SoFi opens the doors to OpenAI, SpaceX, Anduril & Co. for private investors.

Through funds from Cashmere, Fundrise and Liberty Street Advisors, customers will be able to invest in private companies such as OpenAI, SpaceX, Anduril, Databricks and others.

Dear growth investors,

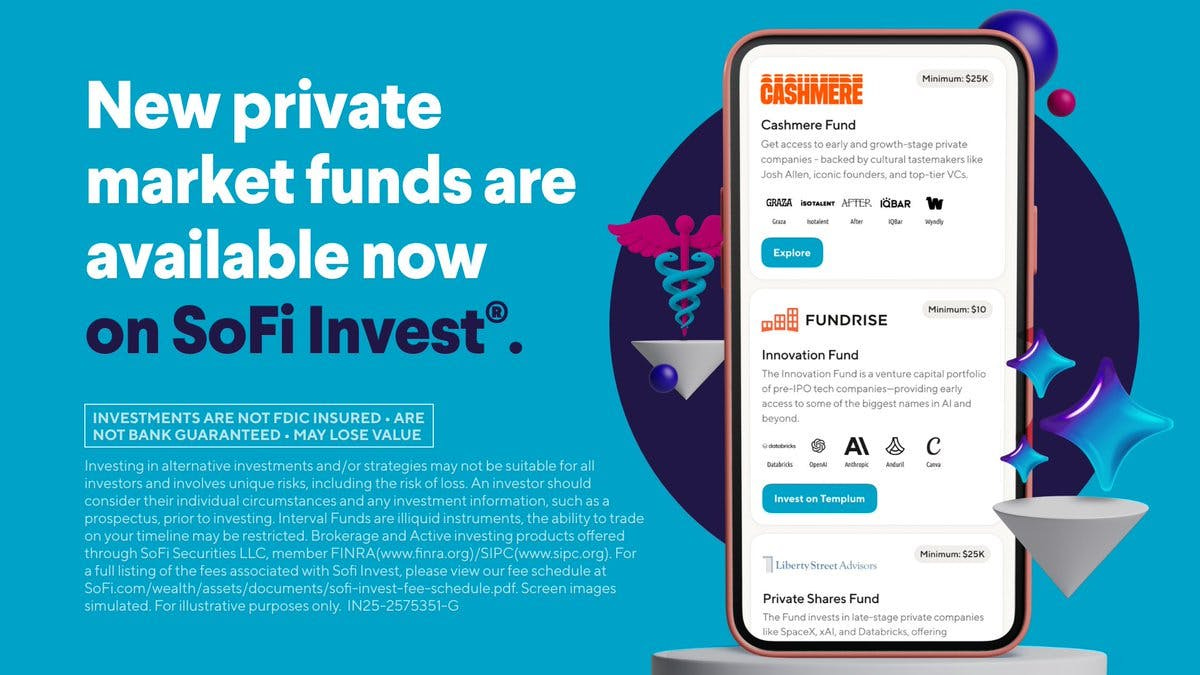

In recent years, SoFi Technologies (Ticker: SOFI) has developed into a comprehensive one-stop shop for digital financial services. Now the company is expanding its offerings even further: Through funds from Cashmere, Fundrise, and Liberty Street Advisors, customers will be able to invest in private companies such as OpenAI, SpaceX, Anduril, Databricks, and others.

Through funds from Cashmere, Fundrise, and Liberty Street Advisors, retail investors can purchase shares in high-growth, privately held companies in the artificial intelligence, space, consumer goods, healthcare, e-commerce, and fintech sectors directly through the SoFi app, with minimum investments starting at $10. For example, private companies such as OpenAI, SpaceX, Anduril, and Databricks.

Cashmere pools investments in early- and growth-stage companies, benefiting from the support of renowned venture capitalists, i.e., investors who specialize in financing startups, and prominent endorsements by athletes such as Josh Allen and Jayson Tatum. The fund leverages its media presence to build market momentum and accelerate the growth of its portfolio companies.

Fundrise, with over two million users, is the largest direct alternative asset manager in the US. Known as a pioneer in the democratization of real estate and venture capital investments, Fundrise offers its investments entirely digitally and directly to private investors.

Liberty Street Advisors partners with experienced managers to offer investors differentiated strategies in private markets and alternative assets. This allows public equities and bonds to be efficiently complemented with private equity, private credit, and real estate positions.

For SoFi, the partnership with Cashmere, Fundrise, and Liberty Street Advisors, according to Anthony Noto (CEO of SoFI), is not only "a new dimension for private investors." SoFi is also "expanding alternative asset classes for a new generation of investors," says Anthony Noto. "With our broad offerings of private equity, venture capital, private credit, and real estate, we enable our members to build truly diversified portfolios and take a big step closer to financial independence."

Last year, SoFi expanded its range of alternative investments to include funds from ARK, KKR, Carlyle, and Franklin Templeton, covering opportunities such as private credit, real estate, and pre-IPO opportunities. At the same time, the company launched a robo-advisor in collaboration with BlackRock, offering its users curated portfolios including real estate and multi-strategy funds. Through a partnership with Templum, members also received exclusive access to leading technology companies such as SpaceX, Databricks, and xAI through the Cosmos Fund, the Pomona Investment Fund, and the StepStone Private Markets Fund.

With investments in OpenAI, SpaceX, Anduril, Databricks, and others, SoFi is catching up with Robinhood, which already unveiled several major innovations in the field of crypto and digital financial products at its "Presents: To Catch a Token" event on June 30. Robinhood launched tokenized stocks. These "stock tokens" are assets mapped on the blockchain that are pegged 1:1 to real stocks. This makes it even easier for users to trade fractional shares.

Conclusion

Robinhood's tokens aren't an actual stake in a company. Rather, they're designed to track a company's value. In my opinion, SoFi offers better value here by investing directly in real equity funds.

What do you think about the news from SoFi?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.