Dear growth investors,

I added a new share to my portfolio yesterday: Cadeler, Ticker: CDLR; WKN: A2QG5D. Revenue and EBITDA are growing at over 100%. Is this company a buy?

Table of Contents

Overview

Business segments

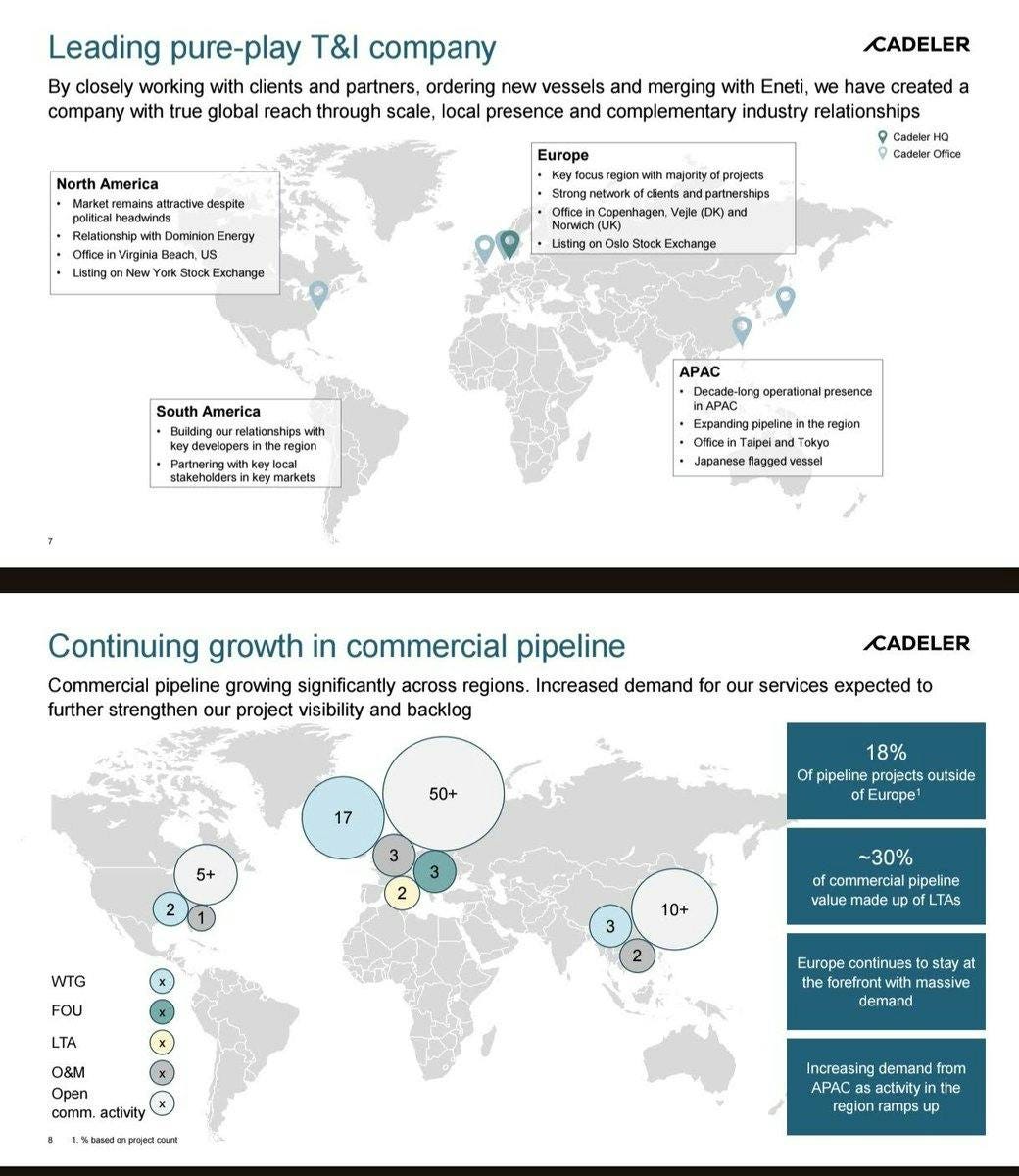

Geographical business activity

Operational Highlights 2024

Financials

Forecast for 2025

Growth and operational strength

Risks and competition

Valuation

Conclusion

Overview

Cadeler is a Danish company specializing in the installation, operation, and maintenance of offshore wind turbines. As a pure-play provider in the offshore wind sector, Cadeler focuses exclusively on this area. With state-of-the-art vessels, Cadeler assists in the construction of large offshore wind farms. This is a huge growth market, as the energy transition in Europe is gaining momentum. Offshore wind is a central pillar of many countries' climate strategies. Cadeler is benefiting from record orders and full order books well into the 2030s.

Business segments

Cadeler operates primarily in two business areas:

Offshore wind turbine installation: Transport and installation of wind turbines at sea.

Foundation installation: Transport and installation of foundations for offshore wind turbines.

Cadeler also offers operations and maintenance (O&M) services for offshore wind farms.

This means that Cadeler does not build turbines or manufacture components for them, but specializes in pure transport and installation services.

Geographical business activity

Europe is the leader in offshore wind farms. Cadeler's main business is therefore located there. However, the company also offers its services in Asia and the USA. These regions offer significant growth potential for offshore wind farms.

Operational Highlights 2024

In 2024, Cadeler recorded significant operational progress:

Fleet expansion: Through the integration of Eneti, the vessels Wind Scylla and Wind Zaratan were added to the fleet. Furthermore, Wind Peak began operations in Q4 2024.

