Dear growth investors,

Chime will have its IPO on June 12th, 2025. The corresponding Ticker is CHYM. The Fintech is a direct competitor to SoFi Technologies (Ticker: SOFI), but can Chime really compete with SoFi? I'll take a closer look at the data.

Chime is an American fintech company founded in San Francisco in 2013. It offers mobile banking services via an app and is aimed primarily at people who want to avoid traditional banks, thus targeting a younger, digital audience.

Chime does not hold a banking license itself, but works with regulated partner banks such as The Bancorp Bank and Stride Bank, which provide the actual bank accounts.

Chime's business model

Chime offers a digital banking experience focused on simplicity, no fees, and financial empowerment. Chime's features and services at a glance:

Spending Management:

Free checking account with debit card

Get Paid Early

Liquidity:

SpotMe: Interest-free overdraft

MyPay: Fast access to earned money

Instant Loans: Instant loans for short-term needs

Credit Building:

Credit Builder: Secured, interest-free credit card

Support in building creditworthiness through FICO score tracking

Savings & Perks:

High-yield savings account

Automatic savings and exclusive offers

Free tax filing

Community:

Send money to anyone (Pay Anyone)

SpotMe Boosts: Support friends with overdraft bonuses

Support & Safety:

24/7 customer support

Chime bot for quick assistance

Security Center to protect user data

How does Chime make money?

Interchange Fees

Chime's main source of revenue is the so-called "interchange fees," which are charged on every card payment.

When a customer pays with a Chime Visa debit card, the merchant pays a small fee (approximately 1-2% of the amount) to Visa, a portion of which is forwarded to Chime.

This commission is Chime's most central source of revenue.

Through interest income on deposits (indirectly via partner banks)

Customer funds are held by partner banks such as The Bancorp Bank or Stride Bank.

These banks earn interest on deposits and pass a portion of it on to Chime, a classic B2B model.

Through SpotMe as a freemium model

SpotMe (an overdraft service) is free up to a certain limit ($20–$200), but users can voluntarily make "tips."

These voluntary contributions ("tips") also generate revenue.

What are the long-term goals of management, or of Chris Britt, CEO & Co-Founder, and Ryan King, Co-Founder?

Create a banking-friendly system for the masses.

Offer a fee-free, customer-friendly business model.

Earn money with members, not from them.

Build our own technology platform (AI and data analytics).

