Robinhood: Big Innovations

Through stock token investing, you can now invest in OpenAI and SpaceX.

Dear growth investors,

At the “Robinhood Presents: To Catch a Token” event in Cannes yesterday, Robinhood (ticker: HOOD) unveiled several major innovations in crypto and digital financial products, with a focus on Europe and the USA.

Table of Contents

Founder and CEO

Products and business model

First quarter of 2025

Robinhood Gold Event - March 26

Robinhood “Presents: To Catch a Token” Event - June 30th

Conclusion

Founder and CEO

Robinhood Markets, Inc. was founded in 2013 by Vladimir Tenev and Baiju Bhatt. The two met at Stanford University, where they studied mathematics and were roommates. Before Robinhood, they founded two financial companies in New York City that developed software for hedge funds.

The idea for Robinhood was born out of the observation that professional traders had access to free trades while retail investors had to pay high fees. Their mission was to democratize the financial market for everyone, hence the name "Robinhood," a platform for everyone.

The current CEO is Vlad Tenev, who has held this position since November 2020 and also chairs the Board of Directors.

Products and business model

Robinhood is a financial technology platform focused on mobile trading, making it easier for investors to access financial markets.

Products and Services:

Commission-Free Trading: Pioneer in offering commission-free trading in stocks, ETFs, and options.

Cryptocurrencies: The platform also allows trading in various cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and others.

Fractional Shares: Investors can also purchase fractional shares, allowing them to invest in high-priced companies with smaller amounts of capital.

Robinhood Gold: A premium subscription service for $5 per month that offers additional features such as larger instant deposits, access to Level II market data (Nasdaq Level II Market Data), and Morningstar research reports. Gold members also receive lower margin interest rates.

Expert-Managed Portfolios (Robinhood Strategies): A service that offers professionally managed portfolios tailored to investors' goals and risk tolerance. Gold members have no management fees for investments of $100,000 or more.

24/5 Trading: Robinhood offers trading in select stocks and ETFs 24 hours a day, five days a week.

Money Management: The company also offers money management services, including interest-bearing savings accounts and debit cards. The launch of checking and savings accounts, as well as a credit card, has also been announced.

Robinhood's business model is primarily based on a "freemium" approach, where basic trading services are offered for free, while additional features are monetized through premium services or other revenue streams. Robinhood's main revenue sources are:

Payment for Order Flow (PFOF): This is one of Robinhood's primary sources of revenue. Robinhood routes customer orders (for stocks, options) to market makers who execute these orders. The market makers pay Robinhood a fee for receiving these orders.

Net Interest Income: Robinhood earns interest on uninvested cash in customer accounts, as well as from extending margin loans to Robinhood Gold members.

Robinhood Gold Subscription Fees: The monthly premium membership fees also contribute to revenue.

Cryptocurrency Markups: Robinhood also generates revenue through small markups on cryptocurrency transactions.

First quarter of 2025

In Q1 2025, Robinhood increased revenue by 50% year-on-year and earnings per share by over 100%. Robinhood also further expanded its share buyback program.

Total net revenue increased 50% year-on-year to $927 million.

Transaction-based income increased 77% year-on-year to $583 million.

Net interest income increased 14% year-on-year to $290 million.

