Oscar Health: The insurance disruptor with 5-10x potential?

Oscar Health is an innovative US-based health insurer that combines modern technology with a clear focus on user-friendliness.

Dear growth investors,

Oscar Health (Ticker: OSCR) has recently attracted considerable market attention, not only for its ambitious vision to transform the complex health insurance landscape, but also for a decisive turnaround in its financial performance. However, the company generates 97% of its revenue through the Affordable Care Act (ACA). This Act is at risk of subsidy cuts at the end of 2025 and could significantly shrink Oscar's addressable market. But there is one aspect that could potentially multiply the stock: through the Individual Coverage Health Reimbursement Arrangement (ICHRA), a relatively new (2020) insurance model.

Table of Contents

The US Healthcare System

Oscar Health - Overview

Management

Business Model

Market Opportunity (ACA & ICHRA)

Financial Indicators

Valuation and Long-Term Outlook

Opportunities and Threats

Conclusion

Oscar's share price has shown a very volatile development since 2021. Immediately after its IPO, the share initially recorded significant losses and fell sharply, falling by more than 90% from its peak by the end of 2022.

However, from the beginning of 2023 onwards, a trend reversal became apparent: The share price began to gradually recover, accompanied by improved fundamentals and stronger operating performance. This positive momentum continued in 2024, supported by rising revenues, first-time profits, and the growth of the +Oscar technology platform.

Despite the noticeable recovery, the share price still remains around 59% below its original price level. The chart thus reflects the high volatility and the initial strong doubts the market had about Oscar's business model, but also the confidence that has been rebuilt over the past two years through operational progress.

In the following analysis, I will examine whether the share is a buy.

The US healthcare system

The American healthcare system is based on a mix of private and public insurance. There is no centralized government health insurance system for all citizens.

Government programs include Medicare, Medicaid, and Tricare.

Medicare is a federal health insurance program established in 1966. It primarily serves Americans age 65 and older, but also covers younger people suffering from end-stage renal disease, ALS, or certain other serious disabilities.

Medicaid is a joint federal and state program that provides financial relief to low-income people by covering their healthcare costs. It also includes services not typically covered by Medicare, such as home health care or personal support services.

Tricare, a program that provides healthcare for military personnel and their families, was also established in 1966. To this day, it remains, alongside Medicare and Medicaid, one of the pillars of the US healthcare system.

In 2010, President Obama initiated a far-reaching reform of the US healthcare system with the Affordable Care Act (ACA), known as "Obamacare." The law essentially requires everyone to have health insurance and provides financial subsidies for low-income people, which are offset by contributions from high-income families and healthcare providers. Key elements include newly created online marketplaces where citizens can select their policies, as well as a ban on insurers rejecting applicants due to pre-existing conditions or charging them surcharges. As a result, the ACA marketplace has become a mainstay of the American health insurance landscape, an area in which Oscar is also active.

The rest of the population only has the option of purchasing private health insurance, either through their employer or on an individual basis.

Private Health Insurance Through Employer

The majority of Americans are covered by private health insurance through their employer. These are usually group plans whose costs are shared between employer and employee. Employees often pay monthly premiums and cover co-payments for doctor visits or deductibles for certain treatments. A key disadvantage of this type of insurance is its strong connection to the workplace: If a person loses their job, insurance coverage often ends as well. Those affected are then left without protection against the extremely high costs of treatment, which is unaffordable for many and often leads to personal bankruptcy.

The Individual Coverage Health Reimbursement Arrangement (ICHRA) is a relatively new model introduced in 2020. It allows employers to provide their employees with tax-free subsidies, which they can use to purchase health insurance on the open market, for example, through the ACA marketplaces. Instead of offering a standard group insurance plan for all employees, ICHRA gives insured individuals more freedom to choose their individual plan. At the same time, employers retain full control over their healthcare budget. This model is particularly attractive for small and medium-sized businesses, as well as for employers who no longer want to provide traditional group insurance but still want to make a financial contribution.

Private Health Insurance for the Self-Employed

Self-employed individuals and anyone without access to employer-sponsored health insurance are often forced to purchase private insurance. They face several hurdles in doing so: Private policies in the US are usually very expensive and come with high deductibles, meaning even those with insurance often struggle to pay their medical bills. Many people simply cannot afford these high premiums or are denied coverage due to pre-existing conditions. The result: Some remain completely uninsured, while others are insured but still struggle with high out-of-pocket costs, which can lead to financial strain or even personal bankruptcy. In addition, a large portion of insurance policies come from for-profit private providers. These are focused on keeping their expenses as low as possible and maximizing profits, which can negatively impact the quality and accessibility of medical care.

Out-of-Pocket Payment

Those without insurance must cover all medical costs themselves. This can lead to enormous financial burdens, especially in cases of serious illness, and can also result in personal bankruptcy.

Problems of the US Healthcare System

In the United States, the government intervenes only to a very limited extent in healthcare, instead, the market is heavily dominated by commercial interests. This leads to a number of problems:

Private health insurers offer extremely diverse benefit packages. Cheaper plans often cover only a portion of necessary treatments, which is why many Americans are inadequately insured. Some even forgo insurance altogether.

In addition, doctors and hospitals are legally obligated to treat emergencies, even for uninsured patients. However, patients usually have to cover the resulting costs themselves, which can quickly lead to enormous debt. Unpaid medical bills and hospital stays are among the most common reasons for personal bankruptcy in the United States.

Another factor exacerbating the situation is the extremely high cost of health insurance, caused, among other things, by rising drug prices.

In short, while many industrialized countries offer a unified, government-organized healthcare system, the US system is based on a fragmented model that combines heavily employer-based insurance plans, individually purchased policies, government-subsidized programs, and direct out-of-pocket payments.

Financially, the US invests nearly 18% of its gross domestic product in healthcare, the highest figure in the world and well above the OECD average of around 8.8%. Annual expenditures per citizen amount to over $12,500, with the majority covered by insurance premiums and government subsidies for programs such as Medicare and Medicaid. Direct out-of-pocket contributions by insured individuals also play a role, but are somewhat less significant overall. The main reasons for these extremely high expenditures include high drug prices, a complex and costly billing system, and generally expensive inpatient care.

