Hims & Hers – The End with Novo Nordisk

Novo Nordisk is ending its collaboration with Hims & Hers.

Dear Growth Investors,

Novo Nordisk is ending its collaboration with Hims & Hers in the sale of weight-loss medications and is making serious allegations against the US telemedicine company.

On April 29, 2025, Hims & Hers announced news that silenced many critics: Hims & Hers and Novo Nordisk entered into a “long-term” partnership.

Customers could access NovoCare® Pharmacy directly through the Hims & Hers platform. The offering included the option for all dosages of Wegovy® and a Hims & Hers membership. This included around-the-clock care, ongoing clinical support, and nutritional counseling, all in one location. For a single price starting at $599 per month, individuals received a prescription of Wegovy® along with Hims & Hers' world-class, holistic care approach.

But now Novo Nordisk has ended its collaboration with the US telemedicine company - WHY?

The reason for this are serious concerns regarding illegal mass compounding and misleading marketing of medications, particularly in connection with copycat products of the popular weight-loss drugs Ozempic and Wegovy (active ingredient: semaglutide). Novo Nordisk accuses Hims & Hers of offering unapproved versions of semaglutide on a large scale through compounding pharmacies, i.e. pharmacies that prepare medications individually for patients, a practice strictly regulated by law. However, according to Novo Nordisk, Hims & Hers violated these rules by essentially mass-producing the drug and failing to meet the necessary requirements for a legal compounding practice. Novo Nordisk also criticizes the company's marketing strategy as misleading and potentially dangerous for patients. The company emphasizes that such practices undermine both patient safety and trust in medical treatments. Novo Nordisk is currently pursuing legal action against several providers of such unregulated versions of semaglutide, including Hims & Hers, in an effort to protect the integrity and safety of its original products.

The conflict with Novo Nordisk raises legal, economic, and strategic questions and puts Hims & Hers under considerable pressure in the short term.

Are the allegations justified?

First of all, it should be noted that the manufacture and sale of compounded medications is legal in the USA under certain conditions, but with restrictions:

Permissible cases:

If supply shortages occur (as is currently the case with Ozempic/Wegovy), a pharmacy may prepare an individualized compound.

This compounding may only be done by licensed compounding pharmacies that comply with Section 503A or 503B of the U.S. Drug Quality and Security Act (DQSA). Hims & Hers has access to these pharmacies.

Risks / Limited Areas:

Compounded medications are not FDA-approved, even if the active ingredient itself is.

Sales via telemedicine platforms such as Hims & Hers can be problematic if the source of the active ingredients is unclear or if all FDA regulations are not followed.

The FDA had already lifted the temporary exemption for the manufacturing of GLP-1 medications by pharmacies and outsourcing facilities in February 2025, as the supply shortages for semaglutide generics were officially considered resolved.

“FDA has determined the shortage of semaglutide injection products, a glucagon-like peptide 1 (GLP-1) medication, is resolved. Semaglutide injection products have been in shortage since 2022 due to increased demand.”