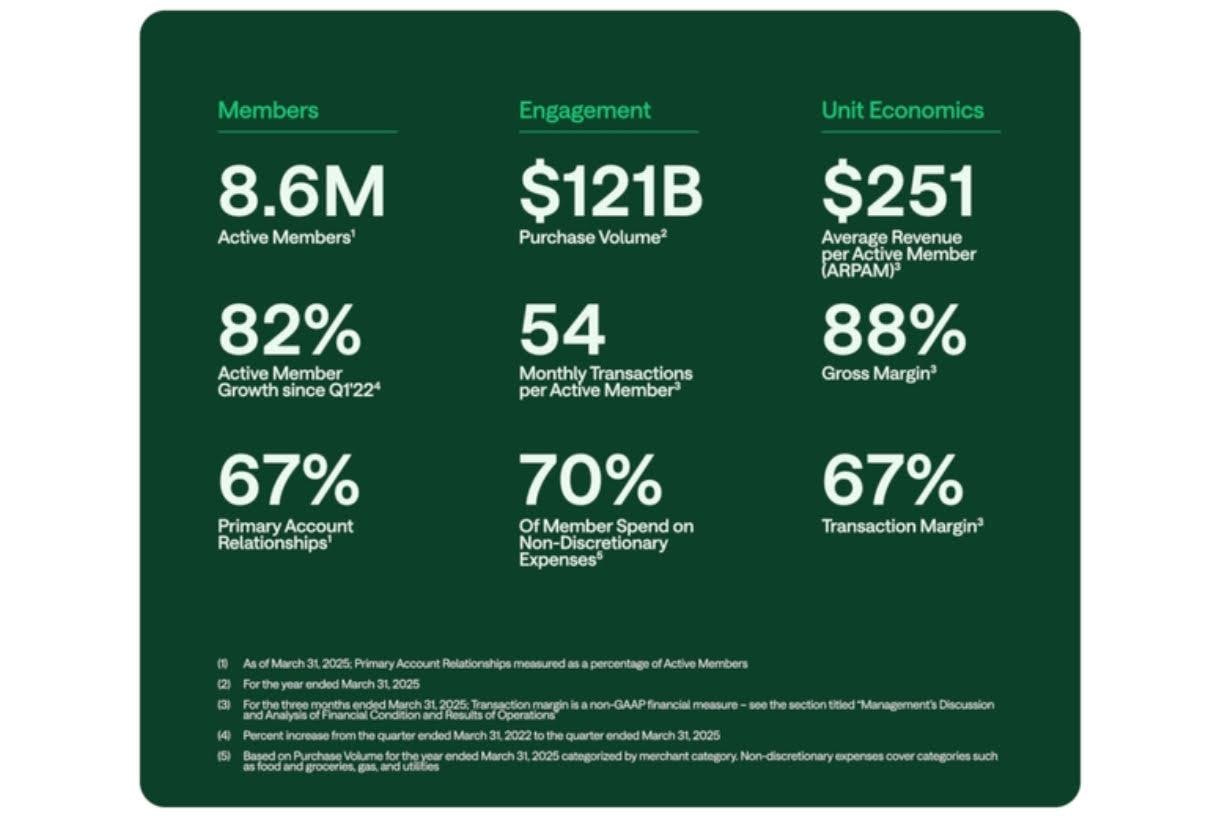

Chime's key performance indicators as of March 31, 2025.

Chime currently has 8.6 million active members, a strong growth of 82% since the first quarter of 2022. Notably, 67% of these members use Chime as their primary bank account, reflecting the high level of customer loyalty and trust in the platform.

User engagement is also impressive: Over the past year, total transaction volume amounted to $121 billion. On average, an active member makes 54 transactions per month, with 70% of spending on essentials such as groceries, fuel, or electricity ("non-discretionary expenses").

Chime is also profitable from a business perspective: Average revenue per active member (ARPAM) is $251. The platform achieves a high gross margin of 88% and a solid transaction margin of 67%, indicating an efficiently scalable business model.

Member Growth

In the first quarter of 2024, the number of active members was 7.0 million, while in the first quarter of 2025 it already reached 8.6 million. This corresponds to year-on-year growth of approximately 22.9% in the first quarter alone.