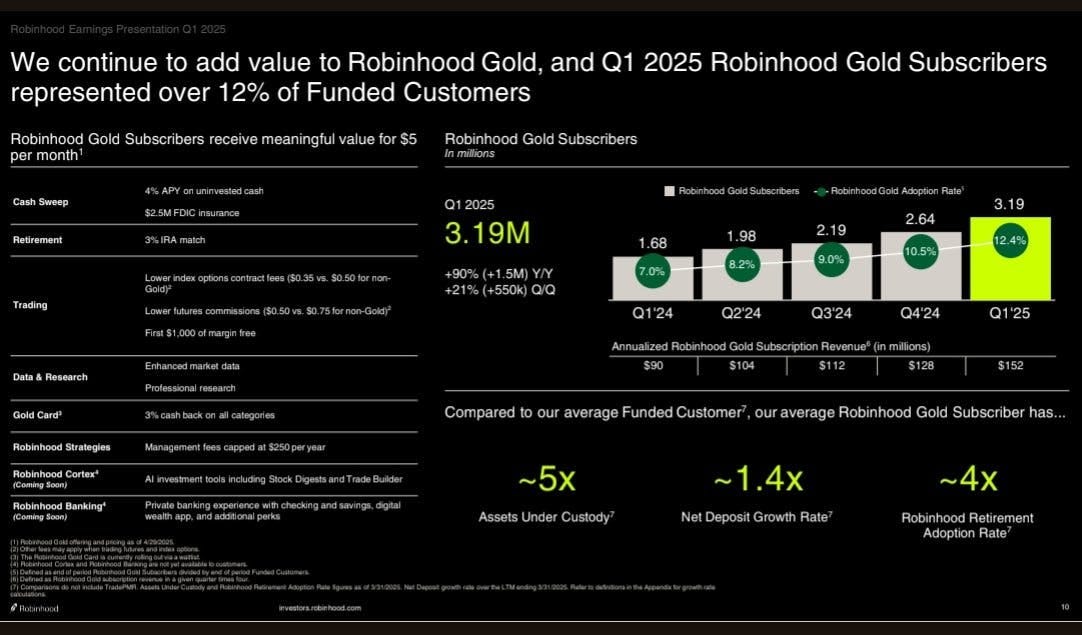

Other income increased 54% year-on-year to $54 million, primarily due to the increased number of Robinhood Gold subscribers.

Net income increased 114% year-on-year to $336 million, and diluted earnings per share (EPS) increased 106% year-on-year to $0.37.

Total platform assets increased by 70% YoY to $221 billion, mainly due to continued net deposits and the acquisition of TradePMR.

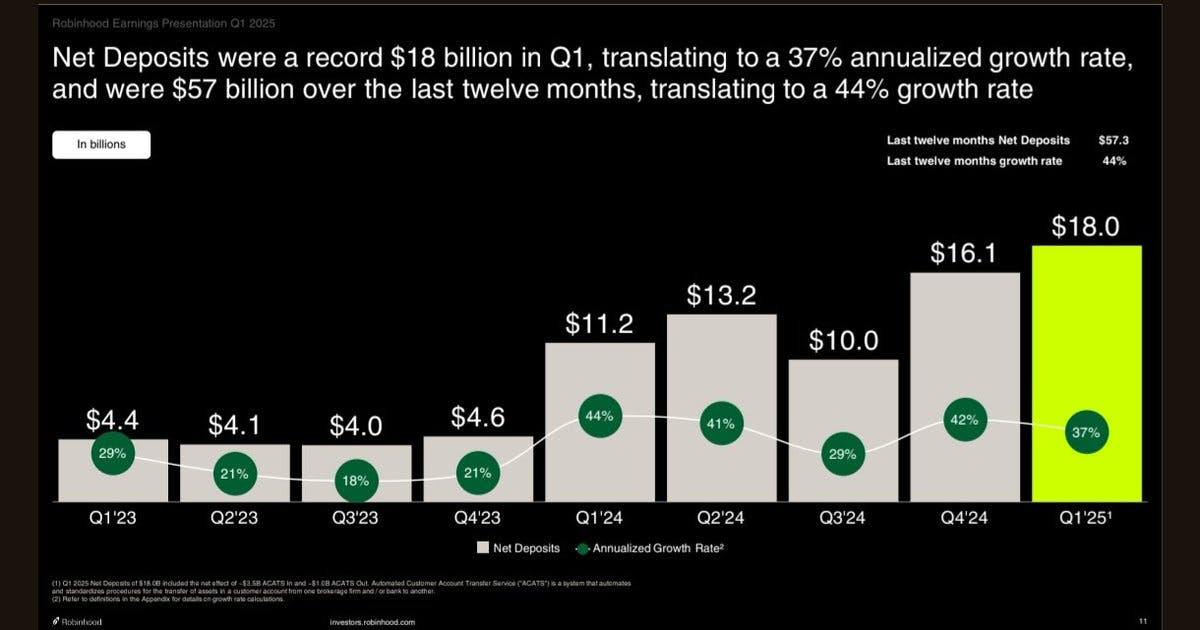

Net deposits totaled $18.0 billion, representing an annualized growth rate of 37% relative to total platform assets at the end of the fourth quarter of 2024.

The number of Robinhood Gold subscribers increased by 1.5 million, or 90%, to 3.2 million year-on-year.

