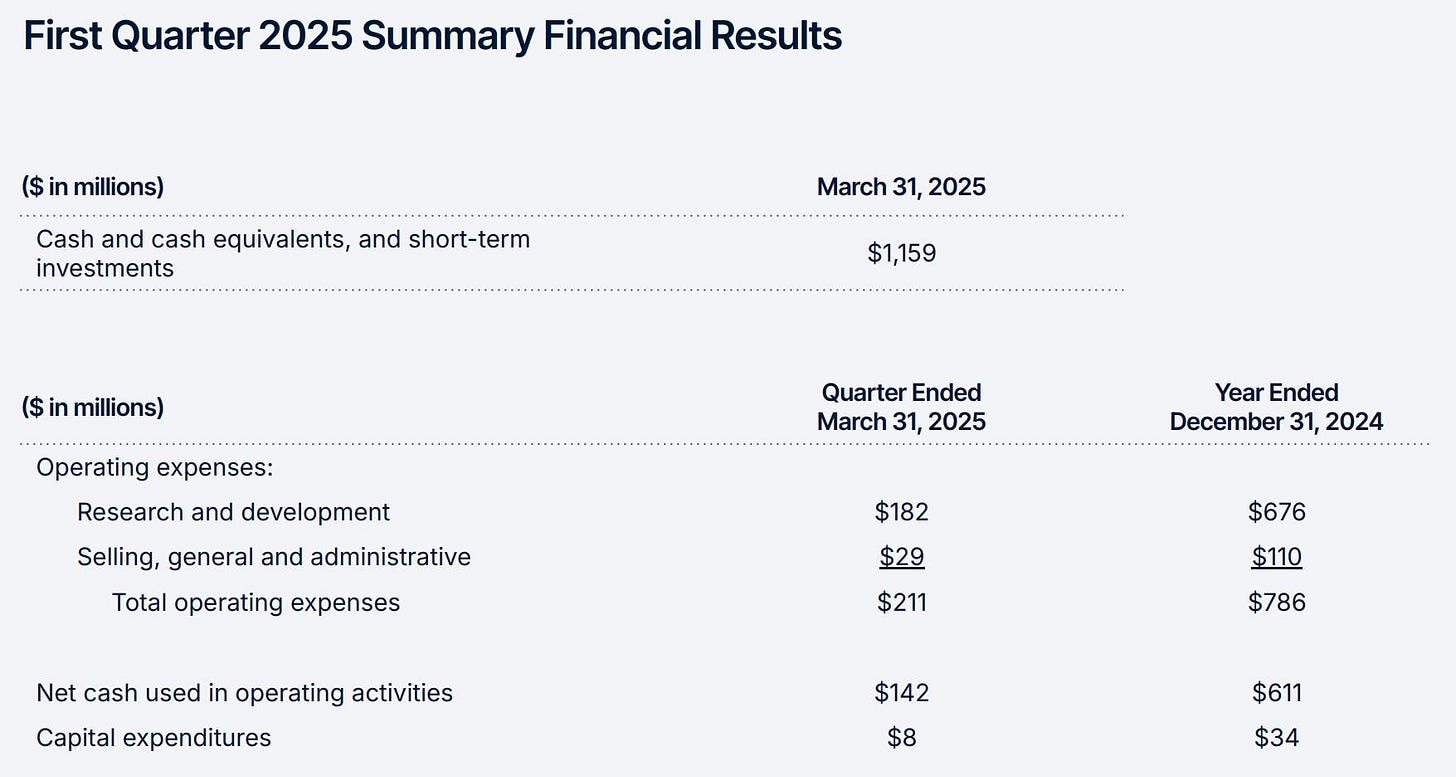

As of the first quarter of 2025, Aurora had cash and cash equivalents of $1.16 billion. Operating expenses during this period totaled $211 million, with the majority of $182 million spent on research and development. Selling, general, and administrative expenses accounted for an additional $29 million.