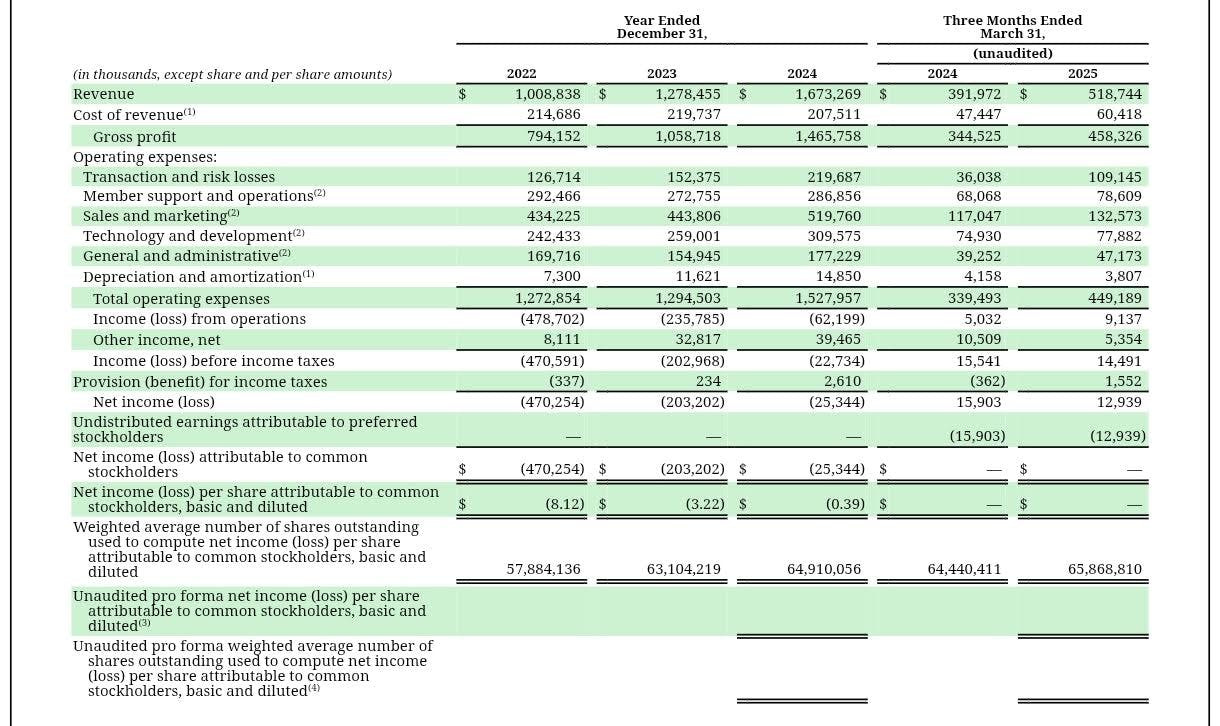

Revenue growth - Gross profit - Net income

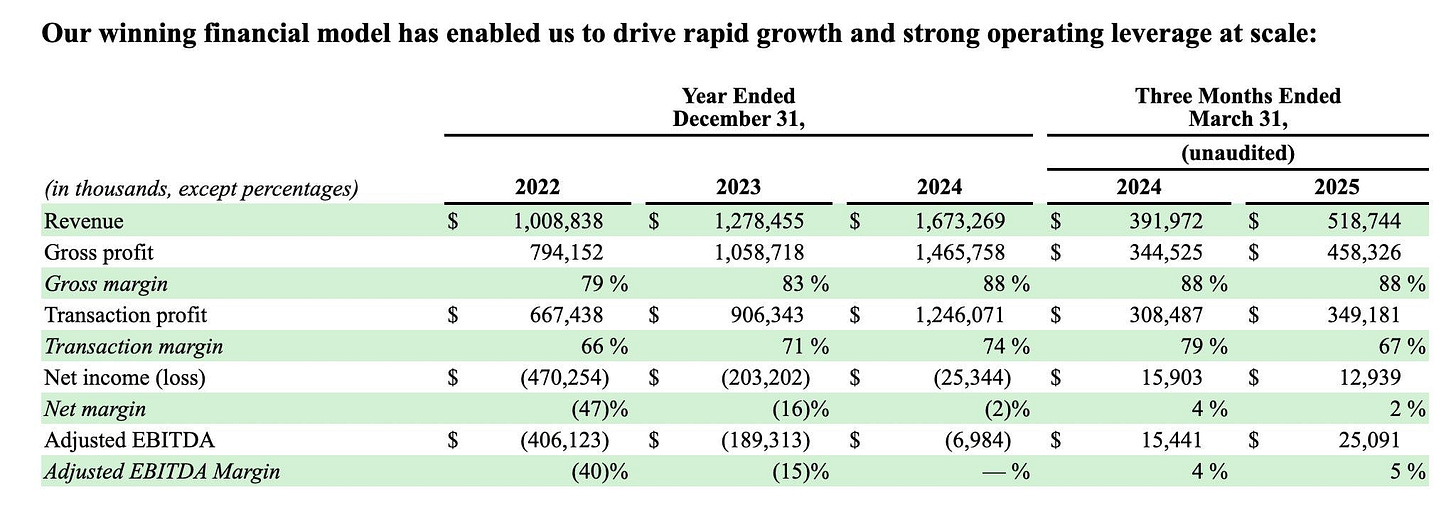

Chime has experienced impressive revenue growth in recent years. Revenue rose from approximately $1.01 billion in 2022 to $1.28 billion in 2023 and further to $1.67 billion in 2024. This represents growth of approximately 65% within two years. The start to 2025 is also strong: In the first quarter, Chime already generated $518.7 million in revenue, significantly more than the $391.9 million in the same quarter of the previous year.

In parallel with revenue, gross profit also developed positively. It was $794 million in 2022, rose to approximately $1.06 billion in 2023, and finally reached $1.47 billion in 2024. In the first quarter of 2025 alone, gross profit already amounted to $458.3 million, compared to $344.5 million in the same quarter of the previous year, a clear sign of economies of scale and high operational efficiency.

Despite the positive development in revenue and gross profit, net income remains negative for the time being, although losses have decreased significantly. In 2022, the net loss was $-470 million, in 2023 it was $-203 million, and in 2024 it was only $-25 million. In the first quarter of 2025, a positive result of $12.9 million was even achieved, a potential turning point towards sustainable profitability.

