SoFi Technologies - The AWS of Fintech?

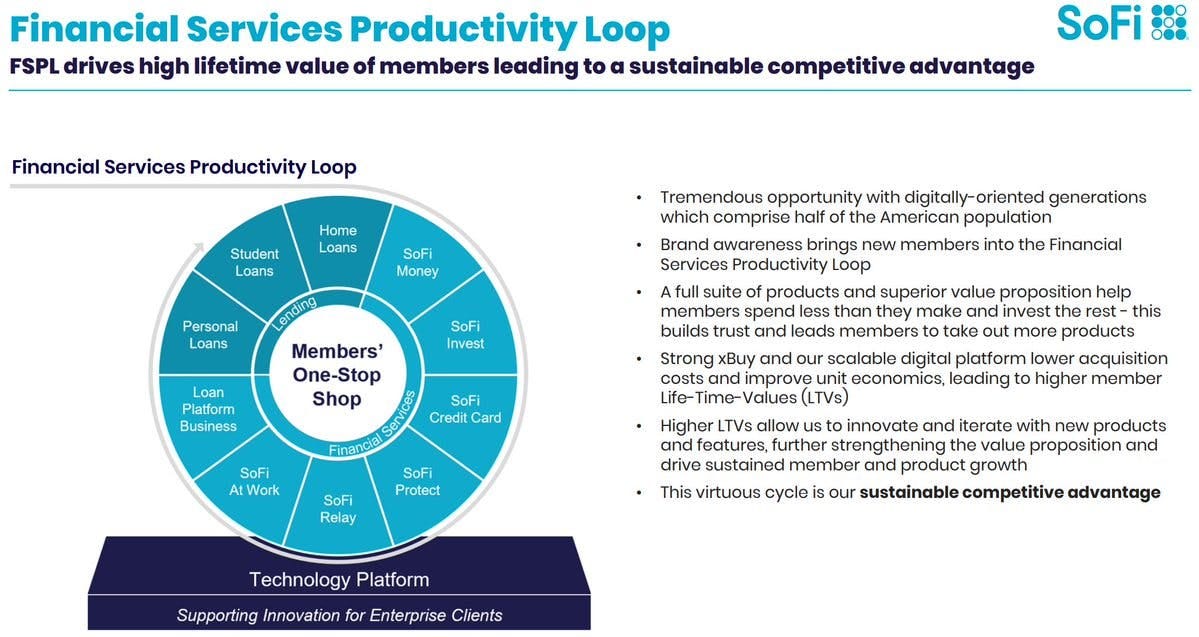

SoFi has grown into a comprehensive digital finance ecosystem, positioning itself as a one-stop destination for today’s consumers.

Dear growth investors,

Over the past few years SoFi Technologies (Ticker: SOFI) has evolved into a comprehensive one-stop shop for digital financial products. Its primary target audience consists of Millennials and Generation Z.

