Hinge Health – The future of exercise therapy is digital

Hinge Health is the market leader in the field of digital exercise therapy and addresses one of the biggest health problems worldwide: chronic pain.

Dear growth investors,

Digital health solutions aren't the future, they're the present. Hinge Health (Ticker: HNGE) is the market leader in the booming field of digital exercise therapy and addresses one of the world's biggest health problems: chronic pain. Scalable, data-driven, and clinically validated. Does this give the company tenbagger potential?

Table of Contents

Foundation and IPO

Business Model

Global Total Market (TAM)

Platform

Partners & Customers

Effectiveness

Moat

Financial Key Figures

Outlook and Long-Term Goals

Future Growth Potential

Tenbagger Potential

Conclusion

Founding and IPO

Daniel Perez and Gabriel Mecklenburg founded Hinge Health in 2014 while studying medicine. Both had personal experience with musculoskeletal disorders. Daniel broke his arm and leg in a bicycle accident, and Gabriel tore his cruciate ligament on the judo mat. Both underwent surgery and completed twelve months of rehabilitation. Physical therapy was effective, but consistently adhering to the treatment plan was difficult.

The frustrations they experienced during their recovery inspired them to found Hinge Health. The founders have built a healthcare platform specializing in digital therapy for chronic musculoskeletal conditions such as back pain, knee problems, and arthritis, among others.

The company completed its IPO on May 22, 2025. Since then, its shares have traded on the New York Stock Exchange under the ticker symbol HNGE. The IPO raised 437.3 million USD for the company.

Business Model

Hinge Health offers digital physical therapy services. Hinge Health partners with insurance companies and businesses to offer this service. These companies subscribe to Hinge Health through a subscription model. The insurance companies and businesses then offer Hinge Health services to their customers or employees as an additional benefit. Individuals can also purchase Hinge Health services individually.

Go-to-Market Strategy

Hinge Health pursues an efficient, targeted sales model based on direct customer relationships and strategic partnerships. The process begins with direct sales to employers.

When their employees benefit from the positive results of Hinge Health therapy, demand increases, and it is precisely this strong demand that opens doors to partnerships with health insurers. This results in preferential access to these partners' networks. By integrating into these networks, Hinge Health can further expand its reach while demonstrating its impact: better treatment outcomes at lower costs for customers. This, in turn, builds trust, so existing partners often expand their collaboration, for example, to include other insurance segments such as fully insured or Medicare Advantage. New partnerships are subsequently formed, further driving growth, and the cycle begins again. This scalable sales approach strengthens Hinge Health's market position in the long term and sustainably.

In the "Employers" segment, the company differentiates between two main target groups:

For large companies and corporations (Enterprise & Large Market), sales are handled either directly by Hinge Health itself or jointly with partners. These partners accelerate contract closing and facilitate technical integration.

For small and medium-sized businesses (SMBs), sales are generally handled entirely through partner networks.

In the "Health Plans" segment, Hinge Health is integrated directly as a solutions partner. The company focuses on fully insured models, Medicare Advantage, and federal insurance lines.

Overall, the model shows that Hinge Health cooperates flexibly with various market participants, depending on company size and insurance structure, and achieves faster market penetration through partnerships.

TAM

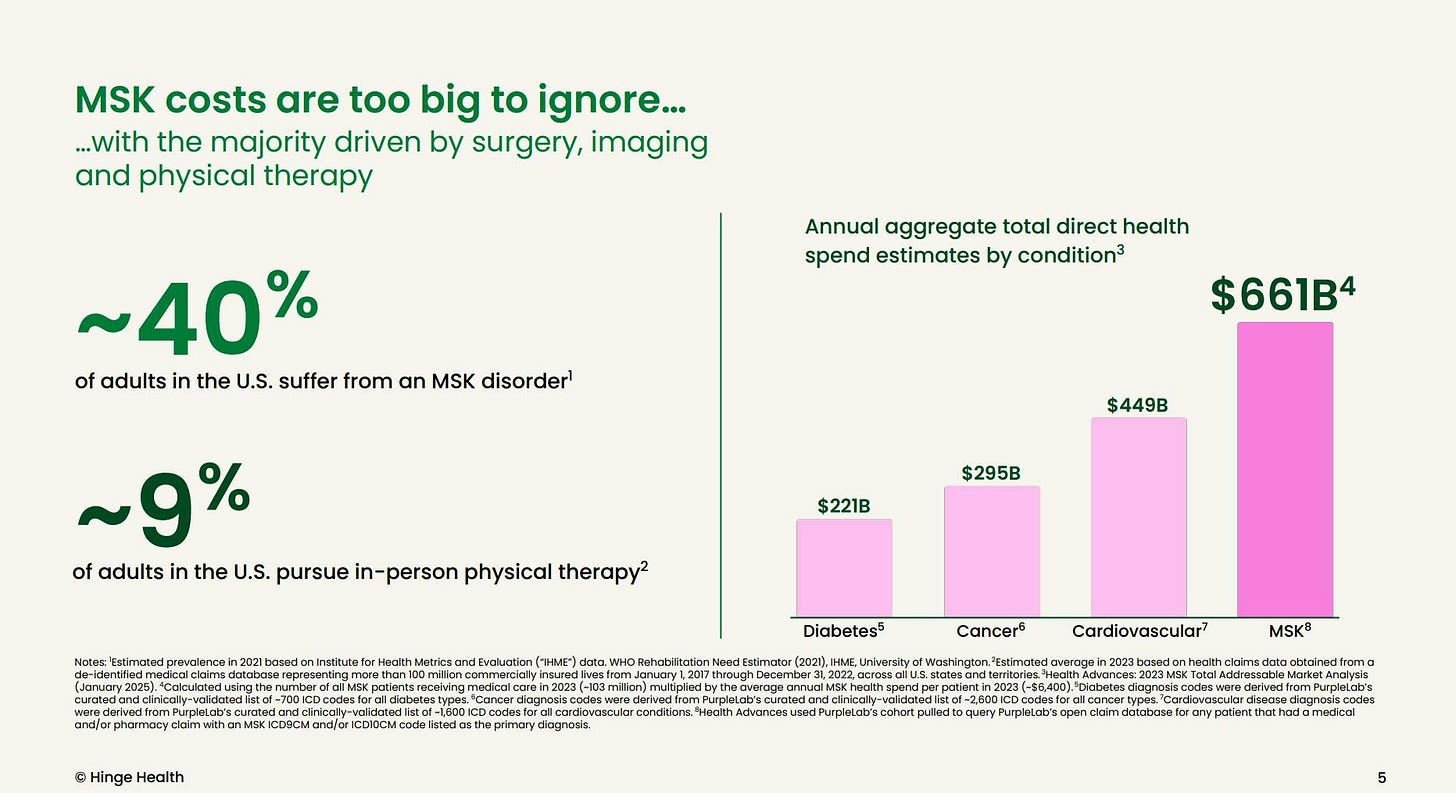

Approximately 40% of adults in the US suffer from a chronic musculoskeletal disease. Annual healthcare expenditures for chronic musculoskeletal diseases amount to USD 661 billion. By comparison, diabetes has annual healthcare expenditures of USD 221 billion, cancer USD 295 billion, and cardiovascular disease USD 449 billion.