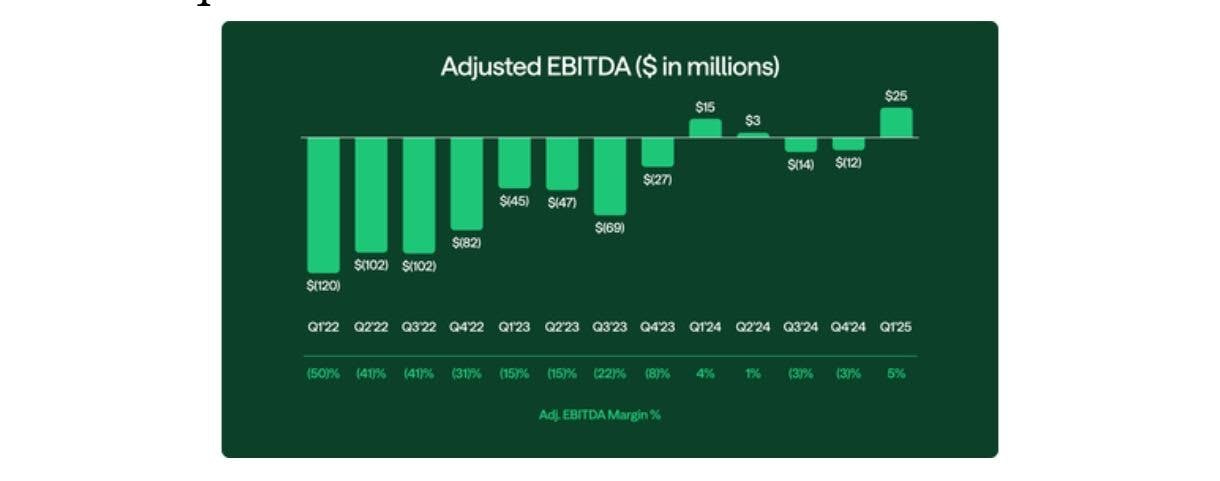

Adjusted EBITDA

The chart shows the development of Chime's adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) in millions of US dollars over twelve quarters, from Q1 2022 to Q1 2025, along with the respective EBITDA margins in percent.

Chime began 2022 with significant operating losses: In Q1 2022, EBITDA was $-120 million, with an EBITDA margin of -50%. The following quarters of 2022 and the first half of 2023 remained significantly negative, albeit with slightly declining losses ($-45 million in Q1 2023, $-69 million in Q2 2023).

A clear recovery is emerging from the third quarter of 2023. In Q4 2023, EBITDA is only $-27 million, before reaching a positive figure of $+15 million for the first time in Q1 2024, accompanied by an EBITDA margin of +4%.

Although two slight setbacks followed in 2024, with losses of $-14 million (Q3) and $-12 million (Q4), the positive turnaround continued in Q1 2025: Chime achieved EBITDA of $+25 million and a margin of +5%, the company's strongest operating result to date.

Conclusion:

Operating losses were continuously reduced.

Break-even was reached in early 2024.

From Q1 2025, Chime will be clearly EBITDA-positive.

Average Revenue per Account per Month

The ARPAM (Average Revenue per Account per Month) value shows an overall positive trend from Q1 2022 to Q1 2025. It began Q1 2022 at $213 and fell slightly over the next few quarters to a low of $204 in Q3 2022. Thereafter, the value rose steadily, with minor fluctuations, declining to $208 in Q2 2023. Starting in Q3 2023, a stable upward trend began, which continued until Q1 2025. During this period, the ARPAM value rose from $212 in Q3 2023 to $251 in Q1 2025, the highest level to date. This trend indicates a steady improvement in average monthly revenue per customer.

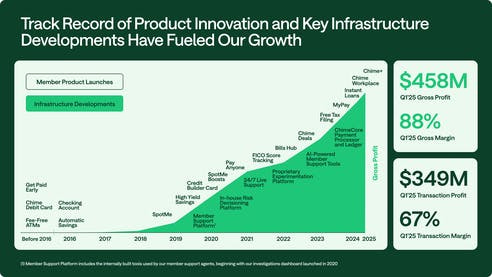

Product Innovation

The company has a strong track record of product innovation and key infrastructure expansion, which has contributed significantly to its growth. Since launching initial products such as the Get Paid Early service, the Chime Card Switcher, and Mobile Check Deposit prior to 2016, new features have been introduced regularly, including the Chime Checkbook in 2017 and SpotMe in 2018.