The US federal structure also complicates reforms, as new laws regularly encounter strong political resistance. As a result, the healthcare system remains highly fragmented. Concepts such as "Medicare for All," which aim for a uniform solution, are repeatedly discussed but often fail due to resistance from private insurers and political groups. Oscar positions itself precisely at this intersection: The company combines traditional ACA-based models with flexible approaches such as ICHRA, enabling people to tailor their insurance coverage more individually and independently.

Percentage of US citizens in the insurance categories

In 2023, according to the U.S. Census Bureau's Current Population Reports P60-284 "Health Insurance Coverage in the United States: 2023," published in September 2024, 92 percent of the US population had health insurance during the year, while around 8 percent, or approximately 26 million people, remained uninsured throughout the year.

Private policies accounted for the majority, covering 65.4 percent of the population: More than half of all Americans (53.7 percent) were covered by employer-sponsored group insurance, while another 10.2 percent were independently insured, mostly through the ACA marketplaces, whose share increased by 0.3 percentage points compared to the previous year. In addition, 2.6 percent were military personnel and their families who received benefits through Tricare. At the same time, public programs covered a total of 36.3 percent of the population. The largest pillars were Medicare and Medicaid, each accounting for 18.9 percent, with Medicare seeing a slight increase of 0.2 points, primarily due to demographic aging. Special veterans' benefits accounted for an additional 1 percent. Since many people have both private and public coverage (e.g., Medicare + employer plan), the individual figures add up to more than 100 percent.

Interpretation of the Study

The distribution first highlights how employer-centric the US system continues to be. More than half of all Americans are still covered by a group policy from their employer. This not only underscores the importance of employment for insurance coverage, but also explains why job losses in the US often immediately lead to insurance gaps. Despite a historically low uninsured rate of 8%, structural weaknesses remain: Those without a stable job continue to face the highest risk of being dropped out. At the same time, cost pressures in the public sector are increasing due to the aging population. The data therefore suggest that reforms that, on the one hand, strengthen the marketplace (e.g., permanent ACA subsidies) and, on the other hand, expand flexible employer-independent models such as ICHRA could make the system more resilient. This is where Oscar comes in.

Oscar Health - Overview

Oscar is an insurance company built on a fully integrated technology platform. Since its founding in 2012, Oscar has continually challenged the existing healthcare system with the goal of making it more accessible and affordable for everyone.

The company offers insurance plans for individuals and families and also develops digital health solutions available under the +Oscar brand. The +Oscar digital platform is aimed at health insurers and healthcare providers who want to streamline and digitize their own processes. By licensing +Oscar, regional insurers can benefit from Oscar's digital technology by implementing new digital products and simultaneously saving costs. The platform enables them to become more competitive while reducing administrative overhead. +Oscar is therefore a SaaS (Software-as-a-Service) platform. Just like with traditional SaaS models, Oscar provides a cloud-based, scalable technology platform that other companies can use for a license fee.

Some key figures illustrate Oscar's size and dynamism: In 2024, the company generated total revenue of $9.2 billion, and Oscar plans are now available in 18 US states (as of December 2024). The medical loss ratio, i.e., the proportion of premium income used directly for medical services, was 81.7% in 2024. The company now has approximately 2 million members (as of March 31, 2025).

Oscar views the ACA market as a particularly high-growth and sustainable market. As one of the largest providers in the ACA market, Oscar aims to benefit from this growth. The ACA market grew by approximately 79% overall between 2021 and 2024. Furthermore, the cost trend in the ACA market is approximately 26% lower than for traditional, employer-based health insurance, a key advantage that makes this segment more attractive.

Oscar has identified a core problem in the traditional US healthcare system: a lack of transparency and competitive pressure. This results in poor patient outcomes, limited universal access, high costs, little consumer focus, and often negative patient experiences, such as complex billing and unpredictable pricing.

This is reflected in the fact that American households now spend a median of 11.6% of their income on premiums and deductibles for employer-based health insurance plans. Nearly half of insured adults (48%) are concerned about whether they will even be able to afford their monthly insurance premiums in the future.

Oscar's offerings clearly differentiate themselves from traditional US health insurers, primarily through its consistently digital, customer-centric approach, which removes traditional hurdles in the healthcare system and significantly improves the user experience. Instead of complex forms and difficult-to-understand policies, Oscar relies on a self-explanatory app and web interface that provide members with clear information about costs, benefits, and network physicians right from the start when selecting a plan. This level of price and benefit confidentiality creates transparency that is often lacking in the traditional system and ensures that policyholders can make informed decisions.

Management

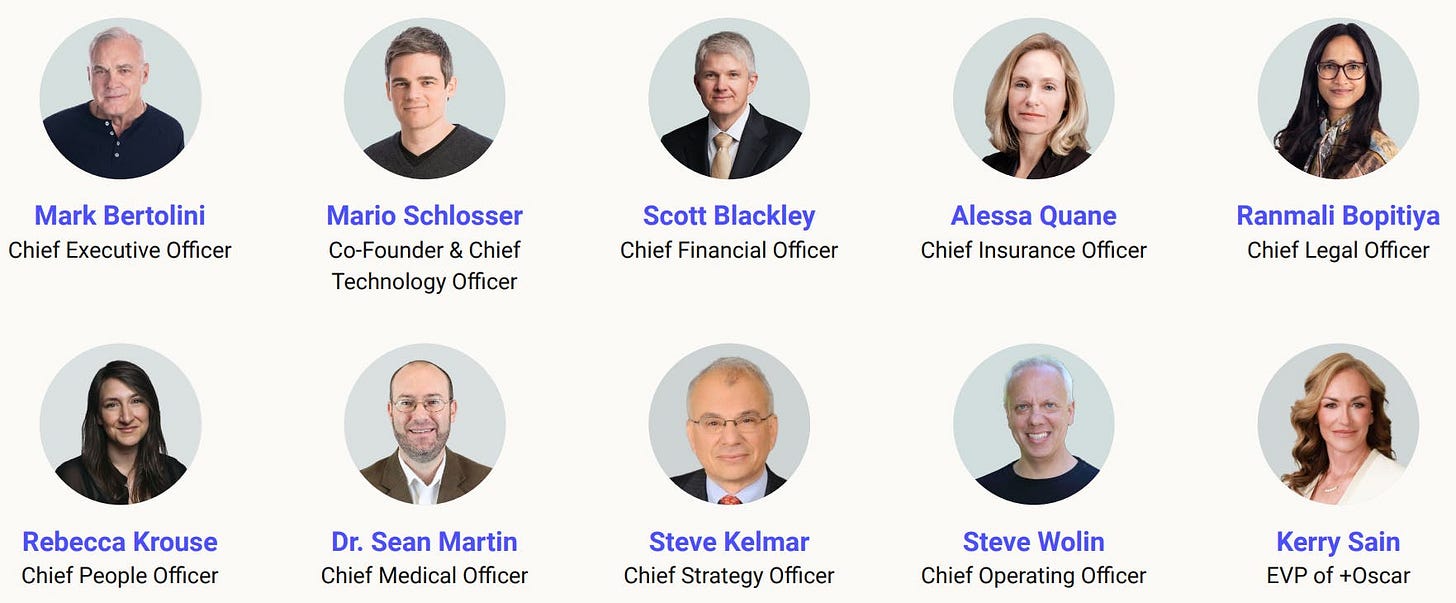

Oscar's management team includes several well-known personalities.