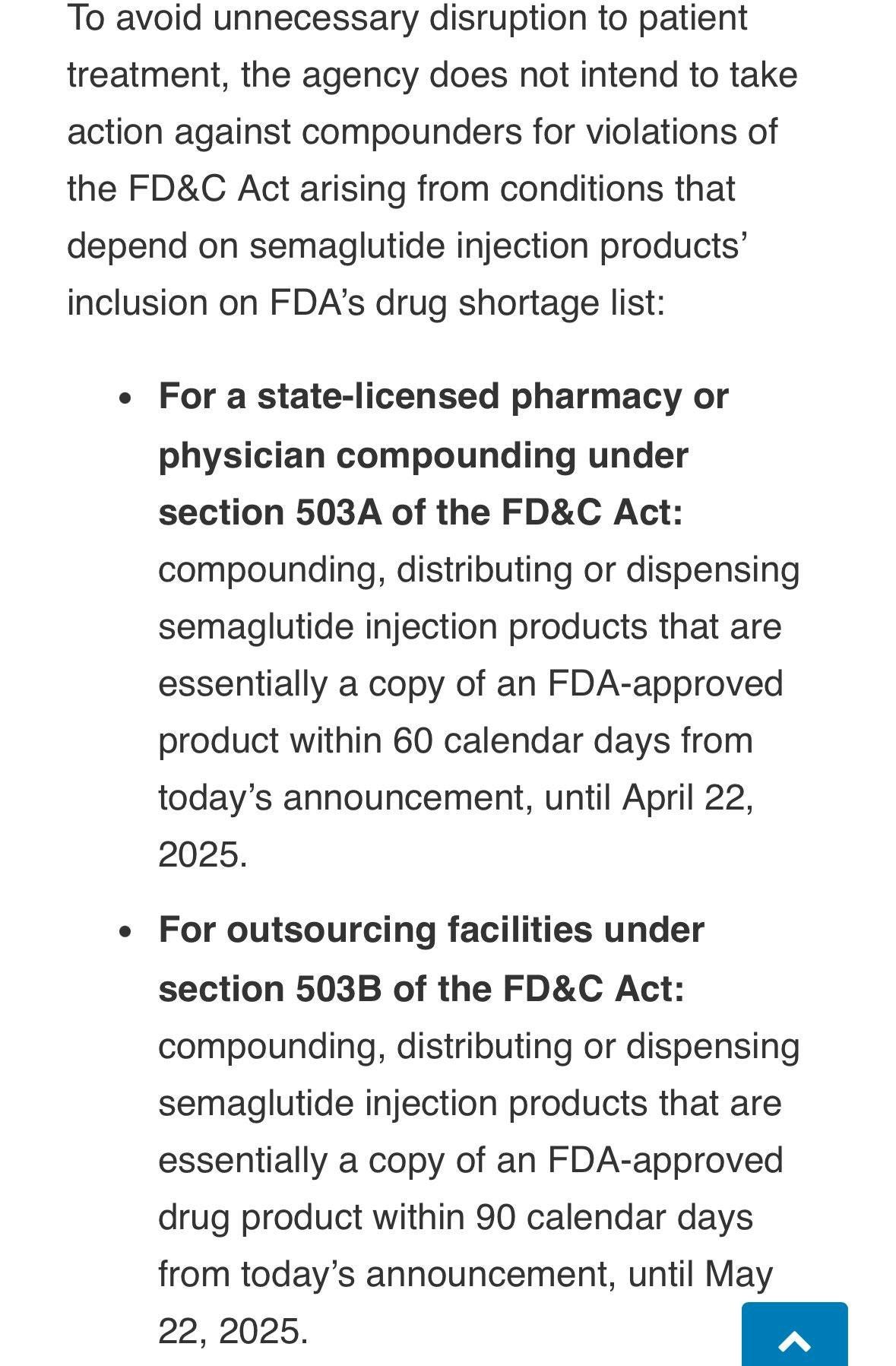

This means that the manufacture and sale of compounded GLP-1 medications that serve as substitutes for the original products have been restricted since then and have a specific exit date:

For state-licensed pharmacies or physicians (503A): Semaglutide-based manufacturing permitted until April 22, 2025.

For outsourcing facilities (503B): Semaglutide-based manufacturing permitted until May 22, 2025.

According to current regulations in the US, Hims & Hers is only permitted to manufacture or offer compounded semaglutide as part of individual ("personalized") formulations. This means:

Individual manufacturing according to a prescription for a specific patient by a registered compounding pharmacy.

A physician must issue a medically justified prescription.

The medication must be manufactured only for that individual person; no stock production or mass marketing is permitted.

Overall, I find Novo Nordisk's argument highly implausible. They must have been aware of these potentially illegal activities even before the partnership was officially announced before April 29, 2025! In my opinion, Hims & Hers has become such a serious competitor that they would rather harm the company than work with Hims & Hers.