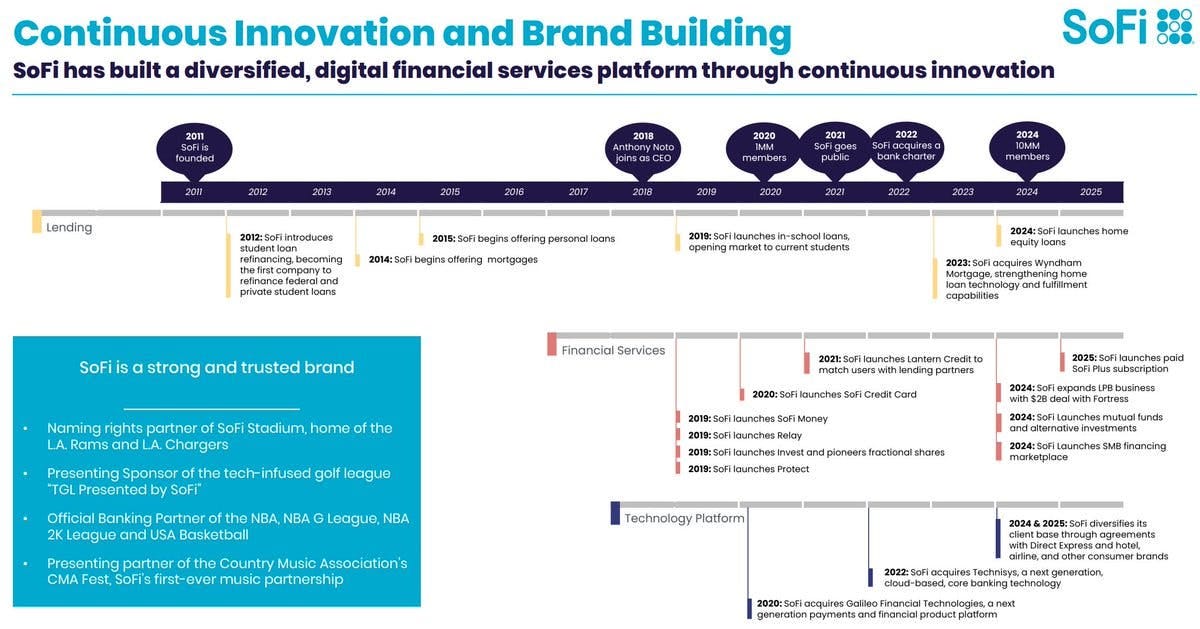

SoFi Technologies was founded in 2011 by four Stanford students: Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady. Their original idea was to create a platform where students could borrow money under better conditions than those offered by traditional lenders.

SoFi Technologies initially focused on student loan refinancing. The company later expanded its offerings to include personal loans, mortgages, and wealth management services.

In 2017, co-founder and then-CEO Mike Cagney stepped down. Anthony Noto, former COO of Twitter and CFO of the NFL, took over as CEO in early 2018 and played a key role in stabilizing and professionalizing the company.

Under Anthony Noto’s leadership, SoFi Technologies evolved into a fully digital full-service bank. The company launched SoFi Money (a cash management account) and SoFi Invest (for stock and crypto trading). In 2020, SoFi acquired fintech company Galileo for $1.2 billion.

Galileo Fintech’s digital payment platform offers powerful API capabilities and B2B services. As the software division of SoFi Technologies, Galileo provides APIs that support features such as account setup, funding, direct deposit, transfers, early wage access, bill pay, and dozens of other functions:

In June 2021, SoFi Technologies went public through a merger with a SPAC (Social Capital Hedosophia Holdings Corp V, led by Chamath Palihapitiya). A SPAC is a publicly traded shell company created for the sole purpose of taking an operating company public.

Shortly after, in January 2022, SoFi Technologies obtained a banking license through the acquisition of Golden Pacific Bancorp.