Joshua Kushner is co-founder, vice chairman, and a member of the board of directors. He has held this role since October 2012. Kushner is also the founder and CEO of Thrive Capital Management, a New York-based venture capital firm. Joshua Kushner is the brother of Jared Kushner, who is married to Ivanka Trump, the daughter of U.S. President Donald Trump.

Mario Schlosser is also co-founder and President of Technology and a director at Oscar. In his role, he leads product development, particularly with a focus on +Oscar's future-oriented technology platform. Mario was previously CEO of Oscar and led the company from inception to reaching over one million members across individual and family insurance, Medicare Advantage, and small group plans.

“We founded Oscar to create a health insurance company that acts like a doctor in the family.”

Before co-founding Oscar, Mario built the largest social gaming company in Latin America, where he was responsible for analytics and game design processes. Previously, he worked as a Senior Investment Associate at the hedge fund Bridgewater Associates and as a consultant at McKinsey & Company in Europe, the US, and Brazil.

Mark Bertolini is now CEO and Director of Oscar. Bertolini was previously Co-CEO of Bridgewater Associates, one of the world's largest hedge funds. He is best known as the former Chairman and CEO of the major health insurer Aetna. He assumed the role of CEO at Aetna in 2010 and also became Chairman in 2011. He left Aetna in November 2018 after CVS Health Corporation acquired the company for approximately $69 billion.

Mark Bertolini was a guest on CNBC's "Squawk Box" in December 2024, where he discussed key issues facing the health insurance industry. During the discussion, Bertolini also emphasized the significant potential of artificial intelligence (AI) in healthcare. In particular, he highlighted how AI could help better control problems such as fraud, waste, and abuse under the Affordable Care Act (ACA). Modern technologies could make processes more efficient and significantly reduce costs.

At the same time, Bertolini expressed understanding that profit-oriented management is necessary in the insurance business, but also pointed to growing public dissatisfaction, particularly due to the expected double-digit increase in insurance premiums in 2025 for supplemental insurance and policies for smaller companies. He also predicted that employer-sponsored health insurance would decline in importance as companies increasingly struggle to cover rising premiums. This could lead to more and more insured people opting for individual marketplace offerings, an area in which Oscar considers itself particularly well positioned.

Business Model

How does Oscar Health make money?

Oscar earns the majority of its revenue from ACA insurance premiums. When someone purchases insurance through the government marketplace, the monthly premiums initially go entirely to Oscar. A portion is then passed on to reinsurers, and the remainder remains as income on the balance sheet. There is also an equalization system: If Oscar has a particularly high number of sick insured members, the company receives additional payments from the government. If, on the other hand, it has more healthy members than average, it has to pay itself. This equalization, called "Risk Adjustment Revenue," can significantly impact profits.

A growing revenue driver is the SaaS platform division +Oscar: External partners license the entire tech stack, from digital enrollment to the telecare app, for ongoing usage fees. According to the investor presentation from March 2025, these SaaS revenues increased by 47 percent in 2024, with a gross margin of over 60 percent. Target customers are hospitals with their own health plans, regional insurers, accountable care organizations, and, especially important in the future, employers or third-party administrators rolling out ICHRA grants. Partners pay a setup fee for implementation and subsequent ongoing license or transaction fees, usually on a per-member-per-month basis.

Oscar is continuously expanding its ICHRA ecosystem through a broad network of platform partners to position itself as the preferred insurance provider for employer-sponsored individual plans. At its core is a "platform ecosystem" that brings together renowned ICHRA partners such as Benefitbay, Thatch, StretchDollar, Zizzl Health, Take Command, Liferaft, Remodel Health, Venteur, SureCo, and Zorro. These partners address two core segments: small businesses with fewer than 50 employees and medium-sized companies with up to 1,000 employees. For employees, these offerings mean more plan choices, better user experiences, and lower out-of-pocket costs, for employers, they offer a predictable, contribution-defined cost structure.

Technology platform

Oscar's business model is built on a technology platform designed to simplify and streamline the entire insurance process. The company's mobile app and website enable digital doctor visits, 24/7 telemedicine, rapid price comparisons, and on-demand support. The company also assigns members to concierge service teams who help coordinate treatment and answer questions to improve customer satisfaction and health outcomes. This strong focus on user-friendly digital interfaces aims to make complex healthcare processes as simple and understandable as possible for policyholders. Every member interaction feeds into Oscar's underwriting models in real time. This data is then used to reduce the medical loss ratio (MLR), direct members to cost-effective medical facilities, and automate provider administration. This proactive use of data allows Oscar to make adjustments before alternative choices could result in a loss.

Artificial intelligence also plays an important role in this. Oscar uses AI extensively to increase operational efficiency. AI is used to improve claims settlement, call center efficiency, and member retention.

With its comprehensive services, Oscar strategically positions itself at the intersection of individual health insurance (ACA), innovative insurance models such as the ICHRA, and the +Oscar technology platform. The company leverages its deep expertise in the ACA marketplace, whose potential market size was approximately 21 million consumers in 2024. Oscar also targets the significant small and medium-sized business market, whose potential target audience comprised approximately 75 million employees in 2024.