The global digital musculoskeletal health market was valued at approximately USD 4.44 billion in 2024 and is projected to reach USD 11.64 billion by 2030, growing at a CAGR of 17.7%.

Platform

Setup is easy via the Hinge Health app.

Registration & digital assessment: Users conveniently register through their employer or health insurance provider and answer questions about their symptoms and medical history.

A personalized therapy program is created based on the data.

Physical therapy via app & sensors: Users perform the exercises at home with app guidance. Wearables help with correct exercise execution, and live feedback supports posture and form.

Personal support: Each participant is assigned a team of physical therapists, health coaches, and physicians.

Progress & motivation: Programs are adapted, and users are actively motivated to stick with them.

At the heart of the platform are TRUEMOTION, ENSO, and an AI-powered care team.

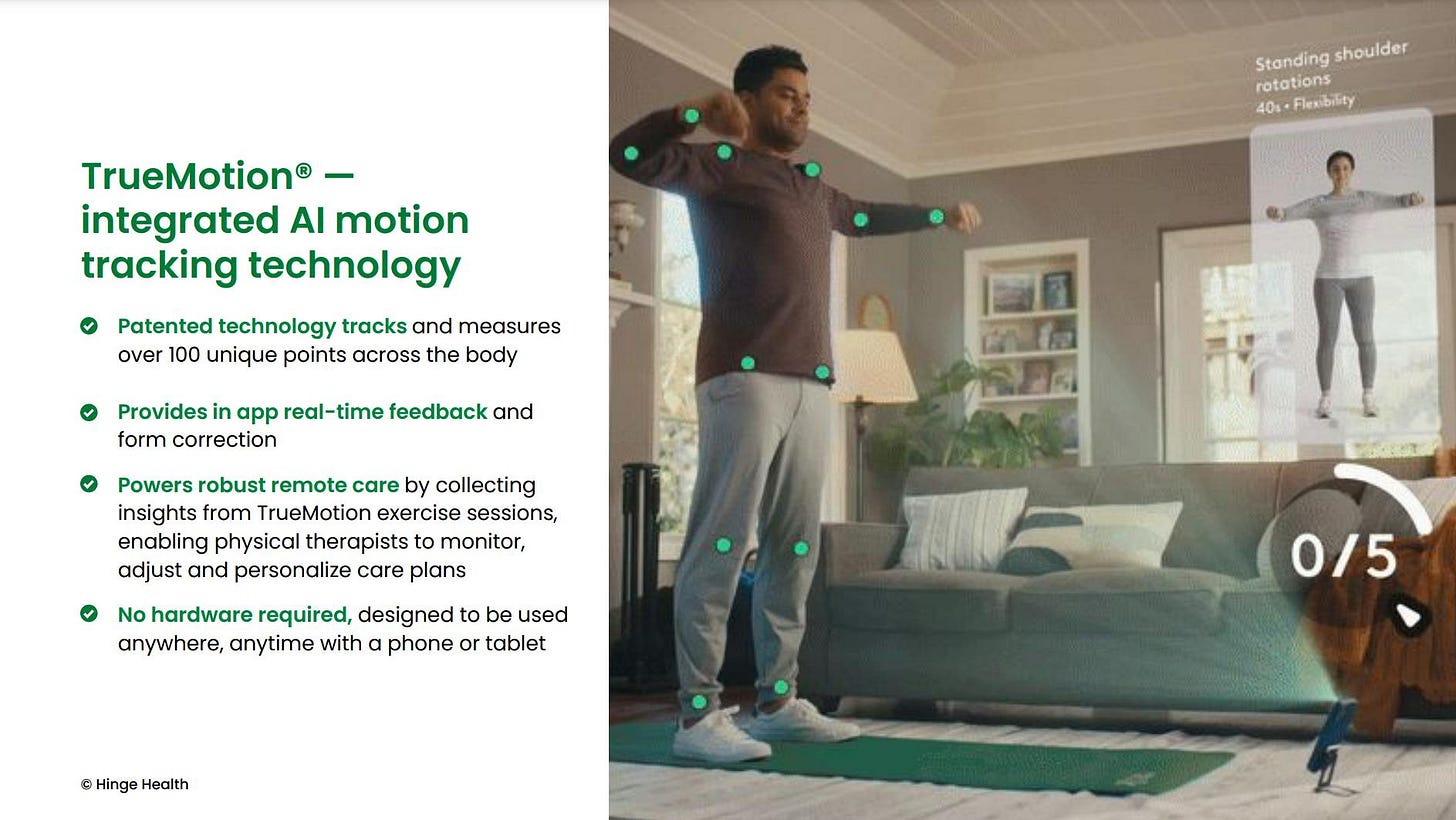

The TrueMotion software provides real-time feedback during movement therapy, powered by AI: The technology detects and measures over 100 body points to analyze movement sequences, providing immediate feedback on posture and correcting exercise execution in real time. TrueMotion works directly via smartphone or tablet.