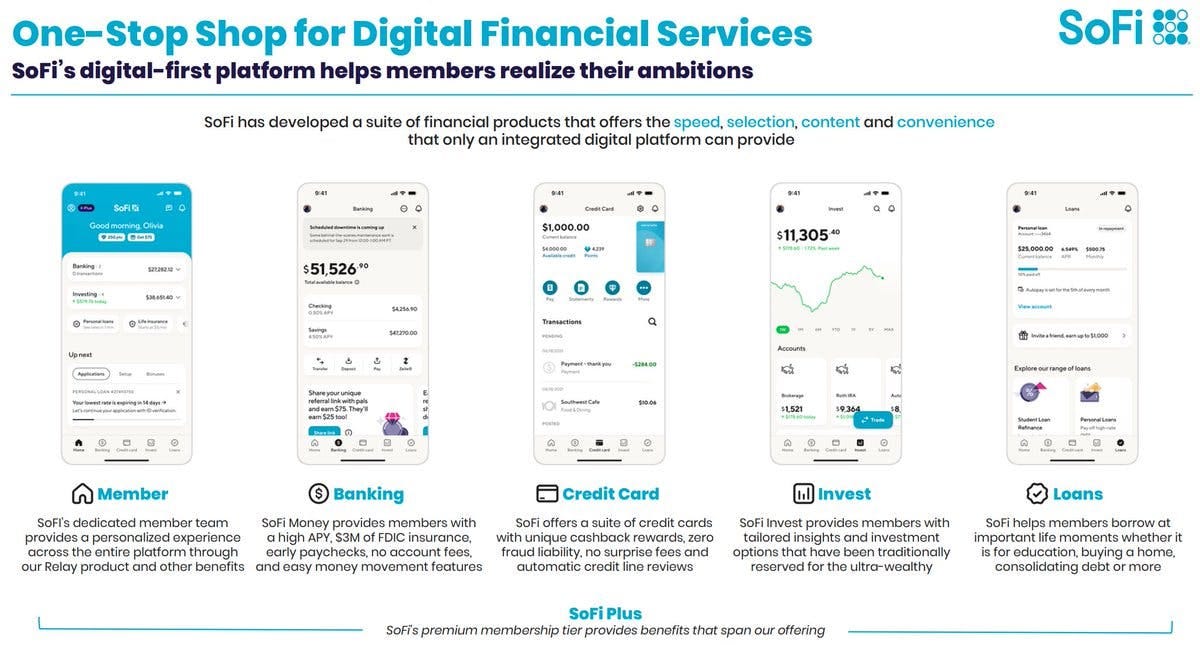

Today, SoFi Technologies is a comprehensive digital financial company offering services such as banking, investing, lending, insurance, and financial education.

The central hub for SoFi’s digital financial services is its integrated platform, which helps members achieve their financial goals. Key areas include: Membership, Banking, Credit Card, Invest, and Loans.

Q1'25 Highlights

SoFi Technologies impressed investors with its Q1 2025 results, exceeding expectations on all fronts.

In the first quarter of 2025, SoFi once again demonstrated strong growth and operational resilience. The company reported a record adjusted revenue of $771 million, marking a 33% year-over-year increase, outperforming expectations in a challenging macroeconomic environment.

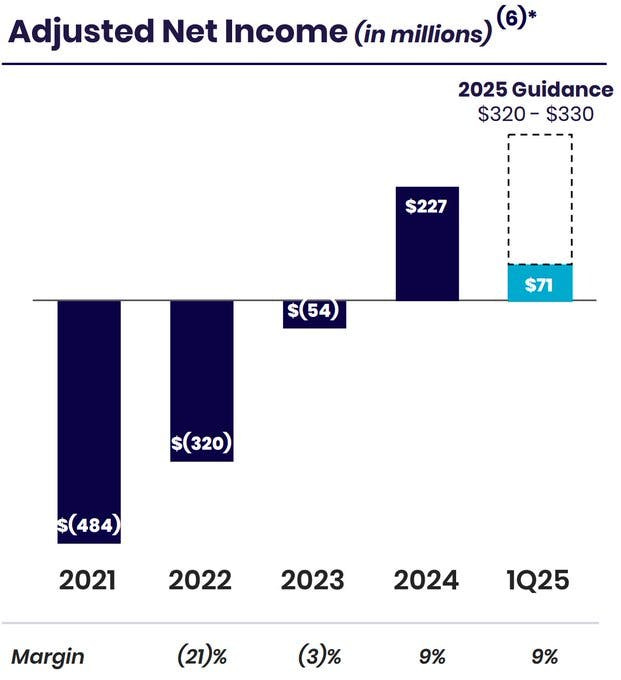

Notably, adjusted EBITDA reached $210 million, a 46% increase year-over-year, signaling improved operating efficiency and growing scale. Net income came in at $71 million, representing a net profit margin of 9%, a significant improvement compared to previous years.

