Sportradar: The Invisible Giant Controlling Global Sports!

The company provides reliable live data, in-depth statistics, and sophisticated analytics.

Dear growth investors,

Sportradar, listed on the Nasdaq under the ticker SRAD, was founded in St. Gallen, Switzerland, in 2001 and is headquartered in Zurich, Switzerland. The company provides reliable live data, in-depth statistics, and sophisticated analytics to sports governing bodies, news media, consumer platforms, and betting providers worldwide, covering over one million sporting events annually.

Table of Contents

Business Model

Growth Strategy

Global Total Market (TAM)

Customers & Partnerships

Product and Content Value Chain (“Take Rate”)

Growth Market: iGaming

Sports Rights

Acquisition of IMG Arena

Financial Key Figures: Q1 2025

Conclusion

Business Model

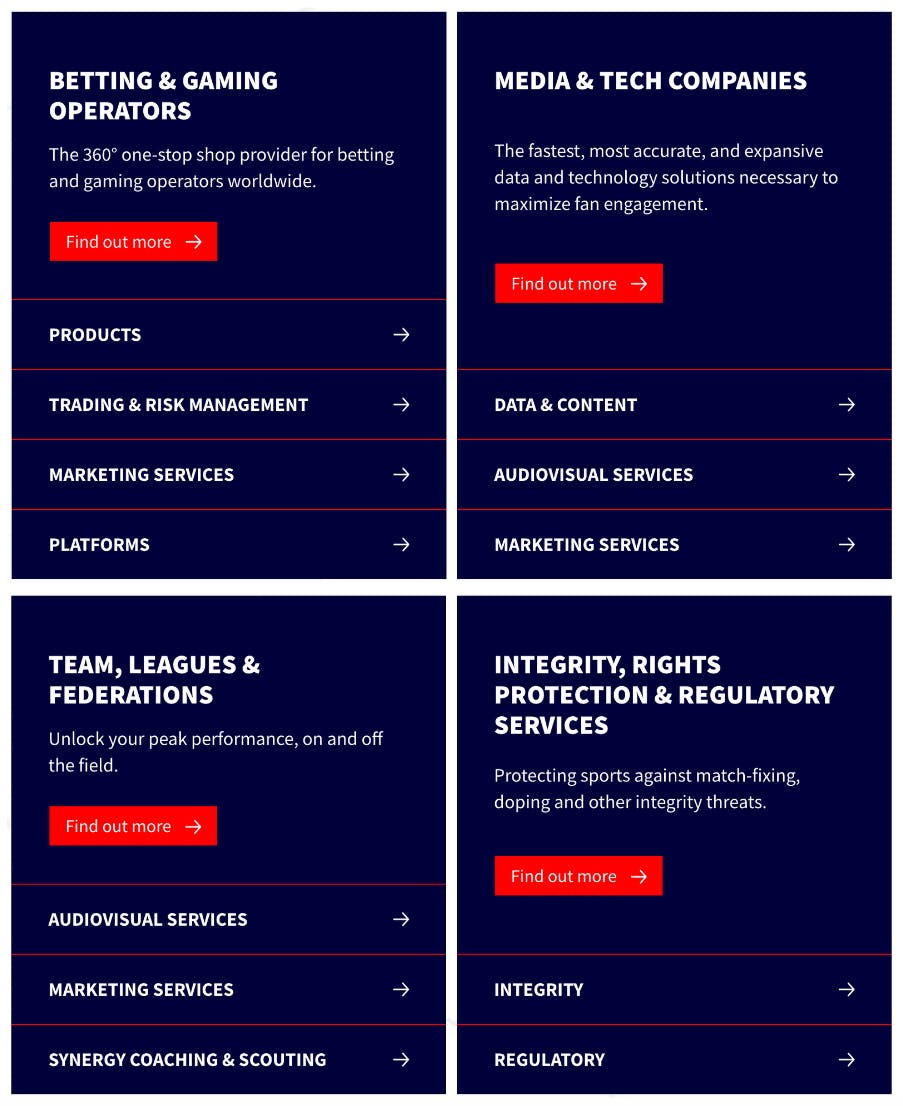

Sportradar sees itself as a comprehensive partner for four key customer groups, providing tailored product and service packages for each.