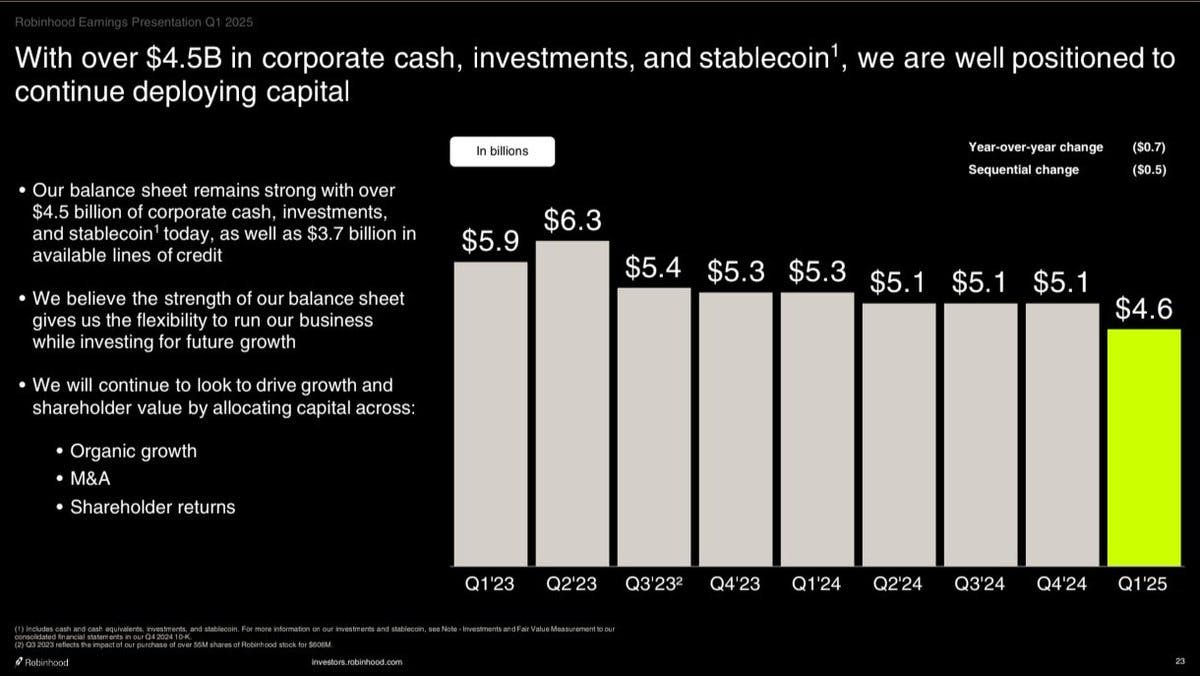

Cash and cash equivalents were $4.4 billion compared to $4.7 billion at the end of the first quarter of 2024.

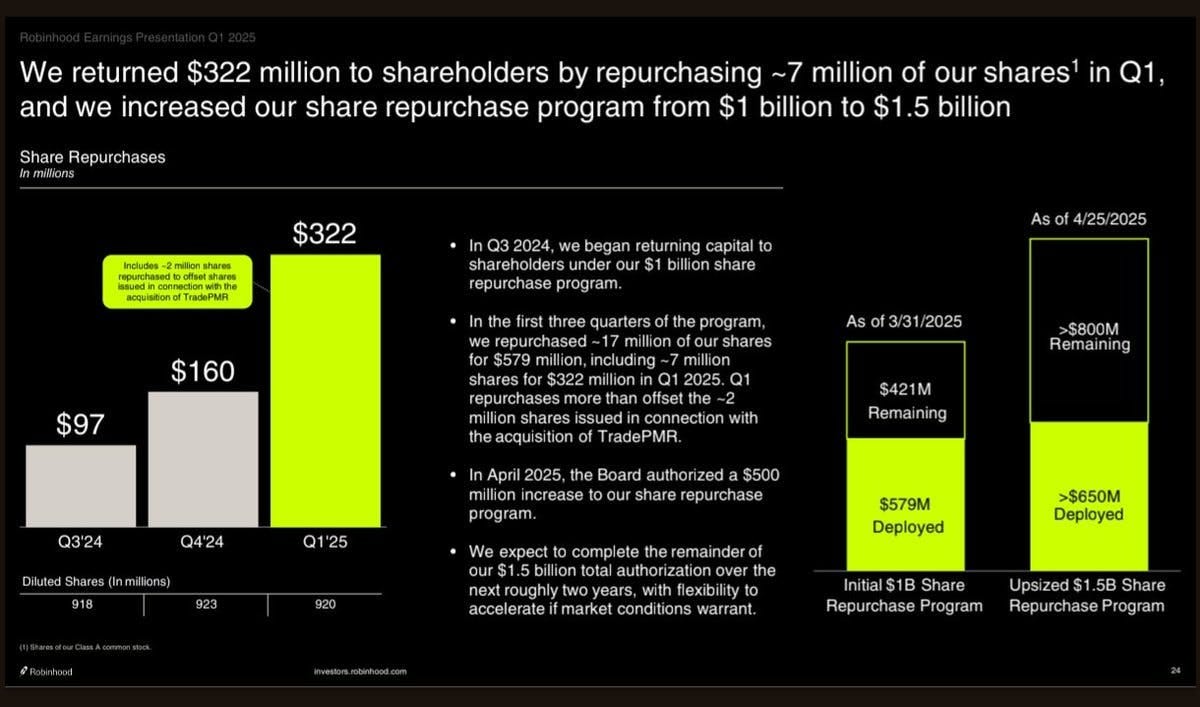

Share repurchases totaled $322 million, representing 7.2 million shares of Class A common stock at an average price of $44.87 per share.