Starting in 2019, growth was accelerated by significant infrastructure developments such as the launch of the in-house risk platform and the establishment of a 24/7 live support team. Additional products such as Pay Anyone, FICO Score Tracking, and Bills Hub were added in the following years. Starting in 2022, a particularly large number of innovations were implemented, such as the AI-Powered Member Support Tool and new financial services such as Chime Workplace Instant Loans.

At the same time, financial metrics increased significantly: In the first quarter of 2025, gross profit reached $458 million with a gross margin of 88%, while transaction profit was $349 million with a margin of 67%. The chart clearly shows that both continuous product innovations and targeted infrastructure measures have contributed significantly to the current market position.

The big question is, which is the better company? SoFi or Chime?

Let's compare four key metrics: members, revenue, adjusted EBITDA, and net income.

Before doing so, I would like to point out my SoFi analysis:

Let’s continue …

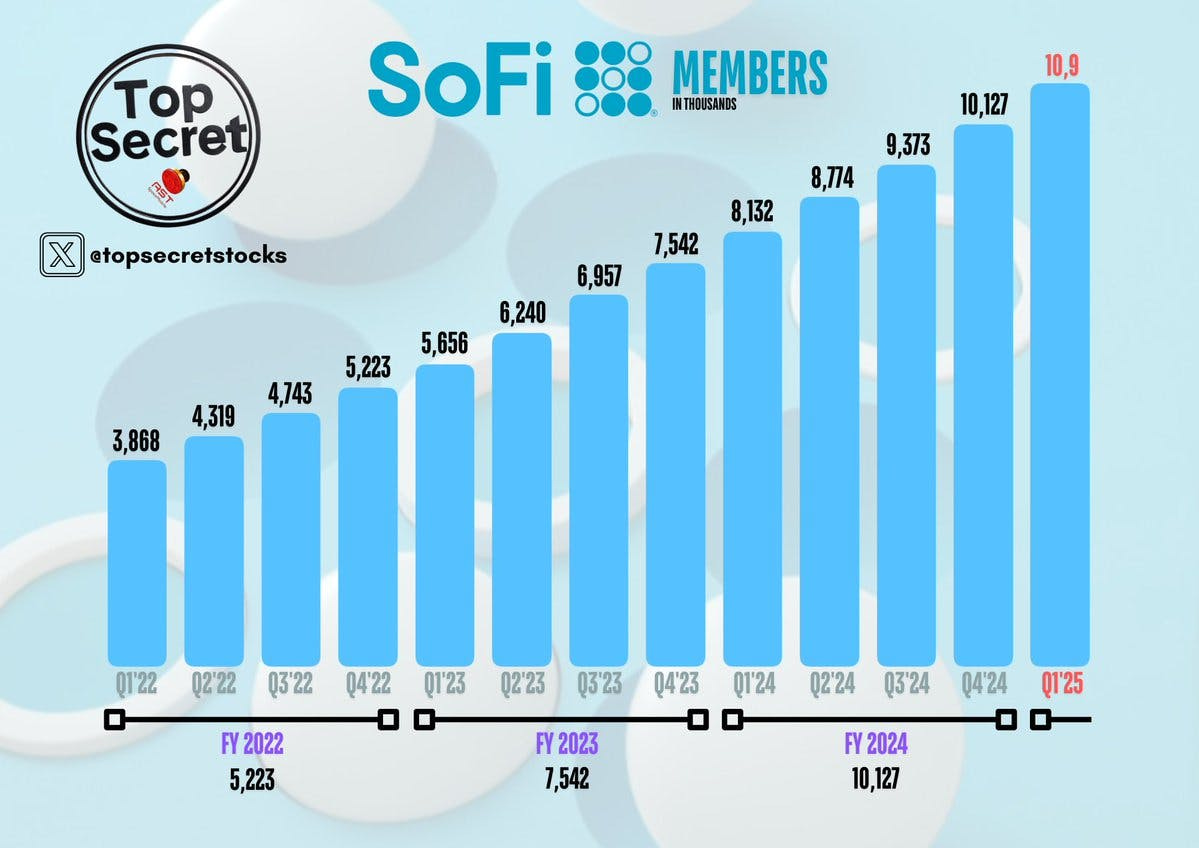

Member Growth

Chime: Growth over 3 years: +22.31%, from approximately 7 million to 8.6 million active members.