Net Promoter Score (NPS)

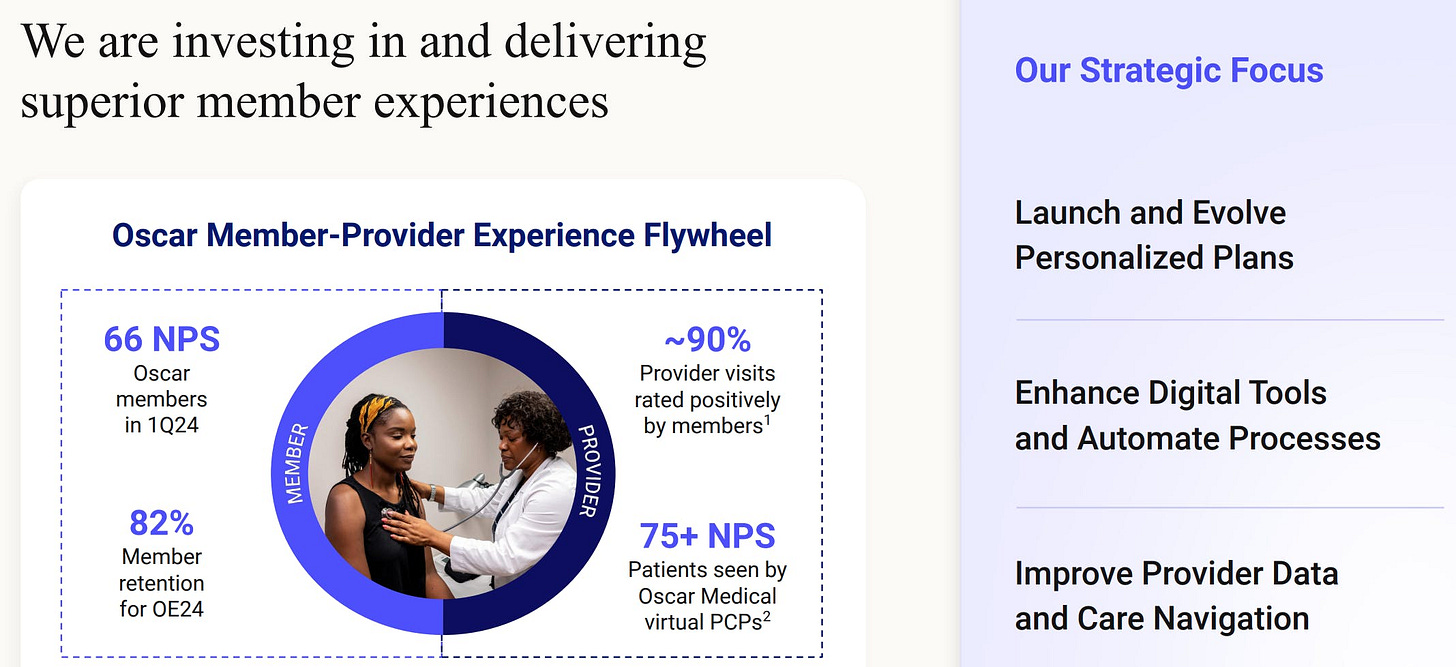

A central component of Oscar's strategy is to make the individual insurance market accessible to more consumers. The company therefore focuses intensively on creating a customer-centric brand and excellent customer experience, which is reflected in an industry-leading customer satisfaction rating (Net Promoter Score - NPS).

To support these ambitious goals and fundamentally transform the insurance industry, Oscar is committed to the widespread adoption of innovative technologies. As early as April 2024, Oscar was serving around two million policyholders via its proprietary technology platform +Oscar. This clearly demonstrates the company's commitment to actively driving digital transformation in healthcare.

Oscar stands out in particular for its exceptional customer loyalty, outstanding member experiences, and technology-driven growth. In the fourth quarter of 2023, approximately 68% of members seeking medical care actively used Oscar's digital tools to search for suitable physicians and providers. Engagement among members with chronic conditions is particularly noteworthy: a full 77% actively interacted with Oscar's care teams during the same quarter.

As mentioned, the positive customer experience is also reflected in exceptionally high customer satisfaction. In the first quarter of 2024, Oscar achieved an industry-leading Net Promoter Score (NPS) of 66 points, a clear sign of above-average member satisfaction and loyalty. Furthermore, approximately 90% of doctor visits were rated positively by members, underscoring the high quality of care. For patients cared for by Oscar's virtual primary care physicians (PCPs), the NPS even exceeded 75 points.

This growth clearly demonstrates Oscar's success: The company achieved a compound annual growth rate (CAGR) of 37% in memberships from 2021 to 2023. In addition, the Medical Loss Ratio (MLR) improved by 7 percentage points during the same period, demonstrating a significant increase in efficiency in medical spending. At the same time, Oscar managed to reduce its SG&A (Selling, General & Administrative Expenses) ratio by 11 percentage points, further demonstrating the company's increased operational efficiency and cost discipline.

Oscar is pursuing a clear strategic direction: the introduction and further development of personalized insurance plans, the improvement of digital tools and the automation of processes are just as important as the expansion of high-quality and up-to-date provider data and optimized navigation through the care system. All of these measures are aimed at continuously improving the member experience and positioning Oscar as a customer-centric technology leader in healthcare. The combination of a superior customer experience (high NPS, low customer acquisition costs, high customer retention) and intensive communication between patients and care teams creates a powerful, self-reinforcing cycle: satisfied members stay and recommend new members.

Market Opportunity (ACA & ICHRA)

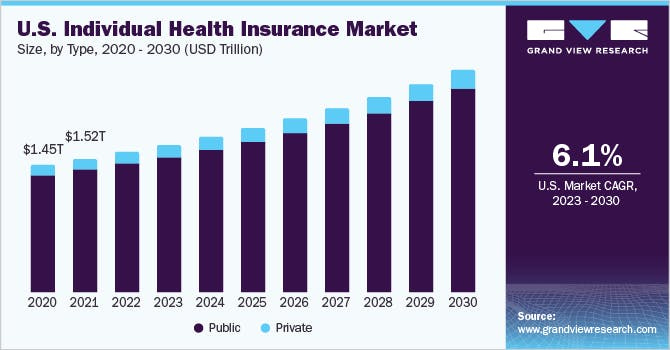

The starting point is a total market of approximately $1.45 trillion in 2020. In 2021, the volume climbed slightly to approximately $1.52 trillion, an initial indication that the pandemic-related boom surrounding Medicaid expansions and ACA subsidies was quickly translated into higher premium income.