Net cash flow from operating activities was negative at $142 million, highlighting the significant investment activity in product development and preparation for commercialization. Capital expenditures for property, plant, and equipment (CapEx) amounted to $8 million during the quarter.

By comparison, total operating expenses for the full year 2024 were $786 million, including $676 million for research and development and $110 million for general and administrative expenses. Q1 operating expenses thus reflect continued high cost intensity, consistent with the strategic goal of commercializing autonomous truck operations in 2025.

Aurora currently has a market capitalization of approximately $9.8 billion, even though the company has not yet generated any revenue. Commercialization of autonomous truck operations is planned for the end of 2025. From a fundamental perspective, the question arises whether this valuation is justified given the company's early stage.

As of March 31, 2025, Aurora had cash and cash equivalents of $1.16 billion. Operating cash outflows in the first quarter were $142 million, which equates to approximately $570 million on an annualized basis. This would give Aurora a financial reach of almost two years, assuming a constant cost structure, but without significant revenue. Compared to other market participants, Aurora is highly valued. Kodiak Robotics has a significantly lower capitalization, although it is also close to commercialization.

In the first-quarter 2025 earnings call, Aurora CFO David Maday emphasized the long road to achieving cash flow positivity:

"In addition to our core growth initiatives, expanding the Aurora fleet, expanding our lanes, adding new customer endpoints, and introducing lower-cost hardware, we will continue to evaluate opportunities to further enhance our competitive position and/or de-risk certain business areas. Considering these factors, we now expect to raise $650 million to $850 million before achieving positive free cash flow, which is expected in 2028."

Conclusion on Aurora Innovation

Aurora's valuation is highly forward-looking. Those who expect a successful market launch in 2025, rapid scaling, and a leading position in the AV trucking market from 2026 to 2028 can consider the valuation justified. However, those who are skeptical about regulatory hurdles, technical implementation, and the high capital requirements are likely to consider the current level overvalued. In any case, this is a speculative investment with a high risk-reward profile.

Opportunities

The main opportunity is the enormous potential for reducing costs per mile. Autonomous trucks do not require drivers, can operate around the clock, and are capable of saving fuel and minimizing wear and tear with consistent driving behavior. The elimination of statutory driving times allows transport to be carried out more efficiently and quickly. This not only results in significantly higher productivity but also relieves the burden on supply chains, especially given the acute driver shortage in the US and Europe. In addition, autonomous systems could also improve road safety in the long term by eliminating human error. Excessive speed, fatigue, or distraction are not a factor in autonomous systems. New business models are also emerging: software providers can license the "virtual driver" as a service, OEMs can integrate autonomous driving platforms directly into their vehicles, and freight forwarders could partially or fully automate their fleets. In combination with electric drives, environmental benefits also arise, such as lower CO₂ emissions and optimized driving profiles.

Risks

However, there are significant risks involved. The technology is highly complex and must function reliably in a wide variety of environments, from construction sites to snow-covered roads. The path to full market readiness is expensive: Companies like Aurora and Kodiak invest hundreds of millions of US dollars annually to develop and test software, sensors, and safety systems. A key challenge is also the regulatory framework, which varies greatly internationally and has not yet been finalized in many countries. Public acceptance of autonomous trucks is also not guaranteed; unions and professional drivers, in particular, view the change critically and fear job losses.

Furthermore, there is intense competitive pressure: Numerous companies are working on similar solutions, which could lead to price wars and lower margins in the medium term. Many of these providers also rely on partnerships with suppliers or platform operators, for example, for lidar systems, trailer infrastructure, or remote monitoring, which can lead to strategic dependencies.

On May 8, Aurora also announced that co-founder Sterling Anderson was stepping down. In turn, General Motors announced that Sterling Anderson would be named Executive VP, Global Product and Chief Product Officer. Anderson was leading Tesla's Autopilot program when he founded Aurora in 2017 along with Chris Urmson, the former head of Google's autonomous driving project, and Drew Bagnell, the head of Uber's autonomy and perception team. The trio, considered pioneers in the autonomous vehicle industry, immediately made a splash at Aurora, helping the company attract well-known investors such as Sequoia Capital, Amazon, and T. Rowe Price Associates, as well as numerous partnerships. While Anderson's move to General Motors could signal future collaboration with Aurora, it doesn't reflect well on the company if one of its co-founders leaves.