Sportradar acts as a one-stop shop for betting and gaming operators: From pre-match and live data feeds to automated trading and risk management, as well as integrated platforms and marketing services, bookmakers and gaming providers receive all the components from a single source. Media and technology companies, on the other hand, benefit from the industry's fastest, most precise, and most comprehensive data and content solutions, a wide range of audiovisual services (live streams, highlights, video clips), and specialized marketing services that maximize fan engagement and reach. For teams, leagues, and associations, Sportradar provides targeted audiovisual services (live commentary, interviews, highlight videos, live sporting events, all produced in-house). Furthermore, clubs, leagues, publishers, and betting providers have the opportunity to plan, manage, and evaluate cross-channel marketing campaigns via the Marketing Services platform, from social media ads to display campaigns and affiliate marketing. Sportradar also offers Synergy Coaching & Scouting: This product is an integrated service package for teams, associations and clubs that combines three key components:

Video Capturing Solutions: Games, match situations, and training sessions are recorded.

Coaching Solutions: Recorded video footage with comprehensive analytics and metrics. Coaches can review moves, individual actions, and tactical patterns in real time or afterward, plan targeted training sessions, and provide their teams with video examples at the click of a button.

Scouting Tools: A video database allows you to study opponents in detail and discover up-and-coming talent. Intelligent filter functions help scouts quickly find suitable player profiles.

Finally, Sportradar's Integrity, Rights Protection & Regulatory Services protect sports against manipulation: With holistic integrity monitoring and regulatory advice, Sportradar protects against fraud risks and ensures transparent, compliant betting and gaming processes.

Growth Strategy

Sportradar's growth strategy is based on four key building blocks: first, consistently capitalizing on market growth through global scaling of its own data and service offerings; second, increasing the take rate, particularly through expanding the live betting offering and gaining additional market share; third, expanding into new business areas with a focus on iGaming to tap into new revenue streams; and fourth, promoting innovation through the targeted use of artificial intelligence.

Total Global Market (TAM)

The total global market (TAM) for sports betting is expected to grow from around USD 97 billion today to approximately USD 131 billion by 2027, a compound annual growth rate (CAGR) of approximately 11%. Europe is growing at 9%. In the USA, where Sportradar already covers three of the four major professional leagues, an impressive CAGR of 23% is forecast. In Latin America, the company gained an early foothold in Brazil. The entire LATAM region is expected to grow at around 17% annually until 2027. Longer-term opportunities also arise in Asia-Pacific markets such as Japan, India, Thailand, and Sri Lanka.

Customers & Partnerships

Sportradar maintains partnerships with over 400 leagues and associations, from FIFA and UEFA to the NBA and NHL, Bundesliga and NASCAR, as well as with around 800 betting providers such as Bet365, DraftKings, Entain, FanDuel, and Paddy Power. The company also cooperates with approximately 900 media and technology partners, including major brands such as Google, Meta, OpenAI, Fox Sports, NBC Sports, Prime Video, and Microsoft. With the help of this global network, Sportradar covers almost 1 million games annually in around 85 different sports and delivers live data, statistics, and multimedia content to its customers in real time. This is very impressive.

It's important to note that Sportradar has extended its partnership with Major League Baseball for eight years through the 2032 season. As the exclusive distributor, the company now supplies MLB with ultra-latency official data, media, and audiovisual content. MLB itself has also acquired a minority stake in Sportradar, further cementing the long-term relationship.

What is "ultra-latency official data"?

Ultra-latency official data, or "ultra-low latency official data," is game and event data that is captured by the league or the official rights holder directly at the venue and delivered to customers with virtually no delay. Ultra-low latency means that only fractions of a second (100 ms) elapse between the actual event (e.g., pitch, throw, goal) and the information being displayed to the end user. By comparison, standard live streams have latencies of several seconds (up to over 30 seconds). Customers who use ultra-latent official data gain an information advantage over competitors.