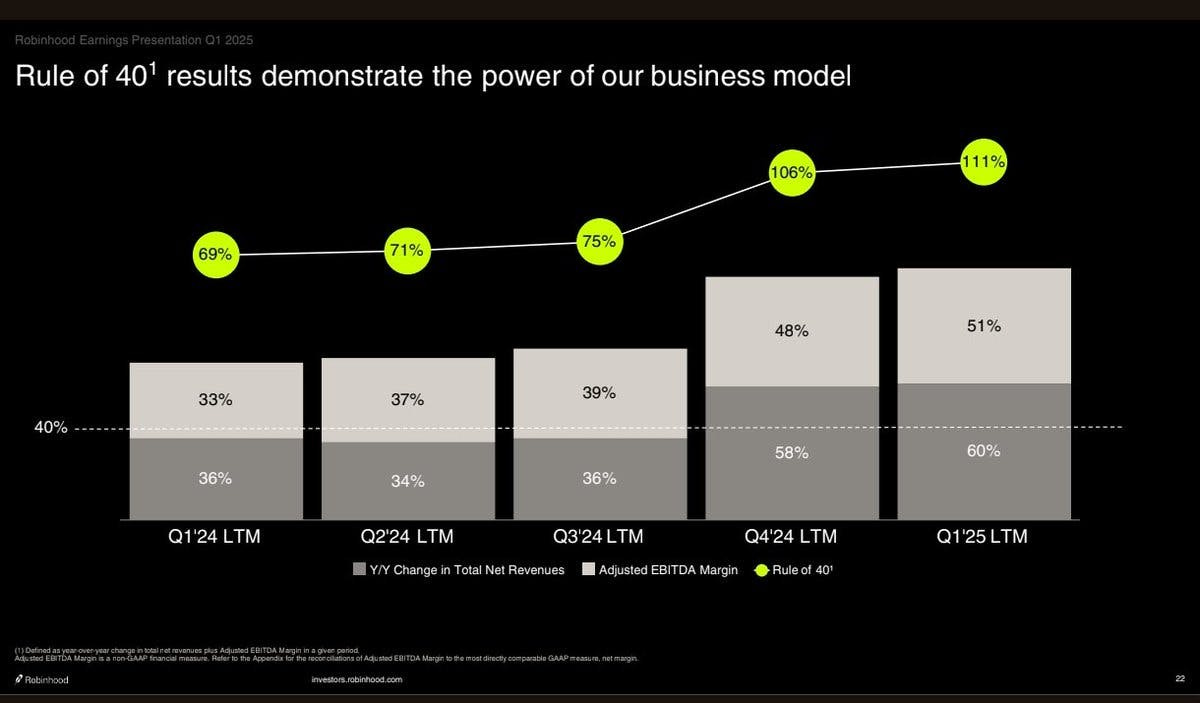

The "Rule of 40" demonstrates the strength of Robinhood's business model. At the same time, the "Rule of 40" is one of my core investment principles. Thanks to continuous innovation and outstanding financial results, Robinhood remains a long-term holding in my portfolio.

Robinhood's recent strategic moves, particularly in wealth management and banking services, demonstrate that the company is expanding into investment and other financial services, thus creating a more integrated ecosystem. One of the most prominent advantages is undoubtedly commission-free trading of stocks, ETFs, and options. Closely related to this is the simple and intuitive user interface of the Robinhood app. The design is deliberately minimalist and user-friendly, making it much easier to enter the world of investing. Finally, Robinhood Gold's premium services offer additional benefits for investors.

Robinhood Gold Event - March 26

The "Robinhood Gold Event," held on March 26, 2025, under the theme "The Lost City of Gold," was the company's second annual keynote event, where Robinhood unveiled a range of new services and features for its premium Robinhood Gold membership.

Robinhood introduced "Robinhood Banking," a new platform launching this fall for Gold members. It offers 4% APR, AI tools, professional tax advice, and global money transfers. You can even get cash delivered to your door.

In detail: The most important announcements and event highlights:

Robinhood Strategies (Wealth Management Reimagined):

Expert-managed portfolios.

Personalized portfolios tailored to the investor's risk profile and goals.

Robinhood Gold members have a low annual management fee of 0.25%, capped at $250 per year. This means that for portfolios of $100,000 or more, Gold members incur no additional management fees.