A steady, almost linear growth path emerges throughout the decade: Annual growth increases year after year, with the public segment clearly dominating. Only from 2025 onward does the private segment become visibly broader, indicating growing interest in unsubsidized or employer-sponsored individual policies. By 2030, the market volume is expected to increase to well over two trillion US dollars. The compound annual growth rate (CAGR) is 6.1 percent for the period 2023 to 2030, a solid, if not explosive, momentum that nonetheless points to regulatory stability and continued cost dynamics in the US healthcare system.

For market participants like Oscar, this projection means two things: First, it underscores that the public ACA market continues to provide the bulk, any extension of the currently increased premium subsidies will further support the public segment. On the other hand, the growing private segment signals that the private individual market is opening up opportunities for innovative models such as ICHRA-based employer insurance or digital direct insurance.

Let's take a closer look at the forecasts:

The US market for individual insurance is growing dynamically. In 2021, the traditional insurance market had approximately twelve million insured people, almost exclusively in traditional ACA plans. By 2024, the number of insured people had already risen to approximately 22 million. The traditional ACA segment still dominates, but a new segment is emerging for the first time: the ICHRA business.

Two scenarios are outlined for 2027. Without an extension of the currently increased ACA subsidies, the market would climb to approximately 24 million people, with ICHRA accounting for a noticeably larger share than in 2024. If, however, the subsidies continue indefinitely, the potential number jumps to approximately 31 million insured people, an increase of almost 30 percent compared to the baseline scenario.

The growth of the traditional insurance market is primarily driven by three factors:

Medicaid reassessments: Around one-third of people who lose their Medicaid eligibility could in the future be eligible for tax breaks to support ACA insurance premiums.

Expansion of the gig economy: The rapid growth of the gig economy, with approximately 58 million independent workers in the US, is increasing demand for individual insurance solutions, as many of these self-employed individuals cannot rely on traditional employer-sponsored health insurance.

In the gig economy, people typically work as self-employed individuals or freelance contractors, undertaking individual assignments for various clients or platforms. Typical examples include drivers for Uber or Lyft, food delivery drivers, freelancers in IT, graphic design, or marketing, as well as individuals who offer services through platforms such as Upwork or Fiverr. The advantage for workers often lies in flexibility: They can decide when and where they work. At the same time, however, the gig economy also entails risks, as social security benefits such as health insurance, pension contributions, or protection against dismissal are generally lacking.

Distribution of the ICHRA model among employers: The ICHRA insurance model is also growing rapidly and was already introduced to 171% more employees between 2022 and 2023. This development also supports growth in the individual insurance segment.