Leveraging its global reach, Sportradar is helping to strengthen MLB's international position and is working with the league to develop AI-powered, highly personalized fan experiences. At the same time, the Universal Fraud Detection System is being expanded.

What is the Universal Fraud Detection System?

Sportradar's Universal Fraud Detection System (UFDS) is a comprehensive integrity platform for the prevention and detection of betting and match manipulation in sports. It uses machine learning and AI models that automatically detect unusual betting patterns, deviations from statistical expectations, or suspicious odds movements.

The expansion of the MLB relationship not only provides Sportradar with long-term cost transparency but also strengthens its position as a leading provider of sports data, media content, and integrity solutions.

Product and content value chain ("take rate")

By gradually expanding its offerings along the product and content value chain, Sportradar is continuously increasing its take rate (revenue share per customer). This increases both customer value and margin.

Product and Content Value Chain:

Pre-Match Data & Odds (basic offering: data & odds before the start of a match)

Live Data (real-time match statistics)

Live Odds (dynamic in-play odds)

Managed Trading Services (MTS) (comprehensive risk management and odds setting)

Betting Platform Solutions (complete betting platform infrastructure)

Streaming & Betting Engagement (integrated video streams with betting features)

Marketing Services (targeted customer marketing and gamification)

Sportradar's Net Retention Rate (NRR) is 122%. This metric measures how much revenue is retained from existing customers over a defined period of time and generated through upsells (more expensive versions of the product or service) or cross-sells (complementary or related products and services that meaningfully expand the original purchase). Both methods together ensure that existing customers are not only retained but also monetized more intensively, which directly translates into an increasing net retention rate (NRR). If the NRR is above 100%, revenue from existing customers increases, even if individual customers churn.

Using football as an example, Sportradar increases its revenue within the product and content value chain (“take rate”) through a combination of comprehensive league collaboration and continuous product innovation.

As a partner of UEFA, Bundesliga, CONMEBOL, and AFC, the company currently covers around 150,000 matches and offers betting providers 190 pre-match markets and 250 in-play options. To bring customers even deeper into the value chain and further increase take rates, three new solutions are set to be launched:

4Sight Streaming for high-resolution live broadcasts.

Alpha Odds for AI-supported odds optimization and a Virtualized Live Match Tracker that interactively visualizes match-relevant data.

This combination of global reach and smart fan engagement tools secures Sportradar a strong position in the football industry and creates additional upsell and cross-sell potential.

Using basketball as an example, Sportradar is increasing its take rate through deeper fan engagement solutions in partnership with the NBA, WNBA, CBA, and 3×3 Basketball.

1,800 betting options per match

50 million viewer sessions in Q1 2025 for the Virtualized Live Match Tracker, which interactively visualizes match events.

~3.5% click-through rate (CTR) from emBET to sportsbook providers as evidence of efficient in-stream betting engagement.

Next-gen products: 4Sight Streaming (high-res live feeds), Virtualized Live Match Tracker, emBET platform, and expanded micro and player markets.

This combination of micro bets, interactive visualization, and streaming features engages fans more intensively and gradually increases revenue per customer.