The service includes interactive portfolio tools, detailed insights into performance and allocations, regular market updates, and simulations to project future returns.

It also includes tax optimization features and year-end loss realization.

Robinhood Banking:

Robinhood announced the launch of Robinhood Banking in fall 2025, exclusively for Gold members.

This service aims to make "private banking" features accessible for everyday use.

Highlights include a competitive annual percentage rate (APY) of 4.00% on savings, significantly higher than the national average.

Access to professional tax advice is also offered.

Other announced benefits include 24/7 support, FDIC insurance of up to $2.5 million (through partner banks), premium perks such as access to exclusive events (e.g., the Met Gala, Oscars, F1 Monaco Grand Prix) and luxury services, and cash delivery directly to your home upon request.

Family account options, including accounts for children with spending controls, were also mentioned.

Robinhood Cortex (AI-powered investment assistant):

Robinhood introduced Robinhood Cortex, an AI-powered tool that provides investors with real-time analytics and insights to improve their navigation of the markets.

Cortex is designed to help identify opportunities and keep them up-to-date on market trends.

Features include factors influencing a stock and Trade Builder, which provides insights into price signals, technical data, market news, and analyst reports.

Robinhood Gold Card (expansion):

The rollout of the previously announced Robinhood Gold Card is expanding to 100,000 additional users.

The credit card offers 3% cash back on all categories and 5% cash back on bookings made through the Robinhood Travel Portal. It is exclusive to Robinhood Gold members.

In summary, with this event, Robinhood clarified its strategy to evolve from a pure trading app into a comprehensive financial services provider. In my opinion, the event was clearly something investors will remember for a long time. Before Robinhood's IPO, the company was considered a small neobroker. Since then, under the leadership of a visionary CEO, Robinhood has established itself as a modern financial platform for the next generation of wealthy individuals. Vlad Tenev created an innovative culture that can only be found at Robinhood. The company launches several new products every month, experiences 30% growth, and is sustainably profitable. Robinhood has enormous total market potential. There is literally no other platform growing as fast.

Robinhood “Presents: To Catch a Token” Event - June 30th

At the "Robinhood Presents: To Catch a Token" event in Cannes yesterday, Robinhood unveiled several major innovations in crypto and digital financial products, focusing on Europe and the US. Robinhood is launching tokenized stocks. These "stock tokens" are assets represented on the blockchain that are pegged 1:1 to real stocks. This makes it even easier for users to trade fractional shares.

Robinhood Stock Tokens are special, blockchain-based derivatives that track the prices of US stocks and ETFs, thus enabling indirect participation in the US market. When purchasing these tokens, you are not purchasing actual stocks, but rather contracts that track their price movements and are stored on the blockchain. These tokens can be bought, sold, or held, but cannot currently be transferred to other wallets or platforms. They are traded in US dollars. Those paying in euros do not need to worry about converting them; this is done automatically using the current exchange rate, with a small fee of 0.10%.

Terms and Conditions:

Robinhood Stock Tokens enable European customers to invest in tokenized US stocks and ETFs.

No spread or commission from Robinhood, but other fees may apply.

Over 200 stocks and ETFs are available, with dividends paid directly in the app.

Trading is currently possible 24/5.

Initially, the tokens will be based on the Arbitrum blockchain, later on Robinhood's own Layer 2 blockchain, which is currently under development.

This Layer 2 blockchain is based on Arbitrum, but is operated by Robinhood itself and is intended to enable 24/7 trading in the long term.

The goal is to create an infrastructure for tokenized real-world assets (RWAs) with lower fees and the option of self-custody.