SoFi: Significantly faster growth: +41.31% in 3 years, from approximately 7.7 million to 10.9 million members. The user base is broader (banking, loans, investments, insurance, etc.).

Conclusion: SoFi is growing faster and has a broader user base.

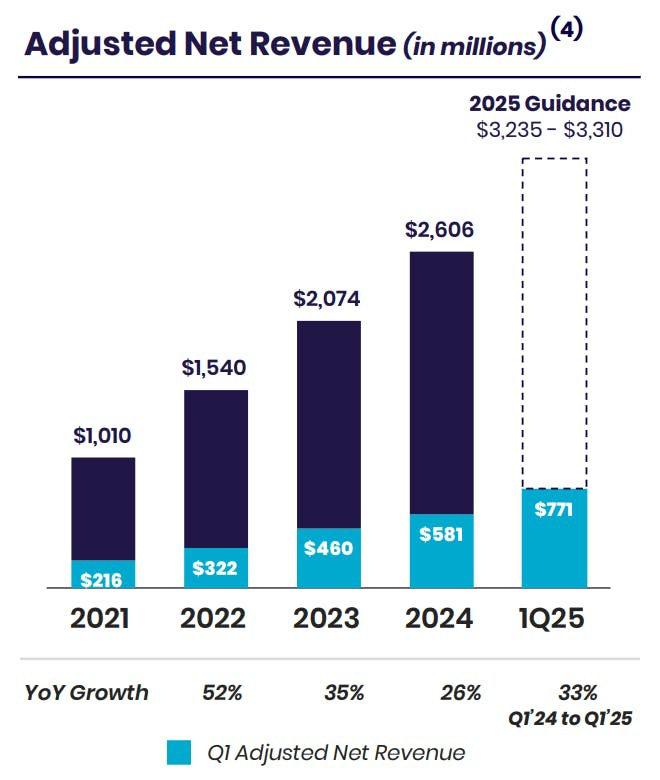

Revenue Development

Chime: Revenue increased from $239.8 to $518.74. Chime's three-year compound annual growth rate (CAGR) is 29.34%.

SoFi: SoFi increased its revenue from $330.34 million (Q1 2022) to $771.8 million (Q1 2025). SoFi's three-year compound annual growth rate (CAGR) is 32.69%.

Conclusion: Although SoFi consistently generates higher revenues, Chime is steadily catching up. Both companies are demonstrating strong growth momentum, with SoFi growing faster than Chime.