iGaming: a growing market

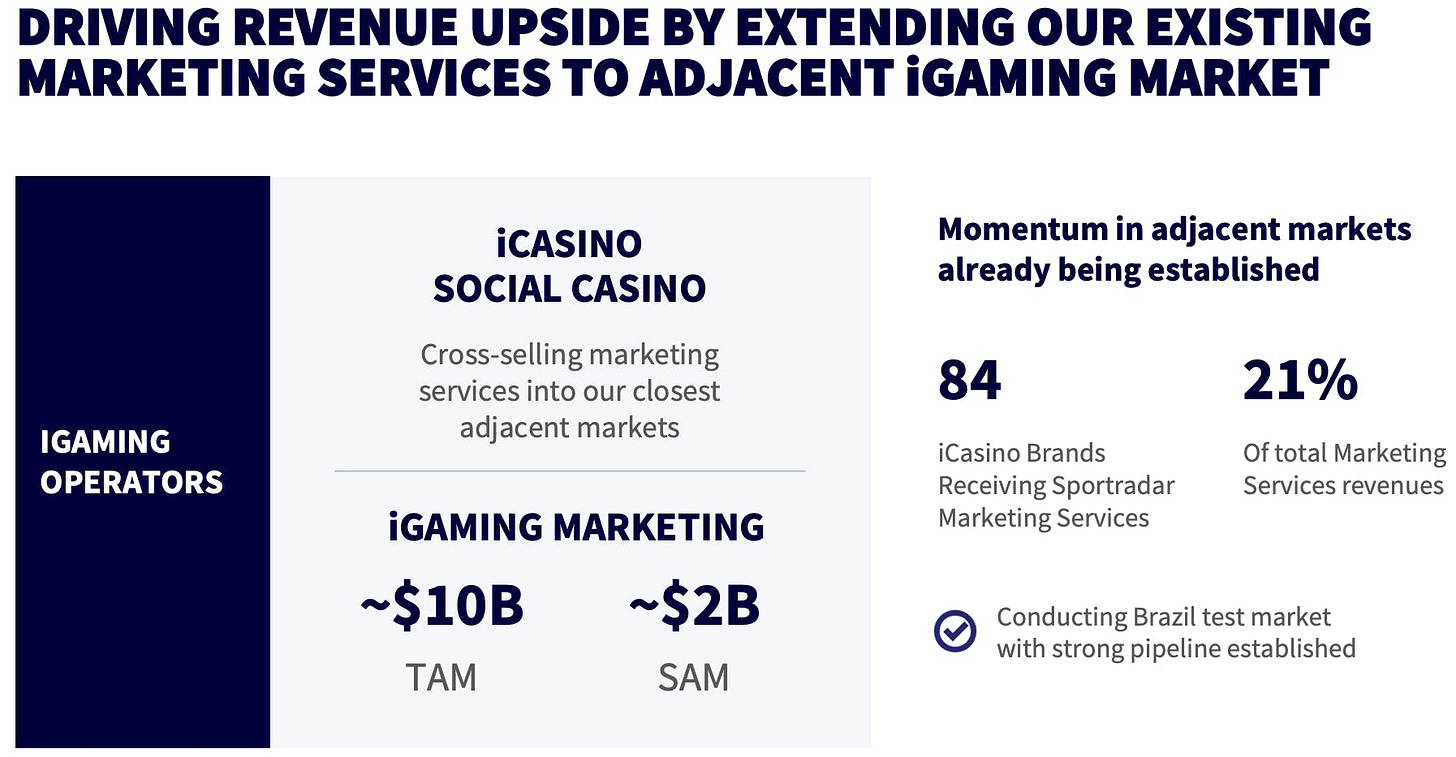

Sportradar is strategically expanding its marketing portfolio into the adjacent iGaming market, particularly in the iCasino and social casino sectors.

The total addressable market (TAM) for iGaming marketing is approximately USD 10 billion, and the directly exploitable submarket (SAM) is approximately USD 2 billion. Currently, 84 iCasino brands already use Sportradar marketing services, accounting for 21% of total marketing services revenue. In parallel, a successful test market in Brazil is underway with a promising pipeline to further drive growth.