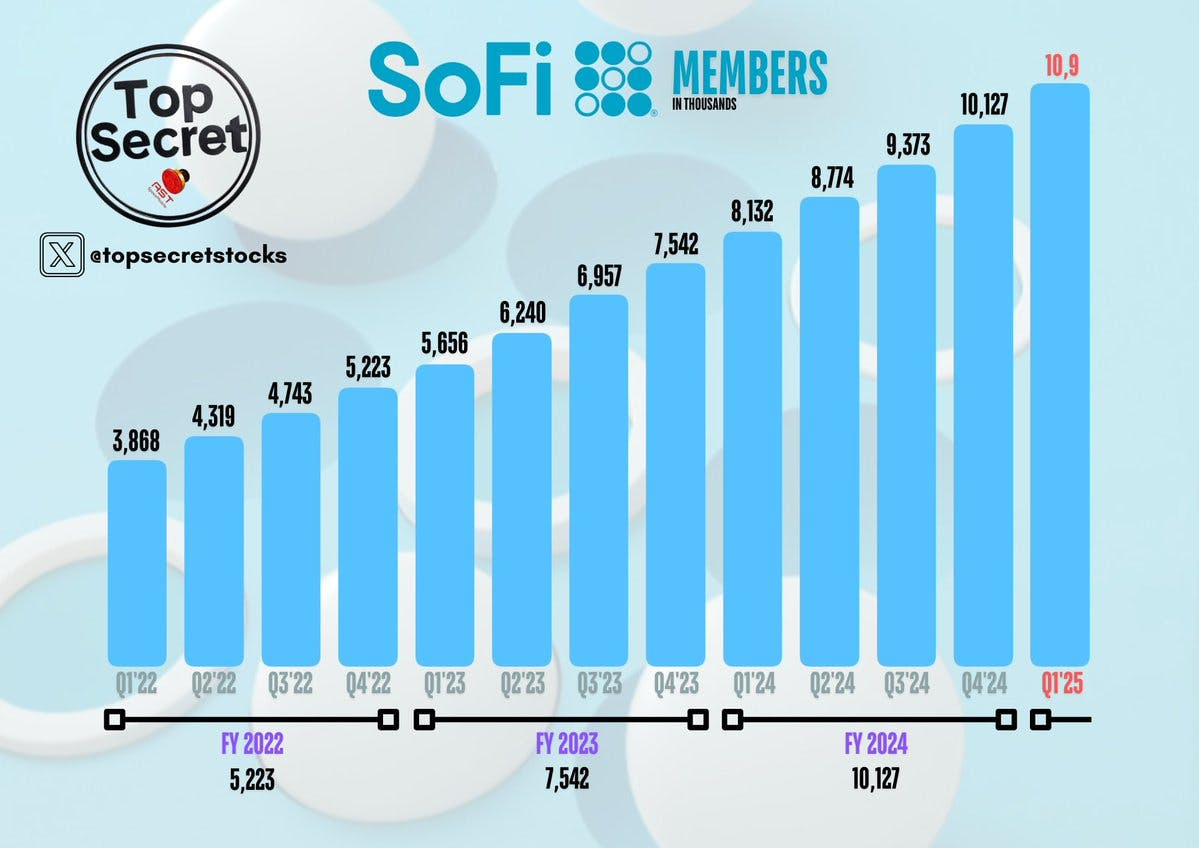

Members

Strong member growth underscores SoFi Technologies' strength in innovation and brand building. The company added a record 800,000 new members in Q1 2025, a 34% increase to 10.9 million.

Revenue

In Q1 2025, GAAP net revenue increased 20% to $771.8 million compared to the prior-year period ($645.0 million). Adjusted net revenue increased 33% to $770.7 million compared to the prior-year period ($580.6 million).