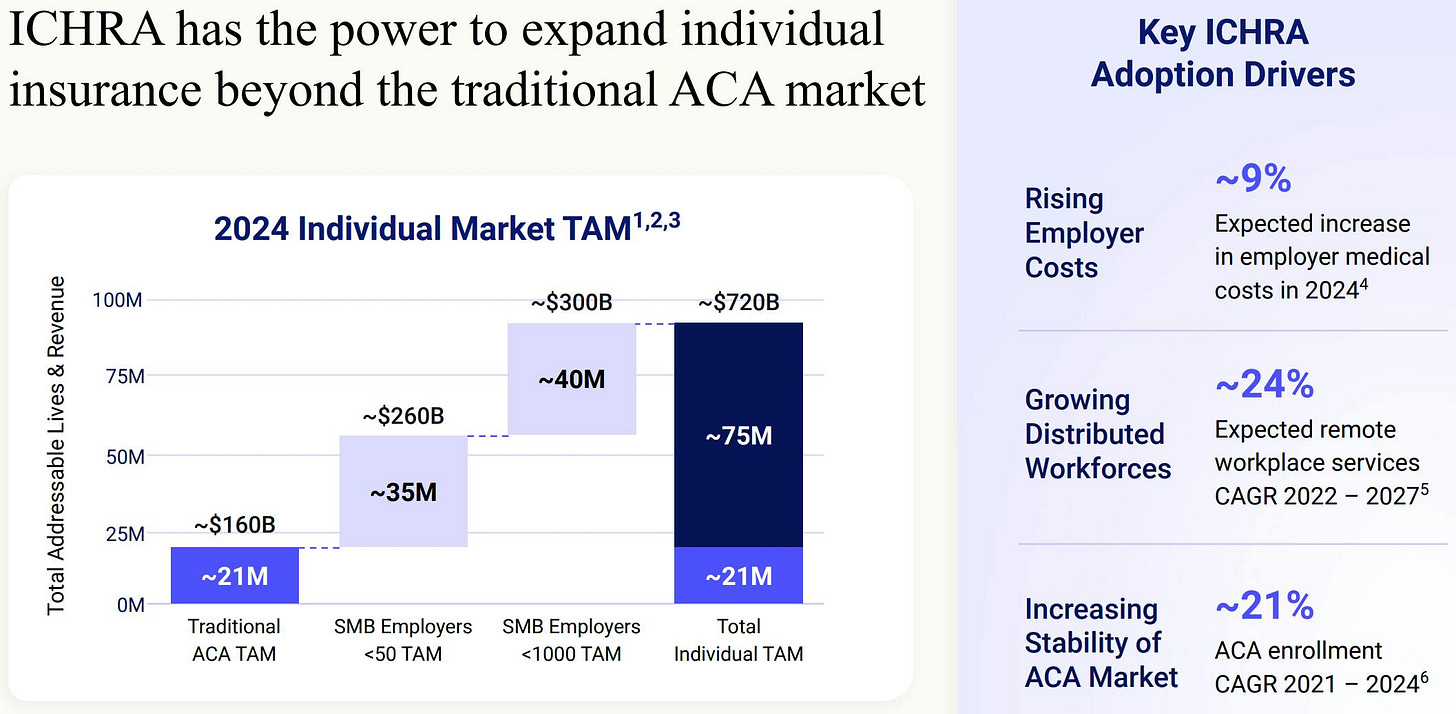

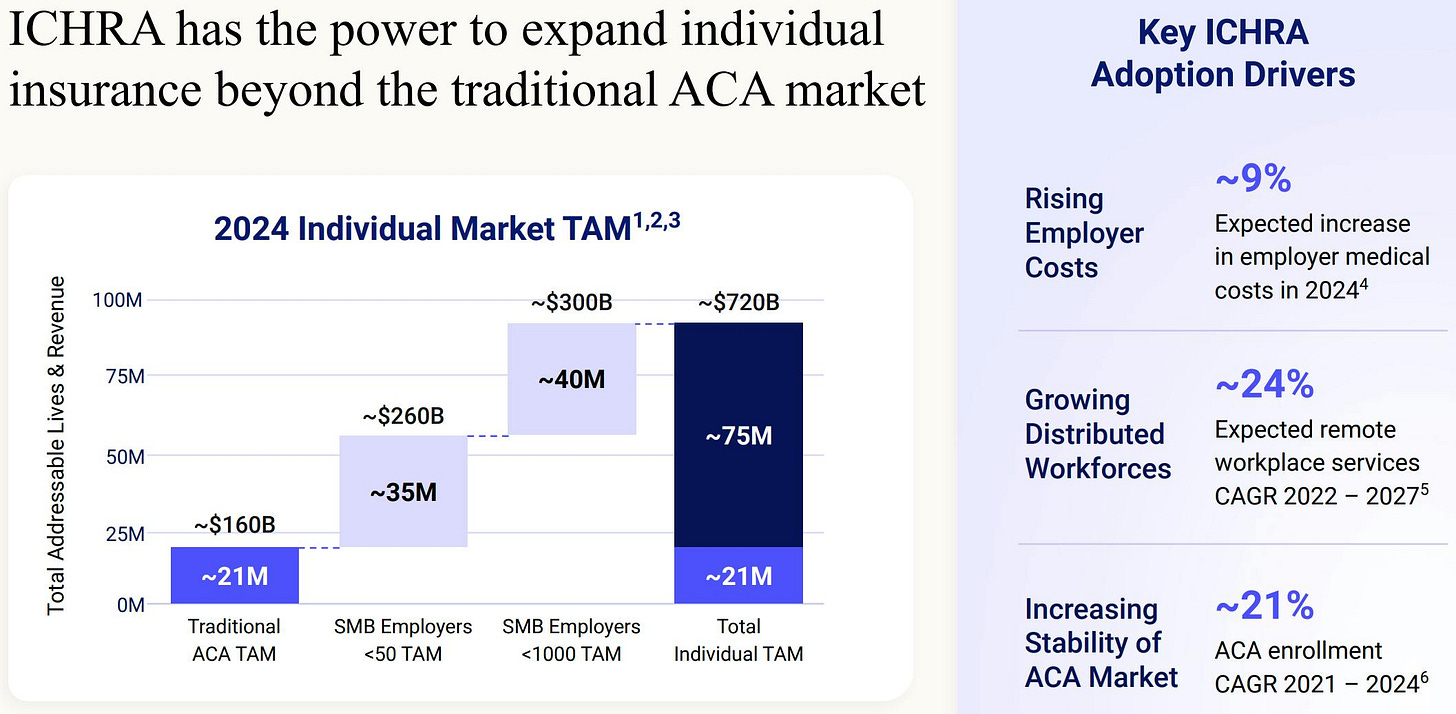

The ICHRA model has the potential to expand the individual insurance market far beyond the traditional ACA structures. In 2024, the traditional ACA market comprised approximately 21 million people with an estimated sales volume of approximately $160 billion.

There is enormous potential among small and medium-sized businesses: Around 21 million insured individuals generate a premium volume of approximately $160 billion. Opening ICHRA to small businesses with fewer than 50 employees opens up an additional pool of approximately 35 million employees, increasing the revenue potential to approximately $260 billion. Expanding the pool to include medium-sized businesses with up to 1,000 employees increases the reachable target group by another 40 million people. This results in almost 75 million potential insured individuals and a total volume of approximately $720 billion.

Key drivers for the growing adoption of ICHRA are rising employer costs, which are expected to increase by around 9% in 2024, and the trend toward distributed and flexible work models. Remote work offerings are expected to grow at an annual rate of around 24% between 2022 and 2027. The increasing stability of the ACA market, which grew by around 21% from 2021 to 2024, is also contributing.

Overall, the chart outlines a compelling scenario: ICHRA is transforming the previously 21 million niche market into a broad, 75 million customer pool, encountering structural cost drivers, remote work models, and a maturing ACA marketplace. For providers like Oscar, this opens up the opportunity to virtually triple their business model without having to change their fundamental product and process logic.

Financial Key Figures

Oscar achieved profitability for the first time in 2024, posting net income of $25.4 million, a remarkable turnaround from a net loss of over $270 million the previous year. This positive turnaround was made possible, in particular, by record new member sign-ups and a significant increase in revenue.

The positive trend continued in the first quarter of 2025, with Oscar recording a 42% increase in revenue to $3.046 billion and a net profit of $275 million.

At the end of the quarter, Oscar served approximately two million insured persons, a growth of 40% compared to the same period last year.

The following chart demonstrates Oscar's impressive revenue growth over the past few years. Since 2020, the company has dramatically increased its revenue: from $391 million in 2020 to approximately $10.08 billion in the last twelve months (LTM). This represents a total increase of 2,478% and a compound annual growth rate (CAGR) of approximately 115%.

Despite rapid revenue growth, Oscar struggled with significant losses in its early years. The net loss in 2020 was around $407 million, peaking at $606 million in 2022. It wasn't until 2023 that the financial situation improved significantly: The loss fell to approximately $271 million, before Oscar reached profitability for the first time in 2024, posting an annual profit of $25.4 million. Over the past twelve months, the company has maintained this trend and further increased its net profit.

The chart thus impressively illustrates the transition from a loss-making start-up to a profitable and rapidly growing healthcare company. Oscar thus demonstrates not only its scalability but also its ability to operate sustainably profitably, an important foundation for future expansion and market share gains.

Valuation and Long-Term Outlook

Oscar's long-term corporate strategy is based on four key strategic objectives:

Market-leading, sustainable, and scalable operations: Oscar plans to achieve strong long-term growth. Specifically, the goal is to achieve a compound annual revenue growth rate (CAGR) of approximately 20% and an operating profit margin of approximately 5% by 2027.

Expanding the Superior Customer Experience: Oscar is focused on ensuring and continuously developing an outstanding member experience across all business areas.

Using its own technology to empower others: Oscar aims to make its internally developed technological platform available to other market participants in the future. This will enable the entire industry to benefit from Oscar's technological innovations and expertise.

Innovative market offerings to expand the individual insurance market: Oscar aims to further expand and sustainably shape the individual health insurance market through innovative and disruptive product solutions, for example, through models such as ICHRA.