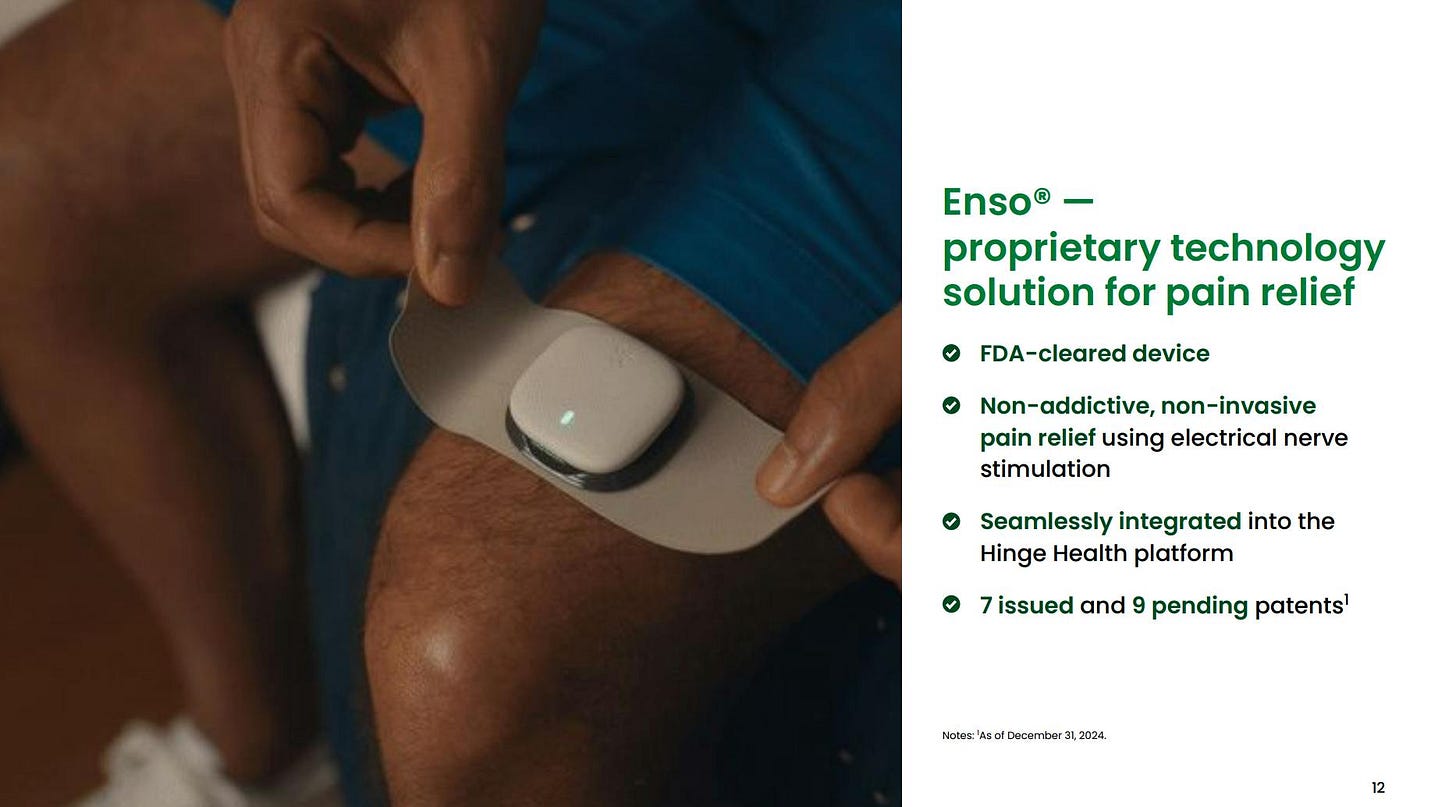

Enso is a high-tech medical device for non-invasive, drug-free pain management, specifically developed for people with chronic musculoskeletal disorders. Pain reduction is achieved without medication and uses electrical nerve stimulation. The device is FDA-approved, and the technology is protected by numerous patents.