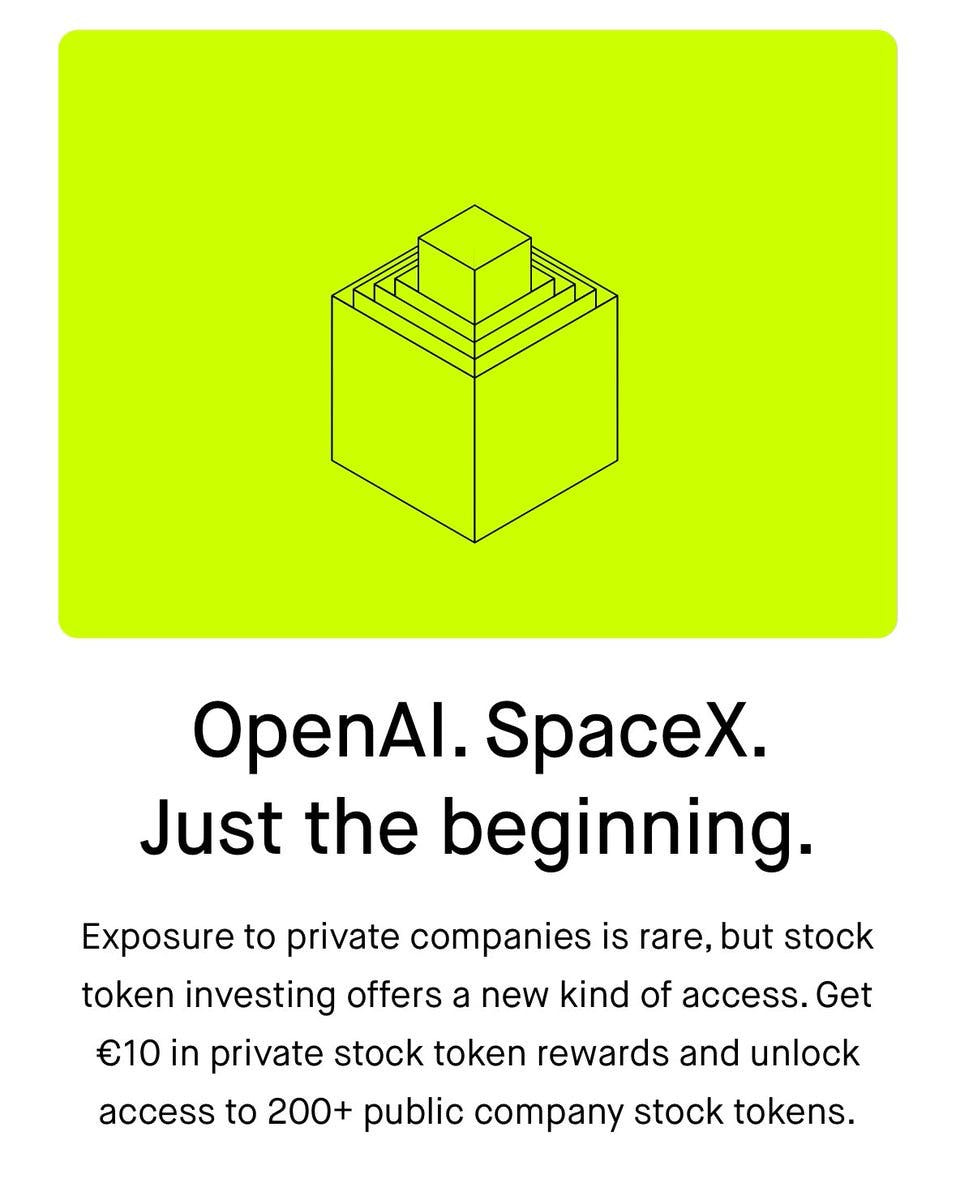

Investments in private companies such as Open AI or SpaceX are typically difficult to access. However, stock token investing (i.e., investing in tokenized stocks) opens up this access for investors. An absolutely gigantic function.

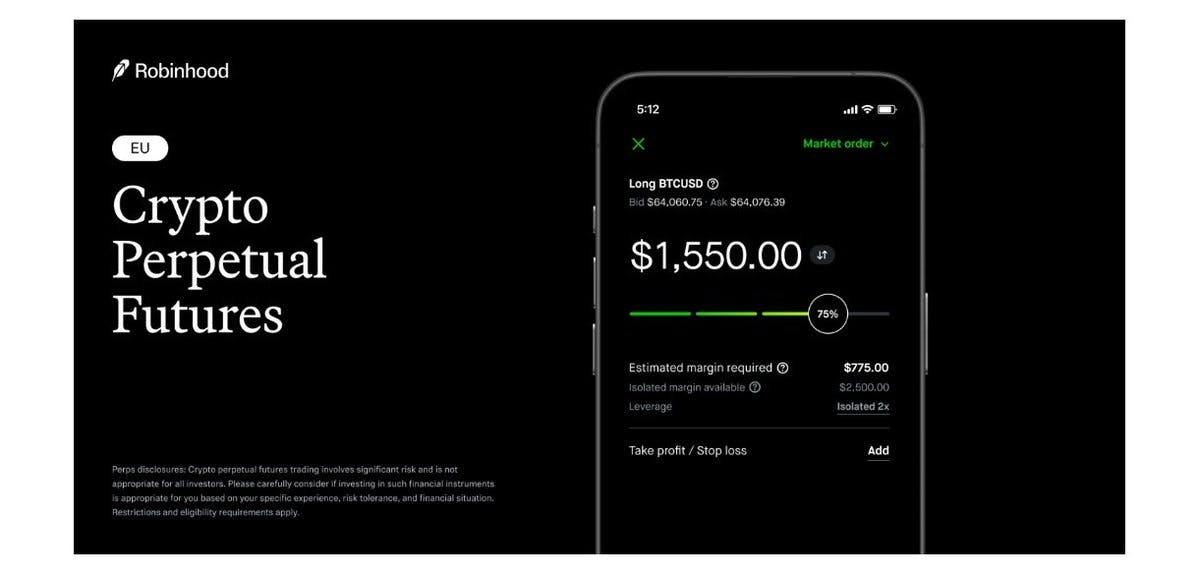

Crypto Perpetual Futures in the EU

These derivatives offer permanent market exposure with up to 3x leverage.