Conclusion

Overall, autonomous trucking offers the potential to fundamentally transform freight transport in the coming years. The economic and operational benefits are significant, provided technology, safety, regulation, and market acceptance can be successfully combined. The outcome of this race remains open, but those who manage to deliver reliably and scalably could secure a decisive long-term advantage.

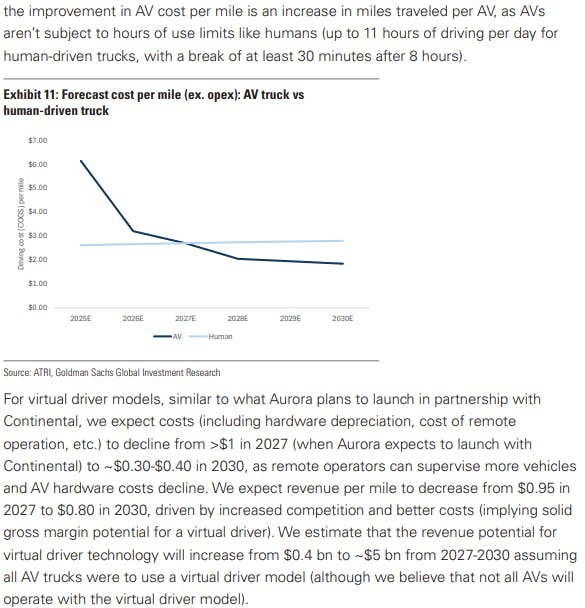

The Goldman Sachs analysis also shows that autonomous trucks could achieve significant economic advantages over human-driven trucks by 2030, both in terms of cost per mile and market potential. In particular, the "virtual driver" model, as planned by Aurora in partnership with Continental, is expected to enable massive cost reductions thanks to technological advances and efficient remote monitoring of multiple vehicles simultaneously.

Once Aurora completes its commercial launch, the cost per mile is forecast to drop from over $1 to around 30 to 40 cents in 2030. At the same time, revenue per mile could decline slightly to around 80 cents due to increasing competition. Overall, revenue from virtual driver models is expected to increase from $400 million in 2027 to around $5 billion in 2030.

Despite the currently small number of trucks deployed by Aurora, Kodiak, PlusAI, and Waabi, data shows significant growth: The number of autonomous vehicles and their market share of US freight transport is expected to increase exponentially by 2030. According to Goldman Sachs, the initial investment of around $150,000 per truck today will fall to around $50,000 by 2030, thanks to improved hardware, economies of scale, and falling technology prices.

The operating costs of a truck (including remote operation, insurance, maintenance, fuel, etc.) are expected to decrease from approximately $6.15 (2025) to $1.89 (2030) per mile. In comparison, the costs for human-driven trucks are expected to rise from $2.61 to $2.80 over the same period, primarily due to rising wages. Overall, this forecast clearly indicates a high economic potential for autonomous trucks in the coming decade.

What do I do now?

Both companies are exciting and have advantages and disadvantages. Kodiak is more attractively valued, and Aurora has strong partners. I'm keeping both stocks on my watch list for now. I'll closely monitor the coming quarters of both companies and check whether their stated milestones are met. Currently, I'm also seeing competitive pressure from other market participants: Waymo is already active in many cities. Zoox, the Amazon-backed robotaxi startup, also operates in Las Vegas. Meanwhile, Tesla launched its long-announced robotaxi project in Austin a few days ago. With this, Tesla is taking a major step toward fully driverless mobility and positioning itself directly in competition with other tech giants. Overall, it's clear that the self-driving revolution is in full swing, with increasingly concrete deployments, new markets, and growing pressure for innovation across the entire industry.

What is your opinion on these two companies? Would you be willing to invest at this point?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.