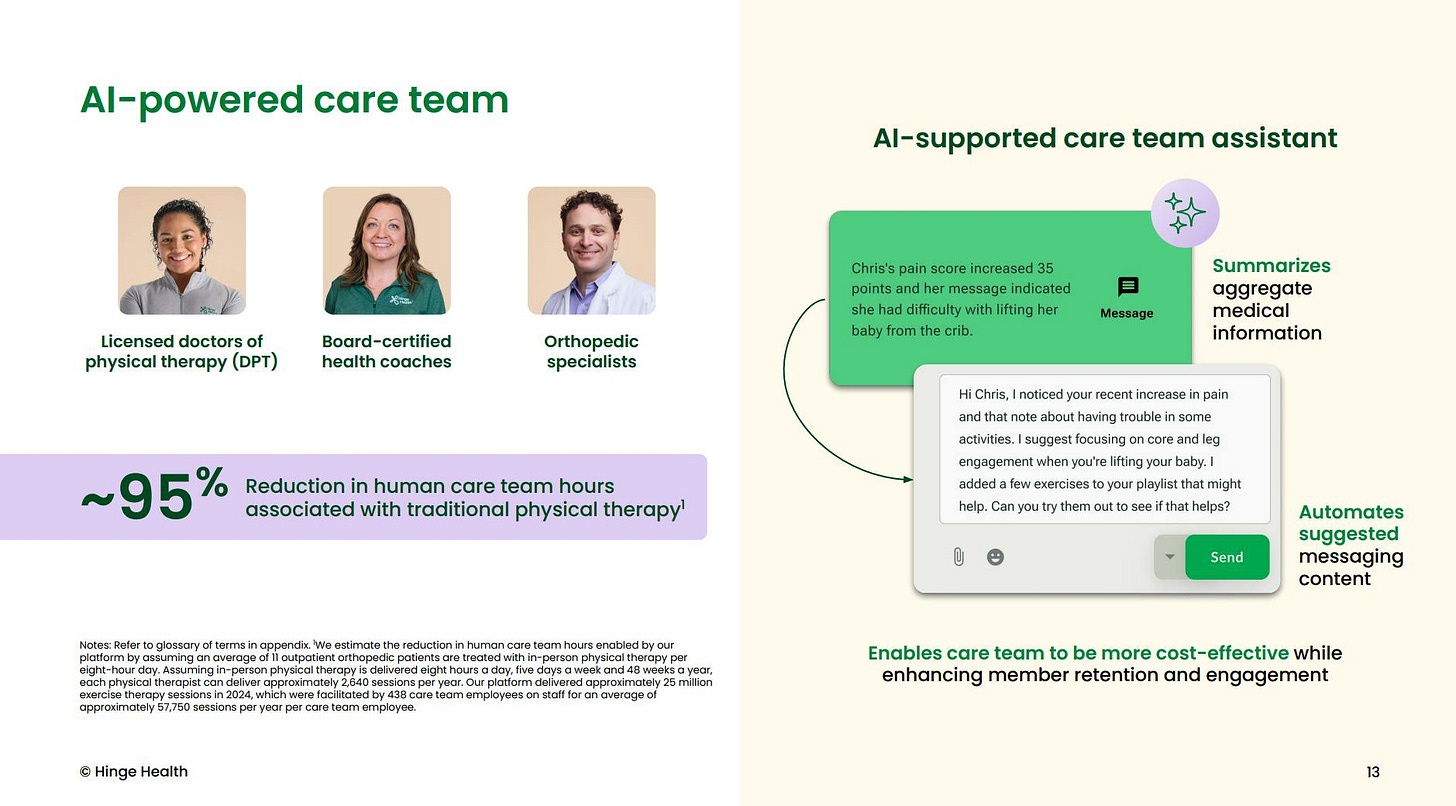

AI-powered care team: Hinge Health combines medical professionals with AI-powered assistance to make digital physical therapy more efficient and personalized. The care team consists of physical therapists, health coaches, and orthopedic specialists. The AI analyzes patient medical data and messages, summarizes relevant information (e.g., increased pain, limited mobility), and automatically generates suggestions for message content, such as tips or new exercises.

What advantage does AI bring to the company?

Database (Proprietary Data Sources)

Hinge Health processes a vast amount of data:

1M+ user profiles (lifetime member data)

Online questionnaires with information on demographics and pre-existing conditions

74M+ recorded activity sessions

32M+ self-reported results and progress

EHR (Electronic Health Records) data from over 750,000 providers

Insurance data: billing, authorizations, referrals

AI & Software Engine

This data flows into a learning system that:

Generates insights ("Actionable Intelligence")

Continuously improves the platform and programs

Scalable & personalized care

AI enables:

Individualized treatment plans

Live motion detection & feedback

Identification of at-risk patients

Efficient care through automated support of the care team

Partners & Customers

Hinge Health's services are already used by over 2,300 customers companies from more than 25 industries, including many of the world's largest employers:

2,300+ customer companies

49% of Fortune 100 companies

42% of Fortune 500 companies

Net Promoter Score (NPS): 87 (exceptionally high customer satisfaction)

98% customer retention rate

Effectiveness of Hinge Health

The effectiveness of Hinge Health has been proven by numerous scientific studies. A total of 19 peer-reviewed research papers have been published, conducted in collaboration with renowned institutions such as Stanford University, the University of California San Francisco, the University of Washington, and others.

The results show clear health improvements among participants in the digital therapy program:

On average, a 68% reduction in back and knee pain was reported.

At the same time, the need for opioid pain medications decreased significantly compared to non-participants.

Psychological complaints such as depression and anxiety were also reduced by an average of 58%.

The expected probability of undergoing surgery in the following year decreased by 67%, a clear indication of patients' trust in the non-invasive treatment.

In addition, there were 56% fewer spinal fusions compared to comparable control groups.

These findings come from large-scale, long-term studies with thousands of participants and demonstrate that Hinge Health achieves measurable, medically relevant results that go beyond mere symptom management, with positive effects on physical and mental health and the avoidance of unnecessary procedures.

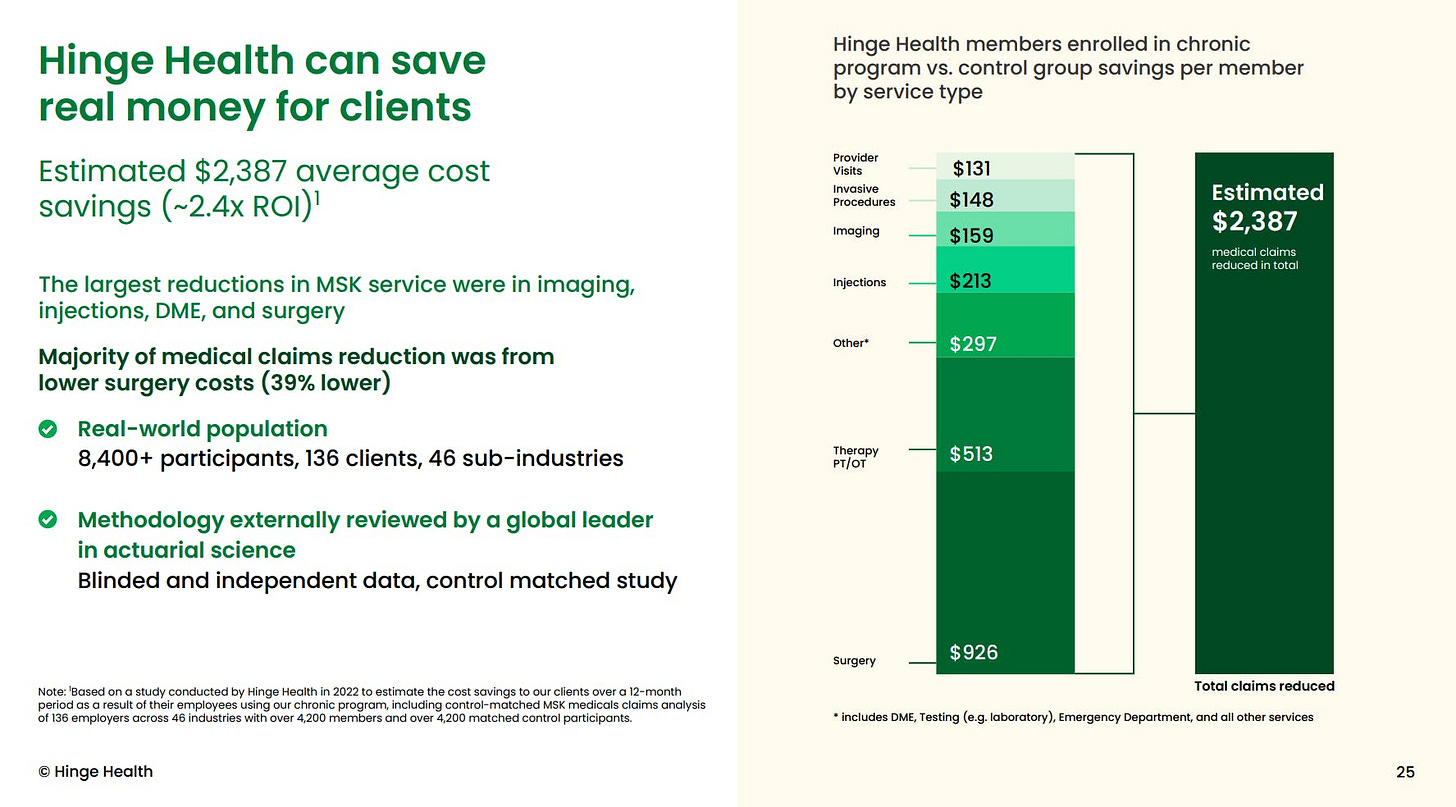

Cost savings for companies

Hinge Health not only offers medical benefits, but also saves companies money.