As mentioned above, Oscar sees significant market potential for 2027, which it plans to build in three steps. Initially, the foundation will be built on the existing market share from 2024, which includes approximately 10 million potentially insured individuals. In the next phase, planned for 2025 to 2027, Oscar aims to reach an additional 6 million people by developing new markets and launching additional products. Finally, the potential could increase by approximately 4 million more people through expanded government subsidies in 2026 and 2027.

This results in an estimated total reach of around 20 million potentially covered people by 2027.

An annual revenue growth of 20% and an operating margin of approximately 5% would correspond to revenue of approximately USD 15.9 billion and an EBIT of approximately USD 800 million. This could give Oscar a valuation of approximately USD 11.2 billion in 2027, almost doubling its current valuation.

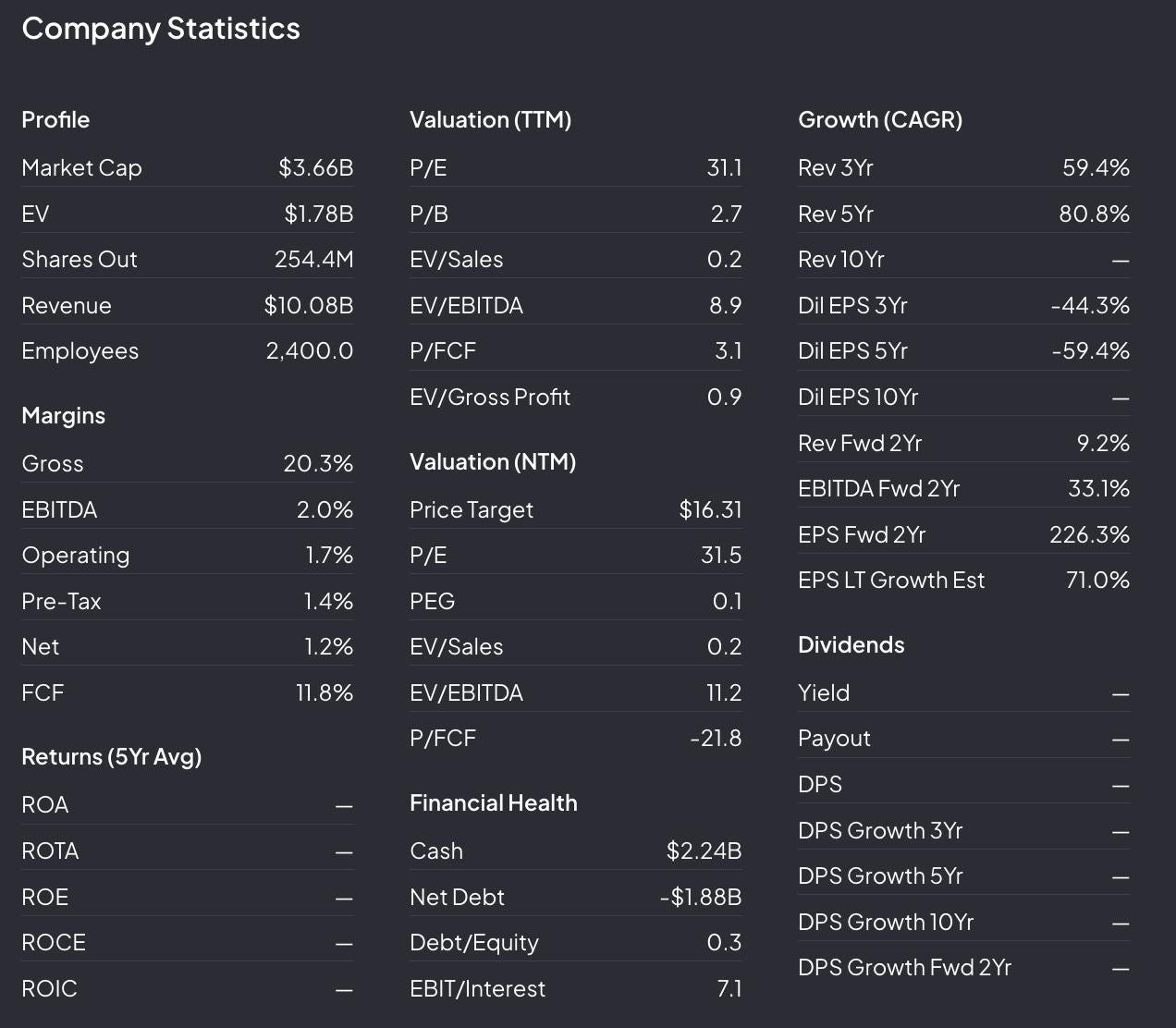

Valuation Ratios

Based on the valuation ratios, the price-earnings (P/E) ratio is 31.1, the price-book value (P/B) ratio is 2.7, and the EV/sales ratio is 0.2. The EV/EBITDA ratio is 8.9, and the price/free cash flow (P/FCF) ratio is 3.1.

For the next twelve months, an expected P/E ratio of 31.5 and a very low PEG ratio of 0.1 are indicated, indicating high expected growth at a comparatively moderate valuation. The EV/sales ratio is expected to be 0.2 and the EV/EBITDA to be 11.2.

Particularly striking is the strong expected increase in earnings per share (EPS), which is expected to rise by 226.3% over the next two years. A long-term EPS growth rate of 71% is estimated.

In terms of financial health, Oscar has a solid cash position of $2.24 billion and debt of $1.88 billion. The debt/equity ratio is low at 0.3.

In summary, the data shows that Oscar is a fast-growing company with a solid financial base and a strong technological focus, focusing primarily on revenue growth and future margin improvement.