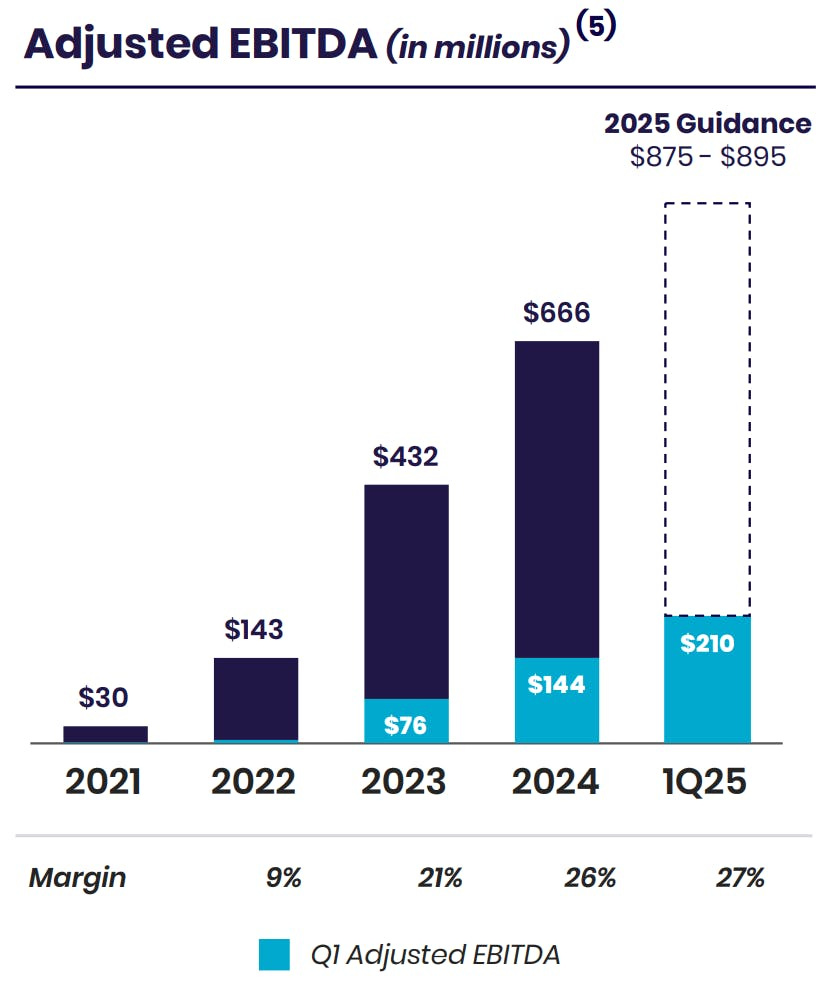

Adjusted EBITDA - Operating Profitability

Chime:

Chime has grown from significant losses in 2022 (-$120 million, -50% EBITDA margin) to +$25 million EBITDA with a 5% margin by Q1 2025.

Operating profitability has been positive since Q1 2024, with a stable and moderate margin.

The focus is clearly on efficiency and sustainable growth.

SoFi:

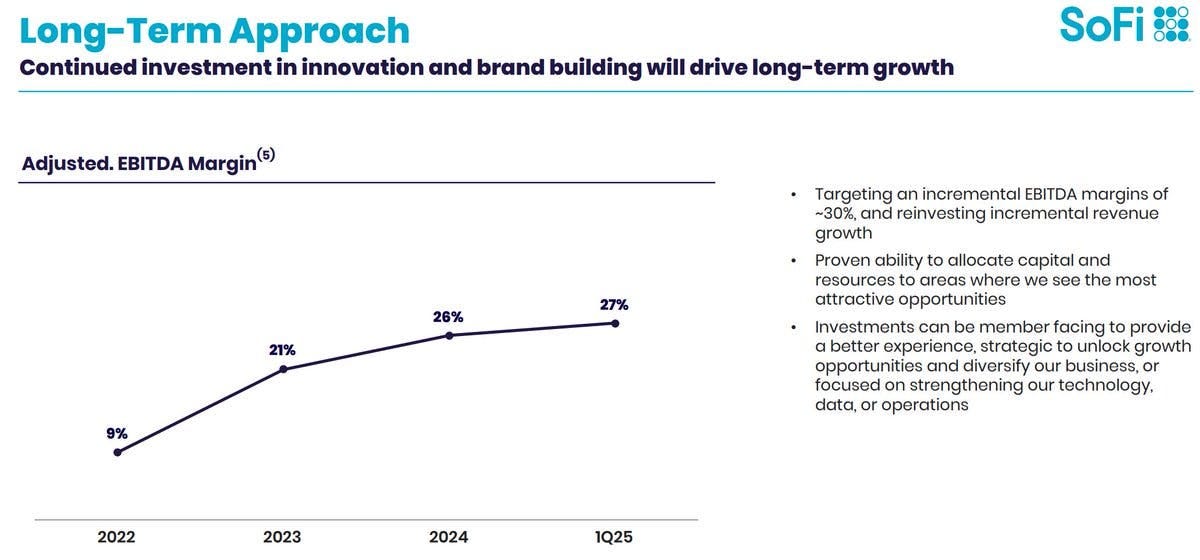

SoFi, by comparison, was profitable much earlier and is showing consistently rising margins.

Adjusted EBITDA reached a record high of $210.3 million in the first quarter of 2025, increasing by 46% compared to $144.4 million in the same period last year. This corresponds to an adjusted EBITDA margin of 27%, more than 10 times that of Chime.

SoFi is thus significantly more scalable.

Conclusion: SoFi is significantly more profitable in terms of EBITDA. However, Chime has reached a breaking point.

Net income

Chime:

Net loss until the end of 2023, but positive for the first time from Q1 2024 (4% margin).

In Q1 2025: +2.49% net income margin, small but sustained positive.

Reflects Chime's focus on controlled growth and cost reduction.