According to an analysis, an average of $2,387 in healthcare costs was saved per participant, corresponding to a return on investment (ROI) of approximately 2.4. The largest savings occurred primarily in surgeries, with an average 39% reduction in surgical costs. Hinge Health not only delivers better health outcomes but is also a wise investment for employers and insurers, because the healthier the employees, the more profitable the company.

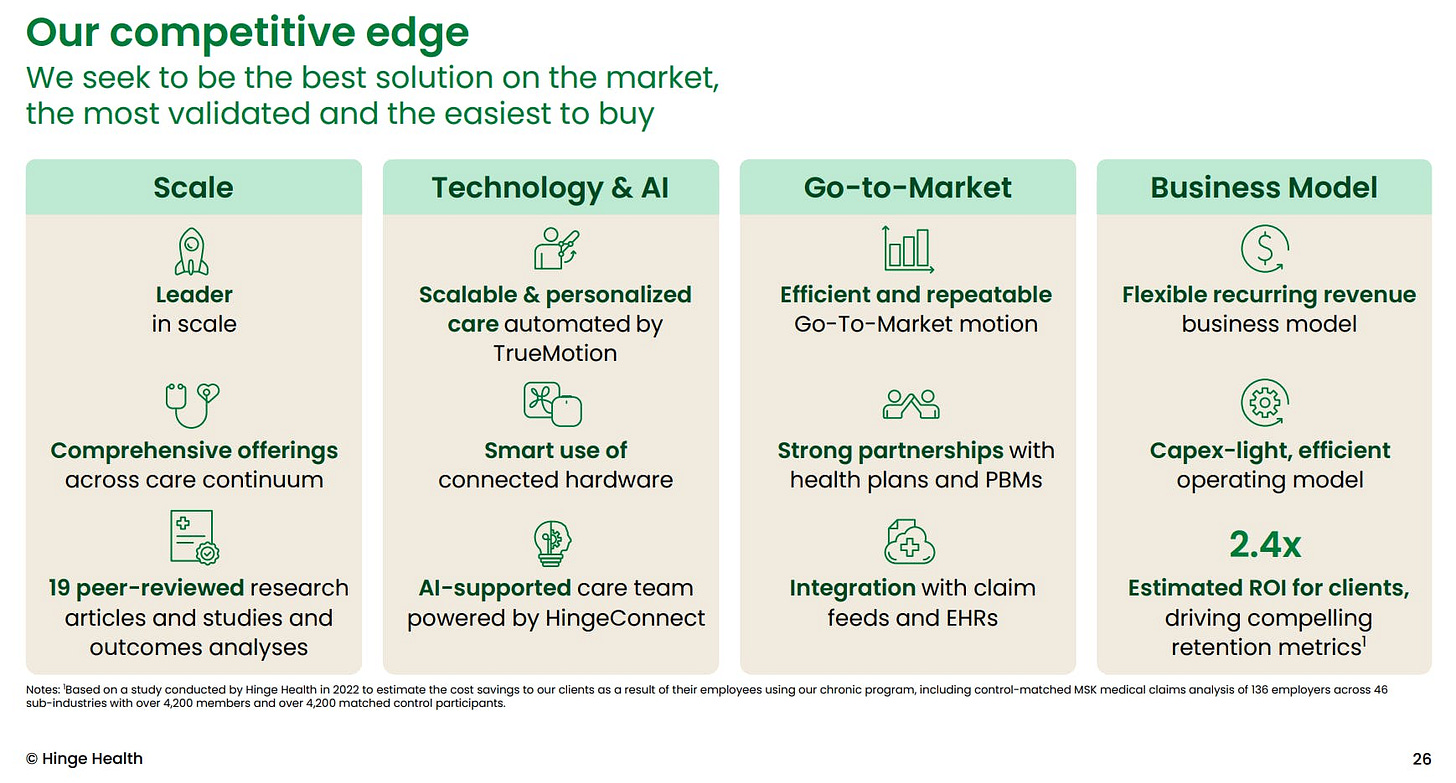

Moat

Hinge Health positions itself as a leading provider of digital therapy for chronic musculoskeletal disorders, with a clear competitive advantage in four key areas: scale, technology, market access, and business model.

Hinge Health is an industry leader in scalability. The company offers comprehensive solutions across the entire care pathway and bases its effectiveness on 19 peer-reviewed studies and outcome analyses. This scientific validation builds trust among customers and partners. Hinge Health also sets itself apart in terms of technology and AI. The platform uses AI-powered TrueMotion technology to enable personalized and scalable care. It also uses connected hardware solutions and the HingeConnect assistance system, which intelligently supports the care team and optimizes care. The go-to-market approach is efficient and easily replicable. Strong partnerships with health insurers and technical integration with billing systems and electronic health records make market access particularly effective.

Hinge Health's business model is flexible, growth-oriented, and resource-efficient: It is based on recurring revenue and a capital-efficient operating model. Customers benefit from a proven return on investment (ROI) of 2.4, which also ensures high customer loyalty. Hinge Health is not only medically and technologically strong, but also offers a commercially viable and scalable model, a combination that makes the company the best choice in the chronic musculoskeletal care market.

Financial Key Figures

Hinge Health is experiencing impressive growth and demonstrating its ability to scale at scale. The financial figures presented for the first quarter of 2025 demonstrate dynamic development in both billed services and revenue.

LTM billings (bills calculated for the last twelve months) grew from USD 329 million in fiscal year 2023 to USD 468 million in 2024, representing growth of 42%. The quarter-on-quarter increase is even more impressive: from USD 334 million in Q1 2024 to USD 507 million in Q1 2025, an increase of 52%. Revenue also showed a significant increase: Year-on-year, revenue increased from USD 293 million (FY 2023) to USD 390 million (FY 2024), an increase of 33%. On a quarterly basis, this represents a 50% increase, from USD 83 million (Q1 2024) to USD 124 million (Q1 2025).