Opportunities and Risks

Risks

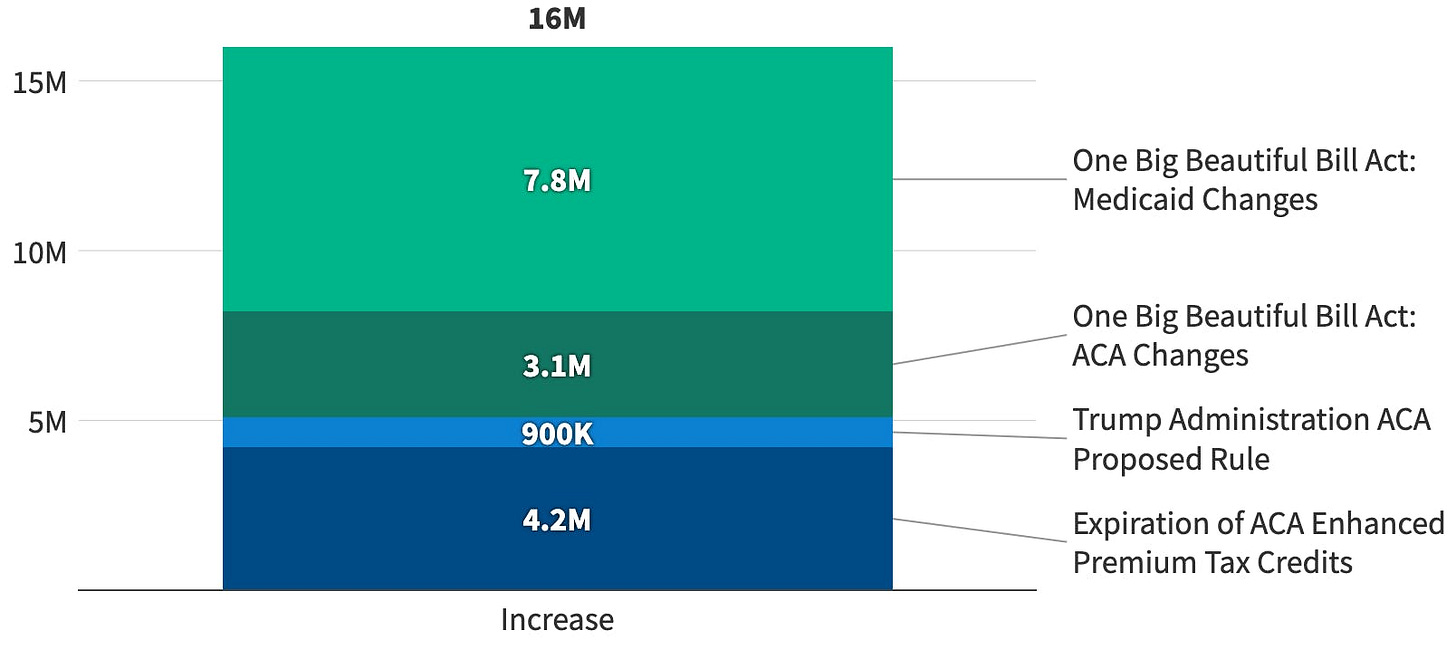

It is important to note that Oscar currently generates approximately 97% of its revenue through the ACA. This poses risks, as political changes and potential subsidy cuts could impact this market.

As an ACA-aligned insurer, Oscar is also closely tied to the regulatory environment of the US healthcare market. A key risk is that the Enhanced Affordable Care Act (ACA) subsidies, which reduce health insurance premiums for many Americans, will expire at the end of 2025. If Congress does not extend these subsidies, health insurance on the marketplace would become unaffordable for many people, which would significantly reduce Oscar's addressable market. The company itself explicitly warns that a reduction in APTCs "could make coverage unaffordable for some, thus reducing overall participation in the marketplaces and our membership."

If the subsidies expire, the Congressional Budget Office (CBO) estimates that a total of 16 million people will be without health insurance by 2034. Those most affected will be those who currently rely on subsidies to finance their insurance, particularly low- and moderate-income individuals. This includes the elderly, the self-employed, and people in rural areas.

Opportunities

In my opinion, the Individual Coverage Health Reimbursement Arrangement (ICHRA) represents Oscar's great opportunity to tap into a market that is many times larger than the current traditional ACA market, and as a result, its stock price could increase fivefold or even tenfold over the next few years.

The chart once again demonstrates how large the market for individual insurance in the US could become if ICHRA models are adopted across the board:

Currently, Oscar addresses around 21 million people with traditional ACA plans, corresponding to a premium volume of approximately $160 billion.

If small businesses (fewer than 50 employees) instead pay their employees ICHRA subsidies, the addressable market grows by an additional 35 million people and a good $100 billion.

If the mid-sized company segment (up to 1,000 employees) is added, the potential increases by another 40 million people, bringing the total to around 75 million insured people and a sales volume of approximately $720 billion.

Several structural drivers favor the introduction of ICHRAs:

Rising employer costs: Companies' medical expenses are expected to rise by approximately 9% in 2024. ICHRA allows them to cap costs as a fixed allowance instead of bearing the outstanding risks of a group policy.

Distributed workforces: The proportion of remote employees will grow at a CAGR of approximately 24% by 2027. For dispersed teams, individually selectable marketplace plans are logistically easier than location-based group plans.

More stable ACA ecosystem: Since 2021, the ACA insured base has grown by approximately 21% annually. Greater plan diversity and improved risk adjustments make individual plans more attractive, and thus also ICHRA subsidies, which flow precisely there.

Oscar is predestined for this change. Its business model, featuring digital customer acquisition, technology-based administration, and data-driven care, is already tailored to ACA individual insureds. ICHRA expands the target customer base.

Conclusion

In my view, Oscar currently presents itself as a compelling buy candidate: The company is facing a structural inflection point because the introduction of Individual Health Reimbursement Accounts (ICHRAs) could expand an addressable market from currently approximately 21 million ACA enrollees to potentially 75 million people and a premium volume of approximately $720 billion, representing a threefold increase without Oscar having to adapt its core digital model. Rising employer costs (+9% forecast for 2024), the rapid increase in distributed work arrangements (+24% CAGR for remote services by 2027), and a steadily growing ACA market (+21% enrollee growth from 2021-24) are creating strong tailwinds for rapid ICHRA adoption. Each new ICHRA allowance is directly integrated into Oscar's existing platform, continuously reducing marketing and administrative costs per member and creating strong economies of scale.

This is precisely why management believes Oscar can achieve earnings many times its current level within the next decade. Combining this profit outlook with a business model that already delivers higher service quality at lower costs thanks to data-driven processes and telemedicine integration results in an attractive risk-reward profile: The market is growing, the cost base remains lean, and the potential earnings leverage is enormous.

In short: Anyone who believes in the continued spread of ICHRA will find Oscar a focused pure play that maximizes the benefits of all the aforementioned macro and technology trends, a valid reason to view the stock as a buy.

What do you think? Does Oscar Health have a 5x to 10x multiplication potential?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.