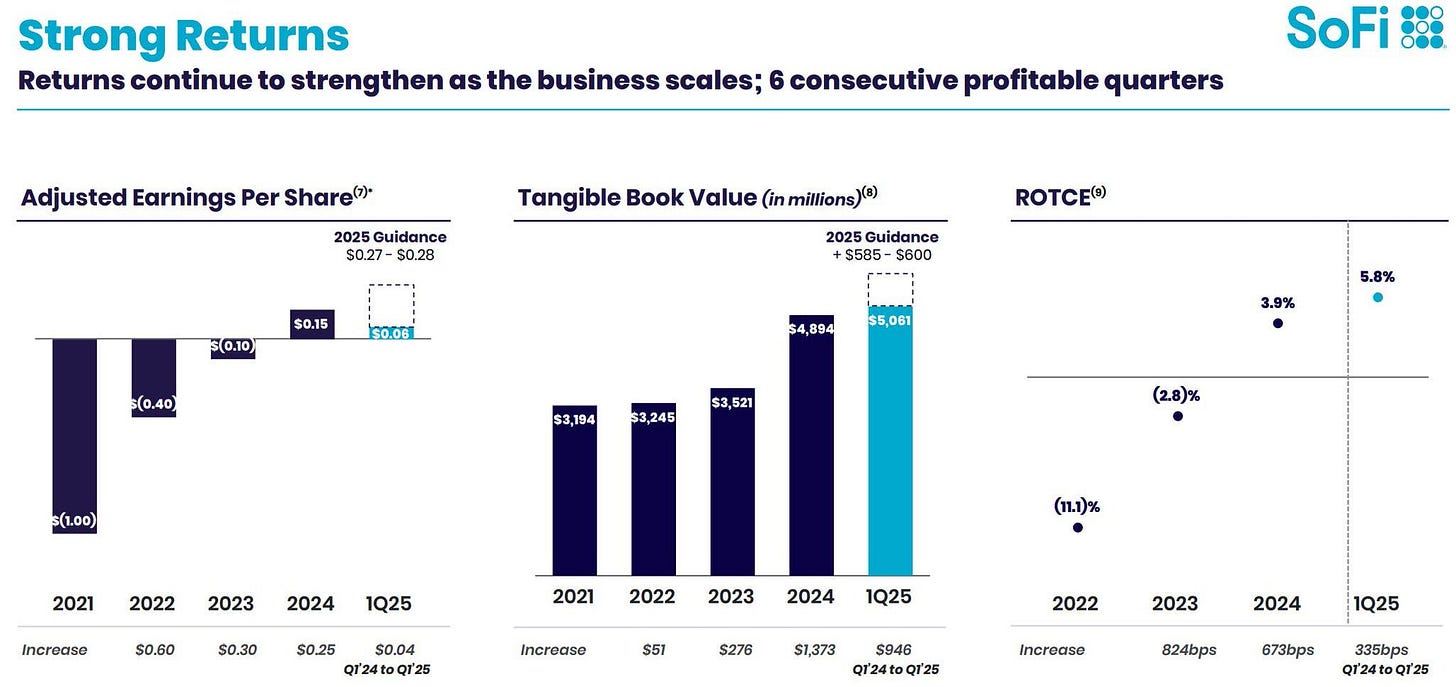

SoFi Technologies reported its sixth consecutive quarter of GAAP profitability. In Q1 2025, GAAP net income reached $71.1 million, with diluted earnings per share of $0.06.

Adjusted EBITDA reached a record $210.3 million in the first quarter, up 46% from $144.4 million in the same period last year. This corresponds to an adjusted EBITDA margin of 27%.

In its Technology Platform segment, SoFi Technologies once again delivered stable revenue of $103 million, with a consistent contribution margin of 30%. While the margin saw a slight decline, profitability in this area remains solid. With its technology stack, Galileo and Technisys, SoFi is positioning itself as the "AWS of fintech."

Net revenue in the Technology Platform segment increased by 10% year-over-year in Q1 2025, reaching $103.4 million. The contribution profit of $30.9 million reflects a contribution margin of 30%.

In addition, SoFi Technologies launched a co-branded debit card program in partnership with Wyndham Hotels & Resorts, and signed an agreement with Mercantil Banco, a provider of retail and commercial banking services in Panama.

Given the strong start to the year, management has raised its full-year 2025 guidance, despite ongoing macroeconomic uncertainties.

Outlook for Full-Year 2025

Adjusted Net Revenue:

Management now expects full-year 2025 adjusted net revenue in the range of $3.235 to $3.310 billion, which is $35 million above the previous forecast of $3.200 to $3.275 billion. This implies year-over-year growth of 24% to 27%, up from the previous estimate of 23% to 26%.Adjusted EBITDA:

SoFi now projects adjusted EBITDA of $875 to $895 million, exceeding the prior guidance of $845 to $865 million. This corresponds to an adjusted EBITDA margin of approximately 27%.GAAP Net Income:

The company anticipates a GAAP net income of $320 to $330 million, up from the previously forecasted range of $285 to $305 million. This equates to a net income margin of around 9%.GAAP Earnings Per Share:

SoFi expects GAAP EPS of $0.27 to $0.28 per share, slightly above the earlier projection of $0.25 to $0.27 per share.Members:

For 2025, management anticipates at least 2.8 million new members, reflecting 28% growth compared to 2024.