Hinge Health is in a strong growth phase, with accelerating revenue and billing momentum, underscoring market confidence and the scalability of its business model.

Profitability and Operating Efficiency

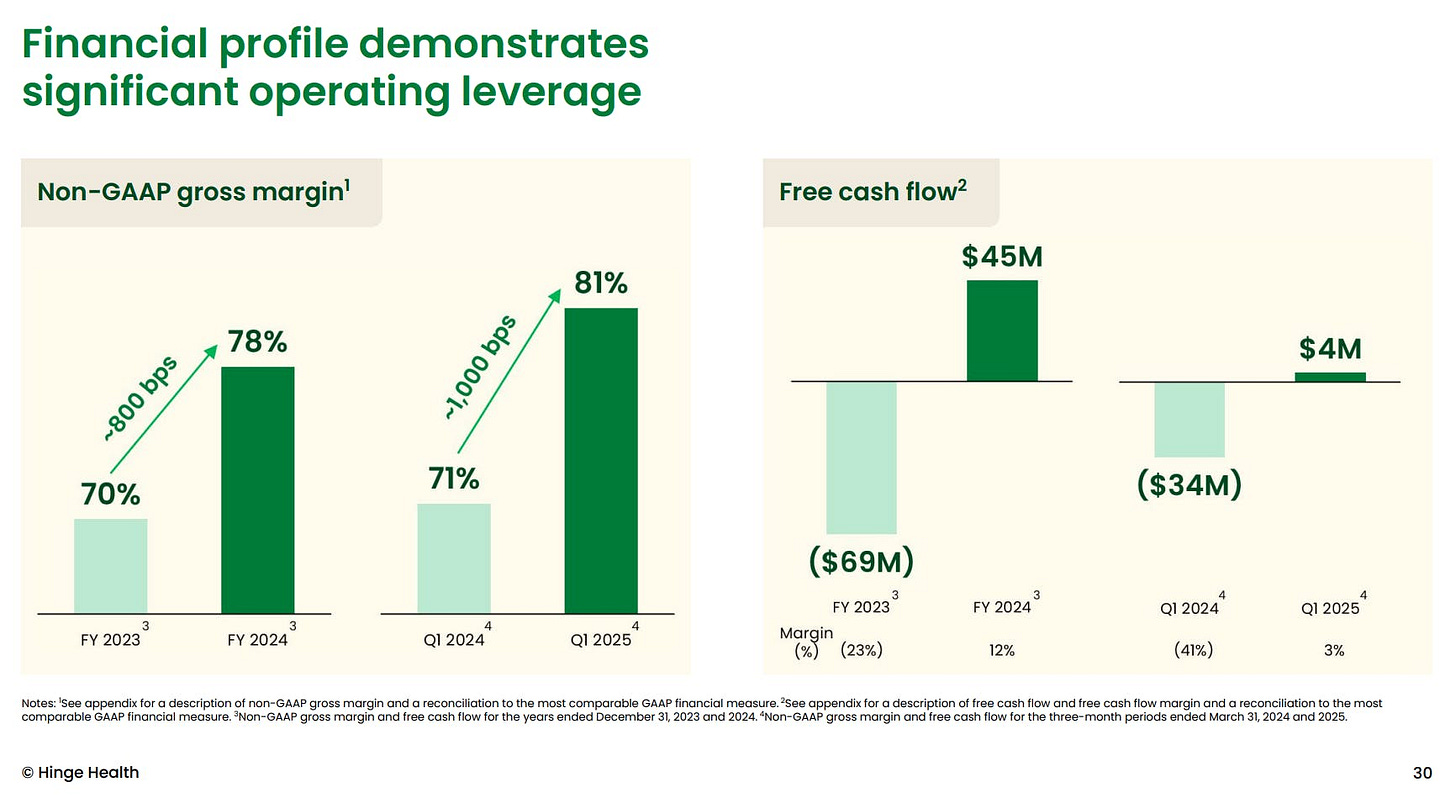

Hinge Health is also demonstrating strong financial performance, with clear improvements in profitability and operating efficiency. Current metrics demonstrate growing operating leverage and improved cash flow.

The non-GAAP gross margin improved significantly, rising from 70% in fiscal year 2023 to 78% in 2024, an increase of 800 basis points. The progress on a quarterly basis is even more significant, increasing from 71% in Q1 2024 to 81% in Q1 2025, an increase of 1,000 basis points, indicating an increasingly cost-efficient scaling of the business.

A significant turnaround was also achieved in free cash flow: While negative cash flow of USD -69 million was recorded in fiscal year 2023, the turnaround to USD +45 million was achieved in 2024, corresponding to a free cash flow margin of 12%. Quarter-on-quarter, cash flow improved from USD -34 million (Q1 2024) to USD +4 million (Q1 2025), a particularly strong performance given a previously negative margin of -41%.

Hinge Health is thus on a clear path to sustainable profitability, with sharply increasing margins and a shift into positive cash flow territory. These figures demonstrate that the company is not only growing but is also operating with increasing capital efficiency.

Technology Investments

Hinge Health is also significantly increasing its profitability through targeted technology investments, which is particularly reflected in the growing non-GAAP gross margin.

In fiscal year 2023, the non-GAAP gross margin was still at 70%. By 2024, it rose to 78%, and in the first quarter of 2025, it reached 81%, an impressive increase of 1,100 basis points. This improvement is a direct result of strategic technical optimizations within the company.

Four key measures are driving this success:

Switch to AI-based motion detection: Instead of tablets and wearables, Hinge Health now uses camera-based, AI-controlled motion capture, which is more affordable, scalable, and user-friendly.

Use of Generative AI (GenAI): New AI functions increase the efficiency of the care team through automated communication, evaluations, and suggestions for therapy adjustments.

Scalable care with drastically reduced staffing costs: Compared to traditional physical therapy, the need for human support has been reduced by around 95%, while maintaining the same high quality of care.

Optimization of hosting costs: Through increasing scaling, infrastructure costs per user were also significantly reduced.