Sports Rights

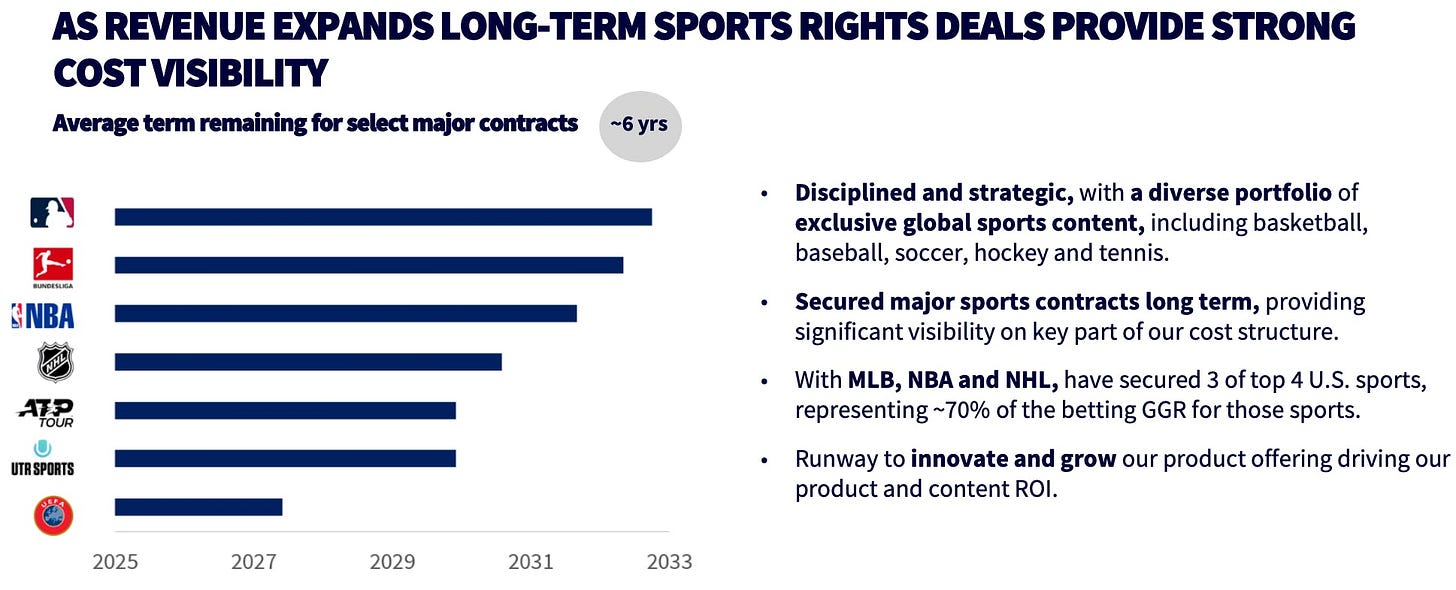

Sportradar has secured its key sports rights on a long-term, exclusive basis. The remaining contract terms are approximately six years, with terms running between 2028 (UEFA) and 2033 (MLB). Partners include Major League Baseball, Bundesliga, NBA, NHL, ATP Tour, and UTR Sports.

Thanks to these deals, Sportradar covers three of the four major US sports (MLB, NBA, NHL), which together represent approximately 70% of betting revenue for these sports. The long-term contracts provide the company with reliable planning security for licensing costs while creating scope for further investments in product and content innovations to further increase returns on the rights portfolio.

Acquisition of IMG Arena

Sportradar is acquiring IMG Arena's entire portfolio of highly strategic betting rights in key sports such as tennis, soccer, and basketball. This includes licenses for 14 sports from over 70 global rights holders, approximately 39,000 official data events, and approximately 30,000 streaming events across six continents.

What's interesting is that Sportradar isn't paying any money to its parent company, Endeavor, for the acquisition. In return, IMG Arena will provide a total of USD 225 million in financial consideration:

USD 125 million in cash payments to Sportradar (graduated over two years).

Up to USD 100 million in upfront payments directly to certain sports rights holders.

The acquisition is expected to close in the fourth quarter of 2025, subject to regulatory approvals and customary closing conditions.

What are the synergies of the acquisition?

The transaction accelerates revenue growth, adjusted EBITDA, and free cash flow. The acquisition is directly accretive to EBITDA margins, meaning it directly improves Sportradar's profitability.

The acquisition of IMG Arena expands Sportradar's integration into the world's three most highly ranked betting sports (basketball, soccer, tennis) and creates additional value along the following dimensions:

Seamless integration into the existing ecosystem: The new rights integrate directly into the platform, data feeds, and streaming services, taking Sportradar's monetization to a new level.

