Portfolio Update - June 2025

My SuperGrowthPortfolio is clearly growth-oriented and focuses on visionary companies from future-oriented industries.

Dear growth investors,

My SuperGrowthPortfolio is clearly growth-oriented and focuses on visionary companies from future-oriented industries such as aerospace, fintech, digital platforms, and healthcare. The largest stocks are active in the aerospace and healthcare sectors. I also focus on companies in emerging markets.

A lot has changed in the last few weeks, so let's take a look at the portfolio together.

Portfolio Allocation

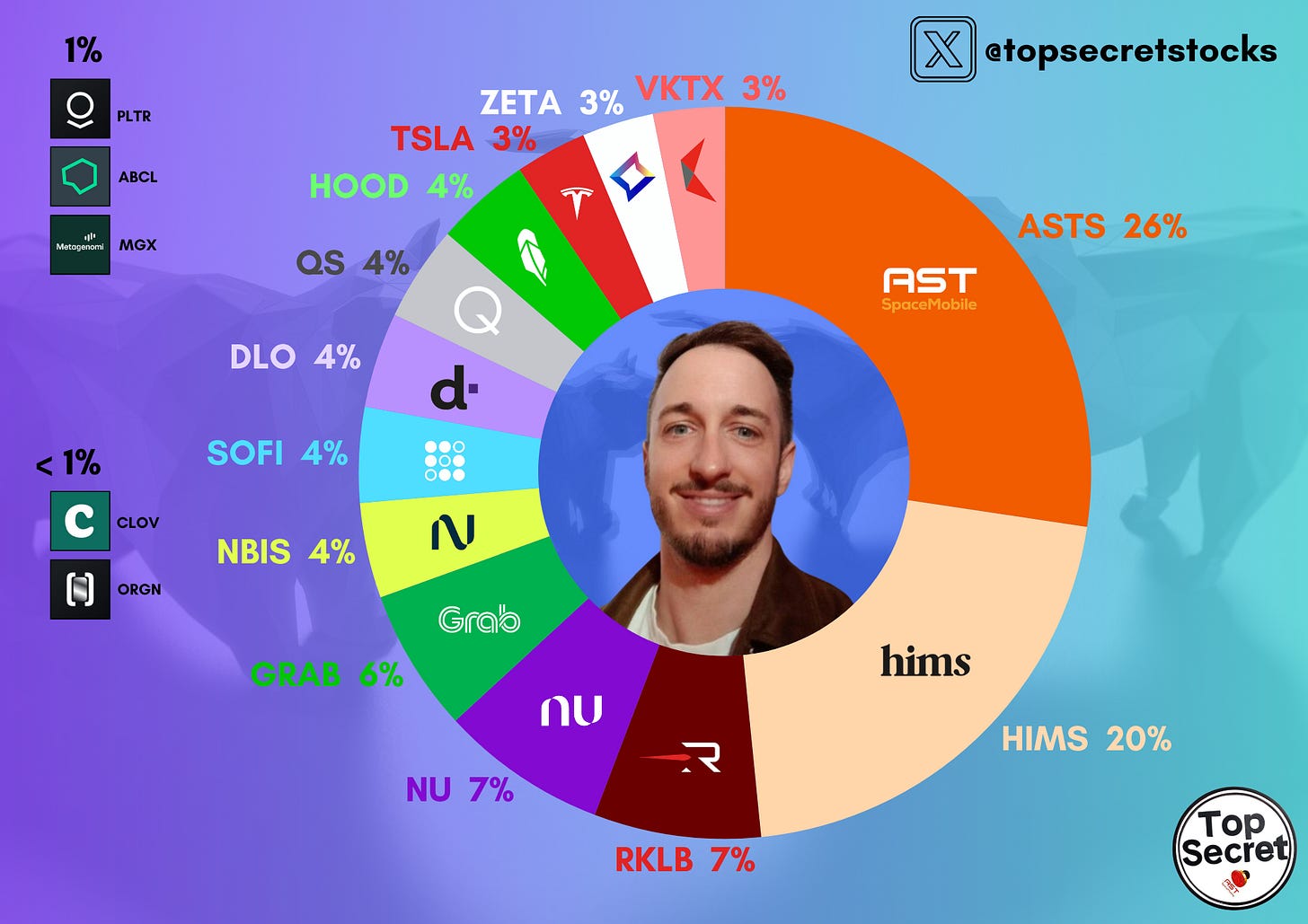

The current "SuperGrowthPortfolio," as of June 2025, comprises 18 individual stocks.