Major projects:

Moray West (Scotland): Successful installation of 60 turbines, each with a capacity of 14.7 MW.

Yunlin (Taiwan): Completion of installation of 46 turbines.

Revolution Wind (USA): Ongoing installation work.

Gode Wind 3 / Borkum Riffgrund 3 (Germany): Continuation of project work. Utilization: Despite planned maintenance work and crane upgrades, fleet utilization remained at 66%.

Financials

Cadeler recorded a strong financial performance in the fourth quarter of 2024:

Revenue: €85.95 million

EBITDA: €55.74 million

Net profit: €37.25 million

FY 2024:

Revenue: €248 million

EBITDA: €126 million

Net profit: €65 million

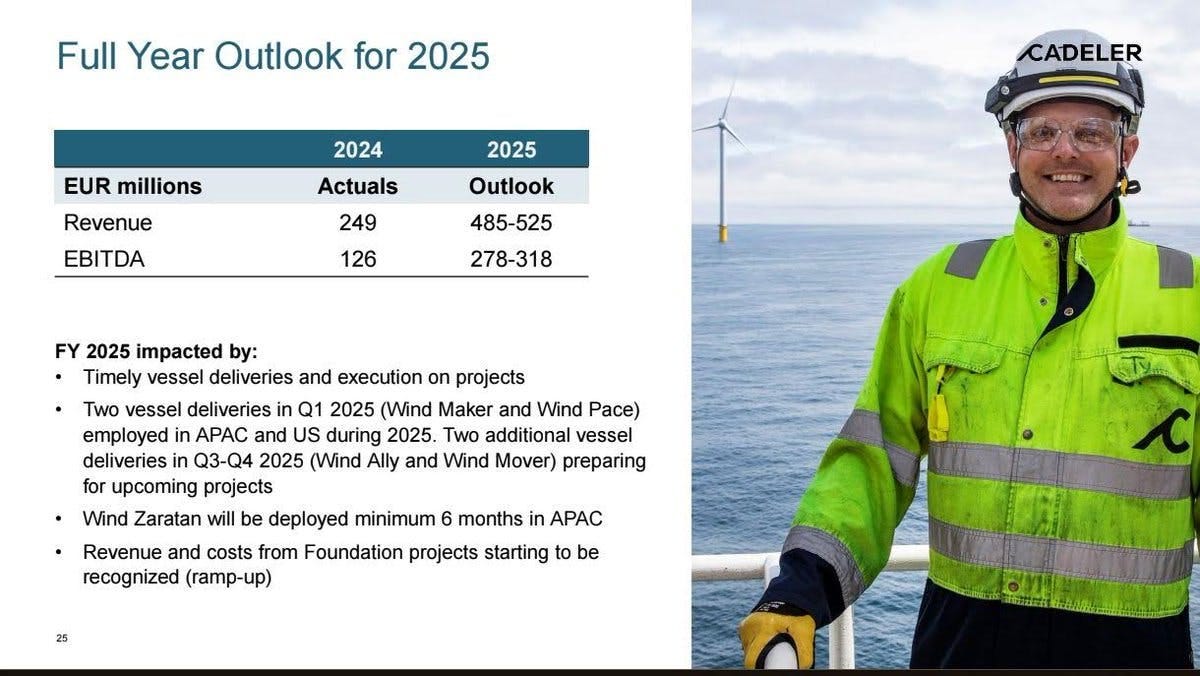

Forecast for 2025

Cadeler expects further growth for 2025:

Revenue: Between €485 million and €525 million

EBITDA: Between €278 million and €318 million

This forecast is based on the strong order situation and expanded fleet capacity.

Growth and operational strength

Order backlog: As of March 2025, the order backlog reached a record high of €2.5 billion, including all contractual options.

Strategic contracts: Cadeler secured significant projects, including:

East Anglia Two (UK): Installation of 64 15 MW turbines and their foundations.

Inch Cape Offshore Ltd.: Installation of 72 15 MW turbines, with commissioning starting in 2026.

Risks and competition

Risks:

Operational delays: Possible delays in vessel modernizations or project implementation.

Market dynamics: Fluctuations in demand for offshore wind installations and regulatory changes.

Valuation

Revenue growth:

2022: €106.4 million (+74% compared to 2021)

2023: €109 million (+2% compared to 2022)

2024: €249 million (+100% compared to 2023)

2025 (forecast): €485–525 million (+100% compared to 2024)

EBITDA growth:

2022: €63.9 million (+129% compared to 2021)

2023: €50 million (-22% compared to 2022)

2024 (forecast): €126 million (+100% compared to 2023)

2025 (forecast): €278–318 million (+~140% compared to 2024)

Based on Based on a DCF model, Cadeler currently appears significantly undervalued. The current market price of approximately €4.23 is significantly below the calculated intrinsic value of approximately €20.08. This indicates a potential upside of over 350% by 2030.

Conclusion

Cadeler has established itself as a leading provider in the offshore wind installation sector in 2024. Cadeler is showing strong growth, with revenue and EBITDA doubling in 2025. The strategic fleet expansion and a record-high order backlog of over €2.5 billion position the company well for further growth. With a forecast EBITDA margin of 59% in 2025 and an expected increase to 70% by 2027, Cadeler offers attractive prospects for investors.

Have you heard of Cadeler before? What's your opinion of the company?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.

It's important to mention here that Cadeler has a considerable amount of debt to finance the purchase of their new vessels, that's in part why it's cheap. Once they pay back their debt, I expect the price will be way higher than now.

Exactly thanks for mentioning