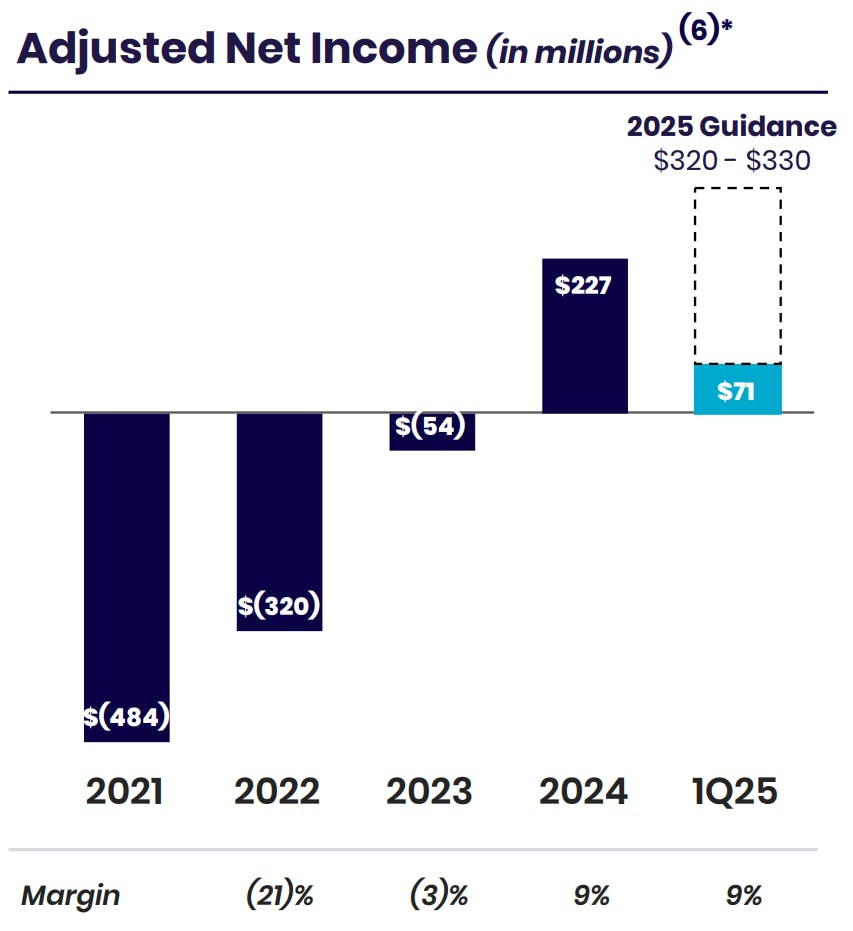

SoFi:

Source: SoFi Investor Presentation

SoFi Technologies reported a GAAP profit margin for the sixth consecutive quarter. In Q1 2025, GAAP net income reached $71.1 million and diluted earnings per share reached $0.06.

Achieved positive net income significantly earlier (since Q3 2023).

Q1 2025: Net income margin of 9.2%, almost four times higher than Chime.

More efficient monetization.

Conclusion: SoFi also leads in net income, especially with a net income margin of +9.2% compared to Chime's +2.49% net income margin.

Overall Conclusion

Chime is showing strong progress in operating profitability and has stabilized after years of losses. SoFi is currently the leader in almost all metrics: higher revenues, faster scaling, and a clearer profit zone.

Why SoFi is currently the stronger company? SoFi outperforms Chime in several key metrics:

Revenue growth: SoFi is achieving a higher 3-year CAGR of 32.69% than Chime (29.34%) and remains the leader in total revenue every quarter.

Profitability: SoFi has moved significantly faster into profitability. Since Q4 2023, SoFi has reported positive net income and margins, while Chime is still struggling with fluctuations.

EBITDA performance: SoFi has consistently shown high adjusted EBITDA margins, recently exceeding 27%, while Chime, despite improvements, remains mostly neutral to negative.

Member Growth: SoFi leads the way here too, with impressive growth of 41.31% in three years compared to Chime's 22.31%.

SoFi impresses with faster growth, improved profitability, and more efficient scaling. The company has proven that it can not only grow quickly but also do so sustainably, a clear advantage over Chime.

Why I will hold SoFi long-term:

Profitable for six quarters.

A comprehensive financial and tech platform enables strong economies of scale.

Strong fundamentals: Continuous revenue growth and SoFi's adjusted EBITDA margin show a consistently positive development.

The CEO, with his visionary leadership style, is driving targeted innovation and technological advancements, making SoFi an exciting bank with long-term potential.

What's your opinion on Chime? Could the company SoFi pose a threat?

Disclaimer

The content and materials presented or linked to are for informational and educational purposes only and do not constitute financial advice or recommendations and should not be considered as such.