With 26%, AST SpaceMobile (ASTS) represents the largest position in the portfolio. AST is developing a satellite-based mobile network that communicates directly with commercially available smartphones without the need for terrestrial cell towers. The goal is global coverage, especially in regions without infrastructure. The company is considered one of the most ambitious projects in the space sector.

Hims & Hers Health (HIMS) is also prominently represented with 20%. The US company offers discreet, telemedical healthcare solutions for issues such as hair loss, skincare, and mental health. Weight loss and many other product categories are on the horizon. Powered by its proprietary AI, Hims & Hers is revolutionizing the digital healthcare market by disrupting the approximately $4 trillion healthcare industry and creating a telemedicine offering that offers quality, access, affordability, and high personalization.

Rocket Lab (RKLB) takes third place with 7%. The company is a rocket launch provider that has already carried out numerous commercial satellite launches with its Electron rocket. Rocket Lab is also building a larger rocket called Neutron and is positioning itself as a flexible competitor to SpaceX with its diversified business model.

Two fintechs follow: Nubank (NU), one of Latin America's largest digital banks, with 7%, and Grab Holdings (GRAB), a super-app provider from Southeast Asia that combines transportation, delivery, and financial services, with 6%.

Nebuis Group (NBIS) has a 4% weighting. Nebius installs and operates data centers with state-of-the-art Nvidia GPU clusters.

SoFi Technologies (SOFI), with a 4% share of the portfolio, is an emerging US fintech that combines banking, lending, investing, and personal financial planning into one app. The company is growing rapidly, recently achieved profitability, and is led by a visionary CEO.

Other stocks, each with a 4% share, include Robinhood (HOOD), known for commission-free stock and crypto trading; QuantumScape (QS), active in the solid-state battery sector; and dLocal (DLO), a payment processor for emerging markets.

Smaller positions (<4%) are spread across names such as Tesla (TSLA), Zeta Global (ZETA), Viking Therapeutics (VKTX), Palantir (PLTR), AbCellera (ABCL), Clover Health (CLOV), Metagenomi (MGX) and Origin Materials (ORGN).

Overall, the "SuperGrowthPortfolio" reflects a clear focus on disruption, driven by companies that are, in some cases, still at the beginning of their careers but have the potential to disrupt entire industries.

Purchases and Sales

Tesla was newly acquired, AbCellera and Clover Health were increased, and Ping An Insurance was sold.

Individual and Overall Performance

The overview shows the individual performance of all positions since their respective purchase dates and clearly shows that the investment strategy has developed very successfully overall, especially with growth positions entered early.

Since the initial investment, some individual stocks have recorded impressive price performance: AST SpaceMobile leads the pack with an extraordinary increase of +662.67%, followed by two others, Rocket Lab with +512.19% and Hims & Hers with +431.21%. Other stocks, such as Palantir (+110.00%) and Robinhood (+93.23%), also achieved solid gains. Overall, the portfolio's maximum performance is +86.32%, while the overall performance for the year to date is also positive, with a solid increase of +26%.

On the other hand, some investments suffered significant losses: The worst performer, Origin Materials, is at -58.22%, followed by Metagenomi (-37.03%) and Zeta Global with -32.91%. Other stocks, such as DLocal, QuantumScape, and Nu Holdings, are also in negative territory, albeit to a more moderate extent.

Overall, the performance balance is very mixed, with clear winners and losers, but with a positive overall trend in 2025.

Investment strategy

How can successful stock picking be actively pursued?

My investment strategy is based on eight clearly defined principles specifically geared toward high-growth, future-oriented companies. The focus is on finding visionary-led companies with disruptive potential and long-term value creation.

A key criterion is "founder-led management", meaning leadership by founders or founding teams. The belief behind this is that founders bring not only vision but also long-term commitment; they build for decades, not just quarters. This is complemented by the second principle: a company should have a unique technology and a defensible business model ("moat") to sustainably differentiate itself from the competition.

The size of the addressable market ("TAM") also plays a crucial role. The greater the market potential, the greater the potential for scaling. At the same time, I pay attention to strong partnerships, as they can provide not only validation but also leverage for growth.

Another principle is a focus on current revenues or at least reliable revenue forecasts. Growth without clear economic substance is avoided. The so-called "Rule of 40", the sum of revenue growth and the EBITDA margin should ideally be 40% or more, serves as a benchmark for balanced growth quality.

Another exciting aspect is looking at people's future behavior. This means that companies whose business models are based on long-term social, technological, or demographic trends are favored. The strategy is rounded out by the expectation of significant free cash flow over time, because ultimately, the business model must be profitably scalable.

Do you have the same stocks in your portfolio?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.