Furthermore, Novo Nordisk claims that compounded semaglutide causes serious health problems. However, only 13% of compounded GLP-1 customers discontinued their treatment with Hims & Hers. Novo Nordisk's allegations therefore sound implausible to me!

Another counterargument is the results of a 12-month cohort study on the effectiveness of personalized GLP-1 therapy, which were published a few days ago. Overall, personalized GLP-1 therapy leads to a more pleasant, effective, and sustainable therapy, perfectly tailored to each individual.

Andrew Dudum (Founder and CEO) adds that the results from the 12-month cohorts demonstrate the long-term effectiveness of personalized GLP-1 programs and allow for continuous optimization of the program.

Thanks to regular telemedical support, around 60% of participants remain in therapy after three months, a rate significantly higher than the average for conventional programs. After just two months, an average weight loss of around 5% is evident, proving that the tailored treatment is working. At the same time, 96% of participants report further health improvements, for example in blood sugar levels and blood pressure.

Why are such good results achieved?

At Hims & Hers, each patient receives an individually tailored GLP-1 dose, rather than a fixed standard amount for everyone. This personalized dosage ensures that potential side effects are reduced.

Why is Hims & Hers publishing its results on the effectiveness of personalized GLP-1 offerings now?

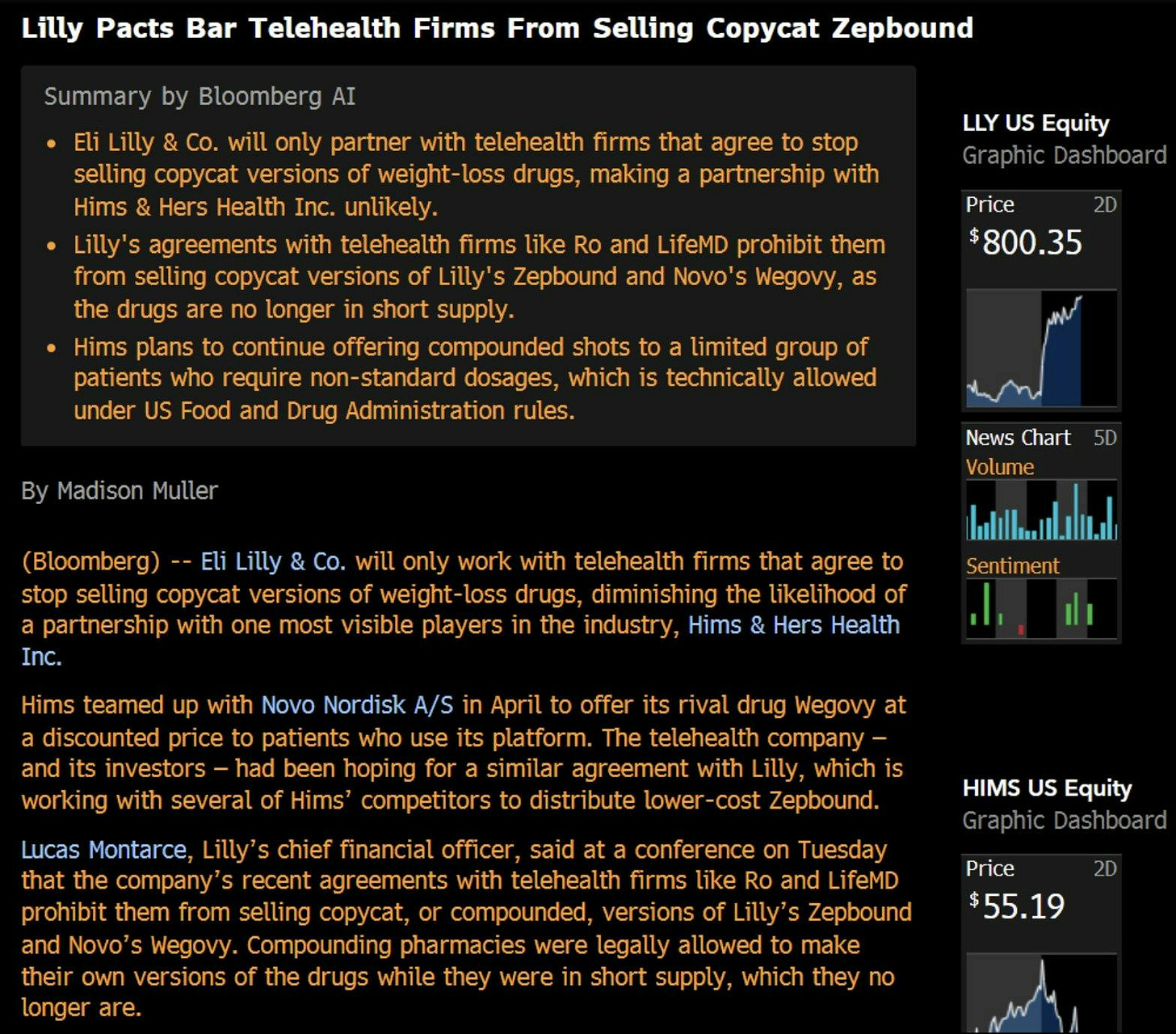

Eli Lilly & Co. recently clarified that in the future, it will only cooperate with telehealth providers that refrain from selling copycats of their weight-loss products. Therefore, a collaboration with Hims & Hers seems rather unlikely. Hims & Hers still offers compounded semaglutide. It has expressly prohibited the sale of copied versions of Lilly's Zepbound and Novo Nordisk's Wegovy with providers such as Ro and LifeMD. Lucas Montarce, Lilly's Chief Financial Officer, also emphasized at a conference that it will only enter into partnerships with telehealth companies that completely forgo copycats.

In addition, Hims & Hers offers not only semaglutide products (original or compounded), but also other weight-loss medications. The company is thus pursuing a broader strategy in the area of weight management that does not depend solely on access to Ozempic or Wegovy.