Global reach: With licenses for 14 sports from over 70 rights holders and over 190 competitions on six continents, the company's global presence is significantly expanded.

Event volume: IMG Arena will provide Sportradar with 39,000 more data events and 30,000 more streaming events per year.

Strategic partnerships: The deal portfolio includes top brands such as Roland Garros, US Open, Wimbledon, UFC, PGA Tour, MLS, EuroLeague Basketball, Concacaf, Liga Endesa, and others, and strengthens relationships with league associations and sports betting providers.

Overall, the transaction creates significant upsell and cross-sell potential, expands the rights ecosystem, and strengthens Sportradar's position as a leading provider of data, streaming, and integrity solutions.

Key Financial Figures: Q1 2025

In the first quarter of 2025, Sportradar achieved record revenue of €311 million, an increase of 17% compared to €266 million in the same period last year. This was primarily driven by strong customer demand in the US, whose share of total revenue grew from 25% to 28%. At the same time, adjusted EBITDA increased by 25% to €59 million, driven by higher revenue and operating leverage in personnel, sports rights, and other expenses. The adjusted EBITDA margin improved from 17.7% to 18.9% (+120 basis points), putting the company on track to achieve margin expansion of approximately 200 basis points over the course of the year.

Sports Content, Technology & Services - Betting Technology & Solutions

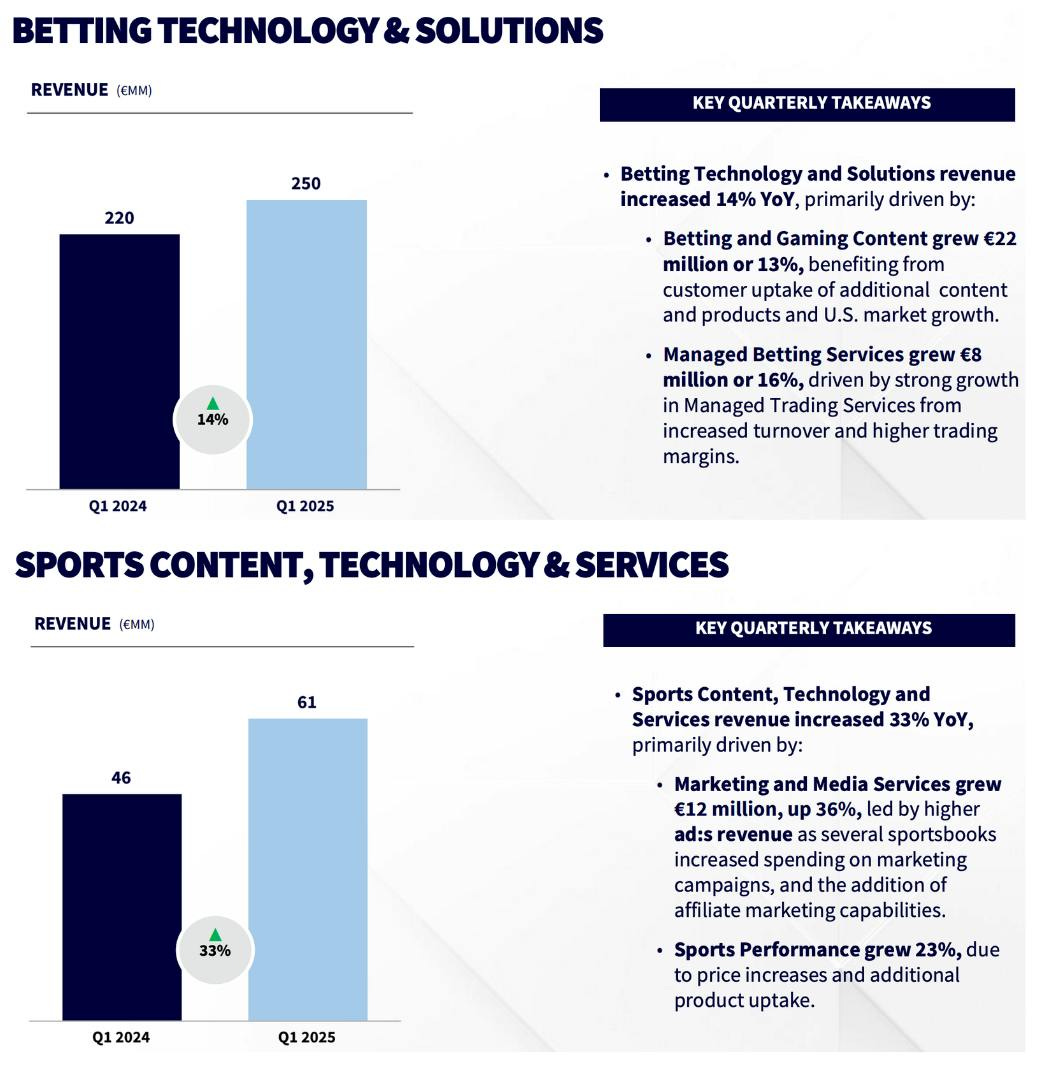

€61 million from Sports Content, Technology & Services (approximately 19.6% of total revenue)

€250 million from Betting Technology & Solutions (approximately 80.4% of total revenue)

In the first quarter of 2025, revenue in the Sports Content, Technology & Services division increased by 33% from €46 million to €61 million. The main drivers were Marketing and Media Services, which grew by €12 million (+36%) thanks to higher advertising revenue and new affiliate programs, and the Sports Performance business, which recorded 23% growth due to price increases and additional product usage.

Revenue in the Betting Technology & Solutions division increased by 14% from €220 million to €250 million. Of this, €22 million (+13%) was attributable to Betting and Gaming Content, boosted by the increased uptake of new content and products as well as growth in the US market, and €8 million (+16%) to Managed Betting Services, where higher revenues and improved trading margins drove growth.