Launch in summer 2025 for clients in the EU.

The user interface has been designed for intuitive access and easy margin management.

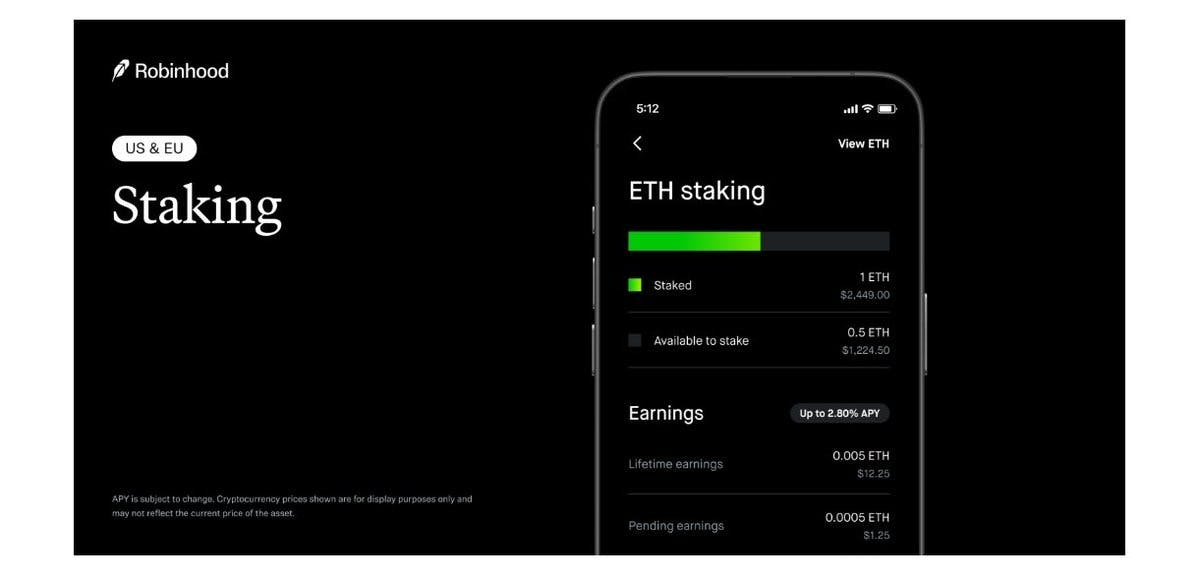

Crypto Staking in the US & EU

Ethereum and Solana are the first available coins.

Both US and EU users can participate in staking with just a few clicks.

Goal: Participate in blockchain networks and earn rewards.

Other New Features & Products

"Instant Boost" for crypto deposits: 1-2% bonus on new deposits (limited time, upon reaching $500 million in total).

Robinhood Gold Credit Card (USA): Cashback that can be automatically converted to crypto.

Cortex: AI-based investment assistant, shows analytics and trends for each token.

Smart Exchange Routing: Automatic price optimization through routing across multiple exchanges.

Tax Lots (USA): Possibility to sell certain tax-relevant positions.

What excites me about the company is not only the regular innovative product launches, but above all the CEO, Vlad Tenev.