With its recently announced expansion into Europe, can Hims & Hers completely do without Novo Nordisk if it wants to compete in the lucrative market for GLP-1 medications (such as semaglutide)?

By acquiring ZAVA, Hims & Hers has gained a strategic advantage. This gives Hims & Hers access to the European markets and circumvents many regulatory hurdles that would otherwise have made market entry almost impossible. ZAVA already prescribes original medications such as Wegovy (from Novo Nordisk) in certain countries, e.g., the UK. This means that Hims & Hers does not have to rely on so-called generic drugs (compounded semaglutide), but can use a legal route through ZAVA, in partnership with pharmacies and manufacturers. The collaboration could therefore continue indirectly through ZAVA, even if it has been terminated in the US.

I actually think Novo Nordisk has recognized that demand for weight-loss medications is very high, especially after their collaboration with Hims & Hers, and that they now want to go it alone.

Andrew Dudum has responded to Novo Nordisk’s allegations.

Hims & Hers expresses disappointment at Novo Nordisk's public misrepresentation. In recent weeks, Novo Nordisk's sales team has reportedly exerted increasing pressure on Hims & Hers to compromise clinical standards and prioritize Wegovy, even when it may not be the best option for patients. Hims & Hers strongly opposes any form of coercion by pharmaceutical companies that compromises the independence of healthcare providers or limits patient choice.

Hims & Hers is committed to protecting the autonomy of providers and patients in treatment decisions and emphasized that it will not compromise the integrity of its platform to maintain partnerships. Patient health and well-being remain its top priority. Hims & Hers will continue to offer a wide range of treatments, including Wegovy, to ensure providers can meet each patient's individual needs. Conclusion: His statement reflects a strong and principled stance on clinical independence and patient-centered care. If the allegations are true, Hims & Hers raises a serious problem: commercial interests could influence medical judgment and thus undermine trust in healthcare systems.