In the first quarter of 2025, Sportradar generated free cash flow of €32 million, corresponding to a cash conversion rate of 54%, a significant improvement from zero free cash flow in the same quarter of the previous year.

Total liquidity increased from €568 million at the end of 2024 to €578 million.

Operating Leverage

Operating leverage describes the impact of revenue growth on operating profit over a specific period. The core idea behind it is:

Cost Structure

Fixed costs: Costs incurred independently of revenue (e.g., rent, salaries, depreciation).

Variable costs: Costs that rise or fall directly with revenue volume (e.g., transaction fees, payment commissions).

Sportradar invests in technology, infrastructure, and exclusive rights (high fixed costs), while many data-based services incur only low additional variable costs. If revenue growth is achieved through new products or rights deals, the additional revenue flows almost directly into adjusted EBITDA, which is reflected in a growing EBITDA margin. At the same time, long-term planning of rights costs and strict cost management enable the targeted control of operating leverage and the securing of margin expansion.

Based on the cost structure shown, Sportradar is developing into an increasingly profitable business model from 2022 to 2025 due to its operating leverage: In the 2022 financial year, sports rights costs accounted for 26% of revenue, while all other expenses combined accounted for 57%, and the adjusted EBITDA margin was 17%. In 2023, the rights share was reduced to 24%, thereby increasing the margin to 19%. Despite a deliberate expansion of the licensing portfolios, sports rights expenses rose to 32% in 2024, while other expenses fell to 48% and the margin climbed to 20%. For 2025, Sportradar is targeting a further decline in total expenses (less rights costs) to 47% of revenue, while the rights share remains moderate at 31%. Thanks to this shift, the company expects margin expansion for the third consecutive year, to approximately 22% EBITDA, and is even targeting levels above 30% in the medium term.

Three-year outlook

In the 2024 financial year, Sportradar generated total revenue of approximately €1.1 billion, which is expected to increase to approximately €1.7 billion by the end of 2027, with an expected annual growth rate (CAGR) of at least 15%. Strong growth is also planned for adjusted EBITDA: Starting from €222 million in 2024, the company calculates a CAGR of 27%, leading to a target of approximately €455 million in 2027. Over the same period, Sportradar aims to improve its adjusted EBITDA margin by 700 basis points from the current 20% to approximately 27%.