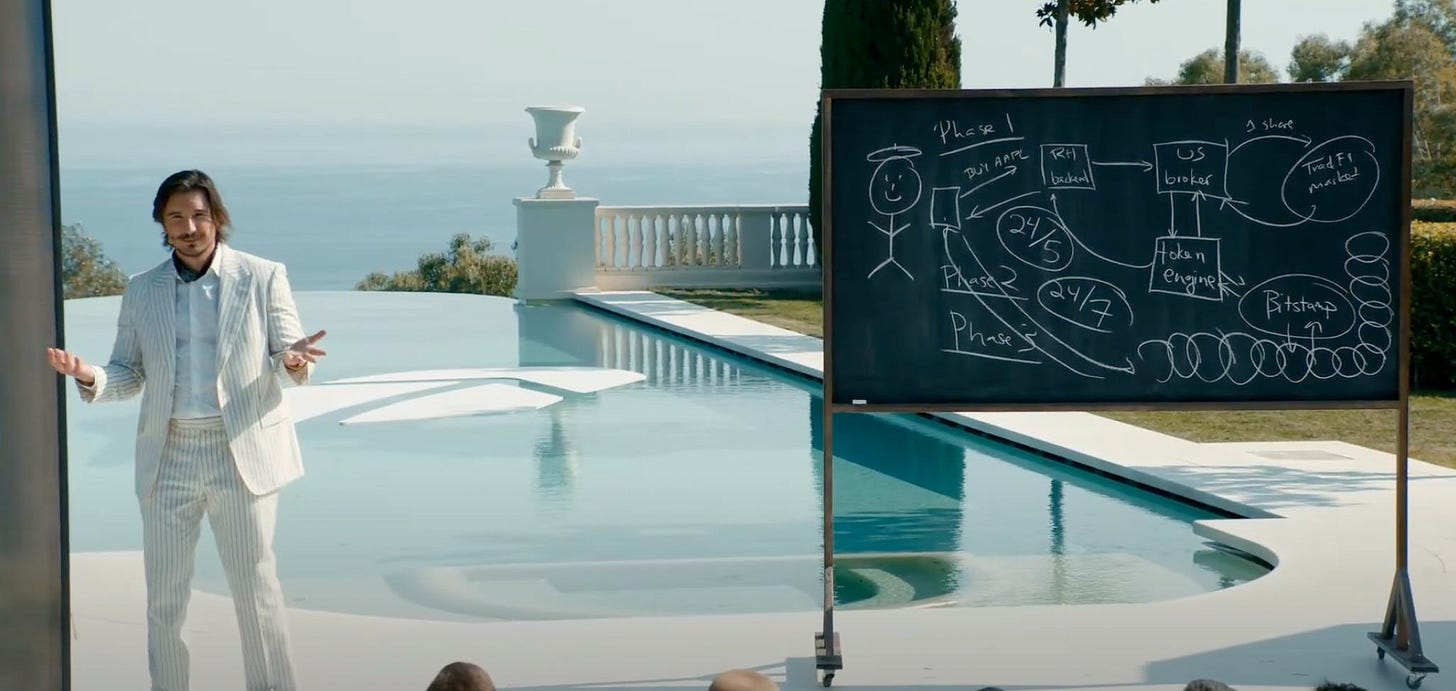

At the product presentation "Robinhood Presents: To Catch a Token" in Cannes, the CEO explained the concept of Robinhood Stock Tokens, which will be developed in several phases, using a classic blackboard:

Phase 1 describes the traditional purchase of shares through Robinhood, which is processed via a US broker and the traditional financial market.

Phase 2 introduces tokenization: The share is converted into a token that can be traded via blockchain platforms (e.g., Bitstamp), even outside of normal trading hours (24/7 instead of just during stock market opening hours).

Phase 3 goes a step further: It is intended to enable complete flexibility and global accessibility. The main focus here is that the tokens can theoretically be traded anytime, from anywhere, and in even more markets (possibly via additional platforms or decentralized exchanges).

In summary: With these phases, Robinhood aims to revolutionize traditional stock trading, making it accessible at any time and combining it with crypto-like flexibility.

Conclusion

With these new stock tokens, Robinhood is opening up access to investments in private companies (e.g., OpenAI, SpaceX) for the first time, something previously only available to large, institutional, or very wealthy investors. At the same time, users can trade over 200 publicly traded stocks in token form, flexibly, around the clock, and in fractional shares. The idea of being able to trade stocks 24/7 and worldwide like cryptocurrencies means much more flexibility for investors: They are no longer tied to the opening hours of traditional stock exchanges, can react at any time, and no longer need to worry about complicated transactions via various brokers or banks. At the same time, this would make stock trading significantly more global. Today, access is often still restricted by national regulations, time zones, and technical hurdles. With tokenization, investors can theoretically participate in US stocks (and perhaps later other markets) from anywhere, similar to trading Bitcoin or Ethereum. This brings Robinhood one step closer to its vision of a more open, tokenized investment world and to rolling out its service worldwide.

For Robinhood itself, this means positioning itself more strongly as an innovative bridge between the traditional financial market and the crypto world. In the long term, this could also put pressure on other brokers and traditional exchanges to modernize their models. It could thus trigger a kind of revolution in which financial markets become more digitalized, token-based, and increasingly adapt to the needs of a new, globally connected generation of investors.

With this step, Robinhood is, in my opinion, creating the best consumer-oriented service in the field of stock and token trading. This not only expands Robinhood's technical innovation but also presents itself as extremely customer-centric, focusing on the needs of a new generation of investors: maximum flexibility, transparency, and ease of use.

Are you invested in Robinhood? What do you think about the news?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.