Guidance for Q2 2025

Adjusted net revenue: $785 to $805 million

Adjusted EBITDA: $200 to $210 million

GAAP net income: $60 to $70 million

GAAP EPS: $0.05 to $0.06 per share

SoFi's Key Financials

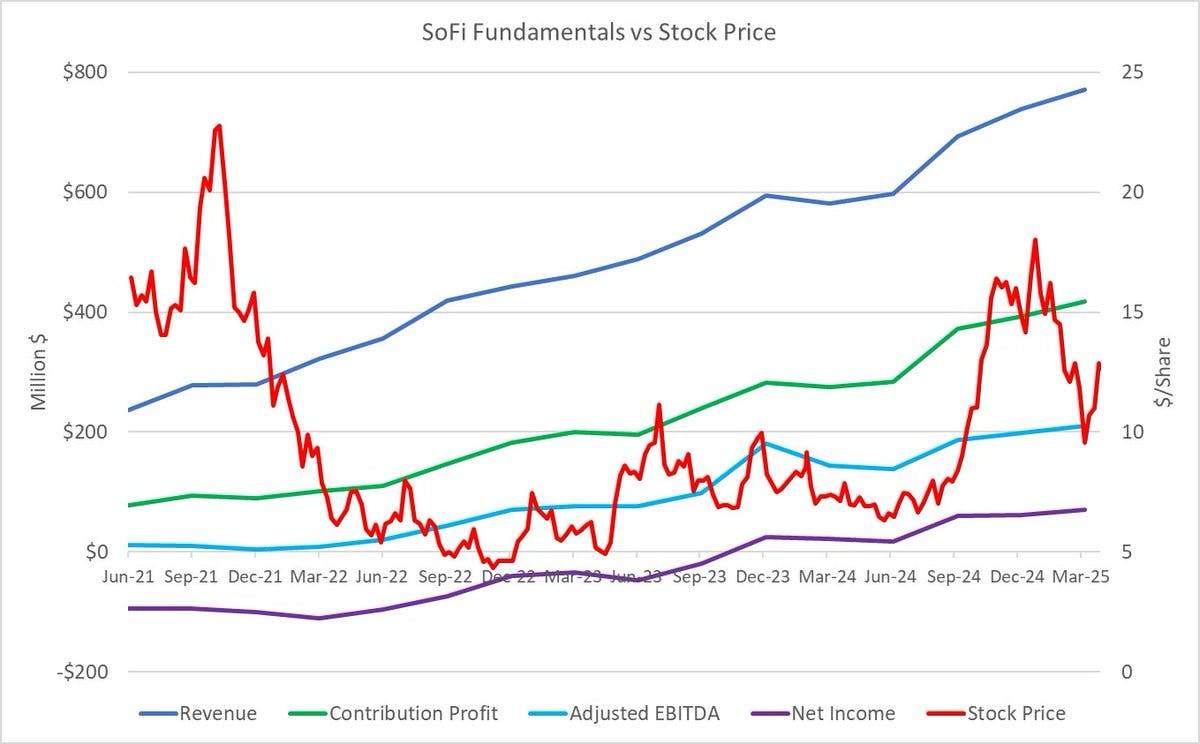

The following chart shows the development of SoFi's key financial metrics relative to its share price over a period from June 2021 to March 2025.

What stands out is the clear disconnect between SoFi’s operational performance and its stock price development. This disparity suggests that the market has only partially priced in the company’s long-term fundamental recovery. While SoFi’s financial results reflect growing efficiency and increasing financial strength, its share price appears to be influenced more by short-term sentiment, macroeconomic factors, or broader market uncertainty.

Free Cash Flow vs. Adjusted EBITDA

Free cash flow is generally one of my preferred metrics when it comes to evaluating a stock. However, this indicator reaches its limits, especially for companies with highly volatile operating cash flows, such as those in the banking sector. I have to agree here with Data Driven Investing:

“Like any single metric, free cash flow only captures part of the bigger picture, and in capital-intensive industries like financial services, it often fails to reflect the company’s true economic reality. In the case of SoFi, it makes more sense to focus on adjusted EBITDA to gain a clearer picture of the company’s actual cash-generating power. In this context, adjusted EBITDA provides a more stable and meaningful basis for assessing the company’s financial position.”