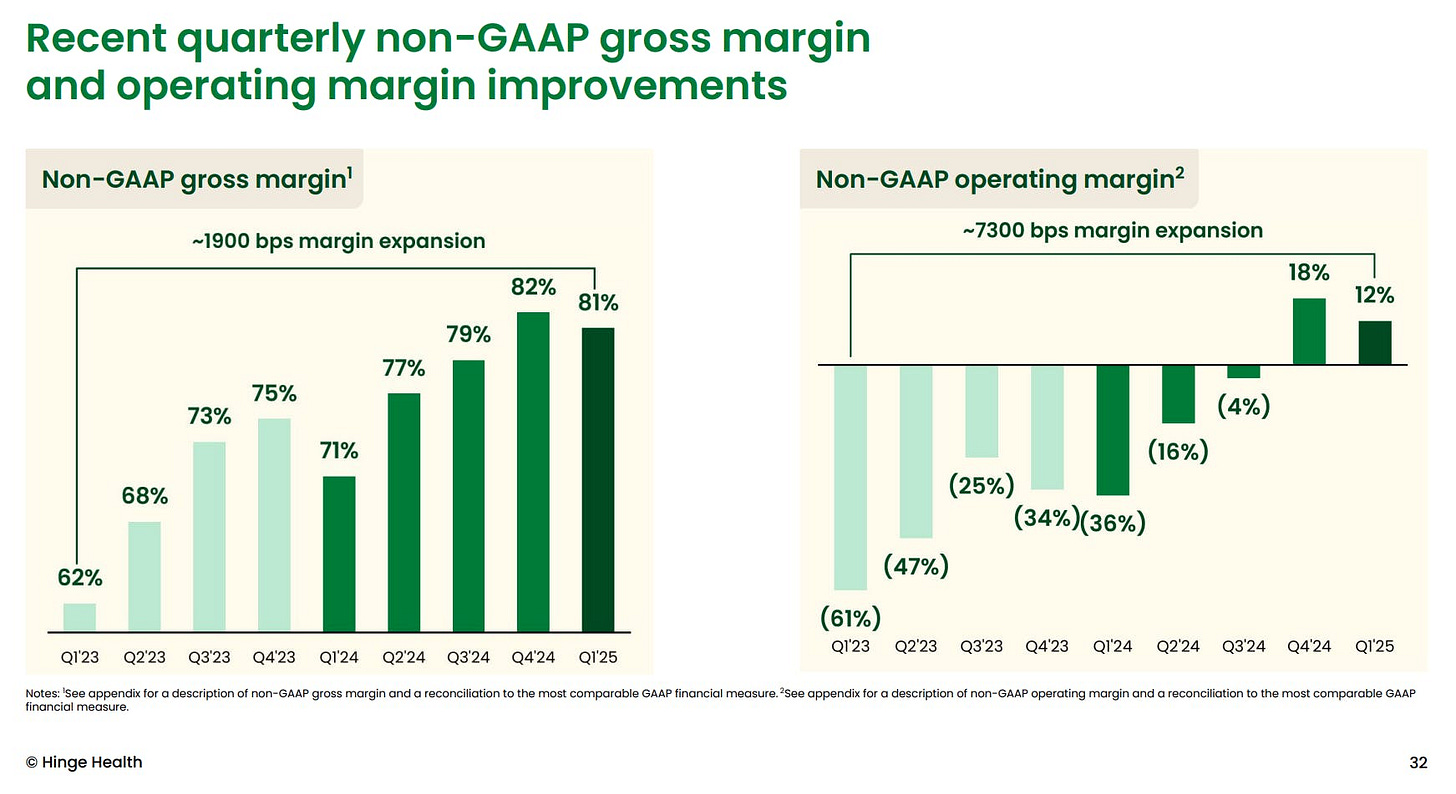

Gross Margin & Operating Margin

Hinge Health is showing exceptionally strong quarterly performance in both its gross margin and operating margin.

The non-GAAP gross margin has shown a consistent upward trend over eight quarters. From 62% in Q1 2023, the margin rose to 81% in Q1 2025, peaking at 82% in Q4 2024. This represents a margin increase of 1,900 basis points (bps). This increase clearly reflects the increasing efficiency and scalability of the business model. In parallel, the non-GAAP operating margin has also improved significantly. While it was still at -61% in Q1 2023, it reached a positive high of 18% in Q4 2024 and was at 12% in Q1 2025. Overall, this represents an impressive improvement of approximately 7,300 basis points.

This development underscores the company's growing operational leverage: Increased growth and scale not only lead to higher revenues but also to significantly improved profitability without proportionally increasing costs. Hinge Health is on a stable, scalable growth trajectory that is becoming increasingly profitable, a strong signal for investors, customers, and partners.

Operating Expenses

Hinge Health's operating expenses show a clear improvement in efficiency and a steady increase in the operating margin, a sign of increasing scale and cost control.

In the first quarter of 2023, total expenses amounted to 125% of revenue, broken down into:

57% Sales & Marketing (S&M)

42% Research & Development (R&D)

26% General & Administrative Expenses (G&A)

Accordingly, the operating margin was 68%.

However, over the course of the quarters, there was a significant decline in the total expense ratio to 70% in Q1 2025, resulting in a significantly improved operating margin of +11%. The decline in general & administrative expenses is particularly noticeable:

S&M share fell from 57% to 38%

G&A from 26% to just 14%

The R&D share was also reduced, while maintaining innovative strength.

The steady improvement in the operating margin across the quarters, from -68% in Q1 2023 to +18% in Q4 2024, demonstrates effective operating leverage. The company is not only growing in revenue but is also becoming more financially robust.

Hinge Health is managing its operating expenses more efficiently as the company grows. The declining cost shares for sales, development, and administration are strengthening profitability and making the business model scalable in the long term.