Conclusion

Novo Nordisk believes it can control Hims & Hers by dictating how they should run their business. Andrew Dudum is absolutely right to free the company from this toxic partnership. It keeps Hims & Hers too small. Hims & Hers is the most customer-centric healthcare company on the market. For many Novo Nordisk customers, Hims & Hers has been a blessing. Customer focus is the key to long-term success. Amazon, for example, knew that customer needs were its top priority, and that is precisely what will make Hims & Hers so successful in the future.

The strategy of Novo Nordisk and Eli Lilly is to pass on high prices to customers, with profit as their top priority. Hims & Hers seeks to offer fully personalized healthcare with a strong customer focus. Novo Nordisk claims to want to protect its original product from imitators. This is misleading. Novo Nordisk should say that it is losing customers to Hims & Hers due to insufficient innovation: The following article highlights that investors are increasingly scrutinizing Novo Nordisk's obesity drug pipeline, particularly due to concerns that the company may be falling behind in innovation compared to competitors like Eli Lilly.

The Reuters article highlights investor concerns that the development of Novo Nordisk's next-generation obesity treatments is not progressing quickly enough in clinical trials.

Worst-case scenario: Possible consequences for Hims & Hers and Novo Nordisk

Consequences for Hims & Hers

1. Legal Risks & Lawsuits

Novo Nordisk could file civil lawsuits against Hims & Hers, for example, for trademark infringement, false advertising, or unfair competition.

If it turns out that Hims & Hers has indeed violated FDA regulations or the Drug Quality and Security Act (DQSA), criminal or civil penalties amounting to millions of dollars could result.

If the case is resolved in court and liability is determined, the financial and reputational damage would be significant, including potential class action lawsuits by patients.

2. Reputational Damage

Accusations of "illegal compounding" and the use of "unsafe, foreign active ingredients" could severely undermine the trust of investors, customers, and regulators.

3. Regulatory Risks

The FDA could initiate investigations based on Novo Nordisk's information.

Risk of warnings, fines, or even operational restrictions in the weight-loss product segment.

Pressure to drastically restrict or discontinue compounding offerings.

4. Economic Setback

If compounded semaglutide is discontinued, Hims & Hers will lose a key growth pillar.

If Hims & Hers is forced to discontinue or restrict its offerings, this could be reflected in future sales.

5. Share Price and Investor Risk

Investors could react with uncertainty, especially if legal action or regulatory investigations become public.

There is a risk of a loss of institutional support and potentially a downgrade by analysts.

Consequences for Novo Nordisk

1. Strengthening Market Position

The availability of authentic, FDA-approved Wegovy allows Novo Nordisk to regain market share from compounding providers.

Sends a signal to the market: Novo Nordisk actively defends the integrity of its product.

2. Gaining Trust among Physicians and Patients

Patients and healthcare professionals see that Novo Nordisk is committed to product safety and regulation.

This can lead to stronger brand loyalty.

3. Potential Legal Precedents

If Novo Nordisk successfully takes action against providers like Hims & Hers, it will have a deterrent effect on other compounding providers.

In the long term, this could permanently reduce the market for copycat products.

4. Reputational Risks Due to Excessive Aggression

If Novo Nordisk takes too aggressive action against telemedicine platforms, the allegations could be perceived as reputational damage in the public's perception.

Accusations of "monopoly protection at the expense of patients" are conceivable, especially if Wegovy remains expensive.

5. Legal Risks & Lawsuits

If Novo Nordisk takes too aggressive action against telemedicine platforms, the allegations could be perceived as reputational damage in the public's perception.

Hims & Hers could allege monopoly abuse (Section 2 of the Sherman Act).

Hims & Hers could file a counterclaim for unfair competition, for example, if Novo Nordisk intentionally disseminates false or exaggerated statements about its products or processes.

What do I do now?

First of all, I'm not selling a single Hims & Hers share. This news will keep the share price very volatile over the next few weeks. When things calm down, I'll increase my position.

What's your opinion on the news? Does Novo Nordisk's withdrawal pose significant legal and financial problems for Hims & Hers?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.