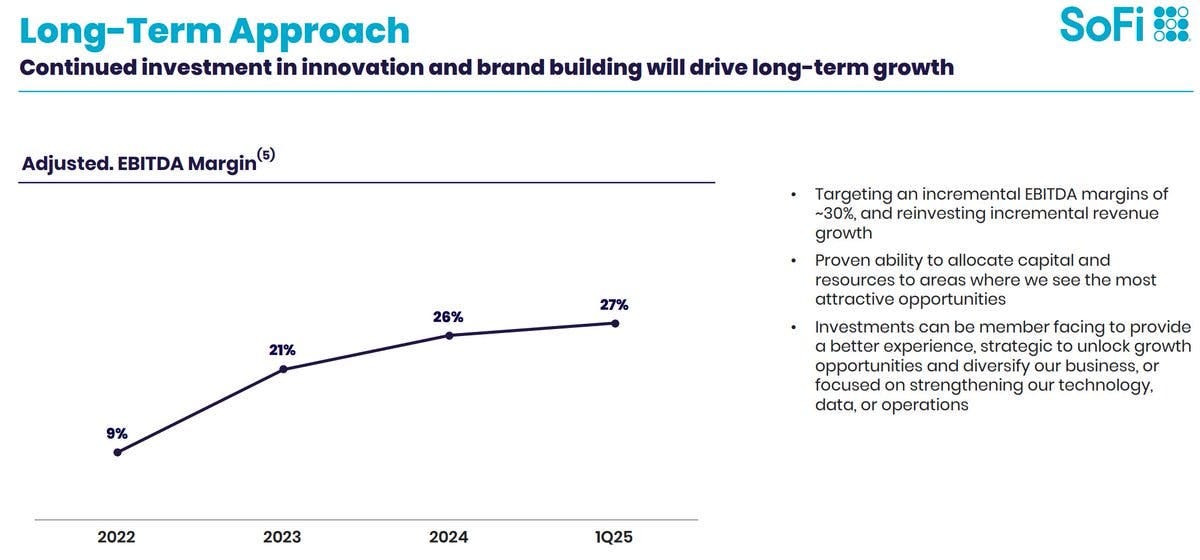

SoFi’s adjusted EBITDA margin has shown a steadily positive trajectory: rising from 9% in 2022 to 21% in 2023. For 2024, the company projects a further increase to 26%, and in Q1 2025 the margin already stands at 27%.

The company is targeting a medium-term adjusted EBITDA margin of approximately 30%. According to SoFi, a key success factor lies in its proven ability to allocate capital and resources efficiently, directing them toward areas where they can generate the highest value, particularly in strategically important growth segments.

The company’s planned investments are diversified and impact-driven. They aim to:

Enhance the overall user experience,

Unlock new growth opportunities,

Diversify the business model, and

Strengthen internal technology, data infrastructure, and operational efficiency.

SoFi is clearly in a phase of profitable growth. While its adjusted EBITDA margin stood at just 9% in 2022, it has improved significantly in the following years, reaching 21% in 2023, 26% in 2024, and 27% in Q1 2025. This trend reflects growing operational efficiency alongside continued revenue growth.

The company’s long-term goal of achieving an adjusted EBITDA margin of around 30% appears increasingly realistic given this consistent upward trajectory.

What’s particularly noteworthy is that SoFi has achieved this progress despite ongoing investments in member experience, technology, and business expansion, underscoring the scalability and strategic discipline of its growth model.

Conclusion

SoFi impresses with strong momentum, a clear roadmap to sustained profitability, and a steadily improving EBITDA margin. The company is not only growing but becoming structurally stronger. Under the visionary leadership of its CEO, SoFi continues to drive innovation and technological progress, making it one of the most compelling digital banks with long-term potential.

Why I plan to hold the stock long term:

Six consecutive quarters of profitability

A comprehensive financial and technology platform that allows for significant scalability

Strong fundamentals: consistent revenue growth and a steadily improving adjusted EBITDA margin underscore operational efficiency and business maturity

What are your thoughts? Could SoFi potentially become the AWS of Fintech?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.