Outlook and Long-Term Goals

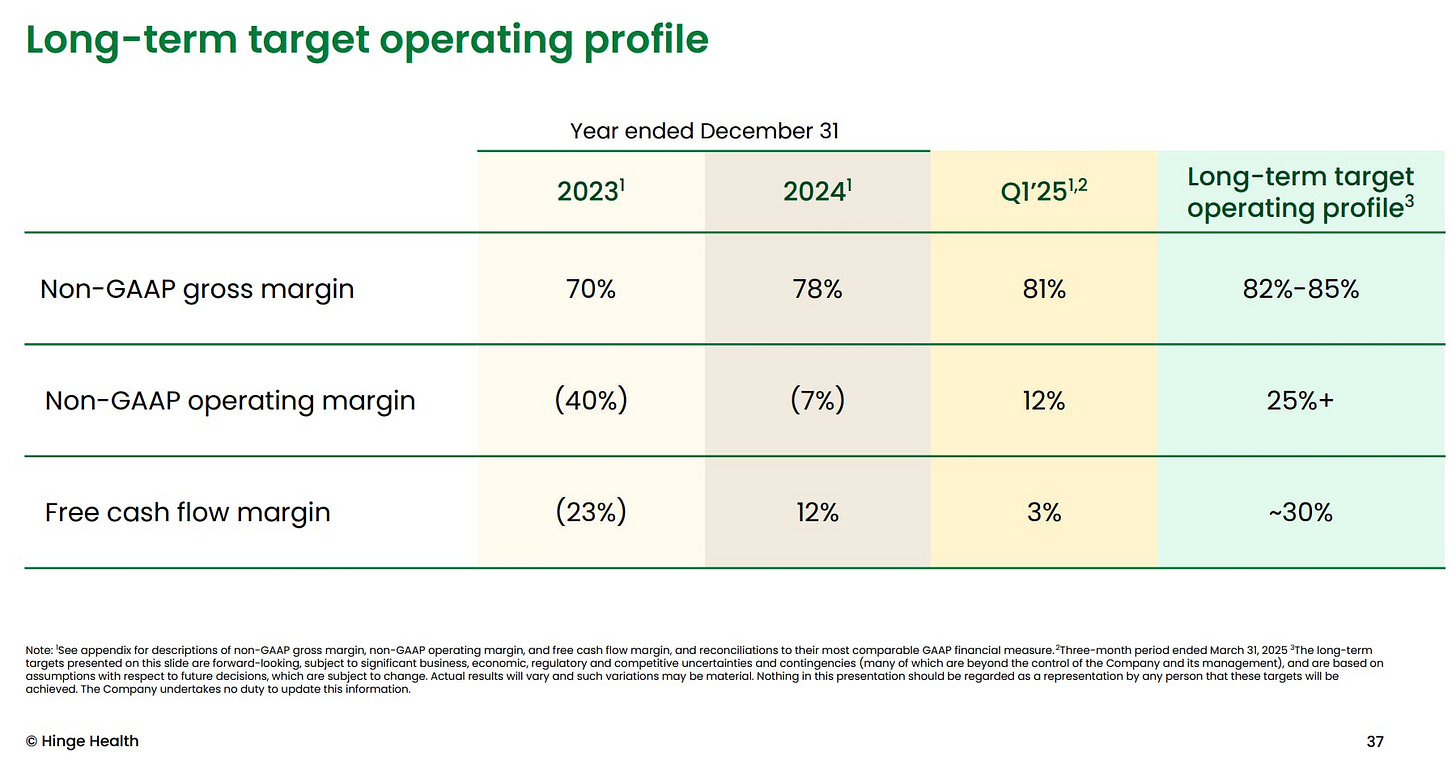

The non-GAAP gross margin increased from 70% in 2023 to 78% in 2024 and was already at 81% in Q1 2025. The long-term target is 82–85%, which appears well within reach given the company's performance to date.

The non-GAAP operating margin shows an even more impressive improvement:

In 2023, it was -40%, and in 2024, only -7%. In the first quarter of 2025, the company already reached profitability at +12%. In the long term, Hinge Health is targeting an operating margin of at least 25%.

A clear turnaround is also evident in free cash flow:

In 2023, it was still negative at -23%, in 2024, the margin was already +12%, and in Q1 2025, it was +3%. The long-term target is a free cash flow margin of around 30%, which indicates a very strong, cash-efficient business model.

Hinge Health is successfully transforming itself into a highly profitable company with a scalable model. Some of the targeted targets are already within reach, which creates confidence in the company's strategic direction and operational excellence.

Future Growth Potential

Hinge Health sees enormous future growth potential in existing and new markets, with access to a total of over 300 million potential customers. The company already serves approximately 20 million customers in its existing markets and over 2,300 enterprise customers.

But the addressable market is much larger: There are approximately 215 million customers in these markets, of which approximately 195 million are currently untapped, a so-called "whitespace" of over 90%. The largest share is attributable to the self-insured core markets in the corporate and public sectors. Further potential exists in additional markets such as:

Fully insured companies

Medicare Advantage

Federal Insurance Systems

These segments together comprise approximately 96 million customers:

In addition, there are significant expansion opportunities in still untapped areas:

Medicare

Medicaid

Other government health programs (e.g., Veterans Health)

International Markets

These new markets bring with them an additional potential of over 112 million customers.

Hinge Health has currently only tapped a small portion of its potential target market. Existing markets offer enormous expansion potential, and international and government healthcare programs open up additional opportunities for sustainable growth.

Tenbagger Potential

Although the current P/E ratio (20-23x) after profitability appears acceptable, the company must continue to deliver strong growth rates to justify this valuation. The high EV/EBITDA figures indicate that profitability on an EBITDA basis is not yet fully scaled.

Hinge Health demonstrates promising fundamentals with strong revenue growth, improved profitability, and a solid balance sheet. The company's ability to increase margins through technology investments is a positive indicator. If Hinge Health can successfully execute its growth strategy and achieve its long-term operating goals, particularly with regard to operating margins and free cash flow, then the company definitely has the potential to become a tenbagger.

Conclusion - What makes Hinge Health special?

Hinge Health's digital solutions enable an impressive time savings of around 95% in care compared to traditional physical therapy, thus offering a significantly higher scalability of the business model. It combines efficiency with a personal approach to patients, thus contributing to stronger patient loyalty. Designed entirely digitally and location-independently, the therapy options are not only cost-effective, as expensive treatments are avoided, but also ideally scalable for companies and insurance companies. Care is based on scientifically sound findings and aims for long-term impact. Supported by modern technology, care is automated: Individual treatment plans are created by an intelligent personalization engine, while a self-learning algorithm evolves with each data entry. Movement therapy is supported by AI-assisted motion detection, and the Enso device enables drug-free pain management. The scalable team of specialists is also efficiently supplemented by AI and software.

How do I proceed?

At this point, it's advisable to wait for the lock-up period to expire to avoid potential price fluctuations or sell-offs by early investors. However, after that, an initial, strategically placed position may be useful to benefit early from potential upside potential, assuming the fundamentals and market environment remain attractive.

Have you heard of Hinge Health before? What's your opinion of the company?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.

nice writeup. came across this stock looking for ai healthcare plays and this is solid research. Thank You.