Free cash flow amounted to €118 million in 2024. Assuming an average annual increase of 33%, it is expected to grow to approximately €275 million by 2027. At the same time, the company aims to increase its cash conversion rate by 700 basis points, from the current 53% to 60% in the future.

These ambitious targets underscore Sportradar's focus on profitable growth, strong margin expansion, and sustainable cash generation over the next three years.

Conclusion

Sportradar is successfully positioned in many markets. How can the company secure its market position over the long term? Sportradar can secure its strong market position over the long term by selectively purchasing long-term sports rights. These rights provide the company with exclusive access to live data and streams, ensure predictable licensing costs, and enable improved profit development as revenue increases. With a broad portfolio across various leagues and sports, customers can gradually be won over to higher-value offerings. Furthermore, new rights open up additional markets in previously underserved regions and improve fraud monitoring through more data. Sportradar thus creates a stable foundation for sustainable growth and increased profitability.

In the chart, sports rights costs rose from €91 million in the first quarter of 2024 to €104 million in the first quarter of 2025, an increase of 14%. At the same time, their share of total revenue declined slightly due to even stronger revenue growth. Expenses for third-party services, including higher advertising, affiliate, cloud, and IT costs, also climbed significantly from €35 million to €44 million (+24%). These developments demonstrate that Sportradar continues to invest in exclusive rights, but also better manages costs relative to revenue thanks to higher revenues and targeted infrastructure spending, thus strengthening the efficiency and profitability of its business model.

Overall, Sportradar has established itself in recent years as a leading provider of sports data, betting technology, and integrity solutions. With a portfolio ranging from pre-match and live data to managed trading services, streaming, and marketing platforms, the company serves sports associations, news media, consumer platforms, and betting providers worldwide. Thanks to long-term rights agreements, including those with MLB, NBA, Bundesliga, and ATP, and a consistent expansion of its offerings, Sportradar was able to increase its revenue by 17% in the first quarter of 2025 and simultaneously expand its adjusted EBITDA margin to almost 19%. The clear cost structure and high proportion of fixed costs allow for strong operating leverage, so that every additional euro of revenue contributes disproportionately to profit.

An important milestone for further expansion is the planned acquisition of IMG Arena. With this move, Sportradar will receive rights to approximately 39,000 data events and 30,000 streaming matches in 14 sports from over 70 rights holders across six continents. This significantly expands monetization opportunities in particularly high-revenue disciplines such as tennis, football, and basketball. The transaction not only strengthens upsell and cross-sell potential but also accelerates EBITDA growth and free cash flow generation.

Valuation

Sportradar's price-to-earnings (P/E) ratio for the next twelve months is 69. This extremely high multiple reflects the business's above-average growth and attractive margins, but also carries the risk that slower growth could lead to a significant price correction.

Analysts

Recent analyst reports for Sportradar are predominantly bullish.

Buy recommendation: 87% of analysts recommend buying

Hold: 13% recommend holding

Sell: No recommendations

The average price target for the end of 2025 is USD 28.36, while the current price is USD 25.33. This results in an upside potential of approximately 11.95% based on 14 analyst estimates.

This expected upside is reflected in the chart forecast: Prices could rise to near USD 28, while the lower end of the range is around USD 23. Overall, most experts see further upside potential and the majority recommend buying the stock.

How I proceed?

Analysts see further upside potential (+12% by the end of 2025) and the majority recommend buying. However, with a P/E ratio of 69, the stock is trading at a very high level, so future disappointments could significantly impact the price. I'm putting Sportradar on my watchlist for now to continue monitoring its price development. Only when the valuation falls noticeably would I consider buying. This way, I weigh the long-term growth potential against the current valuation risk and buy at a significantly more favorable price level.

What is your opinion of Sportradar? Could you consider adding the company to your portfolio?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.